Best- and worst-case scenarios for the Latin America travel market

- Published:

- December 2020

- Analyst:

- Phocuswright Research

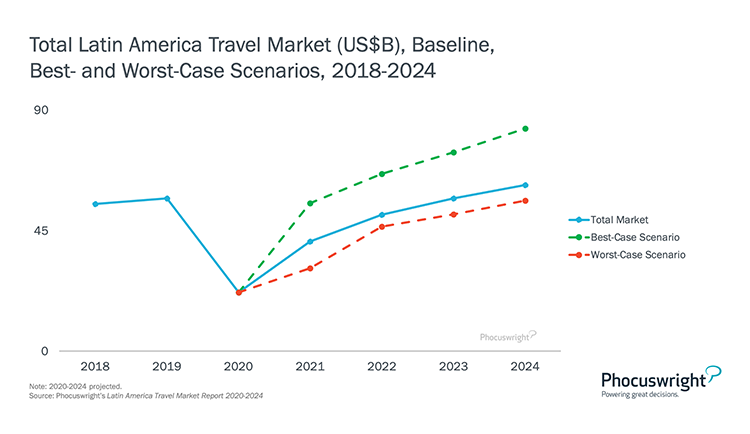

Latin America's ongoing struggle with its coronavirus response will take a heavy toll on the region's travel market in 2020. According to Phocuswright’s latest travel research report Latin America Travel Market Report 2020-2024, gross bookings, which rose 3% to $57.4 billion in 2019, are forecast to plunge 62%. Although the region accounts for 8% of the world's population, by August 2020, Latin America represented 30% of global COVID-19 deaths. There remains a high level of uncertainty around travel market recovery. The majority of Latin American countries were still closed to international visitors as of December 2020, which dampens the outlook for airlines and tour operators, in particular. As more countries lifted domestic travel bans in June and July, however, a surge in hotel and car rental bookings began to generate some optimism. Some destinations that are easily reached by car or bus reported hotel occupancy rates in the 80% range on weekends and holidays, confirming that Latin Americans are eager to resume traveling.

The travel market will begin to recover in 2021, as revenue rises. However, overall gross bookings will not return to pre-pandemic levels until 2024. The region's largest travel segments - hotels and airlines - were already being impacted by a string of bankruptcies and market fragmentation before the COVID-19 pandemic.

An alternative best-case scenario, in which a vaccine becomes globally available early in 2021 and Latin American coronavirus cases (and deaths) experience a marked and steady decline, would boost recovery above pre-pandemic levels as soon as 2022 (see Figure below). Conversely, in a worst-case scenario, where Latin American authorities are unable to bring the pandemic under control in the coming year, and social and political unrest continues, total gross bookings and recovery to pre-pandemic revenue levels would not occur before 2024, as international inbound and outbound travel fail to rebound, and unmanaged corporate travel permanently suffers from long-term changes in the in-person conference and events businesses.

(Click image to view a larger version.)

One positive trend across Latin America's travel market is the continued growth of online distribution. Internet access is expanding significantly - Argentina boasts a 92% internet penetration rate, while Mexico's mobile internet penetration jumped from 36% to 55% in 2019, second only to Uruguay in Latin America. As a result, Latin American online travel revenue rose in 2019.

During the first Phocuswright LataAm/Talk event, held on December 10, Carolina Sass de Haro, Market Specialist, Latin America, Phocuswright and Managing Partner, Mapie, presented an overview of the Latin America travel market. You can watch her presentation plus all of the other sessions here.

This report provides updated market sizing and analysis on the Latin American travel market. Specific coverage includes key player and segment analysis, sizing and projections through 2024, along with an overview of the travel markets in Mexico, Brazil, Argentina, Colombia and Peru. Get it here.

To unlock this report for you and your entire company, subscribe to Phocuswright Open Access. Not sure about the benefits of subscribing? See them here.