Research Insights

The Affiliate Deal of the Decade

The Affiliate Deal of the Decade

- Published:

- August 2013

- Analyst:

- Douglas Quinby

It was the fall of 1999, the heyday of online travel 1.0, among many other heydays.

Sabre, the parent of Travelocity, had announced the acquisition of Preview Travel, then the third-largest online travel agency (OTA). The combined entity would be an online travel powerhouse, pushing Travelocity well past number two Expedia, with whom it had been in a rough-and-tumble knife fight for the top spot.

"This is going to be a very, very impressive business in terms of its reach," said then Sabre Chairman Donald J. Carty, quoted in an October 1999 article in the Wall Street Journal.

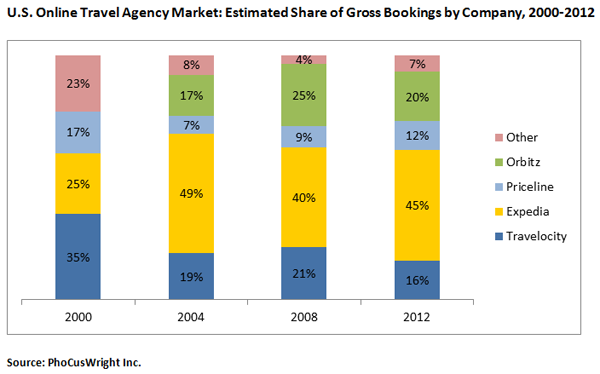

And so it was. The acquisition catapulted Travelocity to a leading position, with 35% of the OTA market in the U.S. in 2000, when total OTA gross bookings reached $6.6 billion. But the experience of being top dog was a fleeting one. Sabre's subsidiary was quickly outflanked.

Within just two years, Expedia had shot ahead with its market-making merchant model for hotels, powered in part by the acquisitions of two online lodging aggregators, Travelscape and VacationSpot. Expedia's new hotel platform gave it an edge that left its competitors as well as hoteliers in a daze amid the recession of 2001 and 2002. By 2004, one year after the additions of Hotels.com and Hotwire, Expedia was the U.S. market leader by a longshot, with nearly half the market.

The story since is a saga well known: a series of bold initiatives that failed to live up to expectations. Travelocity was the first to bet big on Asia with Zuji, sought bold international growth with the acquisition of U.K. online phenom lastminute, and made an ambitious – if ultimately mistaken – bet on customer service under a whiz kid management team from the acquired packaging play Site59. It's almost a perfect counterpoint to Priceline's low-key acquisitions of Active Hotels, Booking.com and Agoda, which have been on a seemingly unstoppable growth tear pretty much everywhere.

Considering Travelocity's history from market leader to laggard, as well as the relentless and ruthless competition between what were long the two top OTAs in the U.S., this development is remarkable on several fronts. Expedia has definitely won the affiliate deal of the year, if not the decade. Travelocity may have been unable to stem the slide, but with 16% of the U.S. market it is still a sizable business. Expedia will power everything under the hood for Travelocity's North American branded sites, with Travelocity effectively throwing in the towel, acknowledging it can no longer compete on platform and supply. Travelocity will continue to own the marketing. Travelocity's lastminute in Europe as well as its affiliate operations are excluded from the deal, although one must wonder what's next.

Why No Sale?

As Sabre's OTA continued to slip, an acquisition of Travelocity – and, for that matter, Orbitz – became fodder for plenty of speculation. The obvious acquirer would be Expedia, but the question is, why buy? Too reliant on low-margin air and the low-growth domestic market, the number two and three OTAs in the U.S. have long been in catch-up mode. Public markets reward margin and growth, and Travelocity would have added neither to Expedia's quarterly filings.

So why buy them when you can beat them?

Sabre was under pressure to do something. Signs of financial challenges surfaced in 1Q12, and the deal no doubt eases some stress on the Sabre balance sheet, improving its prospects for an IPO reportedly in the works. Still, this move is not without irony, given that the core business of Travelocity's parent is, in fact, travel transactions and technology.

A Mature Market's New Rules

As Travelocity struggled to keep up amid a quickly changing market, this deal marks not just a symbolic milestone for the U.S. online travel landscape, but also signals three key dynamics shaping the market today:

- The market is mature, and nobody cares: Yes, the U.S. online market is the largest in the world – OTA domestic gross bookings reached $44 billion in 2012 – and highly penetrated among leisure travelers. But it continues to change as rapidly as ever. Priceline's big buy into metasearch, TripAdvisor's major meta launch, suppliers' relentless quest for direct business and – most importantly – the rapid ascent of mobile and the small screen provide clear reminders of how quickly things can change, and grow. (Yes, there's still lots of online growth ahead, even in the U.S.)

- The battle is moving up the funnel: Transactions are commodity. Bells and whistles, beautiful design and rich content are simply the price of entry. The real battle for today's leisure traveler – who is largely OTA agnostic but content-led and price-focused – is around inspiration and intent. That means marketing, media, meta and mobile take center stage. TripAdvisor's stock price has soared more than 150% since its spinoff in 2011, and the traveler review-cum-meta site is now significantly largely than one-time parent Expedia in terms of market capitalization. Transactions are so 2004.

- No one is safe: Booking has shot past Hotels.com in U.S. site traffic this year, according to both Hitwise Experian and Compete; TripAdvisor's foray into meta is upending a big chunk of OTA referral volume; Trivago is pushing hard into the U.S.; and CheapOair has made impressive gains as well. And let's not leave out a certain general search engine that continues to build its Flight Search, HotelFinder, and much, much more.

This doesn't solve Expedia's biggest worry, which can be summed up in one word: Booking. Expedia will get a nice lift in volume through the deal and even more leverage with suppliers, while Travelocity will bear the cost of marketing. But that is hardly a defense for Booking's dominance in Europe and relentless march into North America. (And Priceline.com, the U.S. branded site, has hardly been sitting idle either.)

Only the Gnome Knows

Some will say this deal means the end of the line for Travelocity, but the folks in Southlake insist there's still some fight left in them, and that they plan to bring it. The move could free up the group to focus on marketing and demand, but Travelocity has its work cut out for it. It will take a lot more than a well-known gnome to compete with the rapidly expanding online marketing spend of Priceline and Expedia (at $1.3 billion and $870 million last year by one estimate).

Once leader, then laggard, now a longshot, the odds are not in its favor. Although at one point Priceline had its own troubles, and was a longshot by any standard. Whether another heyday may yet be in Travelocity's future, however, only the Roaming Gnome knows.