Growth of global short-term rental bookings slowing as significant volume shifts back to hotels

- Published:

- January 2024

- Analyst:

- Phocuswright Research

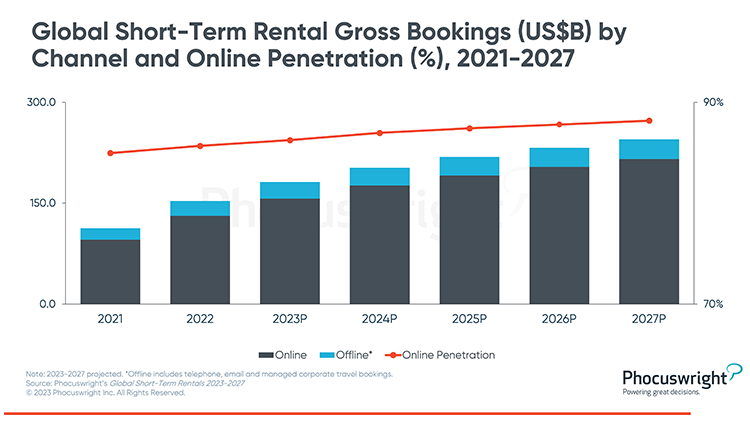

After two plus years of remarkable expansion fueled by booming pandemic-era demand, during which time travelers experienced the category's strengths and flaws, growth of global short-term rental bookings is slowing as significant volume shifts back to hotels. According to Phocuswright’s latest travel research report on the segment Global Short-Term Rentals 2023-2027, the slowdown can be attributed to the following:

- Rebounding demand for hotels, which were hit harder during the pandemic

- The recovery of business travel, which tends to be hotel-centric

- A return to offices, resulting in fewer people working while traveling - a trend which was conducive to STR stays

- Increasing regulations on STRs in many key markets

Phocuswright's U.S. Consumer Travel Report 2023 highlighted the shift back to hotels: The incidence of U.S. hotel stays was at parity with 2019 in 2022 (67% vs. 66%) after a dip in the intervening years, while for U.S. STRs it remained lower than 2019 (25% vs. 28%).

Europe was a slightly different story. Per the Europe Consumer Travel Report 2023, the U.K. tracked similarly to the U.S. in that STRs didn't bounce back as strongly. But across France, Germany, Italy and Spain, STR incidence was significantly higher in 2022 vs. 2019, spotlighting the inconsistent dynamics of the hotel vs. STR markets in various locales.

Phocuswright’s Global Short-Term Rentals 2023-2027 gives readers market sizing and projections for the global STR market by region and distribution channel. Specific topics covered include:

- Global short-term rental sizing, featuring potential “whys” behind the sizing changes

- Online penetration analysis

- Regional distribution shifts – what’s growing and what’s being left behind

- Discussion of upcoming challenges, including nascent STR regulations, persistently high prices, economic stagnation and what STRs may mean for the broader accommodations market

For further intelligence for you and your entire company, subscribe to Phocuswright Open Access. This subscription puts the entire Phocuswright research library and powerful data visualization tools at your fingertips. There’s a reason executives around the world trust and reference Phocuswright research and data on a daily basis. Explore for yourself why.

Plus, we just redesigned Phocal Point, the powerful data visualization tool that now makes it easier to access and interpret Phocuswright data.

It's all about the data. With an updated navigation interface, new dynamic filtering, additional segment and channel breakouts in select markets and rich detailed views of 35+ markets, Phocal Point allows you to create custom interactive charts and view travel data by segment, channel, device, region and country. Our proprietary travel industry market sizing data allows you to look to the future with projections through 2026, and review historical data as far back as 2009.