Beyond points: Rethinking loyalty and brand consistency

- Published:

- November 2025

- Analyst:

- Phocuswright Research

The term "loyalty" in the travel industry conjures associations with a world of points, status, programs and credit cards. These are formidable institutions across every sector of travel, and the points economy is impressive. What does loyalty really mean in an industry where 55% of leisure travelers only planned one or two trips in the past 12 months? Today's conversations about loyalty often gloss over the fact that real brand consistency doesn't always align with the tiers of status created by suppliers. Phocuswright sought to better understand the underlying forces of repeat brand patronage using a study that explored consistency, brand relationships and how programs can influence booking decisions.

Phocuswright's latest report Beyond Points: Rethinking Loyalty and Brand Consistency in Travel unpacks how travelers view their own brand consistency and where their perceptions of loyalty clash with the types of behavior that programs reward. These behaviors are also examined through the lens of generational differences, exploring how Gen Z and other groups define loyalty, and where their approach to travel shopping differs from behaviors in the past.

Traveler Perceptions of Loyalty

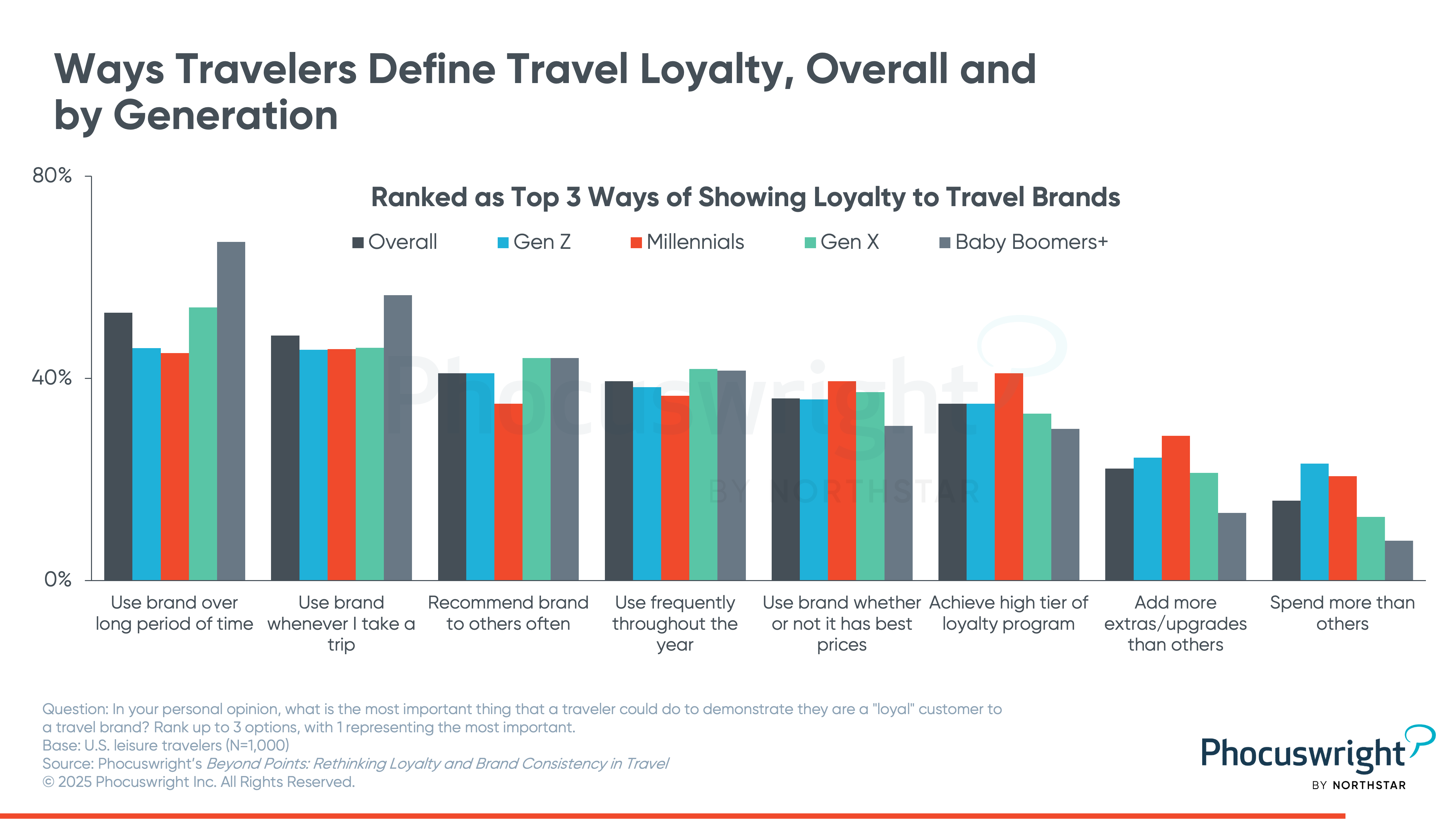

Travelers have different ideas than brands about what constitutes loyal behavior, and some of the traveler values of loyalty are not typically rewarded by programs or credit cards.

Loyalty programs themselves tend to be most rewarding of high spend and frequency of brand use, often encouraging both. For travelers, spending more than the average customer was the least common way to view loyalty (16% ranked it as one of the most important displays of loyalty), though this sentiment is slightly more popular among Gen Z and millennials.

Similarly, travelers feel unimpressed by the idea of defining loyalty through a customer's likelihood to upgrade or add ancillary purchases to a travel booking (22% ranked), though this was viewed more favorably by millennials than others.

The most common action travelers consider to be a signal of loyalty is using the brand over a long period of time (53% ranked). This attitude is far more popular among boomers and the Silent Generation than their younger counterparts, likely because their age groups have had the longest amount of time to build up that longitudinal loyalty.

Other popular definitions of loyal travel behaviors are using the brand whenever there is opportunity to take a trip (48% ranked), which was more popular among boomers and the Silent Generation as well (56%). In contrast, viewing loyalty as frequent use of the brand throughout the year was popular across age groups, but much more supported among super frequent travelers (50% ranked among those who took 6+ leisure trips per year) compared to infrequent ones (39% of those who took 1-2 leisure trips per year). Travelers also showed respect for brand evangelism, which 41% felt was one of the most important ways to demonstrate loyalty.

Though not the most popular articulation of loyalty, 35% of travelers considered it important to achieve high status within the loyalty program itself. Millennials put more emphasis on this compared to other generations. Despite some acknowledgement in the importance of status, it isn't necessarily viewed as attainable. Only 11% of leisure travelers took six or more leisure trips within their past year of travel, and within that elite group, 35% still feel that they don't travel enough to earn high status with travel loyalty programs. So while they may respect status, they may also find more practical motivation in programs that reinforce smaller or more achievable steps.

When discussing what might incentivize more consistency in usage of travel brands, prices played a very strong role. Cost was the clear leading incentive to patronize a brand more often:

The importance of price competitiveness and value (the price charged relative to the perception of the offering) are evergreen but may be amplified in the current season of macroeconomic strain and insecurity.

For brands that are not able to compete on price alone, or those for whom price competitiveness does not align with broader business strategy, travelers brought up loyalty programs and perks or gifts as other features that could motivate more regular bookings. Small gestures can make a big difference in the overall brand relationship:

To continue reading, purchase the report or subscribe to Phocuswright Open Access.

The full report analyzes:

- Preferred Brands & Consistency

- Traveler Perceptions of Loyalty

- Novelty and Loyalty at Odds

- Luxury and Variety

- Is Gen Z Disloyal?

- and more

Phocuswright powers the travel industry’s smartest decisions. Our in-depth insights and analysis give you the confidence to act decisively, stay ahead of the curve, and outperform the competition.

Get the most out of our insights with an Open Access subscription. Explore how it can propel your business.