The five developments driving the evolution of U.S. OTAs

- Published:

- October 2025

- Analyst:

- Phocuswright Research

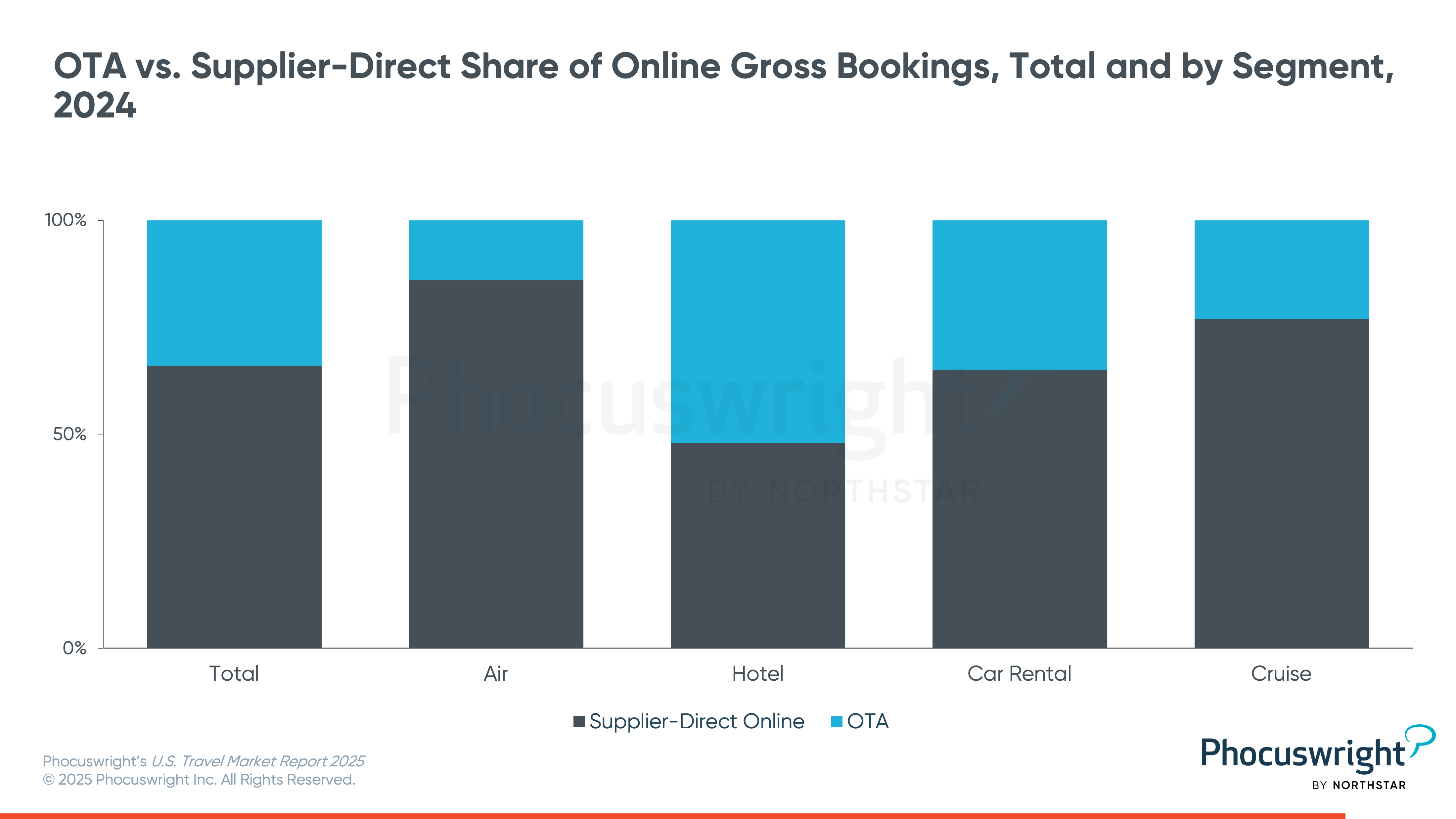

U.S. online travel agencies posted $108.5 billion in gross bookings in 2024, up 4% from 2023 and 85% higher than 2019 levels (excluding short-term rentals). According to Phocuswright’s U.S. Online Travel Agency Market Essentials 2025, OTA market share remains steady with only slight channel shifts anticipated, such as a marginal move toward supplier-direct air and hotel bookings through 2028.

Against this steady backdrop, five key trends are set to define the next chapter for U.S. OTAs.

B2B boost continues:

Expedia, Booking and Hopper are expanding partner networks and white-label deals—especially in Asia—driving significant revenue growth and new private-label travel services.

Higher yield through loyalty:

Unified platforms and stronger rewards are paying off, with Expedia and Booking seeing record direct bookings from One Key and Genius members, lowering marketing costs and increasing repeat stays.

The rise of virtual agents:

OTAs are embedding generative and agentic AI—like Priceline’s Penny and Expedia’s Romie—while partnering with major AI players to personalize search, planning and booking.

Connecting the dots:

Dynamic packages and connected trip strategies are gaining traction, with packaged gross bookings up and projected to keep climbing through 2028.

Versus Airbnb:

OTAs are differentiating and expanding private accommodations, with Vrbo leaning into pure vacation rentals and Booking growing its alternative lodging mix to 37% of room nights.

New in 2025, this Essentials report delivers top-level takeaways for the U.S online travel agency market, featuring charts and analysis on the key trends, segment highlights and market sizing datapoints that matter most.

Other publications in the U.S. Travel Market Report 2025 series include:

- U.S. Airline Market Essentials 2025

- U.S. Car Rental Market Brief 2025

- U.S. Cruise Market Essentials 2025

- U.S. Hotel & Lodging Market Essentials 2025

- U.S. Online Travel Agency Market Essentials 2025

- U.S. Packaged Travel Market Brief 2025

- U.S. Travel Market Report 2025

- U.S. Travel Market Data Sheet 2023-2027 (subscriber only)

Phocuswright Open Access

Phocuswright Open Access gives your entire team unlimited access to the travel industry’s most trusted research—no seat limits, no paywalls. Get instant insights from in-depth reports, interactive dashboards, and downloadable datasets, plus tailored answers from analysts and a dedicated concierge to guide your journey.

It’s more than research—it’s your competitive edge. Validate opportunities, support internal strategy, and stay ahead of change with always-on intelligence organized by sector, region, and trend. Move faster, with confidence, and lead the industry forward. Get your competitive advantage started now.