Fragmentation, regulation, acceleration: The new STR playbook

- Published:

- May 2025

- Analyst:

- Phocuswright Research

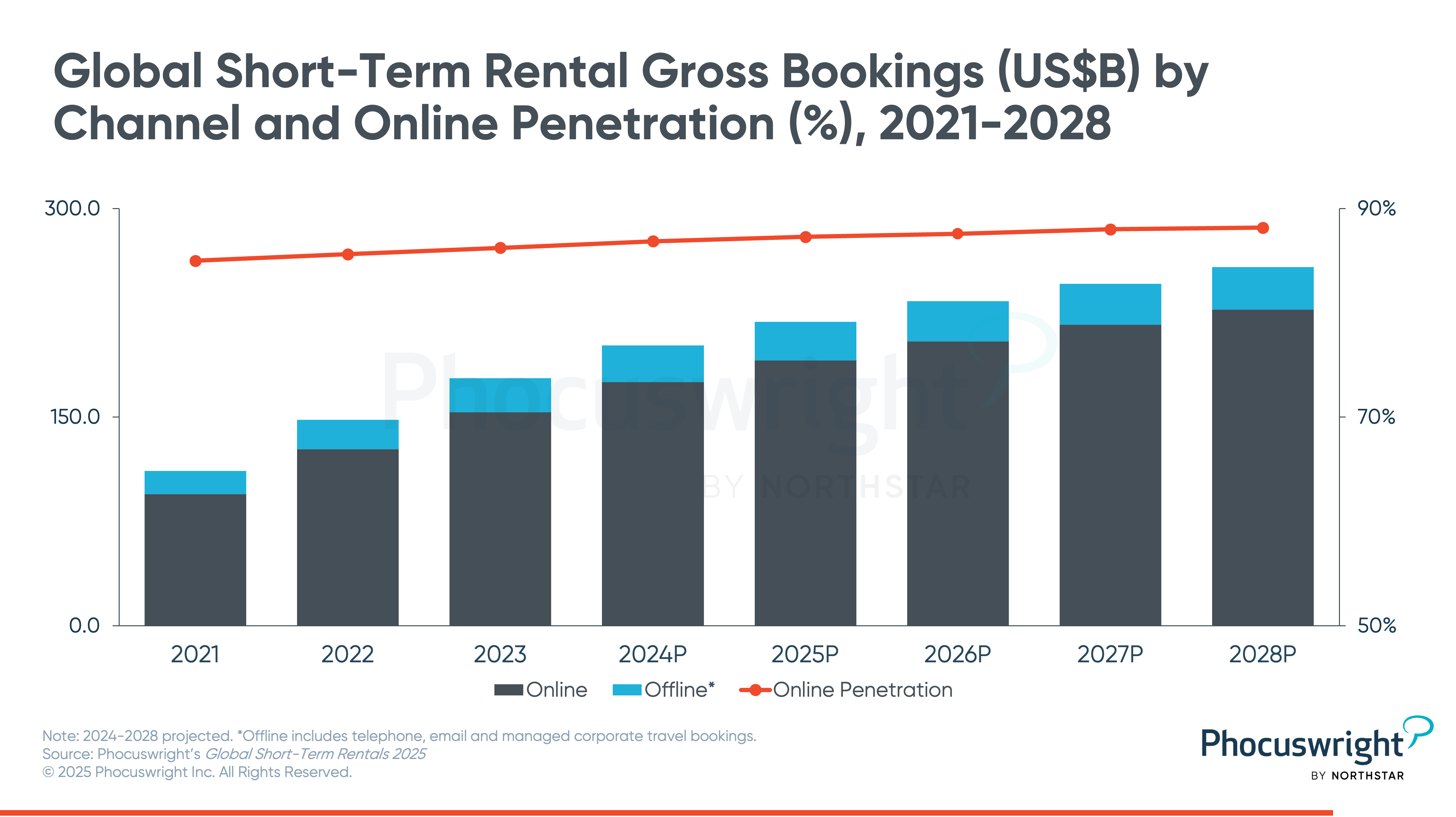

The global short-term rental (STR) market reached $201.6 billion in gross bookings in 2024, following a period of extraordinary pandemic-era expansion according to Phocuswright’s latest research report Global Short-Term Rentals 2025. While growth is expected to moderate to single digits in 2025, the sector remains a structurally significant force in global lodging—particularly in digitally connected and leisure-driven segments.

Bonus: Watch the webinar Short-term rentals 2025: Navigating the next phase of growth

Featuring a research presentation by Madeline List, manager of research and special projects, Phocuswright and a panel discussion featuring Expedia Group's director of vacation rental partner success, Becca Glenn, and Avalara's general manager of lodging, Nicole Rogers, on the future of the STR landscape—from profitability pressures to platform power plays.

Market dynamics and regional divergence

Growth trajectories across global regions are increasingly uneven. North America and Europe continue to command the largest share of STR bookings but are showing signs of maturity. In contrast, emerging regions are driving the next wave of expansion. Asia Pacific has regained momentum following China’s full reopening, while Latin America is experiencing rapid gains. Early indicators also suggest rising activity in the Middle East and Africa.

Strategic pressures and competitive shifts

Operators and platforms face growing external and internal pressures. Regulatory scrutiny is intensifying, particularly in urban markets, and competitive dynamics are evolving as hotel brands expand their STR offerings. Initiatives like Marriott’s Apartments by Bonvoy have moved from pilot phase to strategic growth mode, signaling a new phase of cross-category competition.

Online penetration and distribution shifts

Online channels remain the dominant engine of STR distribution. In 2024, online bookings accounted for 87% of total gross bookings, with that share projected to increase slightly through 2028. This continued digital integration underscores how embedded STRs have become in the broader online travel ecosystem.

Traveler behavior and demand patterns

Shifting travel patterns continue to favor the flexibility and variety STRs offer. Regional travel, extended stays, and lifestyle-oriented lodging remain in demand, though long-haul corridors—particularly in Asia and select emerging markets—face headwinds from macroeconomic volatility and operational friction such as visa processing delays.

The STR landscape is entering a more complex, globally fragmented phase. As growth slows in mature markets and accelerates elsewhere, strategic clarity is essential. Phocuswright’s Global Short-Term Rentals 2025 delivers comprehensive sizing, forecasts, and analysis by region and distribution channel—equipping travel executives with the intelligence needed to assess opportunity, mitigate risk, and adapt to ongoing change.

This executive summary highlights only a fraction of the insights found in the full report. For data-driven analysis, regional forecasts, and market-defining trends, access the full research here.

Ready to turn insights into advantage?

With a Phocuswright Open Access subscription, your entire team gets unlimited access to the industry's most trusted travel research and data. Spot trends earlier, understand markets deeper, and make decisions that drive lasting impact.

Learn more here or contact us.