The supplier shift powering Latin America’s travel growth

- Published:

- November 2025

- Analyst:

- Phocuswright Research

According to Phocuswright’s latest travel research report Latin America Travel Market Report 2025, the region’s travel suppliers are entering 2025 stronger, smarter and more digital than ever. Across airlines, hotels, car rentals and intermediaries, the post-pandemic reset is giving way to a new phase of consolidation and innovation. Airlines remain the backbone of the region’s travel economy, setting new passenger records in Brazil, Mexico, Colombia and Chile. Low-cost carriers continue to expand, while legacy airlines focus on restructuring and strengthening market leadership.

Hotels are gaining ground through rate-driven growth, with ADR and RevPAR rising faster than occupancy. More than 150 new hotel projects are underway, led by Brazil, Mexico and Chile, reflecting renewed investor confidence in inbound demand and the long-term fundamentals of the region’s hospitality sector.

Car rental markets reached record gross bookings in 2024, driven by both leisure and corporate travel, while tour operators and OTAs are accelerating their digital transitions. Online channels now account for more than half of OTA gross bookings, a milestone that underscores the region’s digital maturity.

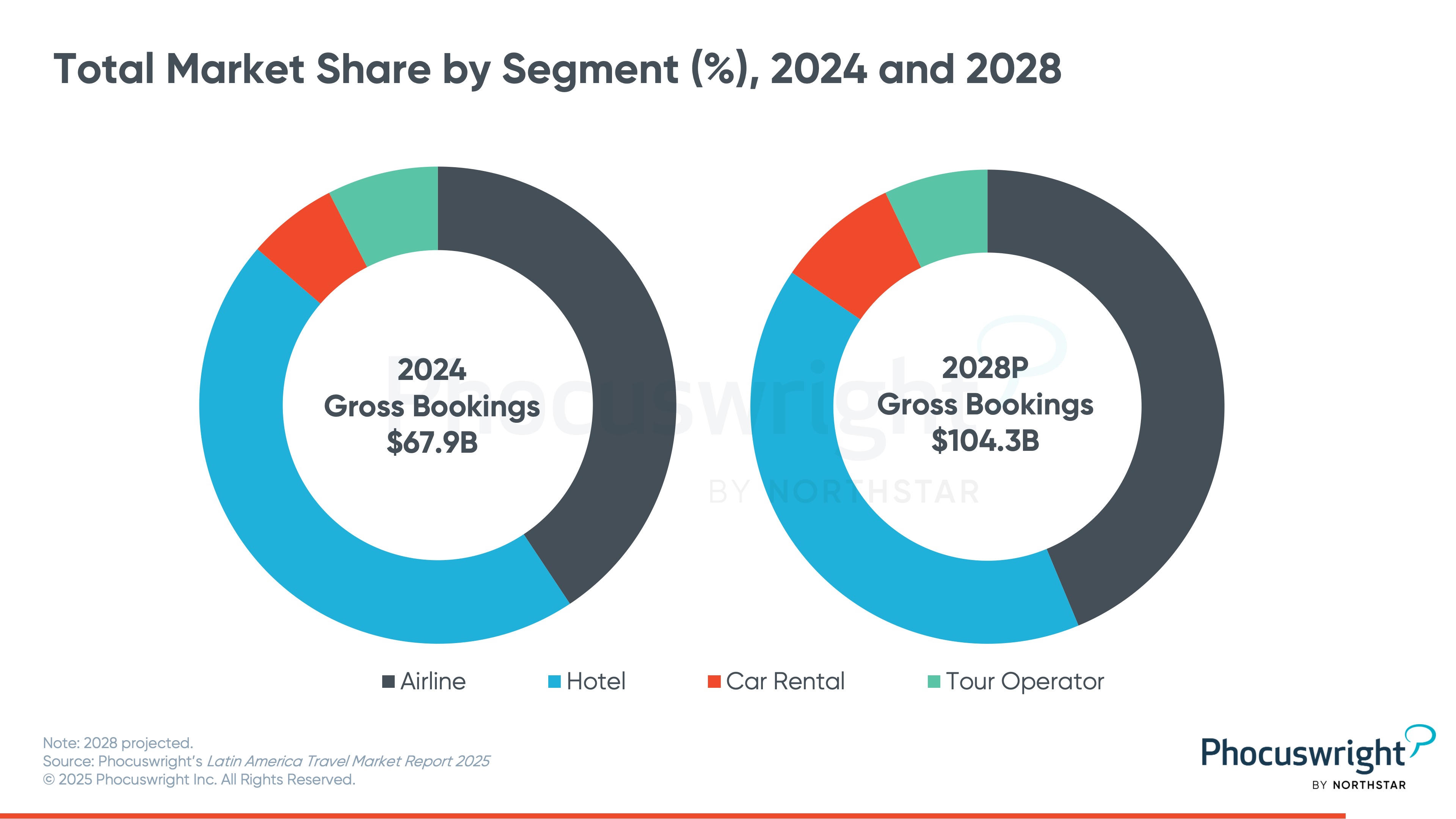

In short, Latin America’s travel sector is navigating a dual reality. Macro and political volatility persist, yet tourism has become one of the region’s most dynamic engines of growth. Despite uneven conditions, the industry generated US$67.9 billion in gross bookings in 2024. Although this was slightly below 2023, the outlook is bright. Bookings are forecast to rise 17% in 2025 to reach $79.2 billion, setting a new regional record.

For stakeholders across the region, understanding how suppliers are adapting to this environment is essential. Airlines are reshaping their structures, hotels are reactivating investment pipelines, fleets are diversifying and intermediaries are redefining distribution. The result is a more connected, competitive and digitally enabled supplier landscape that will shape Latin America’s next phase of travel growth.

The Latin America travel market includes several key country markets: Mexico, Brazil, Colombia, Chile and Argentina. This report provides market sizing, projections and key segment analysis for the Latin America travel industry through 2028.

The Phocuswright Open Access research subscription gives you company-wide access to all of our expert-driven research reports and interactive data, so your team can identify emerging trends and seize new opportunities faster.

Learn how to get insights from the world’s leading travel industry research authority.