Travel bookings hit €347B in 2024 but cost pressures, sustainability fees, and uneven recovery could reshape the market.

An excerpt from Phocuswright's Europe Travel Market Report 2025

European travel market growth normalized at a healthy level in 2024, as consumer segments and products that were slow to recover following the COVID-19 pandemic helped to drive increased travel spending and demand. While higher travel costs were partially responsible for gains, tourism spending also got a boost from the return of high-spending APAC tourists and strong demand for events and blended business-leisure travel.

International tourist arrivals in 2024 increased 5% compared to the previous year, finally pushing international arrivals above the 2019 level. In addition to increased tourism from the Asia-Pacific region, growth was fueled by strong intra-regional demand and robust performance in major source markets like Germany, France and the U.K.

Travel demand remained strong through 4Q24, despite continued inflation. However, rising travel costs led travelers to opt for cost-effective destinations such as Malta, which saw international arrivals increase 23% in 2024 versus the previous year. Travelers also sought to save money by traveling during off-peak periods. It is difficult to predict how travel prices will evolve in the near term. For example, while mandatory sustainability charges may drive up airfares in 2025, fuel costs may decline.

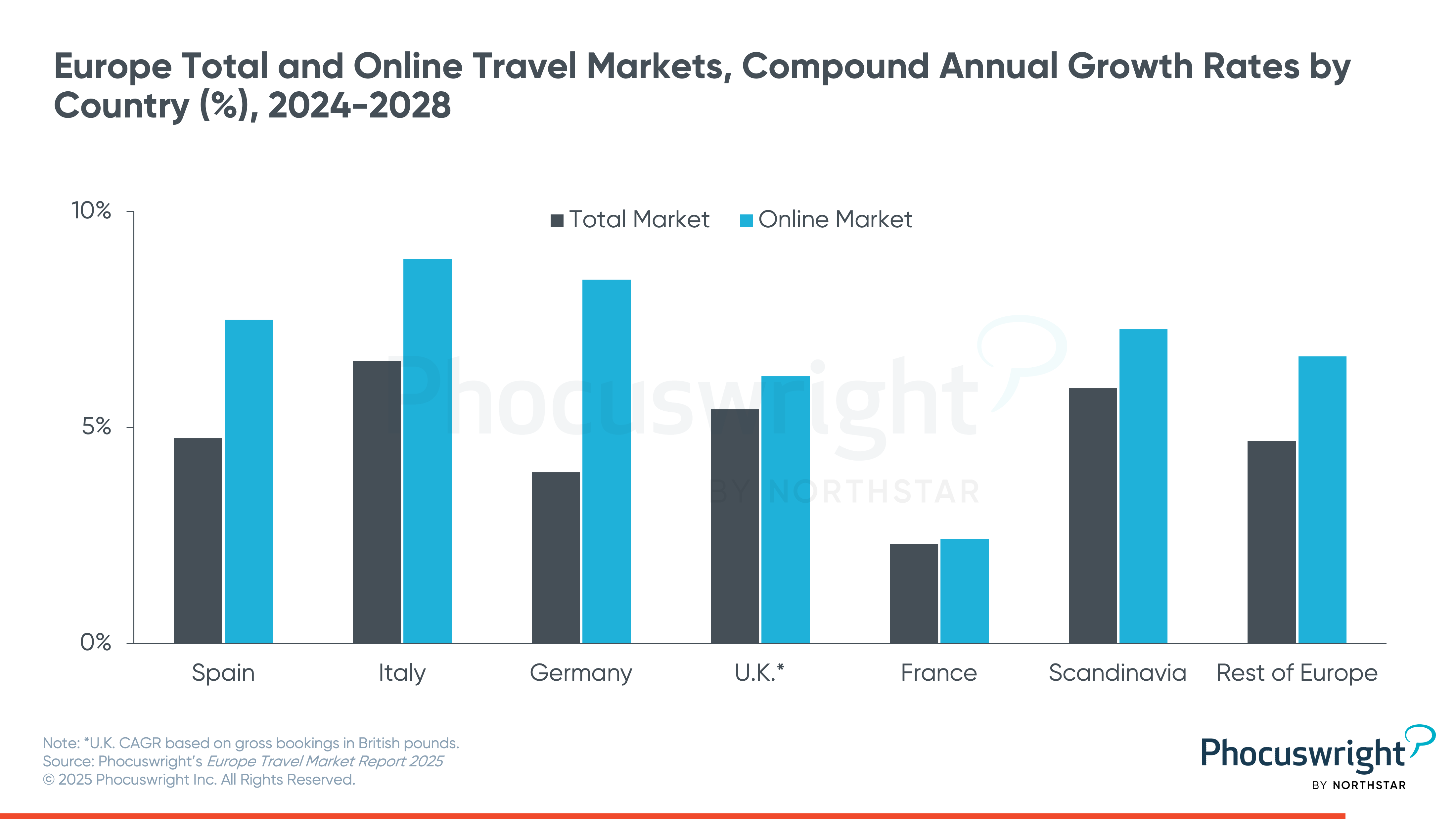

Growth is expected to moderate to 4-5% through 2028, when gross bookings will reach €415 billion.

Economic pressures and geopolitical uncertainties continue to impact the European macroeconomic environment, but resilient demand continues to fuel the market in 2025. European travelers expect to take more international leisure trips and business trips on average compared to 2024, including an uptick in hybrid travel that combines work and leisure.

Despite economic challenges and continued issues with overtourism in destinations like Barcelona and Venice, moderate growth is projected. European stakeholders are prioritizing sustainability and digital efficiency, including AI-powered travel services expected to increase personalization. Although long-haul recovery remains uneven, intra-European travel and niche experiences will drive revenue gains in 2025.

Total travel gross bookings increased 6% in 2024 to €347 billion. Growth is expected to moderate to 4-5% through 2028, when gross bookings will reach €415 billion. Online leisure/unmanaged business travel growth continues to outpace the overall market, with online gross bookings increasing 11% in 2024 to reach €236 billion.

These gains brought European online travel penetration in 2024 to 68%, and that share is expected to climb steadily to 74% by 2028. Online travel growth is expected to slow slightly, as some market segments—such as rail, car rental and low-cost airlines—approach saturation.

This snapshot is just a fraction of the full picture.

What you’ve read here is an excerpt from Phocuswright’s Europe Travel Market Report 2025, the definitive analysis for decision-makers shaping the future of Europe’s travel industry. Inside, our analysts reveal the complete market sizing, segment-by-segment projections, competitive shifts, and the consumer trends that will define the next three years.

In a region balancing resilient demand with rising costs, sustainability pressures, and uneven long-haul recovery, strategic clarity is essential. This report gives you the hard data and forward-looking insights you need to anticipate market turns, capture new revenue opportunities, and outpace your competitors.

Every leading travel company operating in Europe will be making moves based on this intelligence. Without it, you risk being left behind.

Elevate your industry standing with Special Projects

Our multi-client sponsored research projects dive deep into the most important topics impacting the global travel, tourism and hospitality industry.

By partnering with Phocuswright, your company gains exclusive, unpublished insights that not only propel your strategic decisions but also elevate your standing as an industry leader.

Discover our upcoming Special Projects

/cruiserthumb.jpg)

/lux-thumb(1).png)

/genai-survey-thumb.jpg)

/thumb-loyalty(2).png)

/thumb-page(2).png)

/travelertechthumb2.jpg)