Fewer than half of travelers consider themselves to be highly consistent in their travel brand patronage, whether it be the exact providers they use or the booking sites they frequent. The mixed consistency levels also extend to preferred travel brands. 39% of those who flew on a recent leisure trip and 42% of paid accommodation users claim they gravitate towards one or two "go-to" brands in their planning according to Phocuswright’s research report Beyond Points: Rethinking Loyalty and Brand Consistency in Travel. The remainder of travelers find themselves open to many brands, or they use the category so seldomly that they don't feel familiar with the brand landscape.

There are times when travelers have everything go right for them: Booking is convenient and transparent, customer service interactions are positive and services are delivered smoothly and without incident. A traveler will sing a brand's praises, perhaps leave strong reviews and still not use a brand the next time they have opportunity to book with them.

For many travelers, novelty and intrigue are a critical part of the travel experience. It is important for brands to deliver consistent experiences around aspects of quality, such as strong customer service, cleanliness in hospitality environments or timeliness in transportation. Variability in these key markers of quality is generally unwelcome. But once the fundamentals are accounted for, there is a set of travelers who view variety across travel experiences positively—they want to switch up their experiences "just because."

Wanting to try something new is a top justification for using non-go-to brands within the last year across a variety of travel verticals. It is one of the top 5 reasons for "defecting" from a preferred airline (20%), hotel (21%) and OTA (25%).

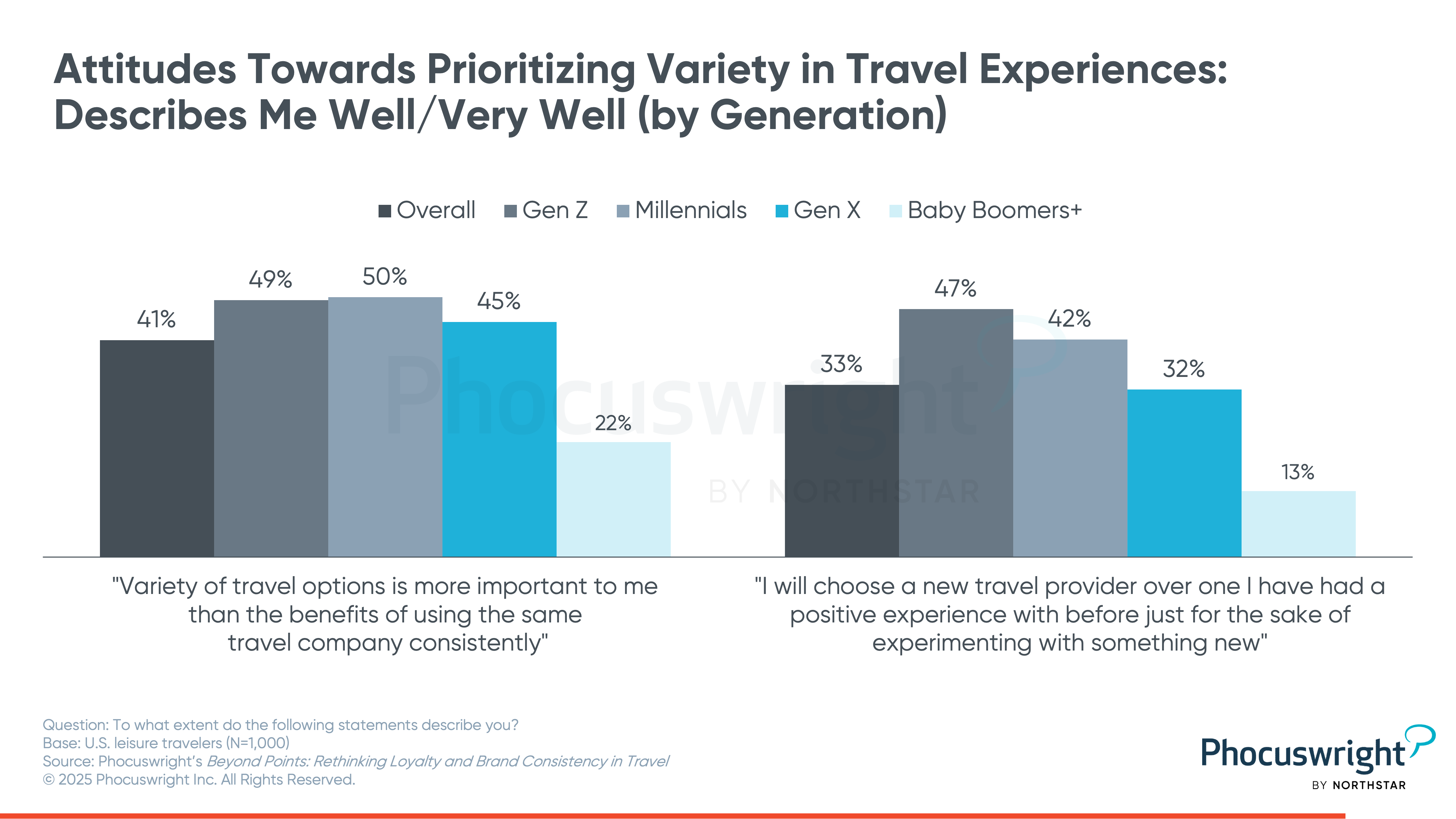

This attitude is far more prominent among younger generations of travelers. Around half of Gen Z (49%) and millennials (50%), as well as 45% of Gen X claim that variety of travel options is more important to them than the value of using the same travel company consistently. These traveler cohorts may be the ones most known for brand hopping or for being the types of travelers whose loyalty is most hard earned. It's the boomers and Silent Generation who are least likely to hold this attitude; only 22% of them would choose variety over consistency.

Gen Z is especially more likely (47%) to identify with the statement "I will choose a new travel provider over one I have had a positive experience with before for the sake of experimenting with something new." This view becomes distinctly less common among older generations with a particular drop-off between Gen X (32%) and boomers and the Silent Generation (13%). With less travel experience overall, Gen Z may approach the brand selection process with more openness and curiosity to understand what the landscape of travel companies can offer. But they may also seek new-to-them brands just because it makes the travel experience more enjoyable to them, not because a past brand experience was subpar.

If travelers are expected to utilize their loyalty programs, these programs must prepare for a traveler who regularly seeks redemption options in new and different destinations. Half of the people who redeemed points or miles on a recent leisure trip were visiting a destination for the first time, compared to 30% of non-redeemers. Redemption options can work best when they are expansive enough that travelers trust they will have attractive "burn" opportunities in unfamiliar destinations.

Check out Madeline List’s presentation from The Phocuswright Conference last month:

Phocuswright’s Beyond Points: Rethinking Loyalty and Brand Consistency in Travel is part of a comprehensive consumer research study delving into the specifics of how U.S. travelers perceive brand loyalty and engage with the current ecosystem. Key questions addressed include:

- How do travelers define loyalty—and how does this differ from how brands structure loyalty programs?

- What kinds of generational differences exist in brand consistency, loyalty engagement and redemption habits?

- Why do travelers stray from their go-to brands, and how does novelty factor in?

- How can loyalty programs evolve to attract younger travelers seeking flexibility, variety and value?

- Which loyalty models are best positioned to succeed in today’s travel environment, given travelers’ shifting priorities toward flexibility, variety, and value?

Phocuswright’s independent research and analysis gives your company a competitive advantage in the travel, tourism and hospitality marketplace.

We offer subscriptions, individual reports, custom research and multi-client special projects to make confident, data-driven decisions that outpace your competition. Learn more here.