Digital dominates amid hostels' ascent

- Published:

- May 2018

- Analyst:

- Douglas Quinby

The broader travel industry may bucket hostels into "alternative accommodations," yet this often-overlooked sector is showing higher online penetration than the hotel or vacation rental categories. Younger travelers (18-34) comprise the largest share of hostel guests, and these digital natives have fueled rapid adoption of online and mobile hostel booking.

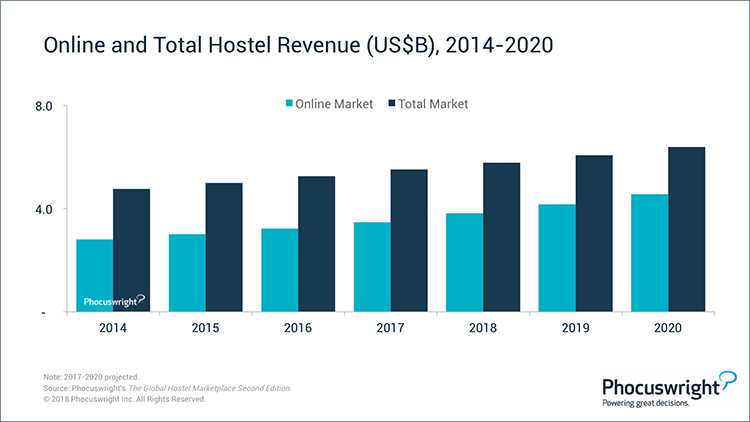

The US$5.5 billion global hostel market in 2017 will grow to nearly $6.4 billion in 2020. Over the same time period, the online hostel market will grow 7-11% annually, rising from $3.5 billion to $4.6 billion. More than 70% of revenue will be booked online, making hostels one of travel's most highly penetrated online travel segments.

(Click image to view a larger version.)

Online travel agencies (OTAs) are the most popular online purchase channel. Amid a highly fragmented market of independently operated properties serving mostly younger, more price-sensitive travelers, OTAs have become the leading booking channel. OTA share of total hostel bookings will rise from 44% in 2014 to 54% by 2020, when OTA bookings will represent just over three quarters of online hostel revenue.

Phocuswright's Global Hostel Marketplace 2016-2020 Second Edition provides comprehensive marketing sizing, forecasting and analysis for this under-studied sector.

What you will learn:

- Key sizing data on the global hostel marketplace by supply and demand, with historical trending from 2014 and forecasts through 2020

- What distribution channels are rising and what is the role of online travel agencies

- Essential operational benchmarks on distribution, ADRs, occupancy and ancillary services

- In-depth segmentation by region, hostel size and type

- The importance of and trends around private rooms vs. dorms and shared rooms

- The various guest amenities and services offered and revenue opportunity

Check out Phocuswright's Global Hostel Marketplace 2016-2020 Second Edition for fresh insight into the current state of the industry and benchmarks for assessing your practices and performance.

Gain company-wide access to Phocuswright's research library

HERE.

Questions? Our team is here to help you! Contact:

sales@phocuswright.com OR +1 860 350-4084 x501