Profile of a loyalty member

- Published:

- July 2021

- Analyst:

- Phocuswright Research

A defining feature of people who join and engage in loyalty programs is that they are often active, savvy and discerning travelers. These programs especially attract travelers who spend generously on leisure trips and travel frequently (see figure below). According to Phocuswright's latest travel research report Loyalty Programs Revisited: Hotels, Airlines and OTAs, nine in 10 travelers who spent $6,000 or more on leisure travel in 2019 belong to one or more frequent flier programs, and 83% are members of at least one hotel loyalty program.

(Click image to view a larger version.)

As a group, loyalty members seek to maximize the value of their travel spend, create reliable and consistent expectations of their providers, and secure better treatment from their favorite brands. Travel providers must take heed not to take them for granted. Members enjoy special treatment from brands and appreciate a streamlined experience of knowing their favorite providers will serve them well, time and time again. That loyalty, however, is conditional on travel companies continuing to fulfill their customers' needs.

Given that loyalty members are typified by their high engagement and desire to maximize their travel spend, they are driven to join loyalty programs for multiple types of travel providers. Eighty-seven percent of hotel loyalty members are also in at least one frequent flier program, and likewise, 77% of frequent flier program members belong to at least one hotel loyalty program. There are some key differences between air and hotel loyalty members, but they often display similar behaviors and trends, given the overlap between the two groups.

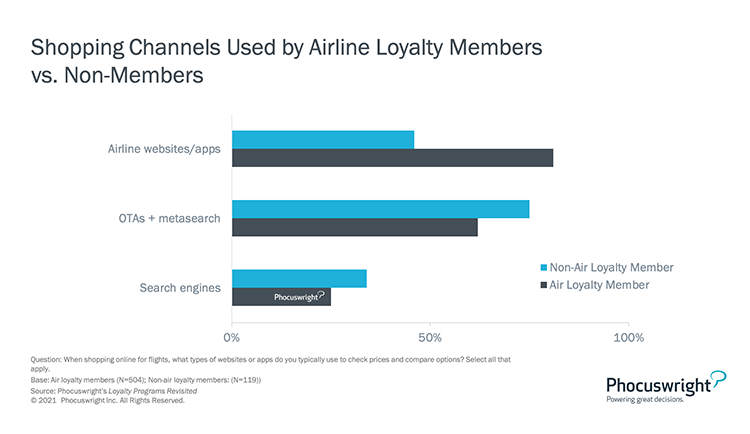

Loyalty members may be partial to certain brands, but their consistency in brand usage does not stem from any naivety about the travel marketplace. They have preferred brands that they often choose at the end of the funnel, but they still take the time to actively compare options and pricing before booking, first checking to see whether their preferred brands are the most advantageous options (see figures below). Loyalty programs are particularly successful channeling members to provider-direct sites at some point in their shopping journey. But most members still scope out their options, and rarely gravitate to a single go-to brand immediately.

(Click image to view a larger version.)

(Click image to view a larger version.)

Loyalty Programs Revisited: Hotels, Airlines and OTAs explores what travelers want from their loyalty memberships, where they are most pleased with their programs, and areas in which suppliers and intermediaries have an opportunity to increase member satisfaction.

Also in this series (available now or publishing soon):

- Loyalty Programs Revisited: Key Metrics and the Impact of COVID-19

- Loyalty Programs Revisited: Tapping Into Travel Credit Cards

- Loyalty Programs Revisited: Business Travelers

To give access of this report to your entire company, subscribe to Open Access. Plus, everyone in your organization will have access to the entire Phocuswright research library and data visualization tools.