U.S. car rental: Cooling off or resetting the ride?

- Published:

- June 2025

- Analyst:

- Phocuswright Research

After reaching a record-breaking $26.9 billion in 2023, the U.S. car rental market tapped the brakes in 2024, slipping slightly to $26.4 billion. According to Phocuswright’s latest research report U.S. Car Rental Market Brief 2025, it’s the first revenue decline since the pandemic rebound—and a signal that the industry is entering a new, more measured phase. With rental rates softening and average revenue per day dipping a few percentage points, companies are shifting gears from high-margin pricing to tighter fleet control and long-game strategy.

The road ahead isn’t all smooth pavement. Inbound travel to the U.S. is forecast to drop by 9.4% in 2025 due to shifting U.S. travel policies, dimming demand in top tourism markets like New York and California. Meanwhile, the EV experiment revealed hard truths: higher costs, faster depreciation and aggressive automaker discounts added up to substantial write-downs across the industry. Even with a growing appetite for road trips, the outlook for airport rentals and international demand remains cloudy.

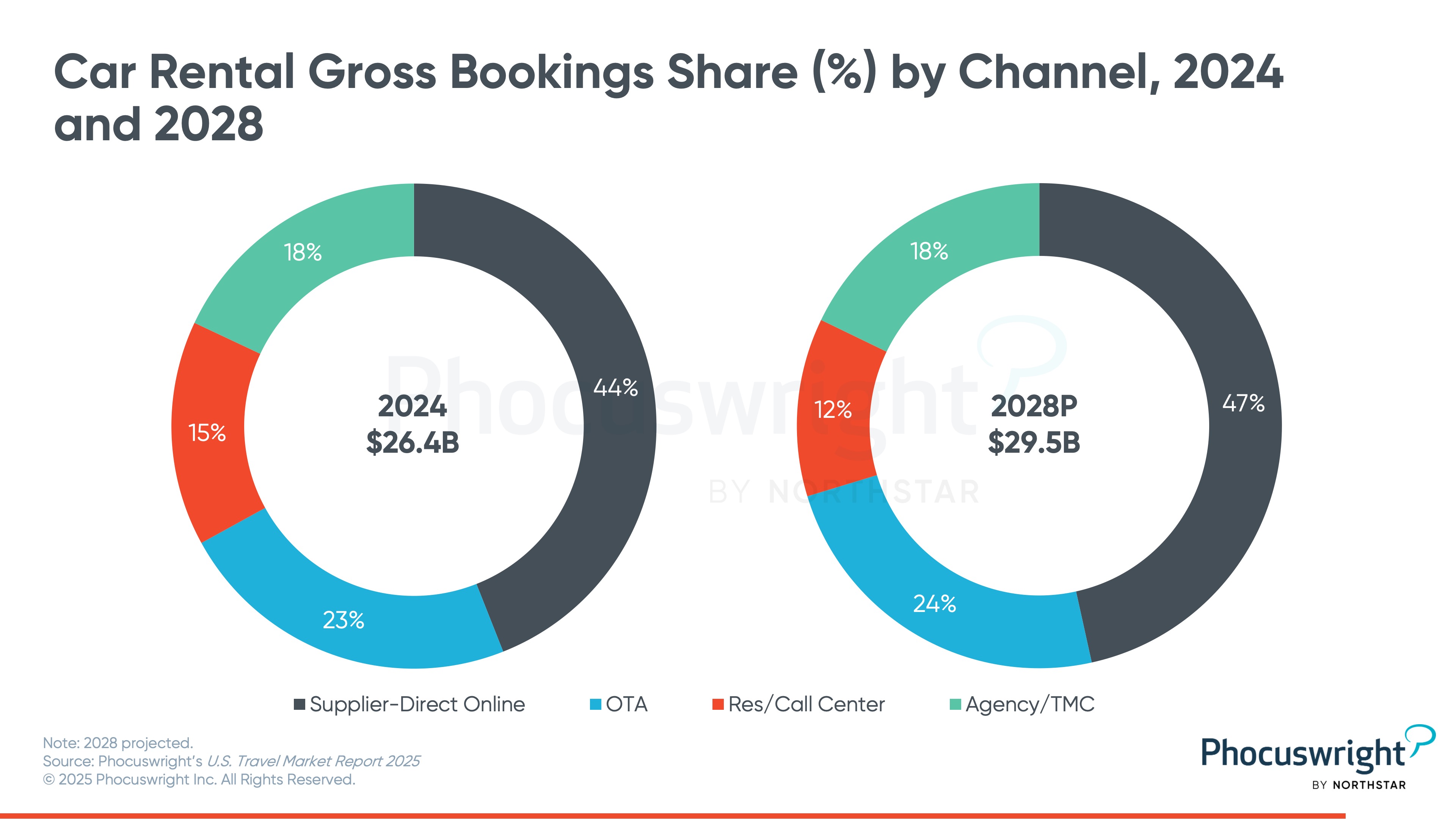

But the industry's not idling. Digital transformation continues to pick up speed assupplier-direct bookings now account for 44% of all reservations, with that share expected to rise to 47% by 2028. Rental brands are investing in app-based tools, digital keys and loyalty features to convert travelers from searchers into direct bookers.

Want to understand what’s really driving the market and what’s stalling it? Tap into the full analysis in Phocuswright’s U.S. Car Rental Market Brief 2025.

This report is part of Phocuswright’s U.S. Travel Market Report 2025: New and improved, while still delivering key stats: Refreshed for 2025, this report series delivers market analysis, comprehensive sizing and projections for the U.S. travel market, along with detailed data and analysis of five key segments: airline, hotel & lodging, car rental, cruise and packaged travel.

A standalone report dedicated to online travel agencies rounds out the coverage. Collectively, the series offers a detailed view of the segments, trends and distribution dynamics that are shaping the United States’ travel landscape in 2025 and beyond.

Other publications in the U.S. Travel Market Report 2025 series (available now or publishing soon) include:

- U.S. Airline Market Essentials 2025

- U.S. Car Rental Market Brief 2025

- U.S. Cruise Market Essentials 2025

- U.S. Hotel & Lodging Market Essentials 2025

- U.S. Online Travel Agency Market Essentials 2025

- U.S. Packaged Travel Market Brief 2025

- U.S. Travel Market Report 2025

- U.S. Travel Market Data Sheet 2023-2027 (subscriber only)

Phocuswright Open Access gives your entire team unlimited access to the travel industry’s most trusted research—no seat limits, no paywalls. Get instant insights from in-depth reports, interactive dashboards, and downloadable datasets, plus tailored answers from analysts and a dedicated concierge to guide your journey.

It’s more than research—it’s your competitive edge. Validate opportunities, support internal strategy, and stay ahead of change with always-on intelligence organized by sector, region, and trend. Move faster, with confidence, and lead the industry forward. Get your competitive advantage started now.