Google Pushes Predictive Pricing and Packaged Travel

- Published:

- September 2017

- Analyst:

- Dirk Rogl

Much has been written about Google Travel's latest announcement of new features in its flight and hotel search. Less has been written about its move into tours and packaging in Europe. Both are significant and could have broad implications across the industry.

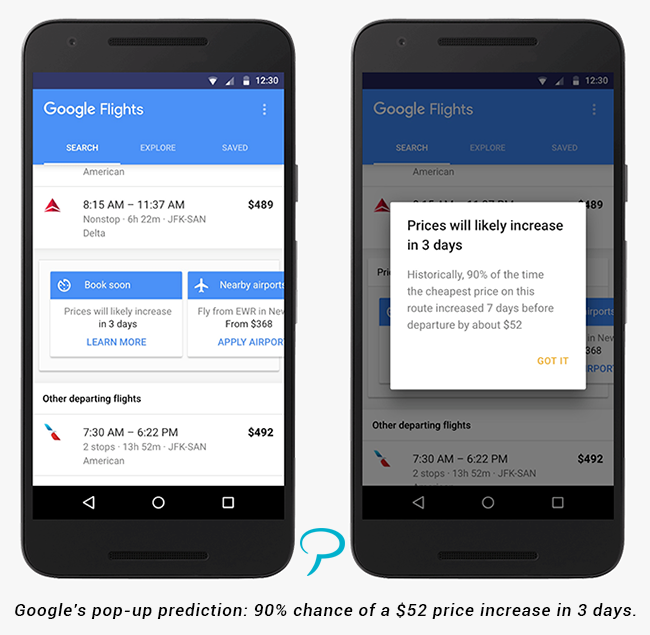

The most press-worthy aspect has been the price prediction feature – which effectively advises consumers on the best time to book a flight. This is not a Google invention. Metasearch brands and some OTAs (anyone remember Farecast?) have been playing at this for a while. The startup Hopper, whose apps are now among the top 10 travel apps globally, has made this a central ingredient in its mission.

But something is new here. While price alerts have mostly been an "add-on" feature, Google is using pop-up buttons to put these front and center for consumers. The accuracy of services like this always depends on the quality and quantity of data evaluated (does anyone have more data than Google?), and acceptance of these tools also relies on great design (here Google's track record is more hit-and-miss). But Google has clearly taken a cue from Hopper's viral rise, and it is evident that price forecasting is becoming a standard component in travel search, shop, buy.

Google's spin is that this makes travel planning much less stressful. However, the widespread adoption of predictive pricing recommendations across a platform as large as Google – and potentially others – promises to introduce some new stress in yield departments across the industry.

Packaged Travel vs. Individual Trips

Google has also just rolled out its metasearch for travel packages. While Google began in April with very limited testing in Germany and the U.K., the service now seems to be broadly available in Germany, at least on mobile. Although it's unclear how widely available Google will make this service, packaged travel metasearch would seem to create a clear consumer benefit: the price comparison of packaged trips and individual components in a single screen.

This appears to be the first time Google has launched a travel application specially designed for the needs of the European market, where tour operators play a very large role in leisure. Comparing the price of tour packages with individual components answers an obvious traveler question: Should I book a package, or purchase my components separately?

Again, Google didn't invent services like this; KAYAK started package metasearch in Germany in 2012. But KAYAK's service compares packages to each other, not to individual travel components. Google is putting the offers of tour operators, hotels and airlines on one mobile screen. While most of Europe is discussing the difficulty of displaying travel offers in accordance with the new European Package Travel Directive, Google is compiling comparative pricing for travelers in a simple view.

It is no surprise that in some cases, tour packages are cheaper than individual component purchases. Until now, this comparison was not easily visible. Tour operator booking systems (and tour operators in general) have not linked well to the online travel ecosystem of flight and hotel price comparison.

Google's effort here is far from perfect. There is some work to be done for Google and the tour operator. For generating the fastest response times, Google Package is not linked to the traditional tour operator distribution networks. Instead, it uses modern price-caching platforms such as German travel tech company Peakwork.

As a result of the technical limitations of the traditional tour operating world, the number of tour brands participating in Google Package is still limited. But this creates an opening for new, nimbler parties such as Lufthansa Holidays, Air Berlin Holidays and Expedia's dynamic packaging product to get a foothold in the European tour operator market.

It is still quite early for Google's meta-package product, and Europe's tour operating landscape has been stubbornly tough to disrupt (although OTAs and low-cost carriers have certainly made their presence felt). Is this a near-term disruption? Unlikely, but it certainly has the potential to irritate the entrenched world of traditional tour operators. And we're perfectly fine with a little irritation – especially if it nudges the industry along a path toward reinvention.

How A.I., Machine Learning and Big Data Are Reinventing Online Travel

Hear from Google's vice president, travel and shopping, Oliver Heckmann; Hopper founder and CEO, Frederic Lalonde; and other digital travel leaders only at The Phocuswright Conference (November 7 – 9 in Ft. Lauderdale/Hollywood, Florida).