Rebuilding growth is a priority, but so too is reviving SE Asia's pre-pandemic dynamism

- Published:

- September 2021

- Analyst:

- Phocuswright Research

When Southeast Asia's travel recovery hits full swing it will be doing so from a heavily diminished base. Between them, the four countries in Phocuswright's latest research report, Southeast Asia Travel Market Report 2020-2024, welcomed 101.4 million inbound arrivals in 2019 - 39.9 million in Thailand, 26.1 million in Malaysia, 19.1 million in Singapore and 16.3 million in Indonesia. That total plummeted to 17.8 million in 2020 - 6.7 million in Thailand, 4.3 million in Malaysia, 4.0 million in Indonesia and 2.7 million in Singapore.

To support a regional recovery, hopes were high that Southeast Asia's 10 countries would align their responses regarding vaccine certifications and digital health passes. This has yet to occur, leaving vital inter-ASEAN travel demand almost non-existent in August 2021. The hoped-for recovery failed to kickstart in 2021, resulting in a forecast of marginal bookings growth to $14.7 billion.

Rebuilding growth is a priority for Southeast's Asia travel market, but so too is reviving its pre-pandemic dynamism. While low-cost carriers (LCCs) transported spiraling volumes of leisure tourists, business travel expansion supported expansion in MICE and transport infrastructure. More people traveled for education and economic migration purposes, and to visit family and friends. The cruise sector flourished, with a rising volume of annual port calls across Southeast Asia. Casino tourism thrived in the sleek integrated resorts of Singapore and the highlands of Malaysia. New beachfront resorts and city hotels sprang up, airports were upgraded, high-speed railways began construction and rural communities forged microtourism economies. Even with borders closed, domestic self-drive trips to nature spots soared in popularity, as has outdoor adventure, ranging from camping and hiking to ziplining and river sports.

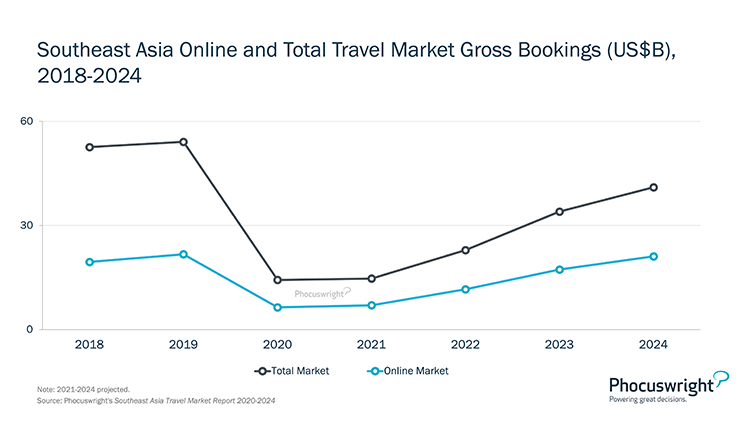

Mirroring developments throughout the Asia Pacific region, innovation in digital technology will boost the travel recovery in Southeast Asia, particularly among younger demographics. Even during the pandemic, interactive technologies have inspired new patterns of travel marketing, like real-time virtual tours, gamified travel promotions and new cashless payment formats. The outlook for online travel distribution reflects these trends. In 2024, gross travel bookings are forecast to reach $41 billion, with more than 50% of this total, $21.1 billion, made online (see Figure below). This compares with online sales of $21.7 billion in a total market of $54.1 billion in 2019.

(Click image to view a larger version.)

This report provides comprehensive market sizing and projections for the Southeast Asia travel industry from 2018-2024, including analysis of key segments, country-level share and trends, distribution dynamics and more.

Also available in the Asia Pacific Travel Market Report 2020-2024 series:

- Asia Pacific Travel Market Report 2020-2024

- Australia-New Zealand Travel Market Report 2020-2024

- China Travel Market Report 2020-2024

- India Travel Market Report 2020-2024

- Japan Travel Market Report 2020-2024

- Asia Pacific Travel Market Data Sheet 2020-2024

Phocuswright's Open Access research subscription puts the world's most comprehensive library of travel research and data visualization at your fingertips.

We work closely with companies in all sectors of the travel industry to provide the research and data needed to make smart business decisions. Explore the Open Access benefits best suited to your company.

In the immediate future, a regional travel recovery will hinge on the interplay of three factors: the trajectory of the Delta variant, speed of national vaccination programs and shifts in government border policies. In August 2021, Singapore signaled its intention to gradually ease border restrictions with selected 'low-risk' countries. Other governments in the region are expected follow its lead once vaccination rates improve.