Travel experiences: operator performance, sentiment and challenges

- Published:

- January 2023

- Analyst:

- Phocuswright Research

Operators of tours, attractions, activities and experiences have faced rapid change over the past several years, and the impacts of the COVID-19 pandemic have varied widely across regions and activity types. As a result, operators are experiencing an uneven recovery: Many are still working toward recovery, while a lucky few thrived throughout the pandemic and some ceased operations altogether.

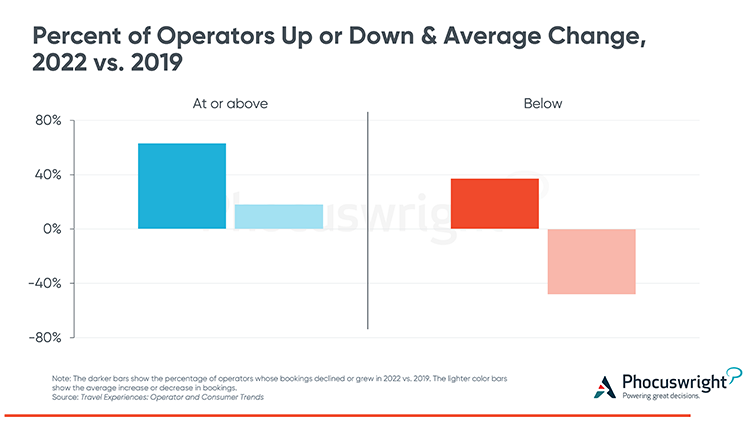

According to Phocuswright’s latest travel research report Travel Experiences: Operator and Consumer Trends, overall, 63% of global operators indicate that bookings in 2022 are at or above the 2019 level (see figure below). Among this group, bookings are up an average of 18% versus 2019. For more than one third of operators, however, bookings remain well below the pre-pandemic level. These operators on average are seeing just over half the bookings they received in 2019.

(Click image to view a larger version.)

Operator sentiment

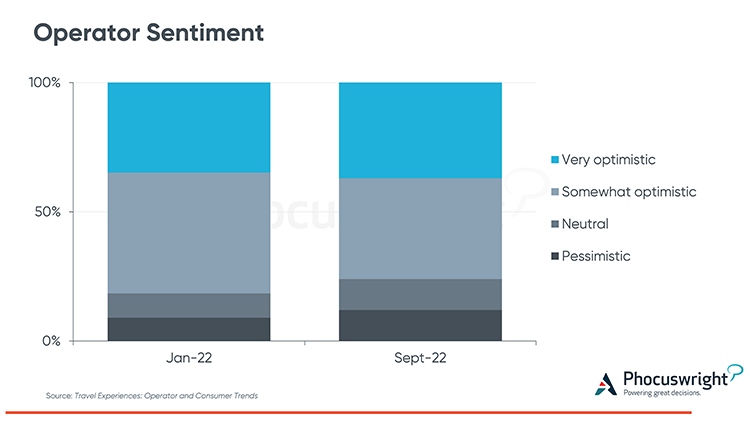

Despite the challenges of the past few years, operators are largely optimistic about the future (see figure below). In September 2022, roughly three quarters (76%) of operators indicated they are somewhat or very optimistic about prospects for the coming year. Despite the largely positive response, this sentiment reflects a decline in optimism compared to January 2022, when 81% of operators expressed similar optimism. While prospects appear good overall, persistent inflation, paired with currency woes and the ongoing conflict in Europe have dampened expectations slightly, amid fears of a looming recession.

(Click image to view a larger version.)

The challenges

Among the challenges impacting operators are rising costs for a broad range of essential expenditures. Many operators are paying more for new equipment, technology and staffing/wages. In addition to cost-of-living increases, staffing challenges in many locations have resulted in pay increases in order to attract and retain staff. More than half of operators report higher costs for marketing as well as insurance. Cost increases are substantially more widespread than they were in 2021, when only a minority of operators experienced rising cost pressure.

This report is based on findings from Phocuswright's Tours, Activities, Attractions and Experiences joint research project with Arival, which measured the size and opportunity of the global experience marketplace; assessed operators' business practices and performance; and explored traveler attitudes and behaviors when choosing and consuming in-destination experiences. This report provides findings from the operator and consumer research.

Table of Contents:

- Objectives and Methodology

- Methodology

- Key Terms

- Key Findings

- Operators

- Travelers

- Operator Trends and Landscape

- Operator Performance

- Booking and Distribution

- Marketing and Technology Trends

- Consumer Behavior

- Experience Inspiration

- Research and Shopping

- Booking

- Spotlight on India

For market sizing and related trends, see The Outlook for Travel Experiences 2019-2025.

For more deep insights into the travel trends, markets, segments and innovations covered by Phocuswright, subscribe your entire company to Open Access. This subscription puts the entire Phocuswright research library and powerful data visualization tools at your fingertips. There’s a reason executives around the world trust and reference Phocuswright research and data on a daily basis. Explore for yourself why.