U.K. travel market sees mobile acceleration and a shifting infrastructure landscape

- Published:

- May 2025

- Analyst:

- Phocuswright Research

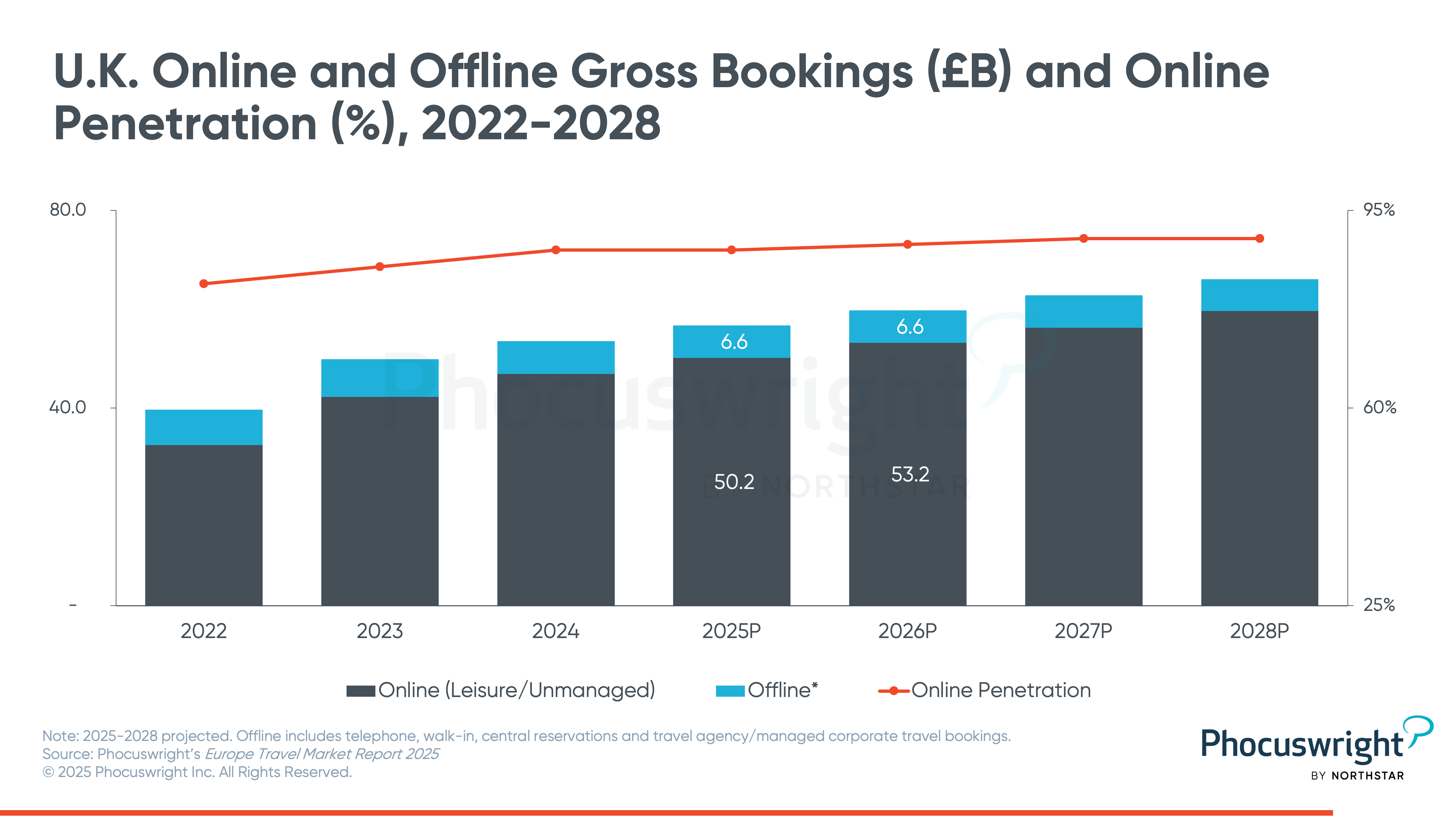

The U.K. travel market reached £53.5 billion in gross bookings in 2024, up 7% from the previous year, according to Phocuswright’s latest research report U.K. Travel Market Essentials 2025. Although growth is expected to moderate to around 5% annually from 2026, the market remains robust—particularly in digital channels. Online penetration climbed to 88% and is on track to hit 90% by 2027, as offline bookings steadily decline. Direct supplier channels dominate, accounting for nearly 80% of online bookings, with online travel agencies growing at a slower pace.

One of the most striking developments is the rapid rise of mobile booking, which made up 46% of online gross bookings in 2024 and is expected to overtake desktop by 2026. Segments like car rental and rail already see more than 60% of supplier-direct online bookings via mobile. Investment in mobile-native tools—from keyless hotel check-in to AI-driven flight search—is accelerating across the sector.

On the policy and infrastructure front, the U.K. government is reshaping domestic travel. Rail is gaining ground, both through public investment and the decision to re-nationalize major train operations under the forthcoming Great British Railways entity. Meanwhile, in aviation, new sustainable aviation fuel (SAF) regulations introduced in 2025 will raise operating costs for airlines, as the fuel currently costs up to five times more than conventional jet fuel and supply remains limited.

Despite headwinds—from environmental regulations to structural reforms in rail—the U.K. travel market is benefiting from a stable economy, rising consumer demand, and strong digital adoption. It remains one of Europe’s most mature and mobile-forward travel landscapes.

New in 2025, this Essentials report delivers top-level takeaways for the U.K. travel market, featuring charts and analysis on the key trends, segment highlights and market sizing datapoints that matter most.

Other publications in the Europe Travel Market Report 2025 series (available now or publishing soon) include:

- Europe Travel Market Report 2025

- France Travel Essentials 2025

- Germany Travel Market Essentials 2025

- Italy Travel Market Essentials 2025

- Scandinavia Travel Market Brief 2025

- Spain Travel Market Brief 2025

- U.K. Travel Market Essentials 2025

- Europe Travel Market Data Sheet 2023-2027 (subscriber only)

Enhance your strategic planning with data insights tailored specifically to your market and operational needs.

It's all about the data. With an updated navigation interface, new dynamic filtering, additional segment and channel breakouts in select markets and rich detailed views of 35+ markets, Phocal Point allows you to create custom interactive charts and view travel data by segment, channel, device, region and country. Our proprietary travel industry market sizing data allows you to look to the future with projections through 2026, and review historical data as far back as 2009.

Data points for market sizing include:

- Market size

- Market share

- Annual change

- Segment share (air, car, hotel and rail)

- Online channel share

- OTA/supplier share

- Desktop/mobile share

- More than 35 regional and global markets

- Conversion into multiple foreign currencies

- Short-term rental sizing