Investor analysis

- Published:

- August 2022

- Analyst:

- Phocuswright Research

As dollar amounts rise, more investors are piling into each round to provide the funds to travel startups. According to Phocuswright’s latest travel research report The State of Travel Startups 2022, the average number of investors participating in each funding round jumped from approximately 1.9 pre-2020 to 3.1 in 2021 and 1H22.

The most active large investors in travel are Sequoia Capital, Lightspeed Venture Partners, Goldman Sachs, Andreessen Horowitz and Kinnevik AB, all of whom have consistently contributed to funding rounds in the tens or hundreds of millions every year since 2018.

Sequoia Capital, a longstanding late-stage travel industry investor, maintains its position as arguably the most influential investor in the space, having participated in funding rounds worth $2.6 billion since 2018, including Bird, Bolt, Happay, OYO, Stanza Living, Tourlane, Wicked Ride and Zoomcar.

But increasingly, many investors in travel startups are first-timers in the industry. Investors who have only participated in a single travel startup funding round have been growing steadily since 2012 (see figure below). The number dipped in 2020 but rebounded in 2021 as travel once again started looking enticing.

(Click image to view a larger version.)

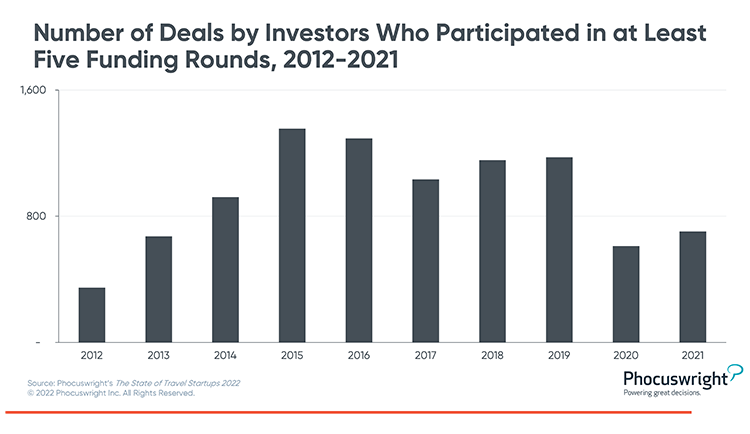

In contrast, the number of investors who have participated in at least five rounds ramped up from 2012 to 2015, but has declined significantly since then.

(Click image to view a larger version.)

Phocuswright has tracked the digital travel startup landscape for well over a decade, and innovation in the travel industry has flourished during this period. Though the pandemic has proven to be a challenging period for funding, a significant comeback has occurred – with record funding recorded in 2021.

Still, questions remain about the stability of the upswing as inflation and market uncertainty grow. Analysis of travel startups covers those founded since 2012 and includes funding rounds raised by these companies through May 2022. Leveraging Phocuswright’s proprietary interactive database, this updated report provides a comprehensive assessment and outlook for travel startups in today’s dynamic environment.

Specific topics include:

- Analysis by year, type, region and category

- Funding activity by stage

- Market trends driving investment

- Focus on key verticals

To explore the data behind this analysis, please check out The State of Travel Startups Interactive Database.

For further intelligence for you and your entire company, subscribe to Phocuswright Open Access. This subscription puts the entire Phocuswright research library and powerful data visualization tools at your fingertips. There’s a reason executives around the world trust and reference Phocuswright research and data on a daily basis. Explore for yourself why.

.png)