Earning points and loyalty: Branded vs. redemption credit cards

- Published:

- April 2021

- Analyst:

- Phocuswright Research

Travel loyalty programs are well penetrated among U.S. travelers - 89% belong to an airline, hotel, online travel agency, car rental, and/or cruise loyalty program according to Phocuswright’s latest travel research report Loyalty Programs Revisited: Tapping Into Travel Credit Cards. Loyalty programs have been designed to incentivize and reward bookings and entice travelers to repeat purchases. But one of the inherent hurdles that travel companies face in building loyalty with customers, especially if relying on a loyalty program as the primary mechanism, is the infrequency of travel compared to other consumer purchases. Pre-pandemic, 56% of U.S. travelers took more than two leisure trips a year, and though loyalty members tend to travel more than non-members, only 59% of loyalty members did so.

Travel companies have tried to broaden appeal and earning opportunities of their loyalty programs by allowing points to be earned on more frequent purchase categories like ride-sharing, shopping or dining. Several airlines have dining programs where members can link any credit or debit card to earn frequent flier miles on spend at participating food and beverage establishments. Loyalty members can click through to retailer websites from airline or hotel loyalty shopping portals to earn points and miles on online shopping from participating merchants. These expanded earning opportunities require a level of awareness and some effort on the travelers' end, though, and are limited to participating partners. Credit cards, however, are a straightforward mechanism to accelerate point accumulation by allowing earnings on everyday purchases.

Several travel brands have teamed up with financial institutions to offer credit cards that link points earnings and redemptions directly to their loyalty programs, such as Delta SkyMiles American Express, Marriott Bonvoy Boundless Visa, and Expedia Rewards Card from Citi. These cards have attracted 51% of U.S. loyalty members to sign up. There is card user overlap to another breed of travel credit cards - the travel redemption card; 29% of loyalty members have both a travel-branded card and travel redemption card.

Travel redemption credit cards like Chase Sapphire Preferred/Reserve or American Express Gold/Platinum can appeal to a broader pool of travel enthusiasts. Redemption cardholders place less priority on racking up points in a specific travel loyalty program than branded cardholders. For air, 41% of branded cardholders versus 31% of redemption cardholders say earning loyalty points is a top factor when deciding where to book; for hotels, the share is 21% and 15% respectively. Travel redemption cards still reward travel-related purchases and offer travel redemption options (not limited to a single travel brand) and also offer other travel benefits (lounge access, global entry, preferred rates). Frequently, earnings can be used toward other categories or for cashback, and additional non-travel related perks and partnerships are also part of the deal. Still, most travel redemption cardholders are also members of traditional travel loyalty programs. Overall, 39% of U.S. travelers hold a travel redemption credit card, and loyalty members account for 97% of cardholders.

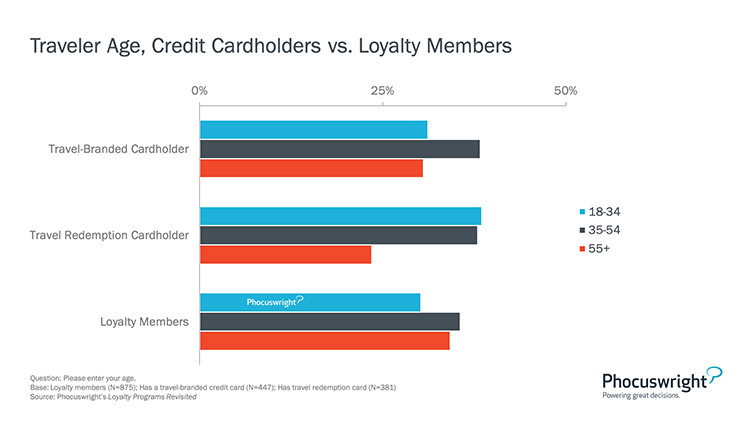

Travel redemption cards are especially attractive to younger travelers. Fewer than one in four redemption cardholders are 55 or older; instead, older travelers are more likely to opt for a travel-branded card or traditional travel loyalty program.

(Click image to view a larger version.)

Loyalty Programs Revisited: Tapping Into Travel Credit Cards examines how U.S. travelers who have a travel credit card view and use their cards. It also explores how cardholder behaviors differ from non-cardholding travelers. Download it here.

To give access of this report to your entire company, subscribe to Open Access. Plus, everyone in your organization will have access to the entire Phocuswright research library and data visualization tools.