Phocuswright Research Roundup 2H25

The signals shaping travel now

Across 33 reports published in the second half of 2025, Phocuswright explored how global travel is evolving in real time. Market sizing across APAC, the Americas, Europe and the Middle East reveals where growth is concentrating, while consumer research exposes shifting expectations around value, loyalty and how trips are discovered and booked. At the same time, deep dives into AI, fintech and digital identity show how the foundations of travel commerce are being rebuilt.

This roundup offers a smarter path through that work, spotlighting the insights that explain what is changing, why it matters and how the industry is responding.

Here's a recap of the insights, data and more. (Click on each report title to access the report).

Phocuswright's Travel Forward: Data, Insights and Trends for 2026, sponsored by Travel Guard, provides broadscale insights into the $1.67 trillion global travel market, offering essential data for understanding industry trends and growth.

Featuring highlights by segment, channel, consumer behavior metrics and more, this report equips industry stakeholders with the key data and trends needed to navigate the rapidly evolving travel landscape. Please note that all market sizing data for 2025 and 2026 is projected.

Loyalty and luxury

Beyond Points: Rethinking Loyalty and Brand Consistency in Travel

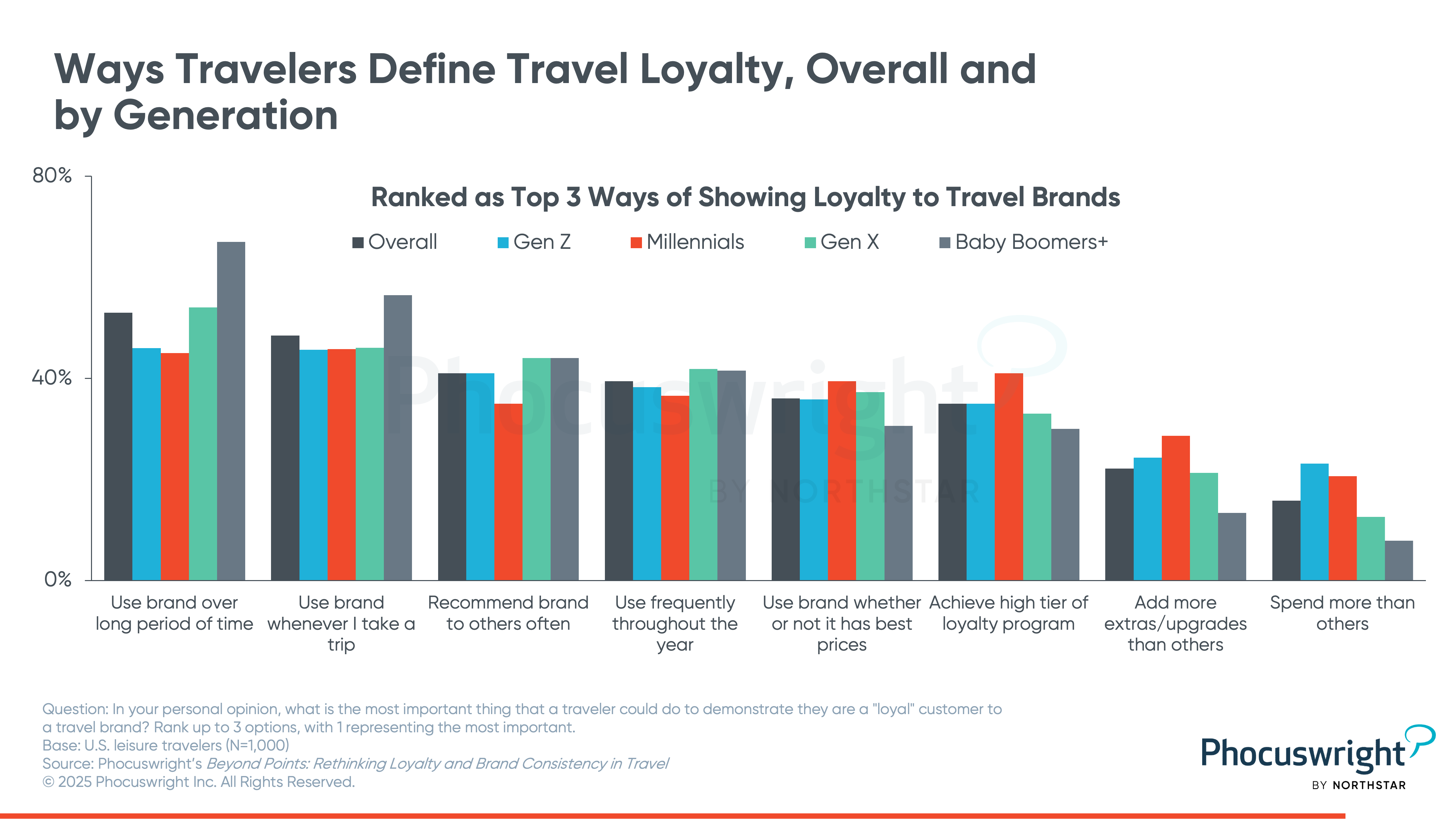

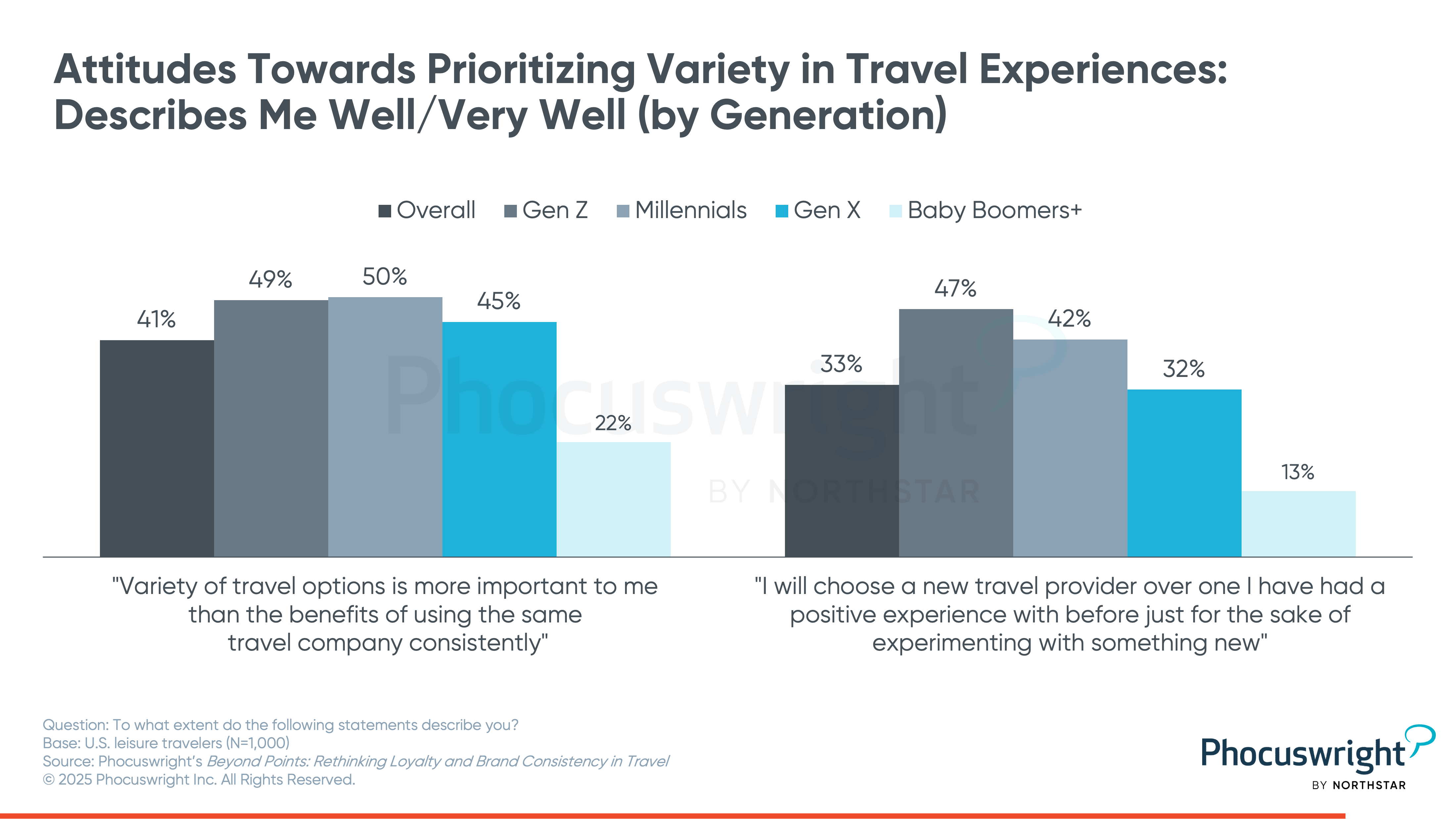

Loyalty in travel is evolving beyond points and perks: A widening gap between how travelers define loyalty and how brands reward it. For most U.S. leisure travelers, long-term trust, value, and consistency matter more than high spend or elite status. Yet novelty, especially among Gen Z, millennials, and luxury travelers, often eclipses repetition, challenging brands to build programs that reward flexibility and exploration as much as frequency.

Phocuswright’s Beyond Points: Rethinking Loyalty and Brand Consistency in Travel is part of a comprehensive consumer research study delving into the specifics of how U.S. travelers perceive brand loyalty and engage with the current ecosystem. Key questions addressed include:

- How do travelers define loyalty—and how does this differ from how brands structure loyalty programs?

- What kinds of generational differences exist in brand consistency, loyalty engagement and redemption habits?

- Why do travelers stray from their go-to brands, and how does novelty factor in?

- How can loyalty programs evolve to attract younger travelers seeking flexibility, variety and value?

- Which loyalty models are best positioned to succeed in today’s travel environment, given travelers’ shifting priorities toward flexibility, variety, and value?

Free Research Insights article:

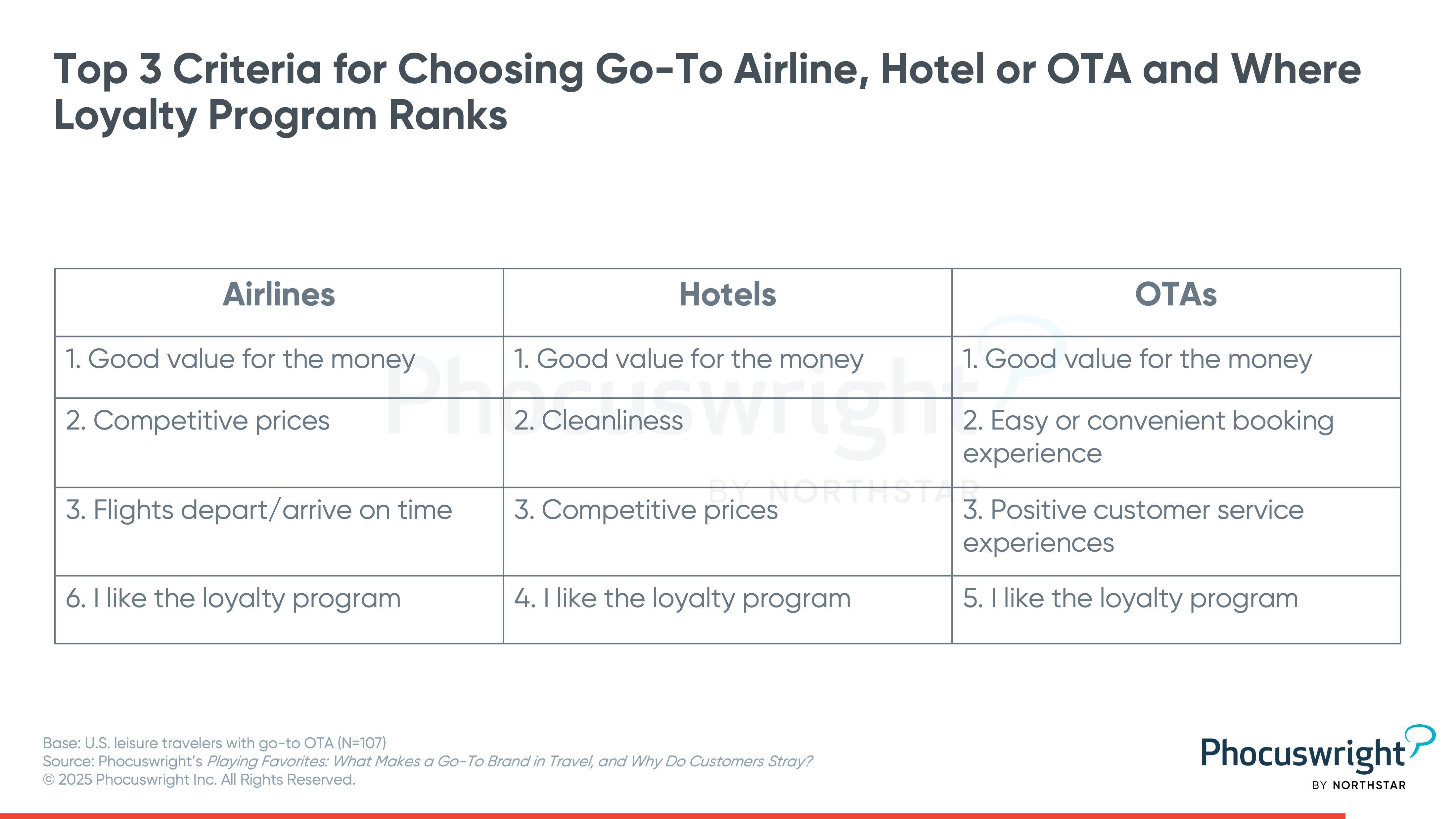

Playing Favorites: What Makes a Go-To Brand in Travel, and Why Do Customers Stray?

What makes a traveler return to the same airline, hotel, or booking site—and what makes them stray? Unpacking the “why” of traveler loyalty in an age of endless choice is no small feat. Overall, U.S. leisure travelers report that fewer than half claim a go-to travel brand and most will still “cheat” when price, fit or curiosity tempts them. In some cases, loyalty programs can really make the difference, but only when fundamentals are attained—value, convenience and experience—can repeat business be achieved.

Phocuswright’s Playing Favorites: What Makes a Go-To Brand in Travel, and Why Do Customers Stray? is part of a comprehensive consumer research study delving into the specifics of how U.S. travelers perceive brand loyalty and engage with the current ecosystem. Key questions addressed include:

- How common is true brand loyalty among U.S. leisure travelers

- What motivates travelers to choose or abandon their preferred brands

- How do loyalty programs compare to pricing and value in influencing repeat bookings?

- Which traveler segments—by generation, income, or trip type—are most open to brand experimentation?

- How can travel brands retain customers who crave novelty and flexibility over routine?

Free Research Insights article:

Presentation: Loyalty - Back to the Roots

Consumer research

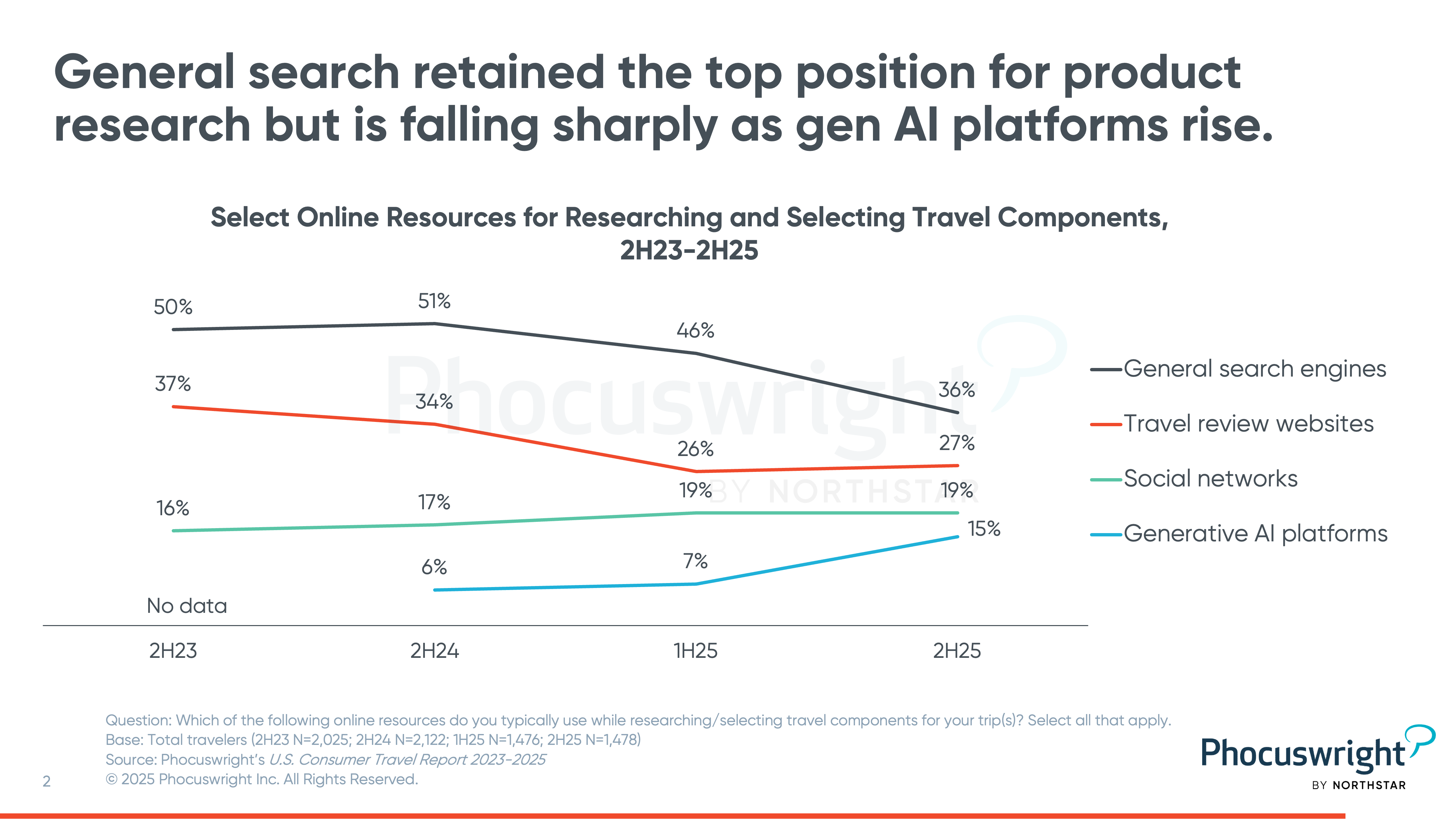

Search Slips, AI Surges: Travel’s New Front Door?

Generative AI is fast becoming travel’s new front door. Nearly 40% of U.S. travelers used gen AI tools to plan trips in 2025, an 11-point jump in just one year. Millennials lead the charge, employing AI to cut through information overload while still turning to friends, family and reviews for final validation. Overall, differences persist between demographic groups: Travelers who use AI are younger, wealthier and more frequent travelers who spend significantly more and rely on both digital and human touchpoints. As AI gains ground on traditional search, its influence on traveler decisions from destination choice to booking signals significant shift in how inspiration and intent converge.

Phocuswright’s Search Slips, AI Surges: Travel’s New Front Door? is part of a comprehensive consumer research study examining how U.S. travelers integrate generative AI into trip planning and booking, reshaping the way they search, decide and spend.

Key questions addressed include:

- How rapidly is AI adoption expanding among U.S. travelers, and which demographic segments are driving it?

- How is generative AI affecting traditional search, review sites and other trip-planning tools?

- What defines the emerging “AI traveler” and what are their demographics, spending habits and decision-making processes?

- How much trust do travelers place in AI-generated results, and where do human input and authenticity still hold sway?

Free research insights articles:

Chat, Plan, Book: GenAI Goes Mainstream

Is generative AI mainstream among U.S. and European travelers? About one in three now use the technology to plan or enhance their trips. While adoption in Europe trails due to regulatory headwinds, usage is rising steadily across all markets. Satisfaction is high, trust is mixed, and expectations are growing—especially among younger travelers—who are increasingly open to AI-powered booking and real-time travel support. As GenAI capabilities converge with tools like digital identity wallets and embedded commerce, travel planning is poised for its biggest shift in decades.

Phocuswright’s Chat, Plan, Book: GenAI Goes Mainstream is part of a comprehensive consumer research study delving into the specifics of how U.S. and European travel consumers employ technology in their travel journey, spanning everything from inspiration gathering to the in-destination experience.

Key questions addressed include:

- How widespread is GenAI use among U.S. and Europe travelers?

- For what travel tasks are travelers using GenAI?

- Do travelers trust GenAI—and do they want to book with it?

- How is GenAI changing the search and booking landscape?

- What role will digital identity and payments play in the GenAI travel future?

Free research insights articles:

From Payments to Priorities: The U.S. Traveler Mindset

U.S. Consumer Travel Report 2025

After years of recovery, the U.S. travel market has entered a new phase. While travel incidence held steady in 2025, spending has tightened as Americans weigh travel against competing financial priorities. Younger travelers, now the largest share of the market, are more cost-conscious, leaning into tools and products that clearly showcase value. In this environment, price transparency, credible comparisons and flexible digital tools have become the new currencies of loyalty. Players who can prove value will win.

Phocuswright’s U.S. Consumer Travel Report 2025 provides a snapshot of American travelers’ recent behavior and sentiment regarding travel. Based on a comprehensive survey of United States leisure travelers, this report provides a range of data and analysis on the American consumer travel market, and what these trends look like over time.

Key research topics addressed by this research include:

- How have U.S. travelers’ spending priorities shifted over the past 12 months, and what does this mean for discretionary travel demand?

- Which booking channels and tools are gaining favor among different generations of travelers?

- How are price sensitivity and economic pressures reshaping decisions about destinations, accommodations and travel modes?

- What opportunities exist for suppliers, OTAs and technology players to capture value as travelers demand smarter, more transparent planning tools?

Free Research Insights article:

Travel in Uncertain Times: U.S. Consumer Travel 2025

Even amid inflation and global instability, Americans refuse to give up on travel, though they may reshape its place in their lives. While the vast majority of U.S. travelers intend to take trips this year, many report favoring shorter, value-driven trips closer to home. As costs rise and safety concerns grow, brands that deliver transparency, trust and tangible value will earn travelers’ loyalty in uncertain times.

Based on a comprehensive survey of U.S. leisure travelers, this analysis unpacks how shifting priorities, generational differences and cautious optimism are redefining the American travel mindset for the year ahead.

Key research topics addressed by this research include:

- How is economic and geopolitical uncertainty influencing Americans’ travel decisions in 2025?

- Which traveler demographics are showing the strongest and weakest comfort levels?

- How are spending priorities shifting across generations?

- What opportunities exist for travel brands amid consumer caution?

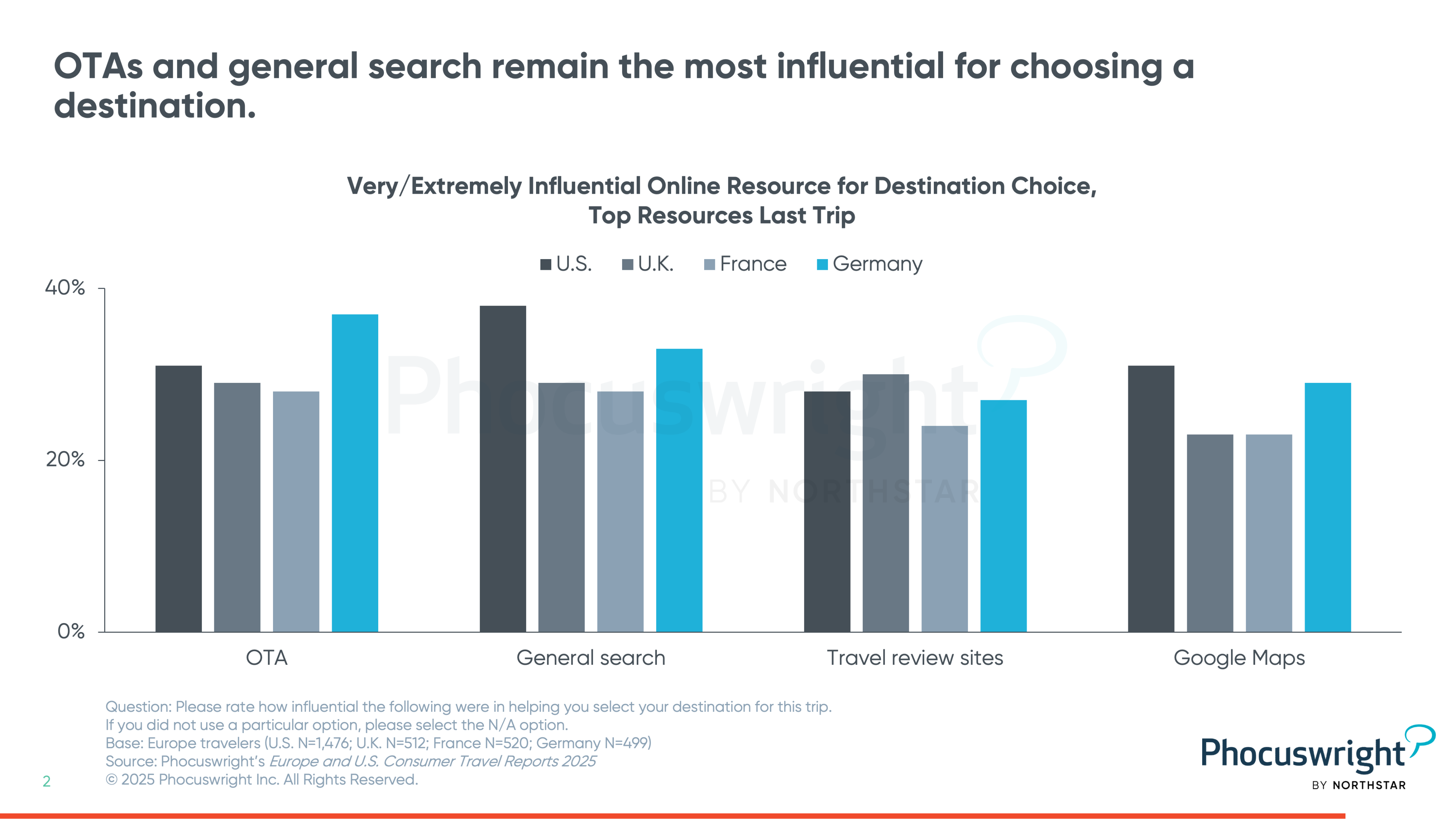

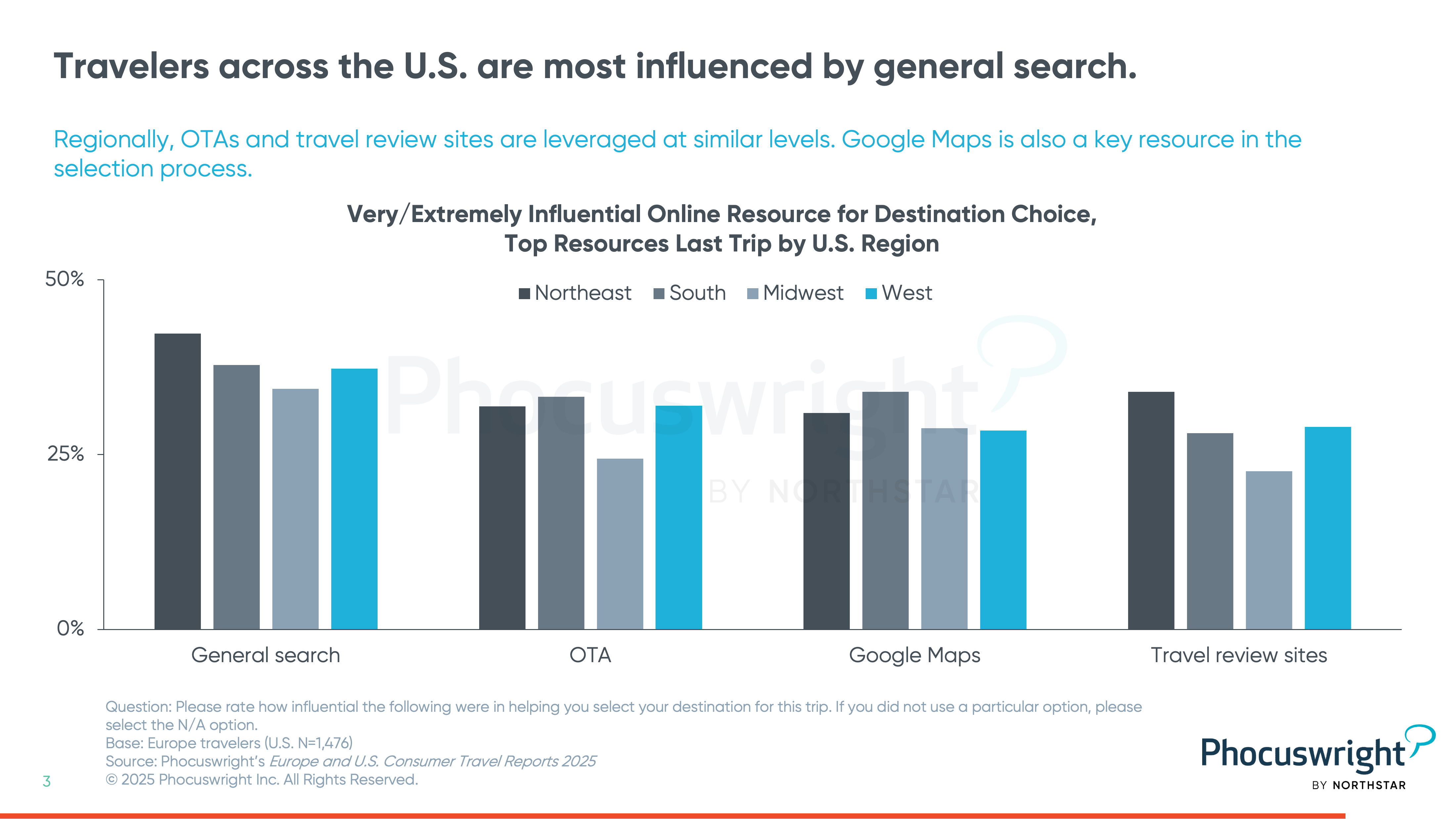

U.S. and Europe Consumer Travel Reports 2025: Destination by Departure

Where are U.S. and Europe travelers headed on their leisure trips? Notable regional and generational differences in destination preferences, as many travelers carefully weigh their plans in the current environment. Destination selection is heavily influenced by digital tools, especially among younger travelers, with general search engines and OTAs playing a key role. While traditional motivators like scenery and relaxation remain strong, travelers increasingly seek personalized experiences based on budget and familiarity.

Based on comprehensive surveys of U.S., U.K., France and Germany consumers who traveled in 2024, this report compares travelers’ consumer trip-planning and purchasing behavior, specifically focusing on how they choose their destinations.

Key questions answered include:

- How do destination preferences differ between U.S. and European leisure travelers?

- What role do digital tools play in influencing destination selection across age groups and regions?

- Which traveler segments are most likely to seek new destinations versus returning to familiar ones?

- How do motivations like price, scenery, and rest shape destination choice across countries?

Free Research Insights article:

What’s Old Is New Again: Travel Agents in the Digital Age

Even in an era dominated by online booking, human travel agents still matter. Sixteen percent of U.S. travelers used an agent in 2025, with younger consumer surprisingly more likely than to turn to professionals for flights and complex trips. Convenience, trust and access to better options remain key reasons for choosing an agent, showing that personal guidance hasn’t lost its appeal. Further, as digital tools expand, agents who align with younger travelers’ expectations for tailored service and support may see new opportunities for growth.

Based on a comprehensive survey of U.S. travel consumers, this analysis highlights notable findings regarding U.S. traveler use of and opinions on professional travel advisors.

Key questions answered include:

- How many U.S. travelers still book through travel agents in 2025?

- What motivates travelers—particularly younger ones—to use agents instead of booking online?

- How do generational preferences differ in choosing travel agents for flights, hotels, car rentals and activities?

- What role do trust, convenience and personalized service play in the continued relevance of travel agents?

Tech and innovation

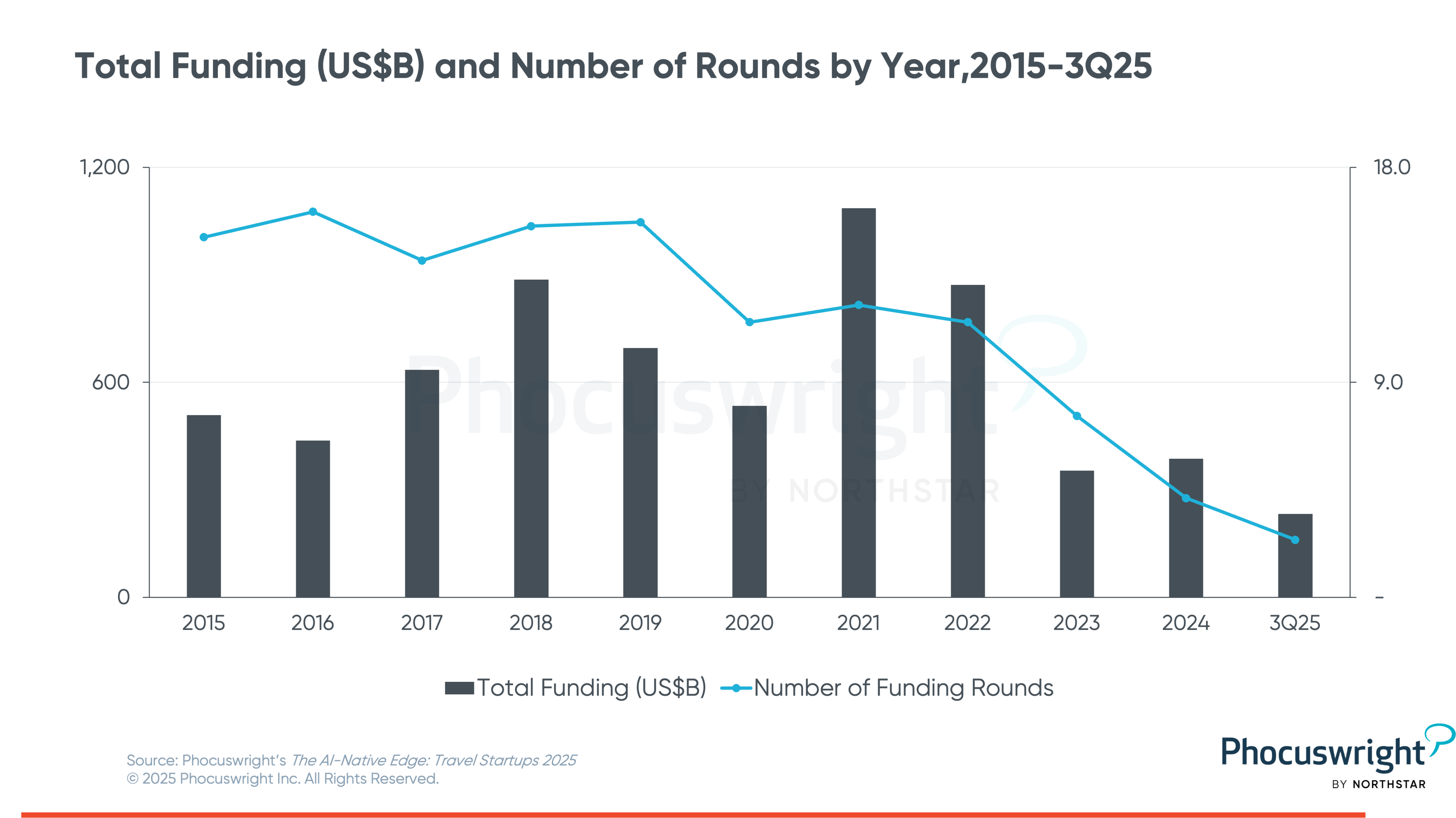

The AI-Native Edge: Travel Startups 2025

Travel startups are navigating a paradox in 2025: funding has slumped to decade lows even as artificial intelligence reshapes the playing field. With just $3.5 billion raised through 3Q25, the sector is undercapitalized, yet founders are using AI to prototype faster, scale leaner and redefine what defensibility means. Nearly every startup is experimenting with generative AI, turning once-costly technical barriers into commodities. Meanwhile, investors focus on distribution, customer access and sustainable models. This convergence suggests that the AI-native companies emerging today may become the next category leaders once capital confidence rebounds.

The analysis covers funding raised between 2015 and the third quarter of 2025. Leveraging data from Phocuswright’s proprietary database as well as desk research and a global survey of travel entrepreneurs, this report presents a comprehensive assessment and outlook for travel startups with takeaways on what the industry can learn from them.

Key questions answered by this report include:

- How is AI changing the way travel startups build, scale, and compete in 2025?

- Why has travel startup funding dropped to decade lows despite a global boom in AI investment?

- What new competitive moats matter most for startups if technology alone is no longer enough?

- Could “seed-strapping” with AI lead to a new generation of lean, acquisition-ready travel companies?

NEW THIS YEAR: Phocuswright's annual startups report now features an AI-powered chatbot that can help answer your specific questions and pinpoint critical, topical research findings. Click "View" to try it!

To explore the data behind this analysis, please check out the Travel Startups Interactive Database.

Free Research Insights article:

What Can Travel Learn from AI-Native Startups?

Will Agentic AI Disrupt Travel Distribution?

After decades forecasting the future of travel technology, Phocuswright’s Norm Rose leaves the industry with a final vision: agentic AI will redefine the travel marketplace as profoundly as the internet once did. This analysis explores how autonomous AI agents, guided by digital identity and blockchain infrastructure, will soon book, service and personalize travel on travelers’ behalf. From the end of user interfaces to the rise of “Know Your Agent” protocols, Rose outlines the new rules of distribution in a post-interface world. Those who fail to prepare for this shift, he cautions, risk becoming the next generation of incumbents left behind.

Fintech and the Indian Online Travel Landscape

India’s travel market has undergone a dramatic transformation, driven by fintech innovation and the rise of mobile-first payment solutions. At the heart of this shift is UPI, which has replaced cash for millions of travelers and expanded online booking far beyond India’s Tier 1 metro centers. Now, emerging tools like Buy Now Pay Later and risk-based ancillaries are redefining affordability and flexibility—unlocking a new era of digital travel growth.

Free research insights articles:

The New Age(nts) Trend Series Part 4 and 5

The New Age(nts) Trend Series is a series of online conversations hosted by Phocuswright exploring the impact of generative AI (GenAI) and autonomous agents on the travel industry. Five online events took place from March through September of 2025 which align with the five trends outlined in the report Travel Innovation and Technology Trends 2025.

Impact of Generative AI on Marketing

In this installment of The New Age(nts) series, experts explored the reshaping of travel marketing, as focus shifts from reaching consumers directly to influencing the AI engines and agents that guide their decisions. Search is evolving into conversational interfaces, new business models, personalized pricing and AI driven experimentation are emerging, and travel advisors and suppliers alike are learning to manage AI tools as core parts of their strategy. The takeaway: success in this new era will favor marketers who adapt quickly, experiment often and build for an AI first future.

This analysis briefly covers the most important takeaways from the discussion and subsequent audience questions for Phocuswright subscribers

Key questions answered by this summary (and its corresponding video seminar) include:

- How are AI-powered search and discovery changing traveler behavior and marketing strategies?

- What content and brand‑visibility practices matter most in an agentic, AI‑driven environment?

- How are business models, pricing and attribution evolving as AI takes a larger role in bookings?

- What new skills and organizational shifts do marketers need to thrive in an AI‑first landscape?

Free Research Insights article

The Convergence of AI and Digital ID

In this installment of The New Age(nts) series, experts mulled over the convergence of AI and digital identity reshaping the foundation of travel distribution. While travelers increasingly express interest in booking via AI, today’s infrastructure still lags behind expectations. Experts argue that portable digital IDs, open offers and trust frameworks are essential for enabling AI agents to act securely and intelligently on travelers’ behalf. If adopted at scale, this shift could unlock not just seamless bookings but also new revenue opportunities in post-sale services and personalization, ideally delivering the long-promised vision of the “connected trip”.

This analysis briefly covers the most important takeaways from the discussion and subsequent audience questions for Phocuswright subscribers.

Key questions answered by this summary (and its corresponding video seminar) include:

- How can portable digital identity enable AI agents to deliver seamless and secure travel bookings?

- What role do open offers and publishing models play in reducing inefficiencies like high look-to-book ratios?

- How can loyalty, fraud prevention, and governance be redefined in the era of agentic AI?

- What opportunities—and risks—does the convergence of AI and digital ID present for incumbents, suppliers, and intermediaries in the travel ecosystem?

Corporate travel

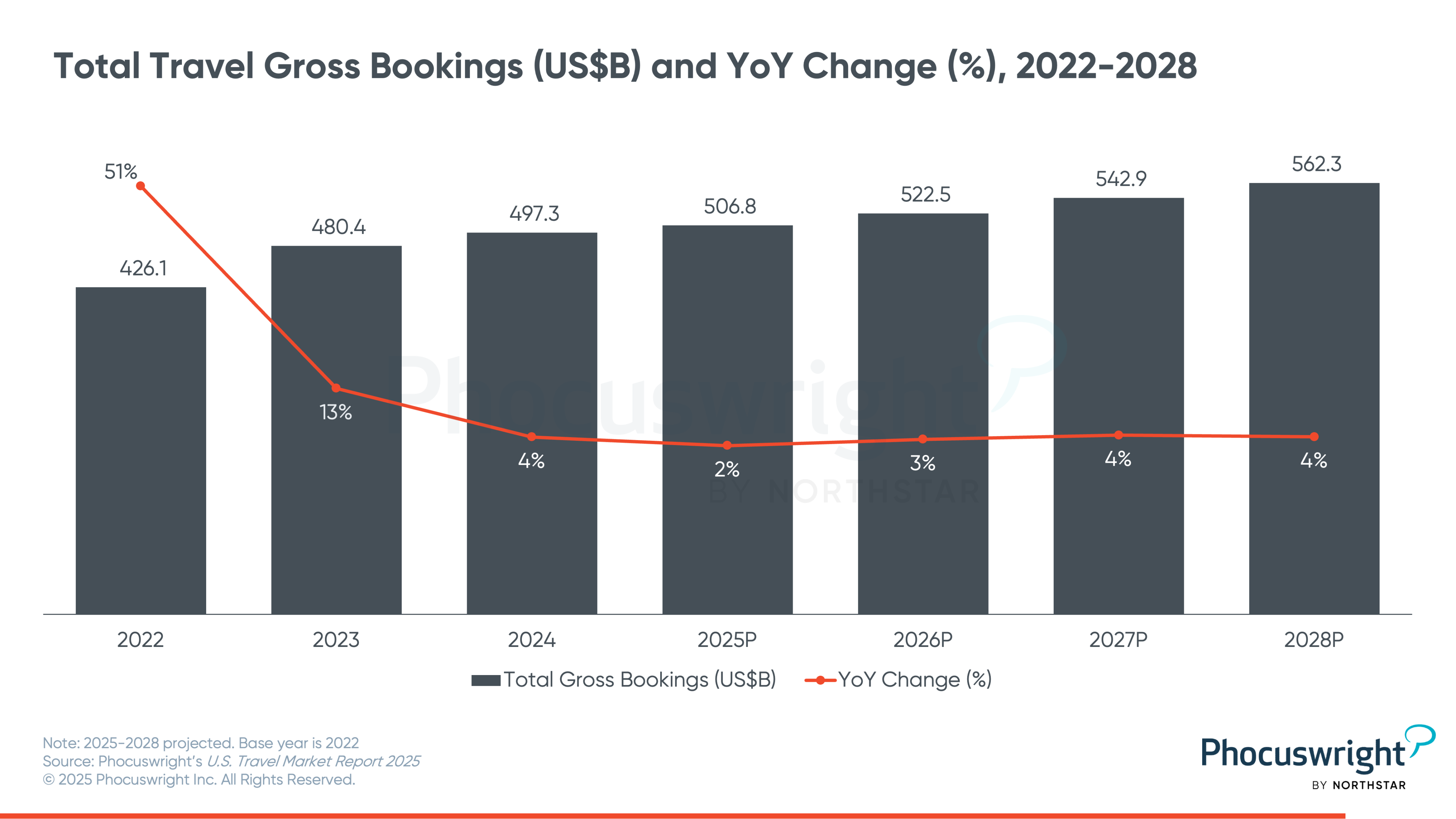

U.S. Corporate Travel Landscape 2025: Market Size, Policy and the Impact of AI

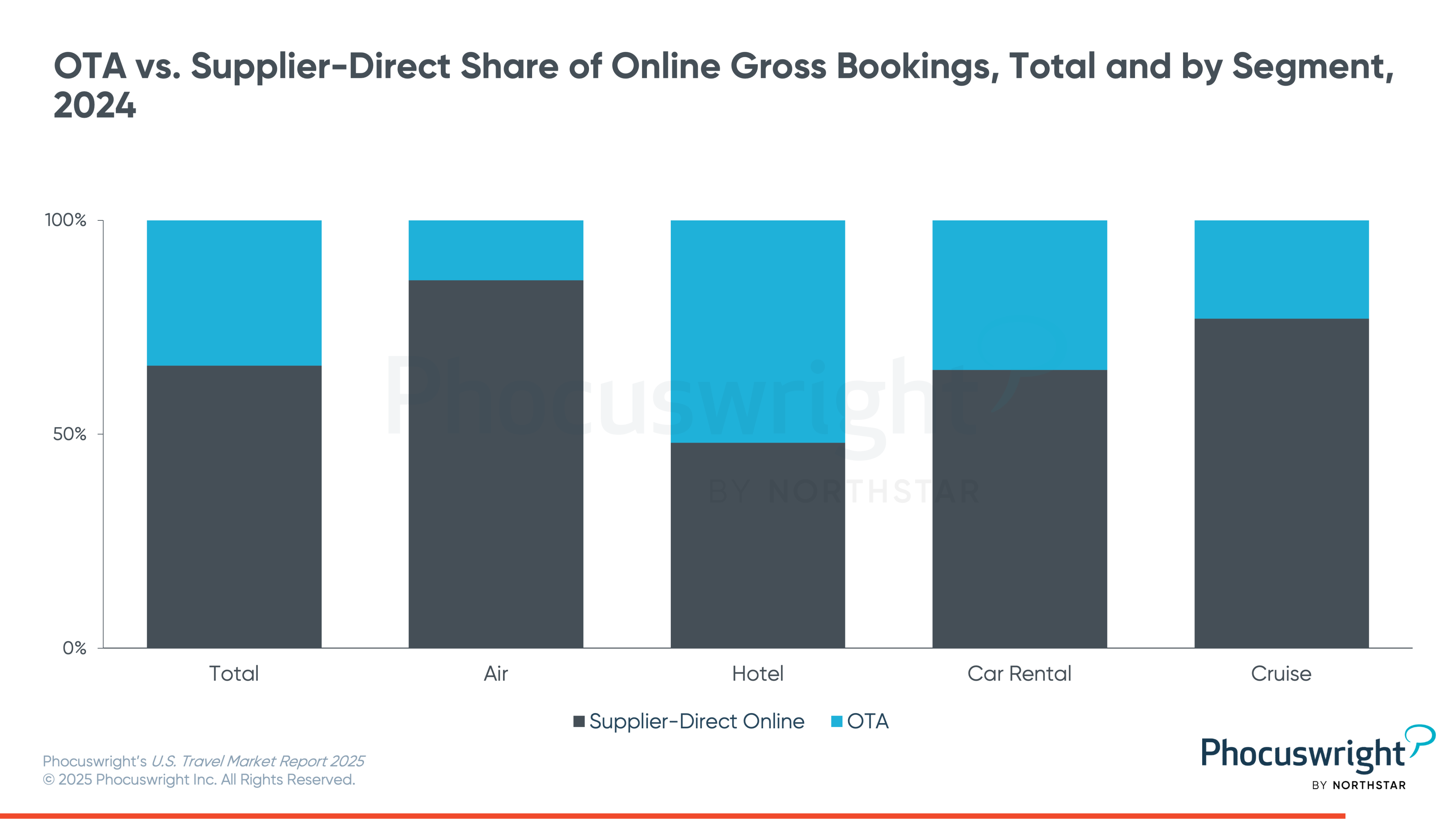

Corporate travel in the U.S. is at a turning point, shaped by technological disruption, evolving workplace priorities and shifting traveler behaviors. While the total U.S. travel market is projected to grow moderately in 2025, managed corporate travel faces a temporary contraction before returning to steady growth through 2028. Nearly 80% of business travel spending now occurs online, underscoring the rapid digital shift toward supplier-direct and mobile bookings. Artificial intelligence is emerging as game-changer—streamlining planning, compliance and back-office functions. Looking ahead, the balance between traveler autonomy, corporate policy and AI-driven personalization will define the future of managed travel.

Based on both a comprehensive market sizing exercise and consumer survey research this report answers the following questions about the state of the U.S. managed travel market:

- How is the U.S. corporate travel market recovering post-pandemic, and what are the growth projections through 2028?

- What role are digital channels and direct supplier bookings playing in reshaping distribution?

- How is artificial intelligence transforming the traveler experience, expense management and travel manager workflows?

- In what ways are evolving corporate travel policies balancing compliance with traveler autonomy?

- What are the implications of shifting traveler preferences, including blended business-leisure trips and the rise of the sharing economy?

Free Research Insights article:

U.S. travel market

U.S. Travel Market Report

New and improved, while still delivering key stats: Refreshed for 2025, this report series delivers market analysis, comprehensive sizing and projections for the U.S. travel market, along with detailed data and analysis of five key segments: airline, hotel & lodging, car rental, cruise and packaged travel. A standalone report dedicated to online travel agencies rounds out the coverage. Collectively, the series offers a detailed view of the segments, trends and distribution dynamics that are shaping the United States’ travel landscape in 2025 and beyond.

Free Research Insights article:

U.S. Airline Market Essentials 2025

U.S. airlines are entering 2025 on uncertain footing as economic strain, geopolitical tensions and shifting consumer sentiment dampen travel demand. Passenger revenue is projected to grow 1% this year, with both leisure and business travelers showing signs of retreat. Still, airlines continue to push forward in digital distribution, with direct online bookings hitting record highs—even as low-cost carriers face mounting pressure to adapt or consolidate.

Free Research Insights article:

U.S. Cruise Market Essentials 2025

The U.S. cruise market delivered robust growth in 2024, with gross bookings rising 12% over 2023 and momentum carrying into early 2025. Shorter itineraries on newer ships, expanded private-island offerings and rising interest from Millennials and Gen Z are shaping demand. Travel advisors remain the dominant sales channel, handling about 70% of revenue as itineraries and pricing grow more complex. While broader economic uncertainty lingers, the cruise segment is entering 2025 on solid footing with a diversified customer base.

U.S. Online Travel Agency Market Essentials 2025

Amid cooling domestic demand, U.S. online travel agencies are adapting to a more competitive and uncertain landscape. With hotel bookings softening and high-income travelers booking elsewhere, OTAs are investing in loyalty, AI and B2B partnerships to stay relevant. Expedia and Booking remain dominant, but upstarts like Hopper and new agentic AI tools are reshaping how travelers discover and book trips. Dynamic packaging, private rentals and international expansion offer new growth paths, but the segment's success will likely depend on how OTAs respond to shifting consumer habits and tech disruption.

Free Research Insights article:

- The five developments driving the evolution of U.S. OTAs

- Looking ahead: U.S. OTAs bet on loyalty, AI and B2B

- U.S. travel platforms navigate plateauing demand and emerging bets

U.S. Travel Market Data Sheet 2025

The U.S. Market Data Sheet 2025 delivers market analysis, comprehensive sizing and projections for the U.S. travel market, along with detailed data and analysis of five key segments: airline, hotel & lodging, car rental, cruise and packaged travel. A standalone report dedicated to online travel agencies rounds out the coverage. Collectively, the series offers a detailed view of the segments, trends and distribution dynamics that are shaping the United States’ travel landscape in 2025 and beyond.

U.S. Car Rental Market Brief 2025

After peaking in 2023, the U.S. car rental market faced a mild correction in 2024 as fleet availability normalized and consumer price sensitivity increased. Rental companies responded by prioritizing margin over volume, adjusting fleet strategies, and pulling back from aggressive electric vehicle investments. Looking ahead, policy shifts, international sentiment and economic uncertainty are likely to weigh on demand, though direct digital bookings and operational recalibration offer some near-term resilience.

U.S. Hotel & Lodging Market Essentials 2025

After years of post-pandemic recovery, the U.S. hotel market is entering a new phase—one shaped more by competition and consumer choice than simply demand. With room revenue growth expected to hover around 2% in 2025, hotels are leaning into loyalty, direct booking channels and experience-driven offerings to hold their ground. But rising pressure from short-term rentals, tighter traveler budgets and the looming impact of AI mean the fight for guests—and visibility—is far from over.

U.S. Packaged Travel Market Brief 2025

Following a strong post-COVID run, the U.S. packaged travel market is hitting a pause in 2025 as economic uncertainty and shifting traveler sentiment cool demand. Inbound operators are feeling the strain most, though domestic packagers are also seeing more cautious consumer behavior—shorter trips, downgraded plans, and last-minute bookings. Online agencies are weathering the downturn more effectively, with dynamic packaging expected to grow modestly. As traditional players brace for a flat year, investment in AI and digital tools may prove critical to long-term competitiveness.

U.S. Travel Agency Landscape 2025

The modern travel advisor is part entrepreneur, part technologist and still the traveler’s most trusted human connection. Despite economic uncertainty, the U.S. agency channel continues to outperform the broader market, buoyed by strong luxury, cruise and family travel sales. A new wave of home-based independents has the potential to reshape the industry, blending personal service with digital agility. With optimism high and new technology, including AI, rapidly gaining traction, travel agencies are evolving to meet the expectations of the next generation of travelers.

U.S. Travel Agency Landscape 2025 is part of a joint research project with Phocuswright and Travel Weekly, tracking the travel agency distribution landscape and overall market size.

APAC travel market

Asia Pacific Travel Market Report 2025

Sharper. Smarter. Still the Source. Refreshed for 2025, this report series delivers market analysis, comprehensive sizing and projections for the Asia Pacific travel industry from 2022-2028. It features dedicated coverage of 12 key regional players: Australia-New Zealand, China, India, Japan, Northeast Asia (including Hong Kong, Macau, South Korea and Taiwan) and Southeast Asia (including Indonesia, Malaysia, Singapore and Thailand). Collectively, the series offers a detailed view of the segments, trends and distribution dynamics that are shaping Asia Pacific’s travel landscape in 2025 and beyond.

Australia-New Zealand Travel Market Brief 2025

The travel sector in Australia-New Zealand is shifting gears: moderating after a post-pandemic surge, this market is still charting steady growth. In 2024, the market reached US$37.8 billion, though much of the increase was inflation-led rather than demand-driven. Online booking remains dominant, yet retail agencies and direct supplier channels continue to play key roles, particularly for complex international trips. As airline and car rental segments rebound via stronger inbound traffic and strategic partnerships, long-term growth is forecast to remain positive. Policymakers are also reshaping the landscape, focusing on high-value tourism to drive sustainable returns amid global uncertainty.

Free Research Insights article:

India Travel Market Essentials 2025

India’s travel market is accelerating at a pace few global sectors can match. Gross bookings climbed 11% in 2024 to $41.5 billion, fueled by domestic demand, rising discretionary spend and infrastructure gains. Online penetration reached 56%, with OTAs and suppliers racing to capture growth in a rapidly digitalizing economy. Airlines and hotels are expanding aggressively despite capacity and supply bottlenecks, while rail modernization and a fast-growing car rental sector add new momentum. With outbound travel surging and niches like destination weddings, medical tourism and sports travel scaling rapidly, India is poised to reshape global tourism dynamics through 2028.

Free Research Insights article:

Northeast Asia Travel Market Essentials 2025

After emerging later than most regions from prolonged COVID-era border closures, Northeast Asia’s travel markets regained momentum in 2024 and moved into a more complex recovery phase in 2025. Gross travel bookings surpassed $50 billion for the first time in 2024, though growth slowed to 5% following the exceptional rebound of 2022-2023, with expansion expected to moderate further through the latter 2020s. Beneath the headline figures, recovery remains uneven across markets and segments, shaped by distinct demand structures, competitive pressures and evolving consumer behaviors. As governments reinvest in tourism and travel patterns grow more fluid, the region is entering a period of recalibration rather than simple rebound.

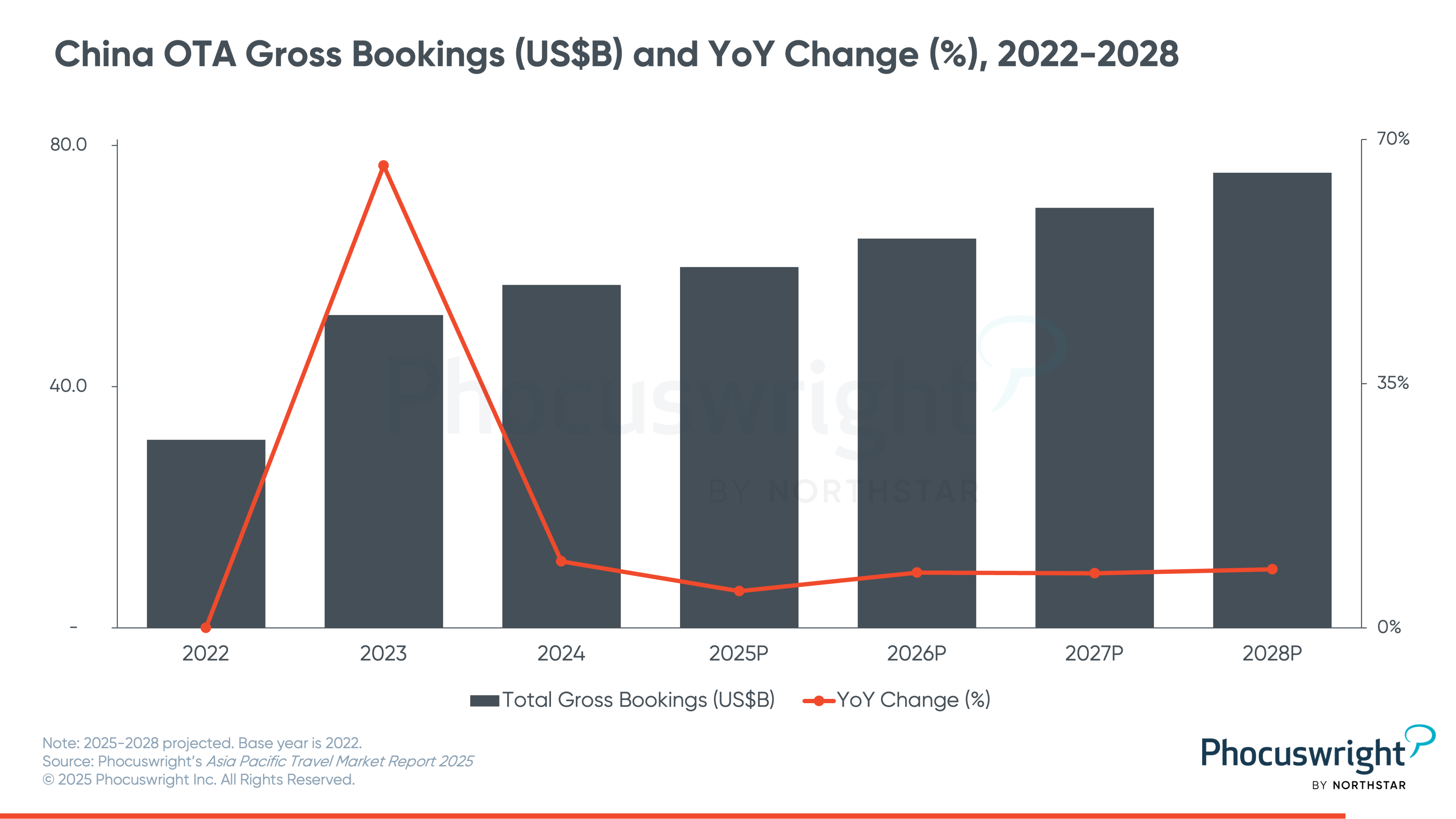

China Travel Market Essentials 2025

China’s vast travel market is navigating a paradox: booming demand alongside persistent pricing pressures. The overall market grew 5.5% in 2024 to $151.8 billion, closely tracking national GDP, yet widespread deflation and weak consumer confidence continue to hold back stronger momentum. Online bookings now account for nearly three quarters of revenue and will reach 82% by 2028, reflecting China’s position as a mobile-first travel economy. Meanwhile, OTAs are expanding aggressively, car rental is thriving, and hyper-fast rail projects promise to reshape domestic travel. Overall, future projections are cautiously optimistic, with outbound travel returning to pre-pandemic levels by 2025 and long-term growth tied to rising digital adoption and government-led stimulus.

Free Research Insights article:

Japan Travel Market Essentials 2025

Japan’s travel market has transitioned from recovery to renewal. In 2024, inbound tourism surged to record highs on a weak yen, yet overall growth in U.S. dollars remained muted. The 2025 Osaka Expo fueled demand, but sustainability and regional dispersion dominate Japan’s next policy phase. Digital maturity is rising, though the country still lags peers in AI adoption, leaving ample room for further transformation through 2028.

Free Research Insights article

Southeast Asia Travel Market Essentials 2025

After years of record-setting rebound, Southeast Asia’s travel market has entered a new, more measured era. The post-pandemic surge gave way to stabilization in as competition intensified, costs rose and traveler priorities shifted toward value. Air connectivity remains the region’s growth engine, driven by low-cost carriers and expanding hubs in Indonesia, Singapore and Thailand. Meanwhile, hotels face slower gains amid rate volatility and supply pressures. Despite global uncertainty, the region’s $61.7 billion travel economy continues to evolve, fueled by digital adoption, cross-border infrastructure and the growing influence of Chinese platforms and investors.

Global markets

Global Travel Market Report 2025

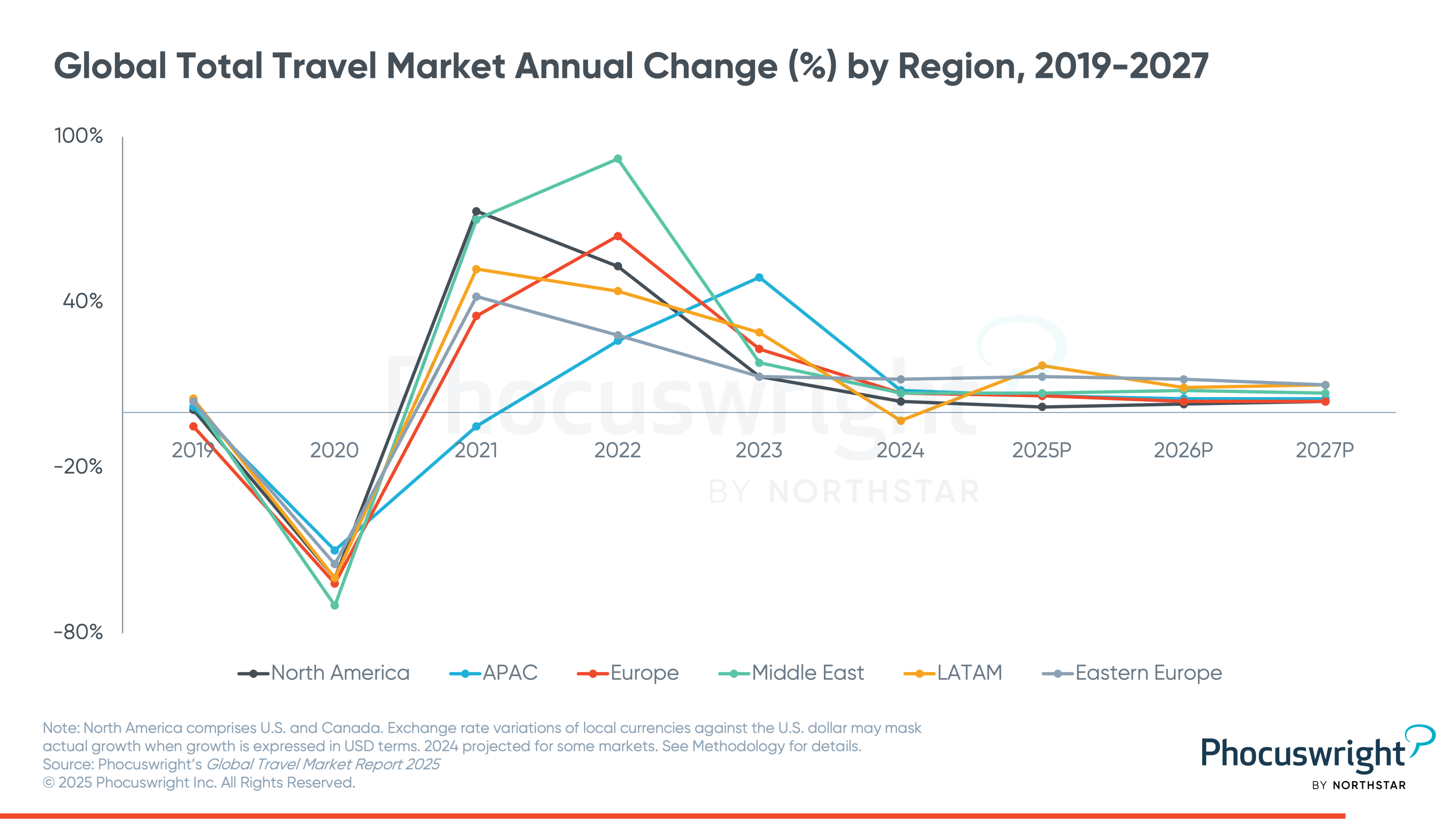

Fully recovered and shifting back towards growth dynamics, global travel gross bookings climbed to US$1.6 trillion in 2024 and are projected to approach $1.8 trillion by 2027. Fueled by digital adoption and steady leisure demand, this era of travel is defined by structural transformation on multiple fronts. Yet growth is far from uniform: while the established markets firmly hold on to their leads, emerging regions like the Middle East and Latin America are rising fast. Together, these trends signal an industry diversifying across markets, channels and consumer behaviors, creating both opportunities and challenges for stakeholders worldwide.

Phocuswright’s Global Travel Market Report 2024 provides comprehensive market sizing and projections from 2021-2027, including analysis of key segments, trends and distribution dynamics for six regions: North America (U.S. and Canada), Asia Pacific (APAC), Europe, the Middle East, Latin America (LATAM) and Eastern Europe. The content presented here is sourced in part from several Phocuswright publications, including the following:

- U.S. Travel Market Report 2025

- Canada Consumer Behavior and Travel Market Report 2022-2026

- Asia Pacific Travel Market Report 2025

- Europe Travel Market Report 2025

- Middle East Travel Market Report 2025

- Latin America Travel Market Report 2025

- Eastern Europe Travel Market Report 2023-2027

Key questions answered by this research include:

- How large is the global travel market today, and what growth is projected through 2027?

- Which regions are leading travel gross bookings, and how do their growth patterns differ?

- How quickly are travelers shifting from offline to online booking channels worldwide?

- What role do suppliers vs OTAs play in digital distribution across air and hotel segments?

- How are geopolitical, economic and policy changes shaping regional travel dynamics?

- What long-term structural shifts, such as AI, sustainability mandates and blended travel, are defining the next phase of global travel?

Free Research Insights article:

Latin America Travel Market Report 2025

Latin America’s travel industry entered 2025 as one of the world’s most resilient and fastest-evolving markets, outpacing GDP growth despite volatile currencies and uneven macro conditions. Brazil and Mexico continue to anchor the region, while Colombia, Chile and Argentina reveal the diversity of post-pandemic recovery stories. Digitalization is crossing a critical threshold: for the first time, more than half of all bookings will occur online in 2025. Further, as low-cost airlines, global hotel brands and OTAs consolidate power, Latin America’s next chapter will hinge on balancing growth, sustainability. With the rising expectations of younger, hyper-connected travelers, the region is reaching a critical sink-or-swim point in its medium-term market trajectory.

The Latin America travel market includes several key country markets: Mexico, Brazil, Colombia, Chile and Argentina. This report provides market sizing, projections and key segment analysis for the Latin America travel industry through 2028.

Free research insights articles:

Italy Travel Market Essentials 2025

The Italian travel market grew 8% to €28.9 billion in 2024, fueled by a surge in inbound tourism and steady domestic demand. Online bookings now account for 57% of the market and are on track to reach 62% by 2028, while offline channels—particularly retail agencies—remain important for complex trips. Hotels continue to dominate supplier revenue, supported by strong luxury demand and record overnight stays, and rail saw double‑digit growth driven by high‑speed services. Despite global uncertainties and structural challenges, Italy’s diverse offerings and strong brand position it for continued growth in the years ahead.

Middle East Travel Market Report 2025

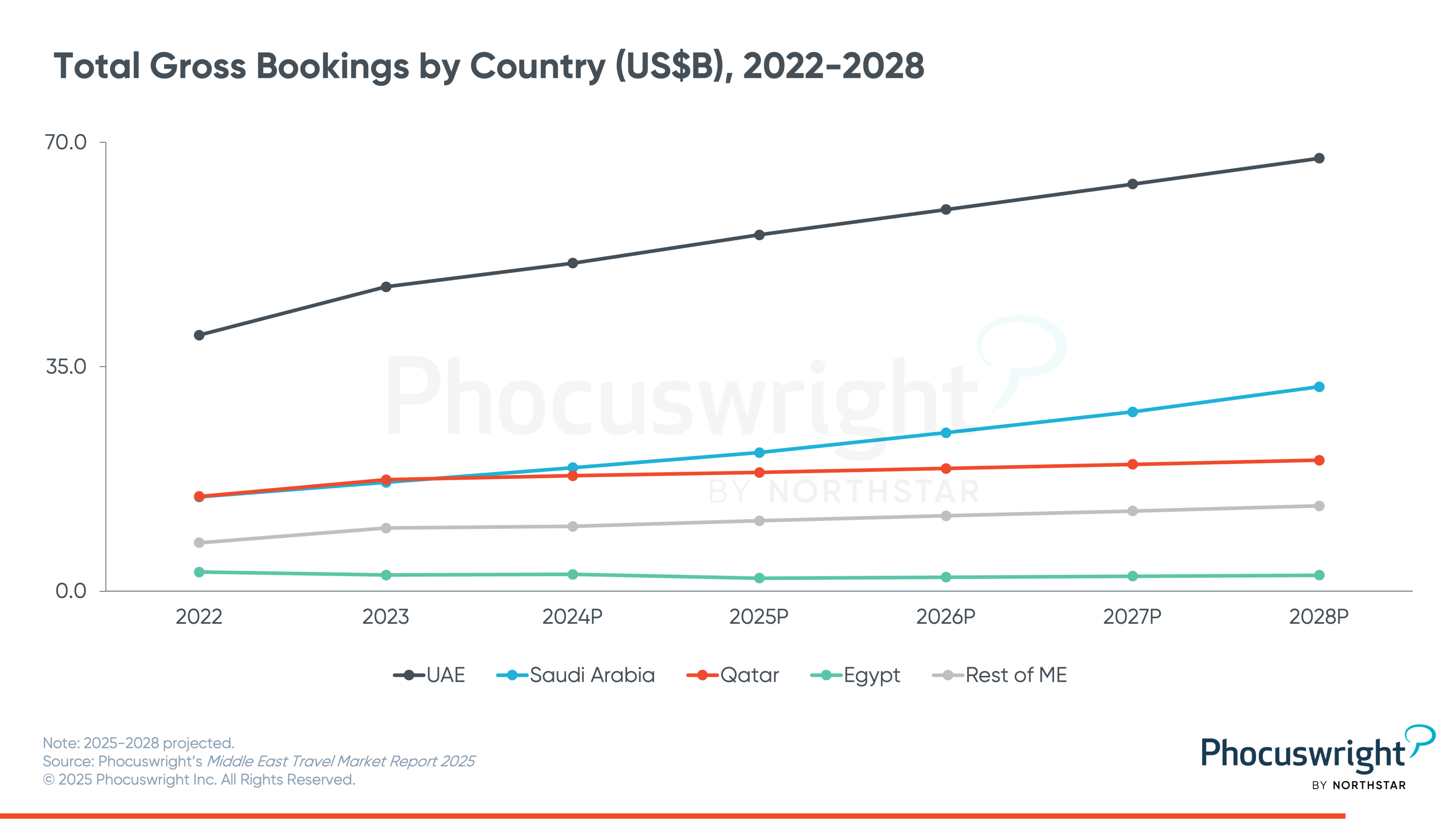

The Middle East travel market is undergoing one of the world’s most ambitious transformations, fueled by Vision 2030 initiatives, massive infrastructure investments and the success of global mega-events. Total gross bookings reached $101.2 billion in 2024, at 23% above pre-pandemic levels—and are projected to grow steadily through 2030. Digital channels are rapidly reshaping distribution, with online penetration expected to climb from 48% in 2024 to nearly 60% by 2028. Alongside luxury and experiential offerings, sustainability commitments and cultural reforms are redefining the region’s appeal, positioning destinations like Saudi Arabia, the UAE, Qatar and Egypt as global tourism powerhouses.

New in 2025, this Essentials report delivers top-level takeaways for the Middle East (the UAE, Saudi Arabia, Qatar and Egypt) travel market, featuring charts and analysis on the key trends, segment highlights and market sizing datapoints that matter most.

Free Research Insights article:

India Travel Market Essentials 2025

India’s travel market is accelerating at a pace few global sectors can match. Gross bookings climbed 11% in 2024 to $41.5 billion, fueled by domestic demand, rising discretionary spend and infrastructure gains. Online penetration reached 56%, with OTAs and suppliers racing to capture growth in a rapidly digitalizing economy. Airlines and hotels are expanding aggressively despite capacity and supply bottlenecks, while rail modernization and a fast-growing car rental sector add new momentum. With outbound travel surging and niches like destination weddings, medical tourism and sports travel scaling rapidly, India is poised to reshape global tourism dynamics through 2028.

Travel Metric of the Month

Phocuswright’s Travel Metric of the Month 2025 features fresh travel industry research published throughout the year, showcasing key data across our market sizing, consumer research, and tech and innovation practices. Each month, we will publish a new visualization that highlights a significant research trend, finding or data set, along with links to the source publication for a deeper dive.

Metrics of the Month 2025 include:

- January: U.S. Travel Agency Bookings, 2020-2026

- February: U.S. Lodging Trends

- March: Asia Pacific Travel Rebound

- April: Travel Startup Funding Trends

- May: Short-Term Rental Trends

- June: Europe Consumer and Market Sizing Trends

- July: U.S. Market Sizing Trends

- August: AI in Travel

- September: U.S. Corporate and Business Travel

- October: Airline Booking & Channel Dynamics

- November: Shifting Slopes: Ski & Mountain Travel

- December: Loyalty in Travel 2025

More than numbers: This is decision-grade intelligence

Phocal Point: Global Market Sizing

When the market shifts, the most prepared teams aren’t just watching — they’re already adjusting.

That’s why we’ve updated Phocal Point and our Short-Term Rental dashboard with new market sizing, sharper forecasts through 2028, and tools built for professionals who need to move with clarity — not guesswork.

Why It Matters

Every percentage point matters

Whether you're modeling revenue, sizing a market, or evaluating a new opportunity, the difference between a good guess and a precise projection adds up — fast.

Regional nuance matters

What’s happening in Western Europe isn’t what’s happening in the U.S. — and it’s definitely not what’s happening in Asia Pacific. Our updated forecasts reflect this complexity, so you don’t have to flatten it.

Distribution strategy matters

Where bookings happen — and how that’s changing — is just as important as how much they’re worth. Our STR dashboard gives you interactive access to gross bookings data by channel, year, and region. Run your own comparisons. Export your own cuts. Back your strategy with specifics.

Weekly Research Insights

We dig deep to give you the data and trends that drive the travel, tourism and hospitality industry.

Get the latest in travel industry highlights with our free weekly research articles and more. Sign up to get the latest delivered directly to your inbox.

FOR MORE INSIGHTS

See all of Phocuswright's free research insights here.

Sign up to get the latest delivered directly to your inbox.

Open Access Research Subscription

Research is our priority. Our Open Access research subscription puts the world’s most comprehensive library of travel research and data visualization at your fingertips.

Clients have relied on Phocuswright's deep industry knowledge for over 25 years to power great decisions, help justify a pitch, build a strategic plan and elevate any presentation through trusted research and data. When companies and executives reference Phocuswright, they gain the trust of an industry keen on data, trends and analytics.

See the full benefits of an Open Access subscription here.

Contact Us

For any questions you may have, please call or email us at

📱 +1 860 350-4084

📧 info@phocuswright.com

About Phocuswright

Events

FAQ

Copyright

Contact Us

Research

News

Privacy & Terms

Press Room

Email Updates

Register for Phocuswright emails about research data, events and more:

A WHOLLY OWNED SUBSIDIARY OF

Copyright © 2025 by Northstar Travel Media LLC. All Rights Reserved. PO Box 760, Sherman, CT 06784 USA | Telephone: +1 201 902-2000

The Phocuswright Conference • Phocuswright Europe • Global Startup Pitch • Travel Tech Fellowship • Phocuswire • Web In Travel • Inntopia • Retail Travel • Hotel Investment