The most used booking platforms for short-term rentals and what makes them attractive

- Published:

- February 2022

- Analyst:

- Phocuswright Research

Over the past several years, travel distribution players have scrambled to add short-term rental properties and content, all vying for their share of the growing rental market. Regardless of what type of accommodation they are shopping for, travelers have a broad range of research options according to Phocuswright’s latest travel research report Through the Roof: U.S. Short-Term Rentals 2021. Among short-term rental (STR) users, rental platforms such as Airbnb or Vrbo are the most popular online source, with 46% using a third-party listing platform to shop for accommodation for their last rental trip.

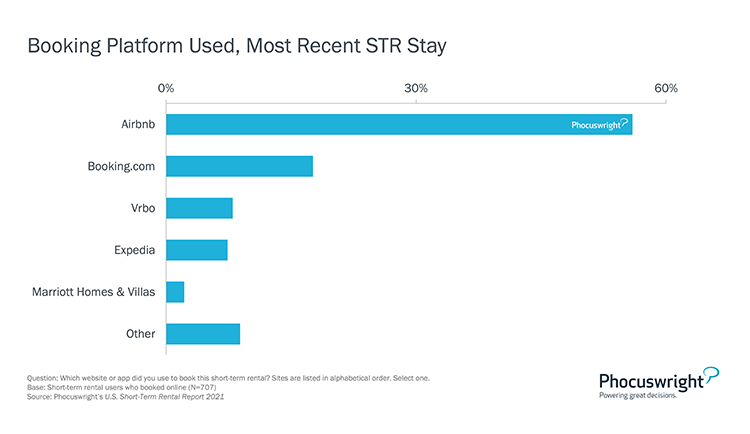

Among STR users who booked online, more than half did so via Airbnb (see figure below). In fact, Airbnb was the highest-regarded brand among consumers overall, scoring top marks for brand recognition, as well as a range of metrics such as property offerings, value for money and unique properties. Travelers associate more familiar STR brands with a better product offering and performance - either due to inherent strengths or due to the brand halo. Furthermore, 66% of travelers feel COVID has made it more important for them to book accommodations from brands that they know and trust.

(Click image to view a larger version.)

Booking.com was the second most-used booking platform for the last rental trip, followed by Vrbo and Expedia.

When booking accommodation, just as certain features can increase the chance of conversion, there are deficits that can result in a lost sale. Ease of booking is among the factors that can make or break a rental transaction. If booking is viewed as being too difficult, some STR users abandon the category altogether. Three in 10 users with a recent hotel stay chose a hotel due to ease of booking.

Streamlined search capabilities and a good user interface are important to accommodation shoppers. Nearly two thirds of STR users give priority to instantly bookable properties when searching. On-request bookings, while offering benefits to hosts seeking greater control over who stays at their property(ies), can dissuade travelers from booking a particular property.

More than six in 10 hosts indicate their property is instantly bookable. Just one quarter of hosts offer on-request bookings only, retaining the option to screen prospective guests before accepting bookings. For these sellers, providing travelers with greater transparency during the on-request process can help to keep prospects and guests happy.

This report, based on a comprehensive survey of STR users, hosts and property managers, explores changes in the STR landscape from both consumer and business-side perspectives. Stakeholders’ attitudes, goals and behavior are discussed in detail, along with projections regarding the growth of the market.

If you become a Phocuswright Open Access subscriber, you can unlock this full report for you and your entire company (plus our full research library). Our Open Access research subscription puts the world’s most comprehensive library of travel research and data visualization at your fingertips. Your team enjoys company-wide access to our research and data library, analyst expertise, event discounts and more. Join the biggest and smartest companies in travel as a Phocuswright Open Access subscriber. More information here.