Phocuswright Research Roundup 2Q25

Refreshed insights.

Q2 saw the release of refreshed and revamped Phocuswright flagship reports on U.S. and European consumer behavior and major travel markets. This collection of focused analyses offers a smarter and more streamlined approach to our vast data and essential insights. Discover some of the high-impact findings below.

And as always, we published fresh data metrics, comprehensive consumer research on short-term rentals, AI's impacts on key areas, updated Phocal Point with new market sizing and sharper forecasts and more. Here's a recap of the insights, data and more. (Click on each report title to access the report).

Tech and innovation

The New Age(nts): Impact of Generative AI Travel Distribution

Mike Coletta, Phocuswright’s senior manager of research and innovation and Norm Rose, senior technology and corporate market analyst, hosted the third session of The New Age(nts) Trend Series , along with three panelists:

- Julie White, CCO of Europe & North Africa, premium, midscale and economy brands at Accor, where she oversees sales, distribution, marketing, loyalty and customer experience.

- Matthias Keller, chief product officer at Kayak, who's leading the launch of Kayak.ai and much of Kayak’s AI strategy.

- Tom Underwood, co-founder and COO at Bonafide, a startup working with hotel and airline brands to ensure that the information about their products and services available to AI systems is accurate and up to date.

The conversation focused on the coming impact of generative AI (GenAI) and autonomous agents on travel distribution. It explored how these technologies are changing the way travel is booked and marketed, and whether the industry's infrastructure is ready for these changes.

This summary captures the most important takeaways from the discussion and subsequent audience questions for Phocuswright subscribers. The full recording is available on YouTube and embedded below. All quotes are paraphrased.

The New Age(nts): Impact of Generative AI on the In-Destination Experience

Moderated by Mike Coletta, Phocuswright’s senior manager of research & innovation, the session featured a panel discussion with:

- Janette Roush, SVP Innovation & Chief AI Officer at Brand USA, the official destination marketing organization promoting the United States as a premier travel destination.

- Mitch Bach, Partner at Tourpreneur, a community and resource hub supporting tour business entrepreneurs, and Co-founder & CEO at TripSchool, a training and educational platform for professional tour guides and operators.

- Alex Bainbridge, CEO of Autoura, specializing in AI-driven tours and autonomous vehicles to enhance the traveler experience.

This summary captures the most important takeaways from the discussion and subsequent audience questions for Phocuswright subscribers. The full recording is available on YouTube and embedded below. All quotes are paraphrased.

Phocuswright’s Travel Innovation and Technology Trends 2025 aims to provide an in-depth overview of the real-time developments surrounding the travel industry, including key focal points on the impact of generative AI on in-destination experiences, company operations, distribution dynamic and more.

Short-term rentals

Phocuswright's U.S. Short-Term Rentals 2025: Guest Attitudes and Decision Making reveals patterns that likely resonate across other mature STR markets: The overwhelming majority of guests seek properties with an interesting look and feel, and nearly half say STRs outperform hotels on uniqueness and design. At the same time, younger travelers under 35—a critical future audience—are less convinced. Only 38% believe STRs offer better value than hotels, and 40% say hotels have delivered the best overall stay in recent trips.

Reputational challenges remain a drag on broader adoption. More than half of all travelers—whether they've stayed in STRs recently or not—say that negative press around cleaning fees, chores or inconsistent experiences makes them think twice about booking. The takeaway is clear: STR operators are no longer competing solely on availability or price. Brand perception—whether of an individual host's inventory or a professional management firm—is increasingly essential to win trust and drive repeat bookings.

These consumer dynamics are fueling the rise of branded and professionally managed inventory, while independent hosts face growing pressure to elevate their offerings—or risk being eclipsed in a more discerning market.

Global Short-Term Rentals 2025

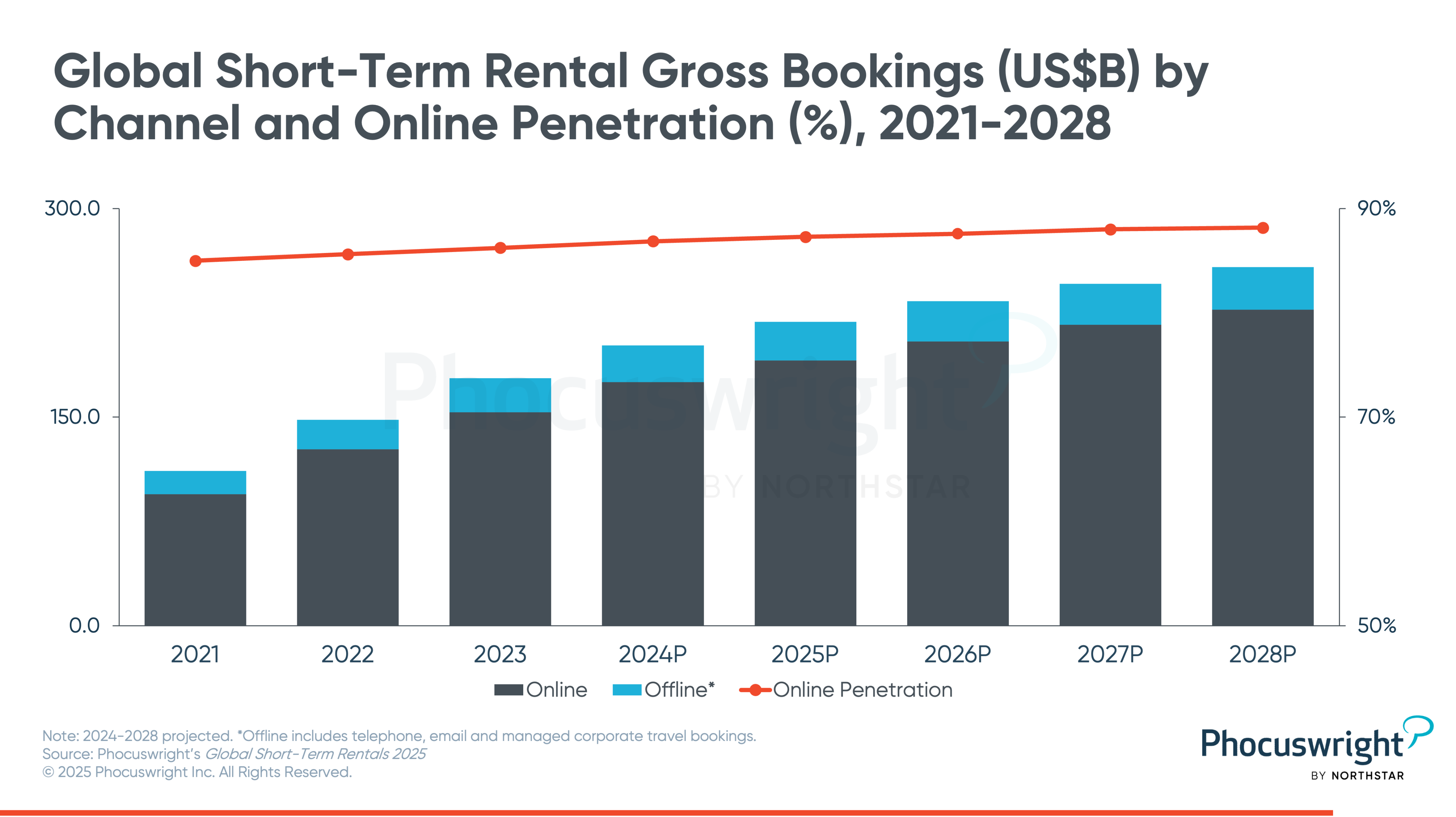

After two and a half years of remarkable pandemic-fueled expansion, growth of global short-term rental (STR) bookings is slowing as significant volume shifts back to hotels. Travelers have experienced the peaks and valleys of the STR segment, and overall find themselves in a more discerning place. With certain markets maturing (U.S., Europe) and others still developing (Asia, Middle East, Africa), the global market is varied and uneven, though overall slower growth is anticipated through the forecast period.

Free research insights articles:

- Fragmentation, regulation, acceleration: The new STR playbook

- Short-Term Rentals: A category at a crossroads

- The path to growing alternative revenue for STRs

Webinar replay:

Phocuswright’s Global Short-Term Rentals 2025 presents market sizing and projections for the global STR market by region and distribution channel. Key questions answered by this research include:

- How is the global short-term rental market evolving post-pandemic—and what’s driving regional growth or stagnation?

- What role do digital platforms and online bookings play in the future of STR distribution?

- What new pressures are STR operators facing—and how are they adapting?

- How are traveler preferences changing, and what must STRs deliver to remain competitive with hotels?

U.S. Short-Term Rentals 2025: Guest Attitudes and Decision Making

The U.S. short-term rental market has undergone a dramatic transformation, shifting from a pandemic-driven boom to an increasingly competitive and complex landscape. With supply growth outpacing demand and consumer preferences evolving, hosts and property managers must navigate rising costs, regulatory uncertainty, and heightened competition from hotels and international rentals. Profit-oriented hosts are proving more resilient, while those with passive management styles face mounting challenges. As the industry seeks equilibrium, success will depend on strategic pricing, operational efficiency, and the ability to deliver consistently high-quality, differentiated guest experiences.

Phocuswright’s U.S. Short-Term Rentals 2025: Guest Attitudes and Decision Making is part of a comprehensive consumer research study focused on the incredibly dynamic short-term rental travel segment. Key questions answered by this question include:

- What drives travelers to choose short-term rentals over hotels—and what keeps them from doing so?

- How do guest expectations and satisfaction levels vary across age groups, property tiers, and booking behaviors?

- How are STR guests shopping, booking, and comparing rentals with other lodging options?

- What implications do guest preferences and perceptions have for property managers, hosts, and platforms?

The following products are included in this report series:

European travel market & consumer trends

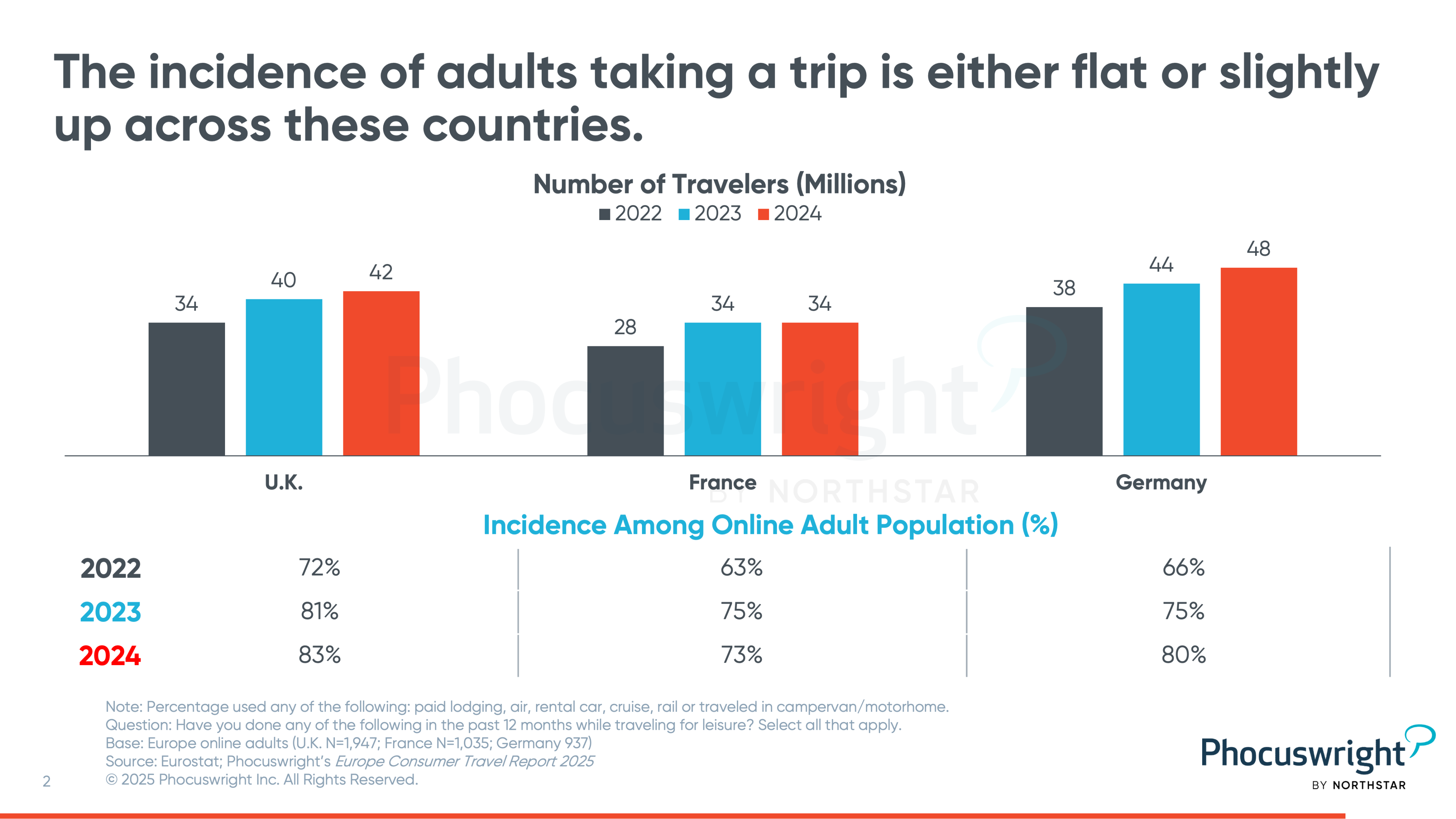

If there’s one overarching narrative emerging from Europe’s travel landscape today, it’s this: in an age of experimental tech and proliferating platforms, travelers are choosing what works, with ease, price and familiarity still reigning supreme. Here are 8 key takeaways from Phocuswright’s latest Europe Consumer Travel Report 2025:

- Travel in the U.K., France and Germany continues to rise.

- There has been steady growth in digital tools, specifically the dominance of OTAs and more travelers trying generative AI.

- As a resource, OTAs are surpassing general search.

- Though its use remains largely experimental, generative AI saw a sharp increase, even doubling year-over-year.

- More travelers are booking through indirect channels, likely so they can compare options and find the best prices.

- There is robust reliance on traditional payment methods, like credit cards, for booking and in-destination packages.

- There is a growing use of social media in planning, with Instagram emerging as the most influential platform across key markets and YouTube with the most content consumption.

- Travelers in Europe remain resilient with plans to travel in the next 12 months without making significant adjustments.

Europe Travel Market Report 2025

Sharper. Smarter. Still the Source. Refreshed for 2025, this report series delivers market analysis, comprehensive sizing and projections for the European travel industry from 2022-2028. It features dedicated coverage of six key regional players: France, Germany, Italy, Scandinavia, Spain and the U.K. Collectively, the series offers a detailed view of the segments, trends and distribution dynamics that are shaping Europe’s travel landscape in 2025 and beyond.

Free research insights articles:

- Spain 2025: Where record-breaking demand meets new competition

- U.K. travel market sees mobile acceleration and a shifting infrastructure landscape

- European traveler mindset in 2025: Simplicity, search and social influence

- From scroll to suitcase: What inspires Europe’s new travelers

New this year, the Europe Travel Market Report 2025 series includes a variety of market Essentials and Briefs, each providing what you need to know in an easily digestible format. Publications (available now or coming soon) include:

France Travel Market Essentials 2025

Despite the global spotlight of the 2024 Paris Olympics, France’s travel market grew modestly by 4%, reaching €55.8 billion—falling short of initial expectations due to uneven international arrivals and economic uncertainty. Domestic travel, however, remained a key strength, with resilient consumer confidence fueling short breaks and rail journeys amid broader ecological and geopolitical shifts. As regulatory changes reshape sectors like short-term rentals and rail deregulation spurs competition, France’s travel landscape continues to evolve in complexity and opportunity.

New in 2025, this Essentials report delivers top-level takeaways for the France travel market, featuring charts and analysis on the key trends, segment highlights and market sizing datapoints that matter most.

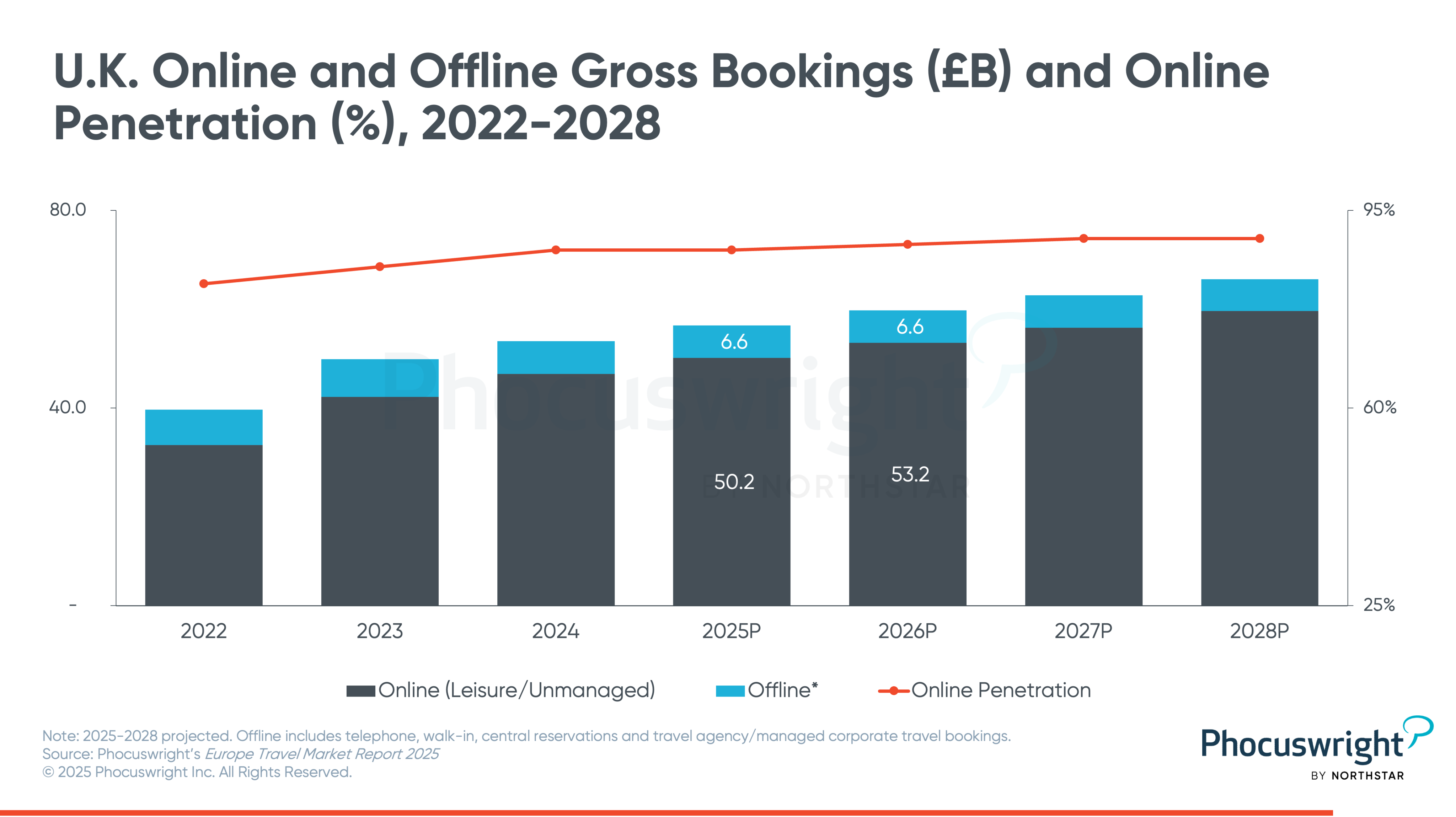

U.K. Travel Market Essentials 2025

The U.K. travel market advanced 7% in 2024 to reach £53.5 billion. With online penetration climbing to 88%—the highest in Europe—and mobile booking poised to overtake desktop, the market is rapidly transitioning to a digital-first landscape. Several segments saw notable double-digit growth, supported by public investment and evolving traveler behavior. While growth is expected to moderate, the outlook remains strong through 2028, underpinned by robust outbound demand and a national focus on sustainable mobility.

New in 2025, this Essentials report delivers top-level takeaways for the U.K. travel market, featuring charts and analysis on the key trends, segment highlights and market sizing datapoints that matter most.

Germany Travel Market Essentials 2025

After a strong 20% rebound in 2023, growth in the German travel sector normalized, growing 5% to €72.4 billion in 2024. Growth was mainly driven by leisure travel demand. While business travel continues to grow, it still substantially lags pre-pandemic levels.

New in 2025, this Essentials report delivers top-level takeaways for the France travel market, featuring charts and analysis on the key trends, segment highlights and market sizing datapoints that matter most.

Scandinavia Travel Market Brief 2025

Scandinavia’s travel market continued its upward trajectory in 2024, growing 7% to reach €17.4 billion. High-profile events, strategic marketing and advancements in airline and rail infrastructure largely contributed to the sector’s momentum. As Scandinavia solidifies its leadership in eco-conscious travel and digital innovation, growth is expected to remain steady through 2028.

New in 2025, this Brief delivers top-level takeaways for the Scandinavia (Denmark, Norway, Sweden) travel market, featuring charts and analysis on the key trends, segment highlights and market sizing datapoints that matter most.

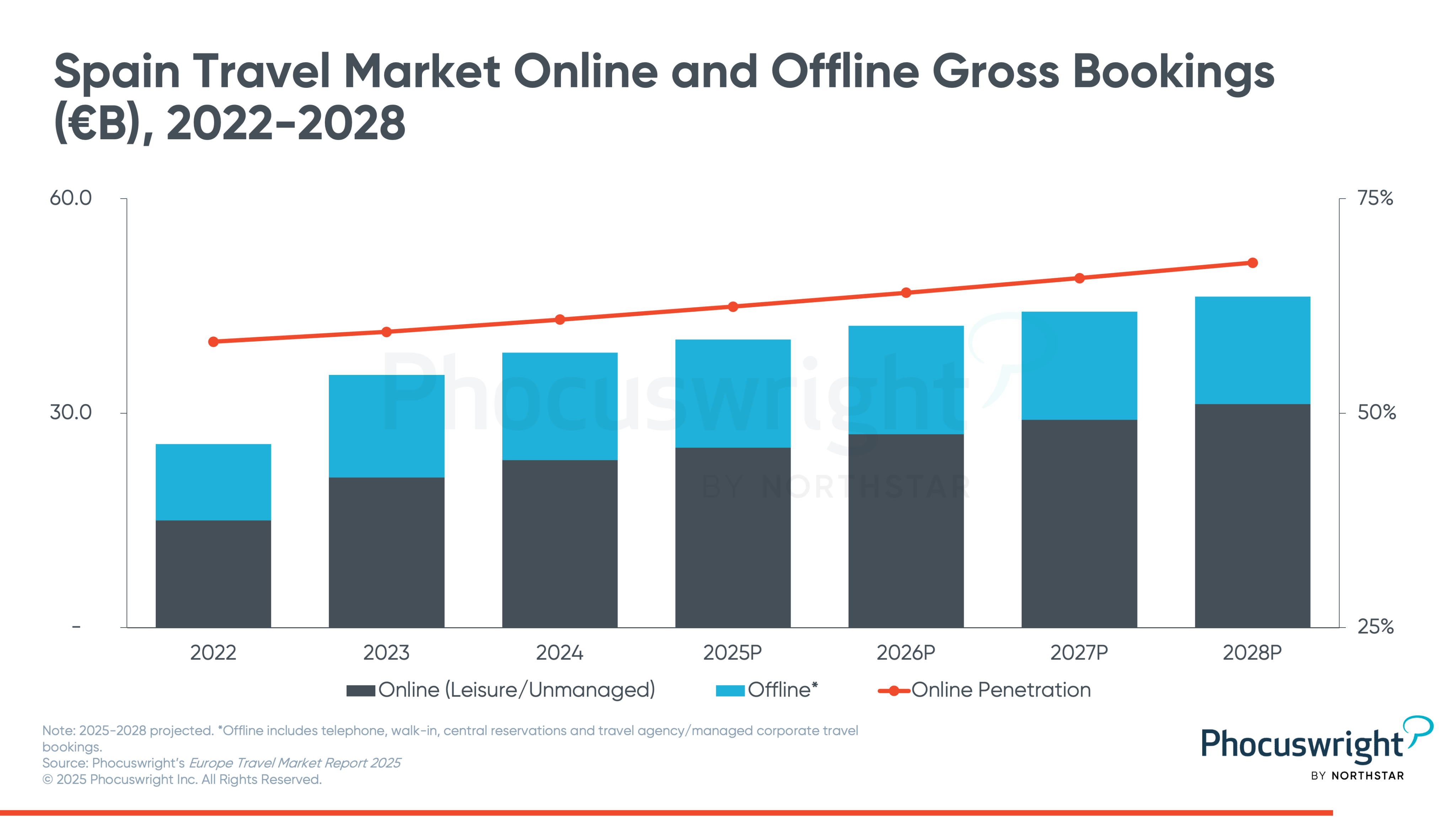

Spain Travel Market Brief 2025

Spain’s travel market continued its post-pandemic expansion in 2024, with gross bookings advancing 9% year over year. Travel spend reached €126 billion, supported by a torrent of inbound demand and steady domestic travel activity. Looking ahead, growth is expected to normalize as the market contends with broader economic and social trends.

New in 2025, this Brief delivers top-level takeaways for the Spain travel market, featuring charts and analysis on the key trends, segment highlights and market sizing datapoints that matter most.

Europe Consumer Travel Report 2025

Travel in the U.K., France and Germany continues to rise. Booking decisions are often influenced by factors revolving around value and price. Social media use has increased when planning and searching for trip ideas. Looking forward, most Europeans have a positive outlook for future travel plans, though these may be hindered by prolonged rising costs and some sustainability concerns.

Revisited and streamlined in 2025, this report is based on a comprehensive survey of U.K., France and Germany consumers who traveled in 2024. It compares European consumers' trip-planning and purchasing behavior, including the impact of emerging technologies on the travel planning process, as well as their expectations and goals for travel in the future.

Free research insights article:

Key questions answered include:

- What does the average traveler look like? How many trips do they take per year, where do they go, with whom, for how long, and how much do they spend?

- What resources - online and offline - do travelers use to research, plan and book their trips?

- How do preferences differ across age groups?

- How do the different European source markets compare in their preferences, and—ultimately—their booking decisions?

- What influences the decisions travelers make about various elements (e.g., air, hotel and activities) of their trips?

- What role does social media and other emerging technologies play in consumers’ travel planning activities?

- What is the sentiment towards future travel? What changes, if any, do travelers intend to make regarding their future travel?

Travel Metric of the Month

Phocuswright’s Travel Metric of the Month 2025 features fresh travel industry research published throughout the year, showcasing key data across our market sizing, consumer research, and tech and innovation practices. Each month, we will publish a new visualization that highlights a significant research trend, finding or data set, along with links to the source publication for a deeper dive.

Metrics of the Month 2025 include:

- January: U.S. Travel Agency Bookings, 2020-2026

- February: U.S. Lodging Trends

- March: Asia Pacific Travel Rebound

- April: Travel Startup Funding Trends

- May: Short-Term Rental Trends

- June: Europe Consumer and Market Sizing Trends

- July: U.S. Market Sizing Trends

- August: Coming Soon!

Free research insights report:

U.S. travel market & consumer trends

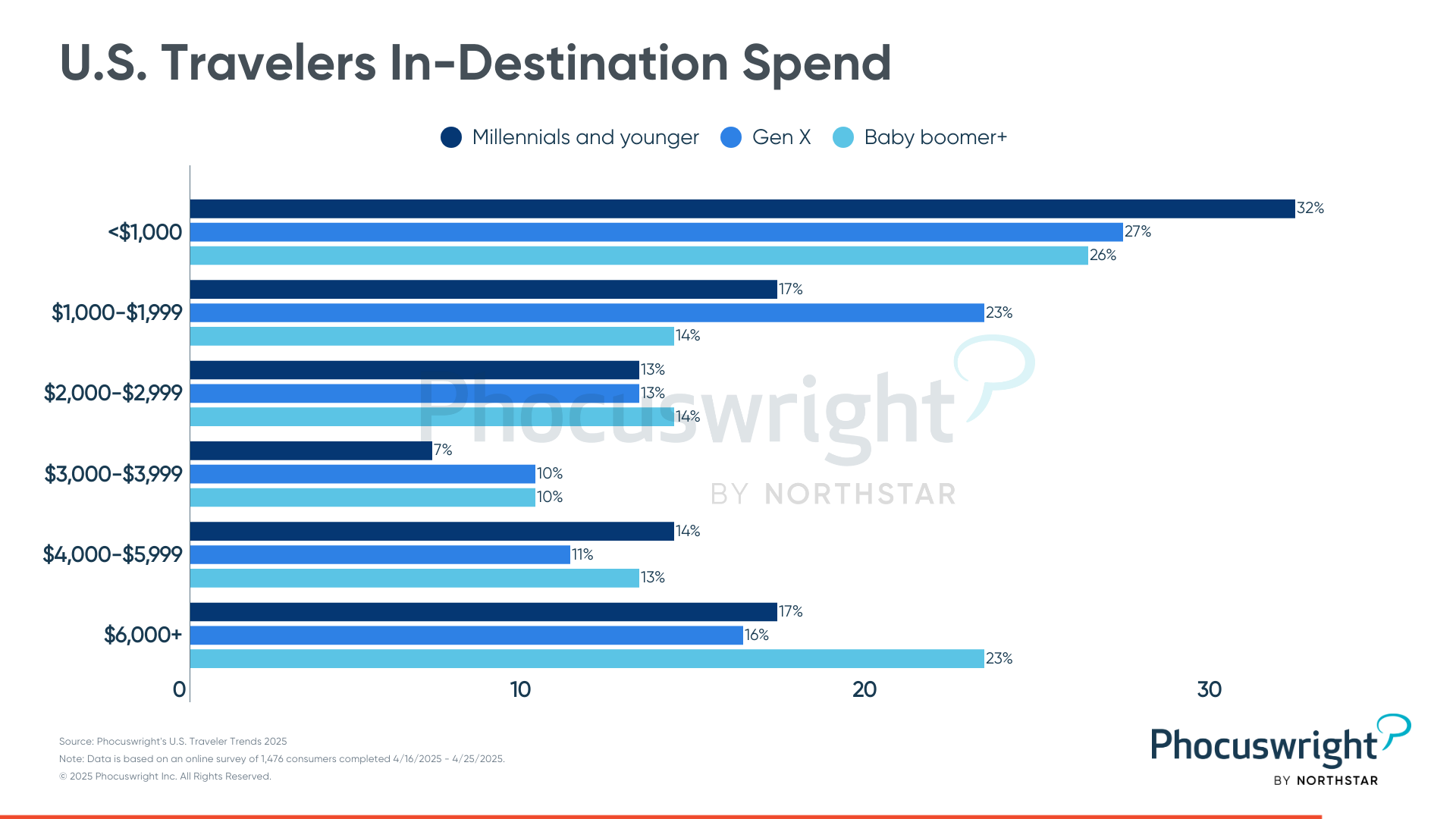

U.S. Traveler Trends 2025

Phocuswright’s U.S Consumer Travel reporting is taking on a new shape this year. Rather than reporting on the trends only once, we are highlighting traveler trends throughout the year.

Phocuswright fields an online consumer survey quarterly throughout 2025 targeting the general U.S. adult population who has internet access and travels for leisure. In turn, each quarter will spotlight key consumer segments and emerging trends shaping the U.S. travel market. Topics will span technology adoption, booking behavior, sentiment toward leisure travel—and more!

For a further deep-dive into the American consumer travel market, and what these trends look like over time, please see the U.S. Consumer Travel Report 2025 (COMING SOON!)

Free research insights article:

U.S. Travel Market Report 2025

Please note: This page is a preview of the upcoming U.S. Travel Market Report 2025. The full report will be available following the publication of all the individual segment reports in the series. Check out our Upcoming Reports page for more information!

New and improved, while still delivering key stats: Refreshed for 2025, this report series delivers market analysis, comprehensive sizing and projections for the U.S. travel market, along with detailed data and analysis of five key segments: airline, hotel & lodging, car rental, cruise and packaged travel. A standalone report dedicated to online travel agencies rounds out the coverage. Collectively, the series offers a detailed view of the segments, trends and distribution dynamics that are shaping the United States’ travel landscape in 2025 and beyond.

The U.S. Travel Market Report 2025 series includes all of the following reports (available now or publishing soon):

- U.S. Travel Market Report 2025

- U.S. Airline Market Essentials 2025

- U.S. Car Rental Market Brief 2025

- U.S. Cruise Market Essentials 2025

- U.S. Hotel & Lodging Market Essentials 2025

- U.S. Online Travel Agency Market Essentials 2025

- U.S. Packaged Travel Market Brief 2025

- U.S. Travel Market Data Sheet 2025 (subscriber only)

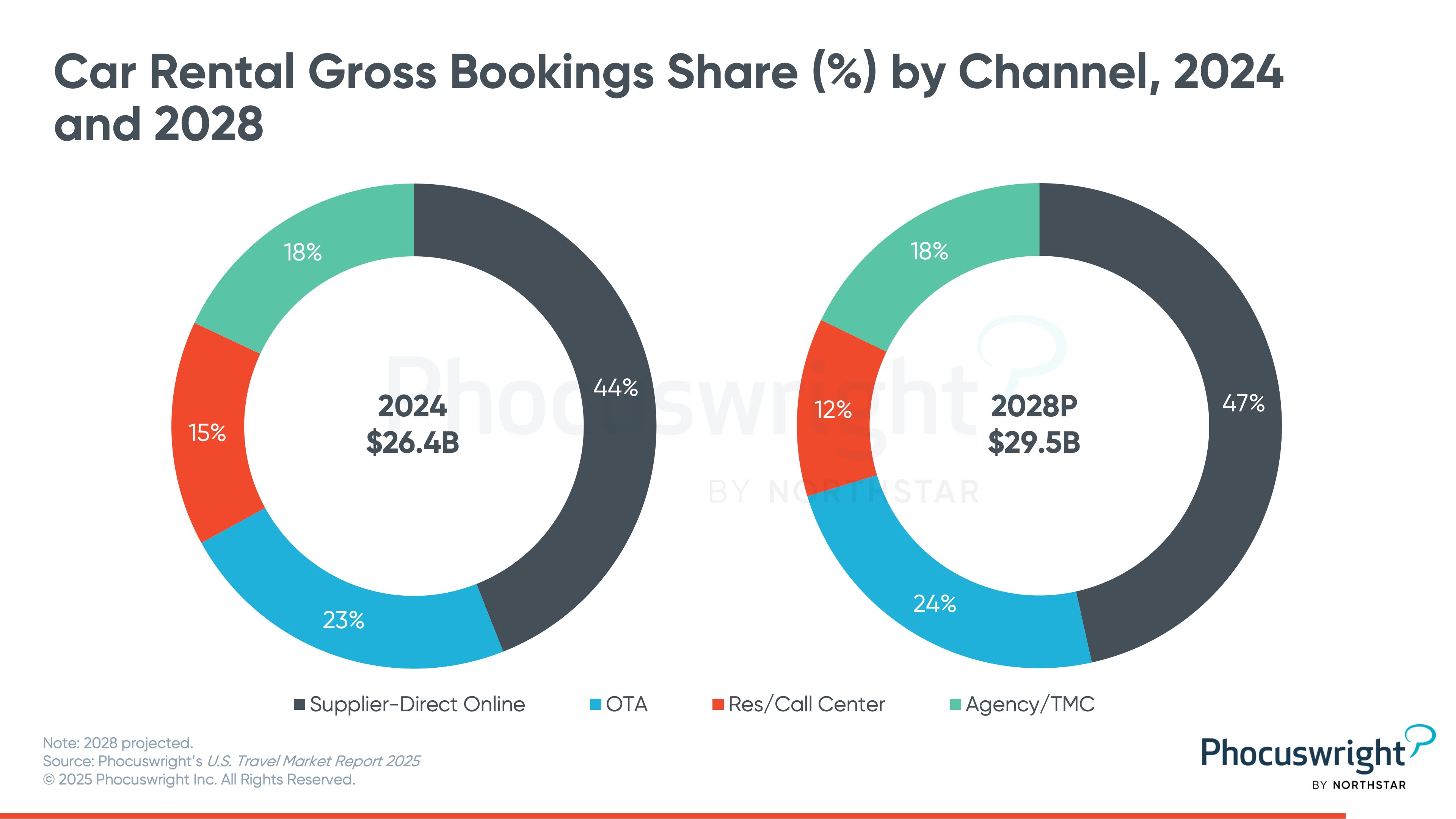

U.S. Car Rental Market Brief 2025

After peaking in 2023, the U.S. car rental market faced a mild correction in 2024 as fleet availability normalized and consumer price sensitivity increased. Rental companies responded by prioritizing margin over volume, adjusting fleet strategies, and pulling back from aggressive electric vehicle investments. Looking ahead, policy shifts, international sentiment and economic uncertainty are likely to weigh on demand, though direct digital bookings and operational recalibration offer some near-term resilience.

New in 2025, this Brief delivers top-level takeaways for the U.S. Car Rental travel market, featuring charts and analysis on the key trends, segment highlights and market sizing datapoints that matter most.

Free research insights article:

What’s driving Canadian travel agency growth in 2025?

The Canadian travel agency landscape is characterized by a combination of traditional and home-based businesses, mixed attitudes and usage regarding emerging technologies, and significant cost challenges. Service fees and international travel dominate revenue streams, and many agencies are optimistic about the future.

Key Findings:

1. Many agencies have seen an increase in bookings over the past year. Advisors use a mix of direct supplier channels, GDS interfaces and consolidators to book travel, though there is still a lack of familiarity with new air distribution capabilities.

2. Travel advisors rely heavily on their websites and free social media to attract new clients, while email and newsletters are key tools for maintaining existing relationships.

3. Most agencies charge service fees, with traditional agencies more likely to do so than home-based businesses. International travel continues to dominate revenue, particularly from all-inclusive resorts and cruises.

4. While awareness of generative AI is growing, adoption remains limited. Some advisors use it for marketing and itinerary creation, but many are still exploring its potential.

5. Most advisors remain optimistic about the future. Key challenges include increasing travel expenses and high airfares, which are prompting agencies to explore new revenue strategies, adjust their business models and expand their teams.

10 insights that should be on your radar in 2025

2024 marked a year of solid global growth in the travel sector, with strong performance in APAC and steady gains in North America and Europe. The Middle East and LATAM continue to emerge as significant markets, albeit much smaller than the three regional powerhouses. Looking ahead, here are 10 key insights from the report that should be on your radar in 2025

Phocuswright Europe Post-Show Wrap Up

Test and Learn: Industry Awaits AI Transformation

At Phocuswright Europe, one thing was clear: the future of travel isn’t a distant idea—it’s unfolding now. The spotlight was firmly on AI and its industry-shaking potential.

“The New Age(nts)” theme sparked big conversations: How will AI transform the traveler experience? Who’s leading the charge? And when will change truly hit? Most leaders agreed—we’re just scratching the surface. But experimentation is happening fast, and expectations are sky-high.

We’ve captured the most compelling insights, quotes, and takeaways from center stage, backstage, and beyond. Catch up now and see what’s next.

It's Game On: Register now for The Phocuswright Conference

November 18-20, 2025

San Diego, CA

Join us to sharpen strategies, uncover superpowers and help contestants navigate to the future, if not the finish line. This is your moment. This is your game.

More than numbers: This is decision-grade intelligence

Phocal Point: Global Market Sizing

When the market shifts, the most prepared teams aren’t just watching — they’re already adjusting.

That’s why we’ve updated Phocal Point and our Short-Term Rental dashboard with new market sizing, sharper forecasts through 2028, and tools built for professionals who need to move with clarity — not guesswork.

Why It Matters

Every percentage point matters

Whether you're modeling revenue, sizing a market, or evaluating a new opportunity, the difference between a good guess and a precise projection adds up — fast.

Regional nuance matters

What’s happening in Western Europe isn’t what’s happening in the U.S. — and it’s definitely not what’s happening in Asia Pacific. Our updated forecasts reflect this complexity, so you don’t have to flatten it.

Distribution strategy matters

Where bookings happen — and how that’s changing — is just as important as how much they’re worth. Our STR dashboard gives you interactive access to gross bookings data by channel, year, and region. Run your own comparisons. Export your own cuts. Back your strategy with specifics.

Research Insights articles

Get the latest in travel industry highlights with our free weekly research articles and more. Sign up to get the latest delivered directly to your inbox.

Upcoming publications

WEEKLY RESEARCH INSIGHTS

We dig deep to give you the data and trends that drive the travel, tourism and hospitality industry.

Get the latest in travel industry highlights with our free weekly research articles and more. Sign up to get the latest delivered directly to your inbox.

FOR MORE INSIGHTS

See all of Phocuswright's free research insights here.

Sign up to get the latest delivered directly to your inbox.

Open Access Research Subscription

Research is our priority. Our Open Access research subscription puts the world’s most comprehensive library of travel research and data visualization at your fingertips.

Clients have relied on Phocuswright's deep industry knowledge for over 25 years to power great decisions, help justify a pitch, build a strategic plan and elevate any presentation through trusted research and data. When companies and executives reference Phocuswright, they gain the trust of an industry keen on data, trends and analytics.

See the full benefits of an Open Access subscription here.

Contact Us

For any questions you may have, please call or email us at

📱 +1 860 350-4084

📧 info@phocuswright.com

About Phocuswright

Events

FAQ

Copyright

Contact Us

Research

News

Privacy & Terms

Press Room

Email Updates

Register for Phocuswright emails about research data, events and more:

A WHOLLY OWNED SUBSIDIARY OF

Copyright © 2023 by Northstar Travel Media LLC. All Rights Reserved. PO Box 760, Sherman, CT 06784 USA | Telephone: +1 201 902-2000

The Phocuswright Conference • Phocuswright Europe • Global Startup Pitch • Travel Tech Fellowship • Phocuswire • Web In Travel • Inntopia • Retail Travel • Hotel Investment