From $1.6T to $1.8T: How global travel will grow, shift and digitize by 2027

- Published:

- October 2025

- Analyst:

- Phocuswright Research

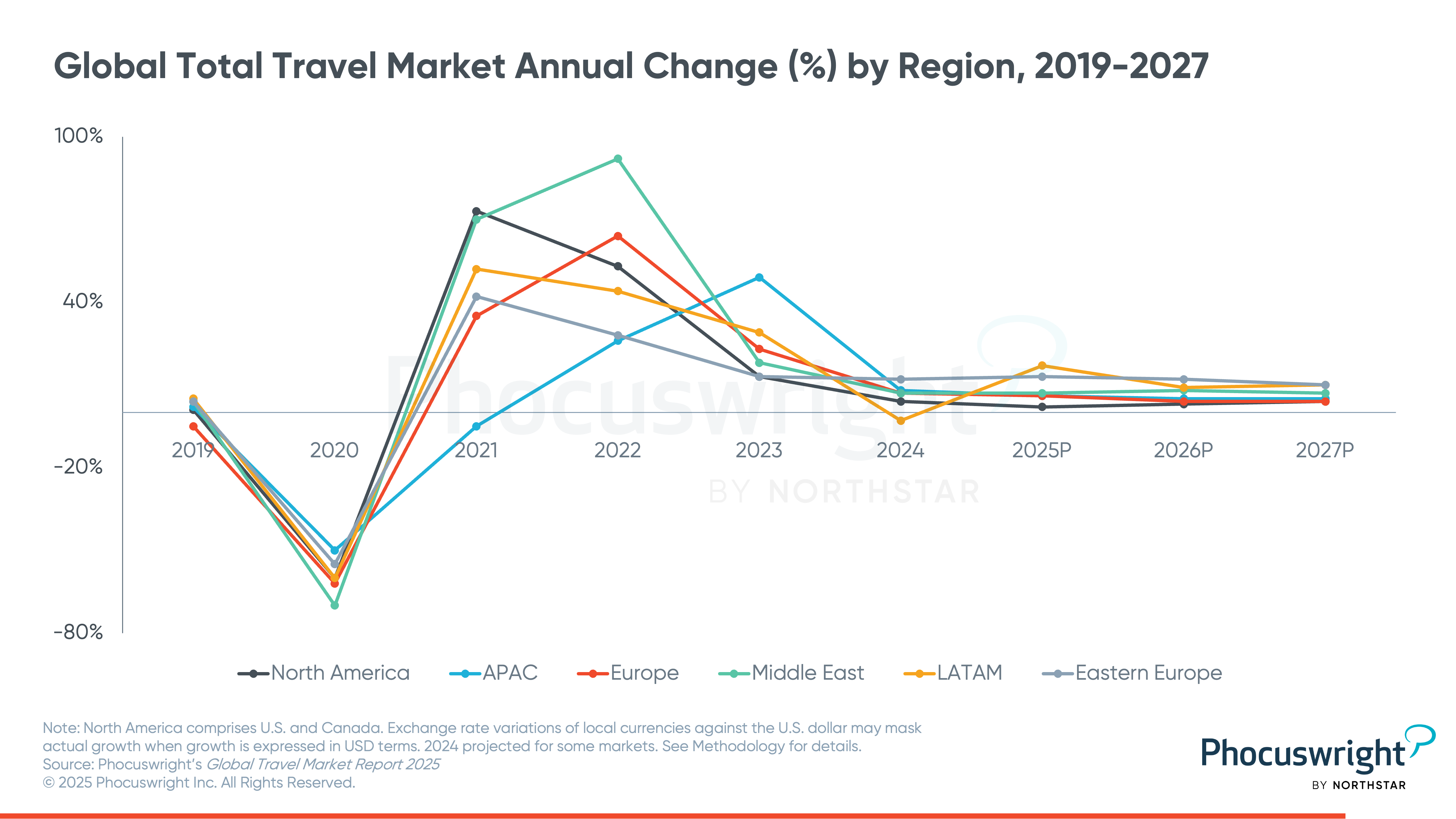

Fully recovered and returning to growth, the global travel industry reached US$1.6 trillion in gross bookings in 2024 and is on track to approach $1.8 trillion by 2027 according to Phocuswright’s latest travel research report Global Travel Market Report 2025. Fueled by digital adoption and steady leisure demand, this new era of travel is marked by structural transformation on multiple fronts. Yet growth is far from uniform: while established markets maintain their leads, emerging regions such as the Middle East and Latin America are rising fast. Together, these dynamics reflect an industry diversifying across markets, channels, and consumer behaviors — creating both opportunities and challenges for stakeholders worldwide.

Global growth sustained.

Travel gross bookings reached nearly US$1.6 trillion in 2024 and are projected to climb to more than $1.8 trillion by 2027.

Digital acceleration holds.

Online bookings grew 9% in 2024, lifting global digital penetration. By 2027, two thirds of all travel will be booked online.

Regional divergence.

North America led with $539 billion in travel gross bookings in 2024, followed by APAC. Europe is the third largest market, supported by resilient intra-regional travel. Emerging regions together will expand faster than mature markets in the forecast period.

Air and hotel dominate.

Combined, the two segments account for nearly three quarters of global travel gross bookings.

Distribution divide.

Suppliers led online bookings in 2024, but OTAs retain their edge in the hotel segment, where fragmentation favors intermediaries.

Shifting top markets.

Within the top 15 markets, Mexico, Brazil and India are forecast to deliver the strongest growth momentum through 2027.

Resilient demand.

Inflation, tariffs and policy shifts have tempered sentiment, yet blended trips, value-seeking behavior and sustainability concerns continue to shape travel decisions.

Taken together, these forces point to steady but uneven expansion, with global gross bookings projected to grow an average of 5.2% annually through 2027. Travelers are proving they will keep moving, even in uncertain times, yet they’re also making sharper, more deliberate choices about where, how, and why they travel. The industry’s challenge — and opportunity — lies in adapting quickly enough to capture this next phase of growth.

Phocuswright’s Global Travel Market Report 2025 provides comprehensive market sizing and projections from 2021-2027, including analysis of key segments, trends and distribution dynamics for six regions: North America (U.S. and Canada), Asia Pacific (APAC), Europe, the Middle East, Latin America (LATAM) and Eastern Europe. The content presented here is sourced in part from several Phocuswright publications, including the following:

- U.S. Travel Market Report 2025

- Canada Consumer Behavior and Travel Market Report 2022-2026

- Asia Pacific Travel Market Report 2025

- Europe Travel Market Report 2025

- Middle East Travel Market Report 2025

- Latin America Travel Market Report 2025 (coming soon)

- Eastern Europe Travel Market Report 2023-2027

Key questions answered by this research include:

- How large is the global travel market today, and what growth is projected through 2027?

- Which regions are leading travel gross bookings, and how do their growth patterns differ?

- How quickly are travelers shifting from offline to online booking channels worldwide?

- What role do suppliers vs OTAs play in digital distribution across air and hotel segments?

- How are geopolitical, economic and policy changes shaping regional travel dynamics?

- What long-term structural shifts, such as AI, sustainability mandates and blended travel, are defining the next phase of global travel?

Phocuswright powers the travel industry’s smartest decisions. Our in-depth insights and analysis give you the confidence to act decisively, stay ahead of the curve, and outperform the competition.

Get the most out of our insights with an Open Access subscription. Explore how it can propel your business.