While inflation and economic uncertainty are among the top challenges facing U.S. travel agencies, the market remains strong. Despite slower projected growth in 2025 compared to the previous year, travel agency sales are outpacing the overall travel market, with exclusive and high-end luxury travel leading gains according to Phocuswright’s recent travel research report U.S. Travel Agency Landscape 2025. Wealthier travelers, undeterred by higher prices, continue to seek out unique experiences and the personal service travel advisors offer. Although U.S. travelers overall are showing heightened price sensitivity, advisors are leveraging a variety of tactics to appeal to more budget-conscious customers.

The client profile of U.S. travel agents

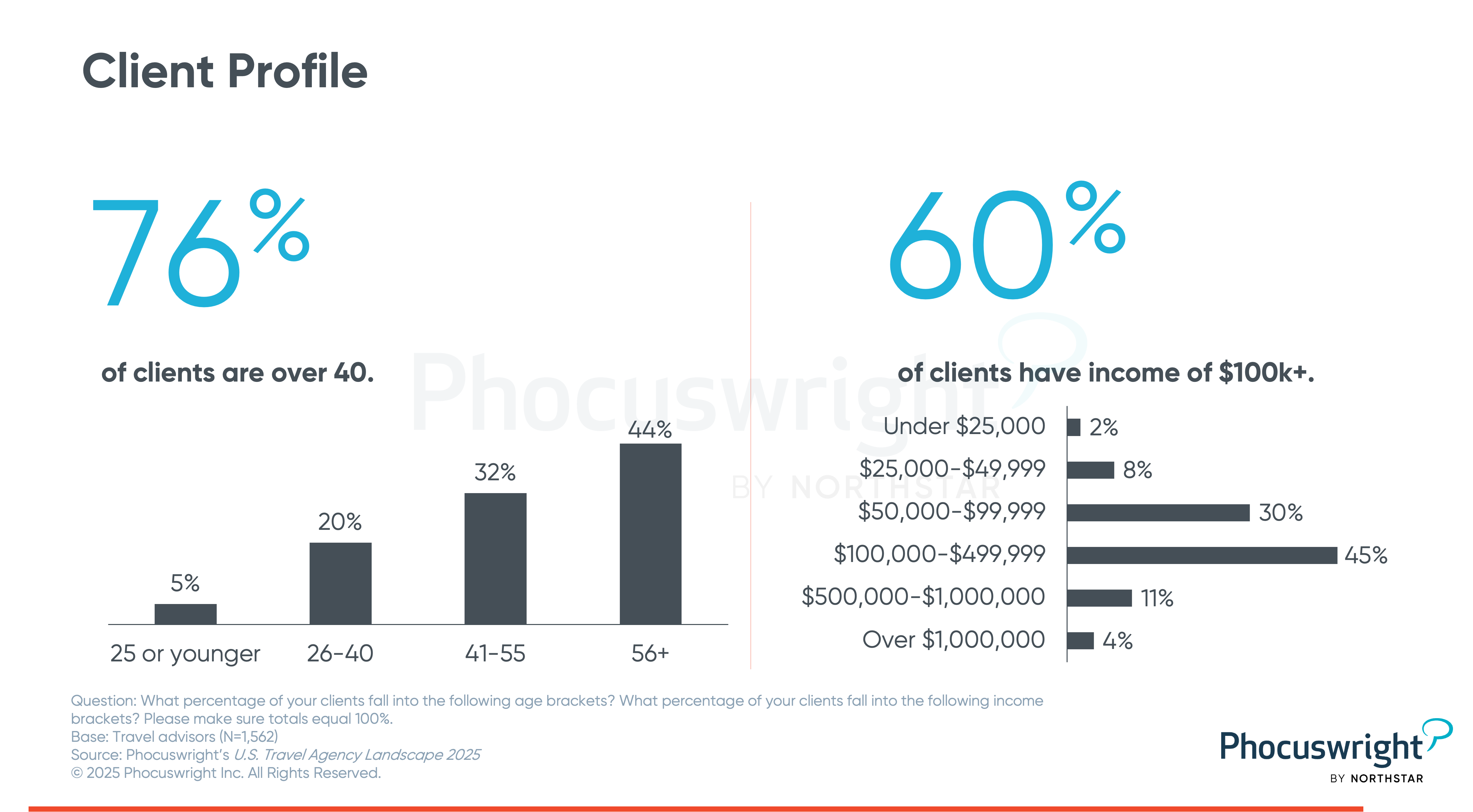

Travelers who work with advisors are typically older and wealthier than the average traveler. More than three quarters of clients are over 40 years old, with 44% older than 55. Six in 10 clients have an annual income of $100,000 or more.

Younger travelers, with a strong drive to travel, are often a key demographic in the broader travel market. However, they tend to be more cost-conscious, often leveraging OTAs to find the lowest price. Yet appealing to younger generations is crucial for the long-term success of the advisor channel. There is increased focus on attracting and training Gen Z and millennial advisors with a large social media presence to better engage with younger travelers.

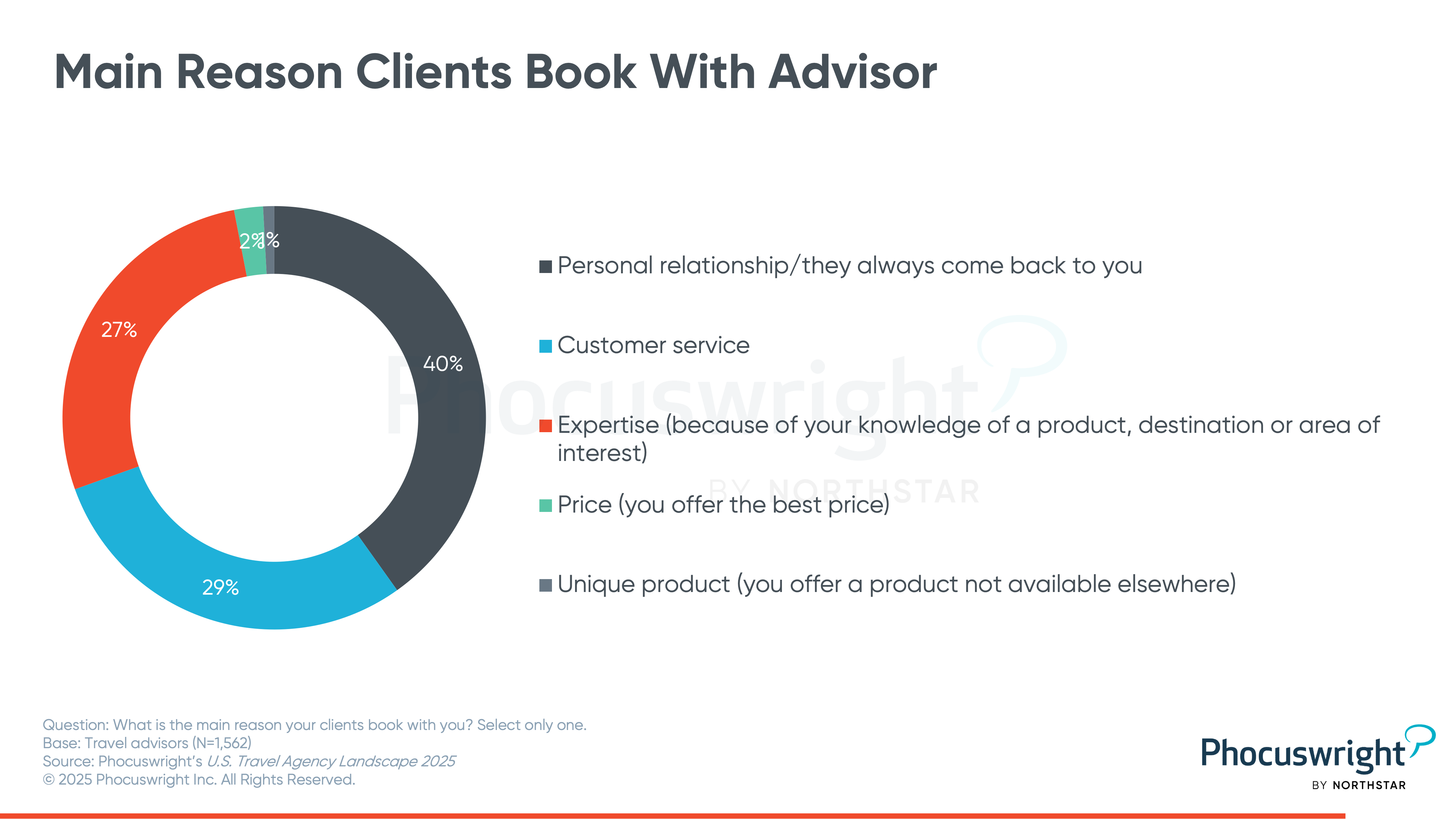

While younger travelers often choose their booking channel based on price, advisors indicate that only 2% of their clients book with them because they offer the best price. Instead, advisors say personal relationships, customer service and their knowledge of travel products and destinations are most important to attracting travelers. Expanding the client base to include a younger clientele will require educating younger travelers about the benefits that advisors can provide—and doing so in a way that will appeal to this younger demographic.

U.S. Travel Agency Landscape 2025 is part of a joint research project with Phocuswright and Travel Weekly, tracking the travel agency distribution landscape and overall market size.

Based on a comprehensive market sizing exercise, along with a survey of more than 1,500 U.S. travel advisors, questions answered include:

- How large is the U.S. travel agency market and how does its growth compare to other distribution channels?

- What trends are driving success for leisure and corporate agencies across air, cruise and tour segments?

- How is the advisor workforce changing, and what role are home-based and independent contractors playing?

- Which technologies—especially AI and NDC—are most influencing advisor operations and client engagement?

- How can agencies attract younger travelers and advisors while maintaining their hallmark of personalized service?

Have you discovered Phocal Point?

Enhance your strategic planning with data insights tailored specifically to your market and operational needs.

It's all about the data. With an updated navigation interface, new dynamic filtering, additional segment and channel breakouts in select markets and rich detailed views of 35+ markets, Phocal Point allows you to create custom interactive charts and view travel data by segment, channel, device, region and country. Our proprietary travel industry market sizing data allows you to look to the future with projections through 2026, and review historical data as far back as 2009.