ANZ travel market outlook: Growth fueled by prices, not passengers

- Published:

- September 2025

- Analyst:

- Phocuswright Research

Australia and New Zealand’s travel industry has surpassed pre-pandemic revenue levels, but the picture behind the numbers tells a more complicated story. New research from Phocuswright’s Australia-New Zealand Travel Market Brief 2025 shows that while gross revenue rose to US$37.8 billion in 2024, the growth is being driven largely by higher prices rather than increases in visitor volumes.

Inflation, not influx

Domestic travel is already saturated, and inbound flight capacity remains constrained. That means limited room for organic expansion, even as airlines, hotels and car rental firms report higher takings. Industry watchers warn that the sector’s reliance on inflationary gains leaves it exposed if consumer spending softens.

Governments in both Australia and New Zealand are leaning into a strategy of attracting higher-spending visitors, a move designed to bolster sustainability but one that puts added pressure on suppliers to deliver premium value.

Online channels hit a ceiling

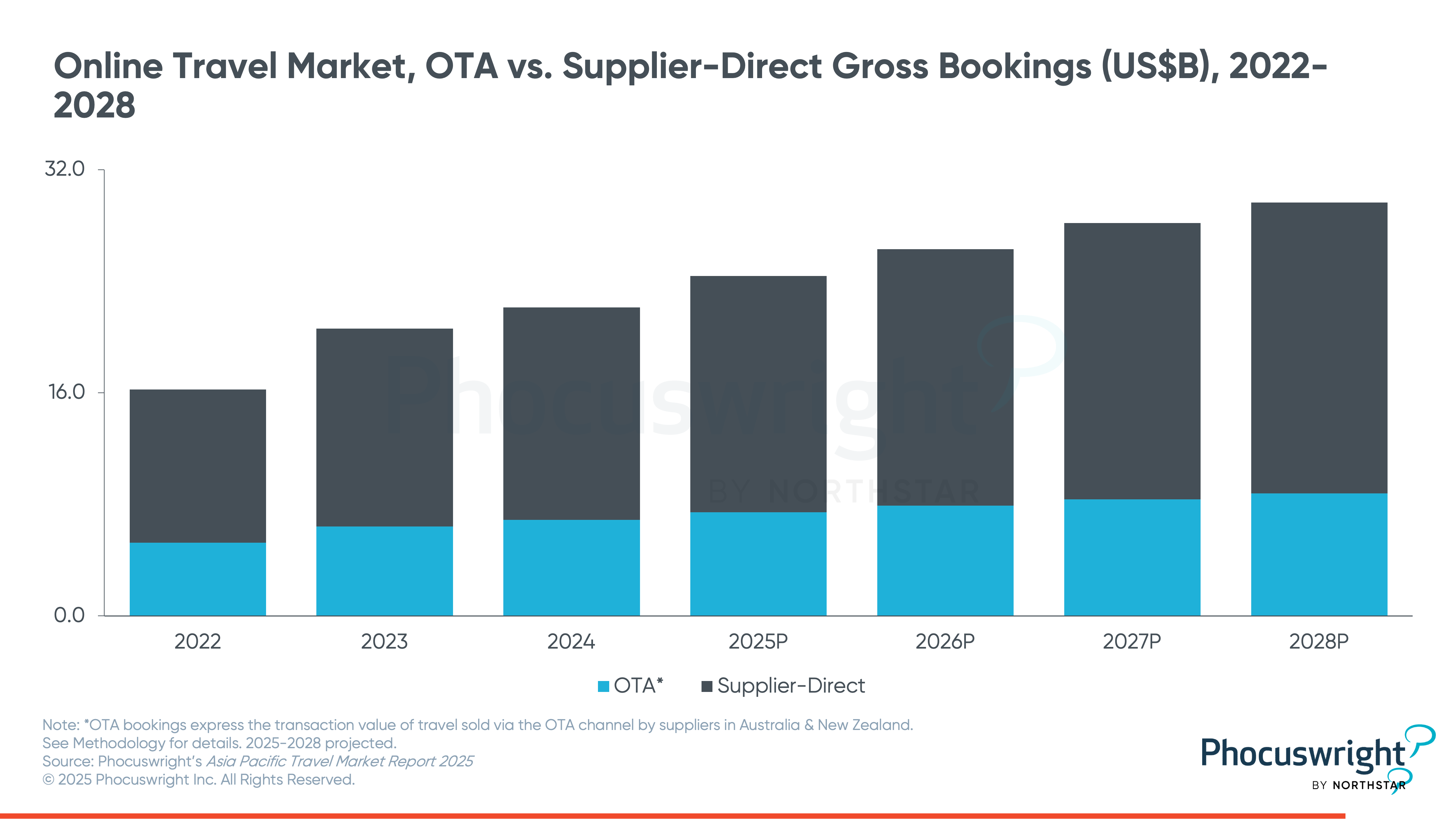

Digital adoption in the ANZ travel market is close to maturity, with online penetration hitting 59% in 2024 and forecast to reach just 61% by 2028. While online travel agencies (OTAs) continue to grow, their expansion is being outpaced by supplier-direct channels.

Major players — from the duopoly of Qantas and Virgin in Australia, to Air New Zealand and hospitality giant Accor — are using their resources and reach to keep more bookings in-house. Traditional retail and corporate agencies, meanwhile, continue to hold sway for complex and high-value international trips, further slowing the momentum of intermediaries.

Airlines poised for lift-off

Performance across travel segments remains uneven. Airlines, despite setbacks including the collapse of Rex and Bonza in 2024, are expected to power growth from 2025 onward. Partnerships, such as Qatar Airways’ investment in Virgin Australia, combined with higher fares and fuller planes, are forecast to drive double-digit revenue gains.

Hotels, by contrast, face a tougher environment. Domestic travelers are shifting their spend abroad, and occupancy rates hover in the low 70% range. While the sector holds considerable inventory, increased competition is restraining growth. Car rental, still recovering to pre-COVID levels, is benefiting from the steady return of inbound travelers and the region’s dependence on self-drive mobility.

What it means

The ANZ travel market is growing, but not in ways that suggest an immediate boom. Price increases, rather than visitor numbers, are propping up revenue. Distribution is tilting toward supplier-direct, limiting gains for OTAs. And while airlines appear set to lead the next growth cycle, hotels and car rental companies face a more challenging path.

For travel companies, the signal is clear: success will hinge less on chasing volume and more on competing for high-value customers, strengthening direct relationships, and aligning strategies with the strongest-performing sectors.

To dig deeper into these findings — including market sizing, projections through 2028, and segment-by-segment performance across airlines, hotels, car rental and more — consider subscribing to Phocuswright Open Access. Our comprehensive research platform delivers the full breadth of Phocuswright’s data and analysis, arming executives and strategists with the insights they need to power smarter decisions. From market pulse updates to long-term forecasts, Open Access ensures you and your team are always one step ahead in a rapidly shifting travel landscape.