5 things to know about the U.K. travel market in 2024 and beyond

- Published:

- April 2024

- Analyst:

- Phocuswright Research

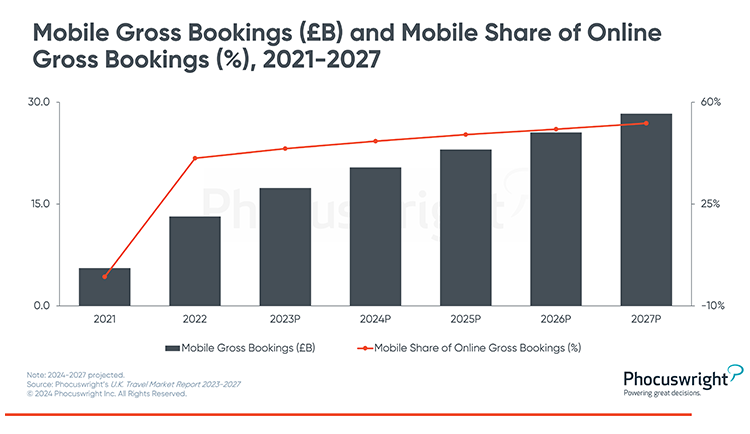

In 2023, the U.K. travel market experienced significant growth, with gross bookings increasing 19%, driven by robust expansion in online bookings, mobile transactions, and key sectors like airlines and car rentals. According to Phocuswright’s research report U.K. Travel Market Report 2023-2027, online bookings continued their surge, highlighting the further shift towards digital platforms and the U.K.’s high online penetration rate.

The airline segment performed particularly well, contributing significantly to the market's overall performance. Though challenges like inflation continue to impact market health, the industry is still on a positive trajectory, with moderate projected growth and technological advancements shaping the future of travel in the U.K. through 2027.

Here are 5 things to know about the U.K. travel market in 2024 and beyond:

- Another year of double-digit bookings growth is expected in 2024, with mobile booking revenue playing a significant role in the U.K.'s online travel market.

- The U.K.'s airline segment accounted for an impressive 56% share of all supplier gross bookings in 2023, as airlines are expected to maintain their dominant position through 2027.

- Net Zero begins with Jet Zero: The Net Zero Strategy outlines the measures needed to enable the U.K. to reach its goal of net zero carbon emissions by 2050. A key pillar of the strategy is for the U.K. to become a global leader in the development, production and use of sustainable aviation fuels.

- The U.K. government has ambitious plans for rail modernization, including both line electrification and the digitization of ticket sales. The railways also play a critical role in the government's Net Zero initiative to eliminate carbon emissions by 2050.

- The U.K.'s traditional travel agents are proving to be resilient, and many brick-and-mortar agencies are reopening their doors and putting pandemic-related losses to digital distribution behind them.

This report provides a comprehensive view of the U.K. travel market, including detailed market sizing and projections, distribution trends, analysis of major travel segments, key developments and more. Other reports in the Europe Travel Market Report 2023-2027 series (available now or publishing soon).

Research is our priority. Our Open Access research subscription puts the world’s most comprehensive library of travel research and data visualization at your fingertips.

Clients have relied on Phocuswright's deep industry knowledge for over 25 years to power great decisions, help justify a pitch, build a strategic plan and elevate any presentation through trusted research and data. When companies and executives reference Phocuswright, they gain the trust of an industry keen on data, trends and analytics.

See the full benefits of an Open Access subscription here.

Plus, we just redesigned Phocal Point, the powerful data visualization tool that now makes it easier to access and interpret Phocuswright data.

It's all about the data. With an updated navigation interface, new dynamic filtering, additional segment and channel breakouts in select markets and rich detailed views of 35+ markets, Phocal Point allows you to create custom interactive charts and view travel data by segment, channel, device, region and country. Our proprietary travel industry market sizing data allows you to look to the future with projections through 2026, and review historical data as far back as 2009.