The share of B2C versus B2B funding tells an interesting story

- Published:

- September 2022

- Analyst:

- Phocuswright Research

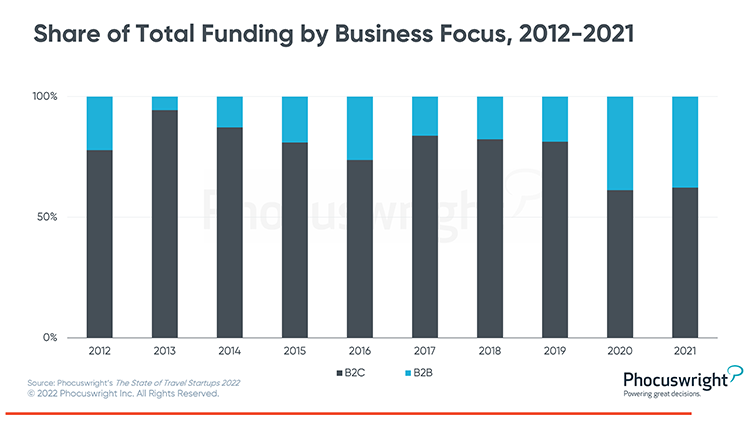

Funding to B2C startups always outpaces B2B because of the investments needed for consumer businesses to scale.

But the share of B2C versus B2B funding tells an interesting story – it has trended toward B2B companies for years, and in 2021 B2B funding hit its highest share ever, at 39% according to Phocuswright’s travel research report State of Travel Startups 2022.

(Click image to view a larger version.)

This was in part due to $3 billion going to the top four urban transportation companies in China, which all operate on a B2B basis: WeRide ($1.5 billion) HT Aero ($500 million), Deeproute ($500 million) and Momenta ($500 million).

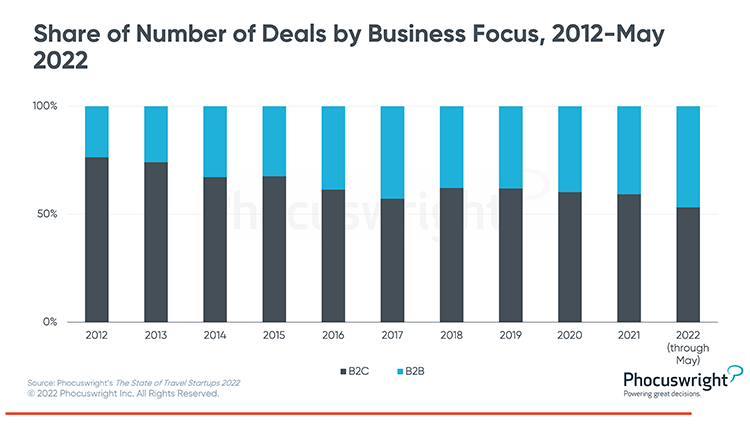

In terms of the number of deals, B2B continues to gain share, even into 2022.

(Click image to view a larger version.)

Although B2B company revenue typically never reaches the lofty heights of B2C juggernauts, their relatively predictable, steady revenue became much more attractive to investors during the uncertainty of the pandemic. Additionally, B2B companies may have better captured attention from potential customers and partners, as openness to technology use for increased efficiency and automation increased in corporate boardrooms across the world.

Furthermore, scaling a B2C startup is only getting harder: SEO/PPC, social media and influencer campaigns were low-hanging fruit for smaller consumer companies, but they all appear to be saturated now, pricing out most smaller companies. In addition, the sheer volume of options produces a noisy and distracting landscape, making it more difficult for B2C companies to cut through and reach the consumer. On the other hand, dozens of programs and investors have focused on facilitating B2B startup introductions and business deals in the past decade, providing a supportive infrastructure for B2B companies.

If you need an analysis on funding, investors, major verticals, horizontals, business focus, regional and the outlook on the future, look no further than Phocuswright’s The State of Startups 2022.

Phocuswright has tracked the digital travel startup landscape for well over a decade, and innovation in the travel industry has flourished during this period. Analysis of travel startups covers those founded since 2012 and includes funding rounds raised by these companies through May 2022. Leveraging Phocuswright’s proprietary interactive database, this updated report provides a comprehensive assessment and outlook for travel startups in today’s dynamic environment. More specific topics include:

- Analysis by year, type, region and category

- Funding activity by stage

- Market trends driving investment

- Focus on key verticals

To explore the data behind this analysis, please check out The State of Travel Startups Interactive Database.

Find more meaningful insights by subscribing to Phocuswright Open Access. This highly beneficial and informative subscription provides company-wide access to the whole library of Phocuswright’s travel research and data visualization.