European traveler mindset in 2025: Simplicity, search and social influence

- Published:

- June 2025

- Analyst:

- Phocuswright Research

If there’s one overarching narrative emerging from Europe’s travel landscape today, it’s this: in an age of experimental tech and proliferating platforms, travelers are choosing what works, with ease, price and familiarity still reigning supreme. Here are 8 key takeaways from Phocuswright’s latest Europe Consumer Travel Report 2025:

1. Travel in the U.K., France and Germany continues to rise.

2. There has been steady growth in digital tools, specifically the dominance of OTAs and more travelers trying generative AI.

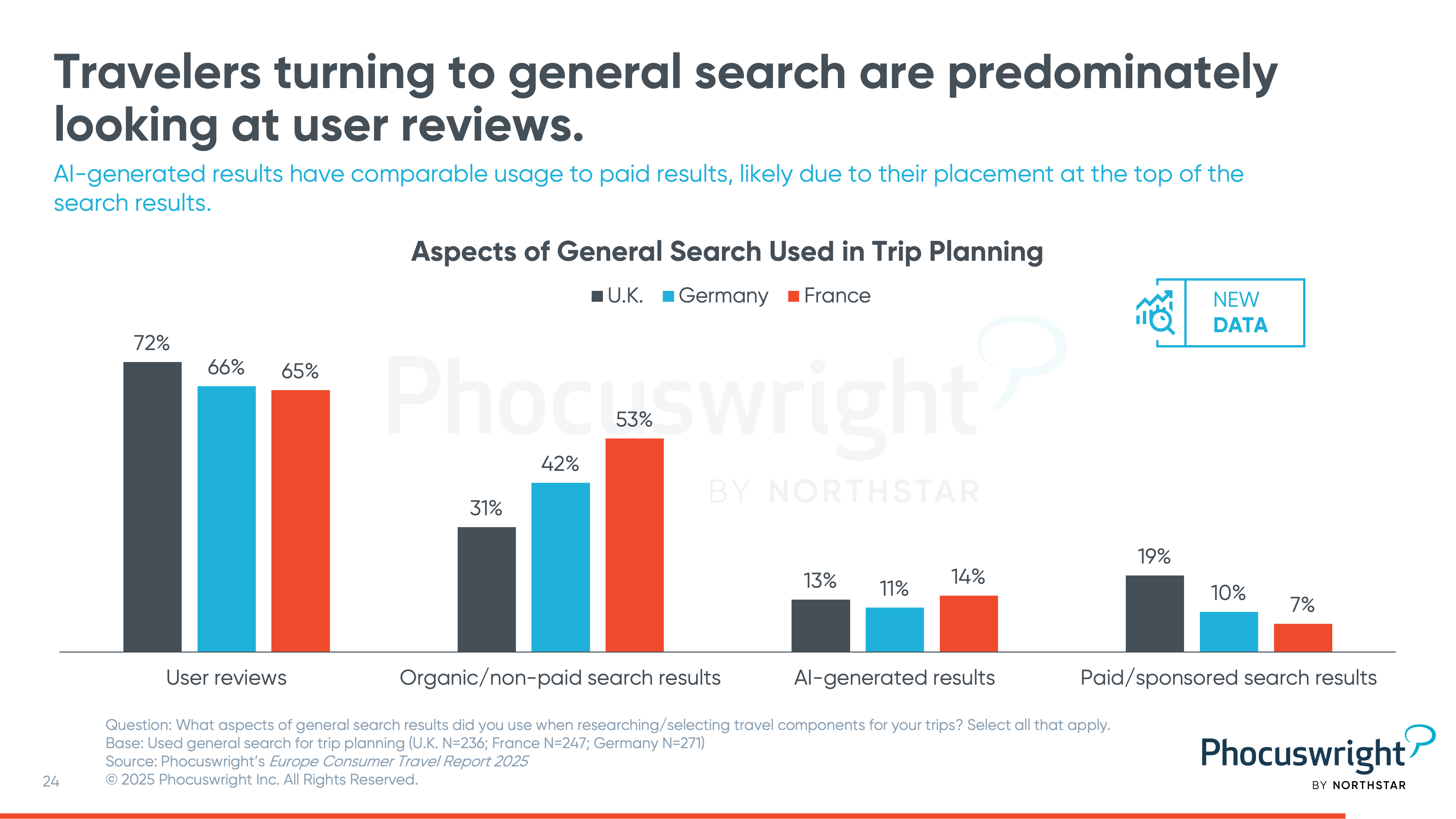

3. As a resource, OTAs are surpassing general search.

4. Though its use remains largely experimental, generative AI saw a sharp increase, even doubling year-over-year.

5. More travelers are booking through indirect channels, likely so they can compare options and find the best prices.

6. There is robust reliance on traditional payment methods, like credit cards, for booking and in-destination packages.

7. There is a growing use of social media in planning, with Instagram emerging as the most influential platform across key markets and YouTube with the most content consumption.

8. Travelers in Europe remain resilient with plans to travel in the next 12 months without making significant adjustments.

For travel companies, digital infrastructure matters more than ever, but travelers are still grounded in pragmatic behaviors. Platforms that reduce friction, compare options, and offer trusted experiences will continue to win. And while generative AI and social media are shifting the planning landscape, they haven’t rewritten the rules ... yet. The modern traveler is open to influence but anchored in ease.

Revisited and streamlined in 2025, Phocuswright's Europe Consumer Travel Report 2025 is based on a comprehensive survey of U.K., France and Germany consumers who traveled in 2024. It compares European consumers' trip-planning and purchasing behavior, including the impact of emerging technologies on the travel planning process, as well as their expectations and goals for travel in the future.

Key questions answered include:

- What does the average traveler look like? How many trips do they take per year, where do they go, with whom, for how long, and how much do they spend?

- What resources - online and offline - do travelers use to research, plan and book their trips?

- How do preferences differ across age groups?

- How do the different European source markets compare in their preferences, and—ultimately—their booking decisions?

- What influences the decisions travelers make about various elements (e.g., air, hotel and activities) of their trips?

- What role does social media and other emerging technologies play in consumers’ travel planning activities?

- What is the sentiment towards future travel? What changes, if any, do travelers intend to make regarding their future travel?

Phocuswright Open Access gives your entire team unlimited access to the travel industry’s most trusted research—no seat limits, no paywalls. Get instant insights from in-depth reports, interactive dashboards, and downloadable datasets, plus tailored answers from analysts and a dedicated concierge to guide your journey.

It’s more than research—it’s your competitive edge. Validate opportunities, support internal strategy, and stay ahead of change with always-on intelligence organized by sector, region, and trend. Move faster, with confidence, and lead the industry forward. Get your competitive advantage started now.

Inside Phocuswright Europe 2025: Connections, Conversations, Innovation

Last week in Barcelona, Phocuswright Europe 2025 brought together the travel industry’s top decision-makers for an unforgettable experience. From bold one-on-one interviews to spirited debates and exclusive insights into the future of innovation, the event delivered powerful moments and meaningful connections. Dive into the highlights and relive the energy through our exclusive photo gallery.