Loyalty programs were once developed to encourage more consistent brand usage, but the world of travel rewards has blossomed into a full sub-economy in and of itself. Providers, intermediaries and financial institutions strike massive deals, making the rewards economy a subject of specialty publications and engendering an enthusiastic set of "hackers" aiming to gain as much as possible from their points and miles. Leisure travelers use these programs heavily, especially as their trip budgets tighten. Using loyalty programs doesn't always translate to true brand loyalty. But when brands leverage them in conjunction with strong services and pricing strategies, they can certainly help incentivize engagement.

For the love of the game

Loyalty programs are designed to bequeath the most rewards to high spenders and super frequent travelers. While brands are eager to incentivize these travelers to use them more consistently, they have expressed a healthy dose of fear over those who might manipulate incentives without paying them heavy patronage in exchange.

But going the extra mile to play the loyalty systems has become the norm, albeit exploited by some travelers more than others.

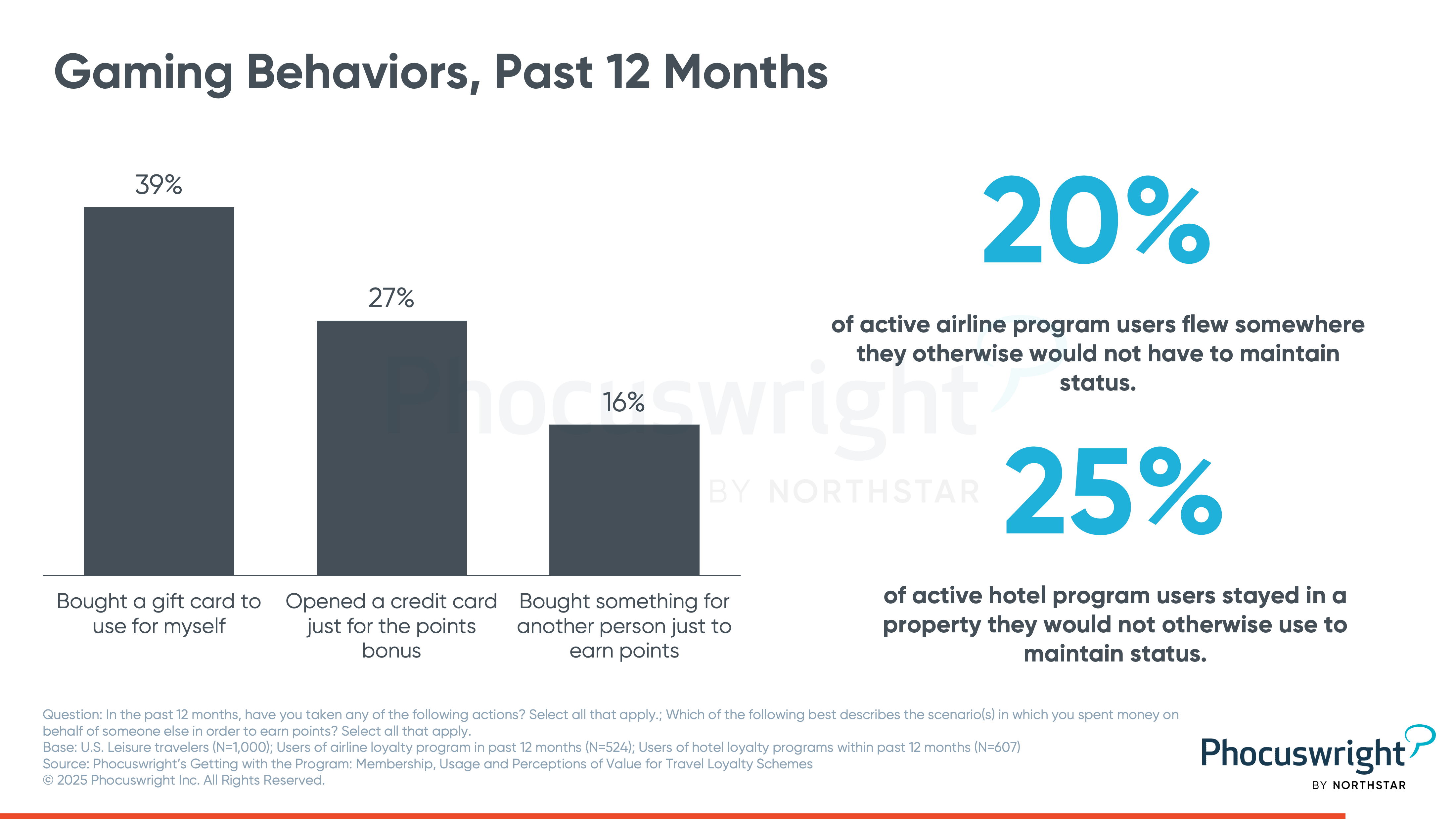

According to Phocuswright’s latest travel research report Getting With the Program: Membership, Usage and Perceptions of Travel Loyalty Schemes, a massive 84% of leisure travelers admitted to participating in at least one gaming behavior in the past 12 months alone. One in five travelers who used an airline loyalty program in the past year (earning or burning) also flew somewhere they would not otherwise have gone in order to maintain their airline status. Likewise, one in four active hotel program users stayed in a property they would not otherwise have chosen for the sake of maintaining their status.

Other gaming behaviors can become more questionable. Thirty-nine percent of travelers charged a gift card to their credit card with intention to use the gift card themselves and earn points in the process. Sixteen percent manufactured spend by purchasing something on behalf of someone else (not a split purchase or a work reimbursement) in order to earn points. Twenty-seven percent also gamed their credit cards through a behavior that's highly concerning to the banks and card issuers: opening a card with intention to either close it or significantly reduce spend after receiving a welcome bonus.

While engagement with loyalty programs can be incredibly active, participation should not be confused with actual brand usage consistency. Across categories of airlines, lodging, and OTAs, 57-68% of travelers who had one or more go-to brands still used an alternative brand option in their past 12 months of travel. This was common even among travelers who described their overall travel-brand usage as highly consistent, or those who reported that they had achieved upper tiers of status in a loyalty program. It takes more than rewards to truly entice travelers to return to a brand consistently. A brand's offerings and price points need to meet their needs, or many types of travelers will find themselves defecting.

Amid tariffs, layoffs and tightening purse strings, leisure travelers are in a redemption frenzy to make their trips more affordable, accessible, frequent and comfortable. Travel brands must ensure that they offer value from the 360-degree perspective: Product, pricing and programs must work in conjunction with one another to secure true customer loyalty.

Phocuswright’s Getting With the Program: Membership, Usage and Perceptions of Value for Travel Loyalty Schemes is part of a comprehensive consumer research study delving into the specifics of how U.S. travelers perceive brand loyalty and engage with the current ecosystem. Key questions addressed include:

- Which types of travel loyalty programs attract the most members and redemptions?

- How do loyalty drivers and perceptions of value differ across generations?

- What are the top frustrations and “gaming” behaviors among loyalty members?

- How can travel brands convert heavy program use into lasting customer loyalty?

Have you discovered Phocal Point?

Enhance your strategic planning with data insights tailored specifically to your market and operational needs.

It's all about the data. With an updated navigation interface, new dynamic filtering, additional segment and channel breakouts in select markets and rich detailed views of 35+ markets, Phocal Point allows you to create custom interactive charts and view travel data by segment, channel, device, region and country. Our proprietary travel industry market sizing data allows you to look to the future with projections through 2026, and review historical data as far back as 2009.