From scroll to suitcase: What inspires Europe’s new travelers

- Published:

- July 2025

- Analyst:

- Phocuswright Research

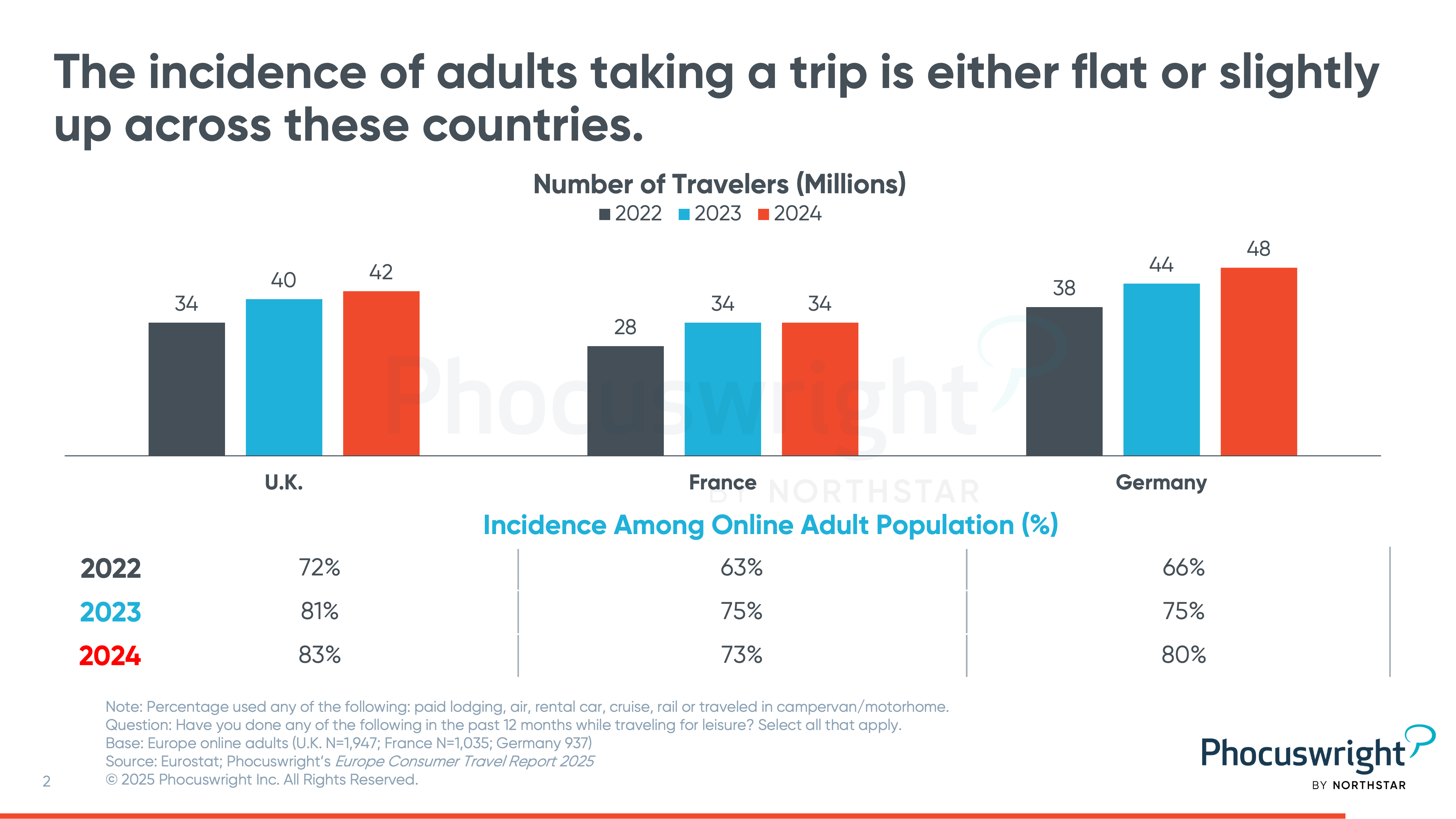

Travel in the U.K., France and Germany continues to rise. Booking decisions are often influenced by factors revolving around value and price. Social media use has increased when planning and searching for trip ideas. When it comes to research before booking a trip, new Phocuswright research report Europe Consumer Travel Report 2025 has uncovered four key insights that travel companies should know about:

- Search engines and OTA sites maintain their lead positions as main research resources. The reviews found on general search engines are leveraged the most.

- Interestingly, AI results in search are at parity with paid search results, likely due to their placement at the top of the page.

- GenAI is gaining momentum but still has a long way to go before being a top resource.

- Recommendations from friends and family are still used more than any other single resource.

Who do European travelers trust the most for travel inspiration & booking?

Looking forward, most Europeans have a positive outlook for future travel plans, though these may be hindered by prolonged rising costs and some sustainability concerns.

Revisited and streamlined in 2025, Europe Consumer Travel Report 2025 is based on a comprehensive survey of U.K., France and Germany consumers who traveled in 2024. It compares European consumers' trip-planning and purchasing behavior, including the impact of emerging technologies on the travel planning process, as well as their expectations and goals for travel in the future.

Key questions answered include:

- What does the average traveler look like? How many trips do they take per year, where do they go, with whom, for how long, and how much do they spend?

- What resources - online and offline - do travelers use to research, plan and book their trips?

- How do preferences differ across age groups?

- How do the different European source markets compare in their preferences, and—ultimately—their booking decisions?

- What influences the decisions travelers make about various elements (e.g., air, hotel and activities) of their trips?

- What role does social media and other emerging technologies play in consumers’ travel planning activities?

- What is the sentiment towards future travel? What changes, if any, do travelers intend to make regarding their future travel?

Phocuswright Open Access

Phocuswright Open Access gives your entire team unlimited access to the travel industry’s most trusted research—no seat limits, no paywalls. Get instant insights from in-depth reports, interactive dashboards, and downloadable datasets, plus tailored answers from analysts and a dedicated concierge to guide your journey.

It’s more than research—it’s your competitive edge. Validate opportunities, support internal strategy, and stay ahead of change with always-on intelligence organized by sector, region, and trend. Move faster, with confidence, and lead the industry forward. Get your competitive advantage started now.