Looking ahead to a sustainable, peer-to-peer car rental segment

- Published:

- April 2022

- Analyst:

- Phocuswright Research

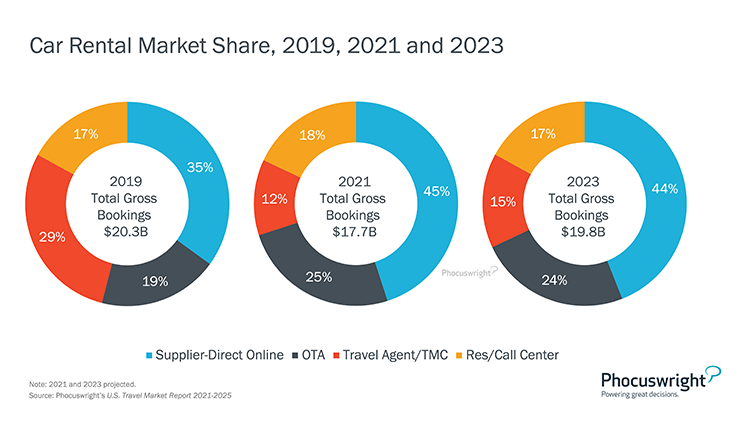

With the echo of the 2020 downturn still lingering, eyes were on 2021 as the year that would kickstart the pandemic recovery for the car rental sector. Following a 37% drop in 2020, the industry recaptured momentum in 2021, regaining 37% year over year. A more tempered period of growth is projected in 2022, with gains flattened by ongoing barriers to fleet growth and delays in vehicle manufacturing.

(Click image to view a larger version.)

Looking ahead

There has been increased conversation on the future of sustainable tourism across the travel industry, and within car rental, the future of sustainable fleets. According to Phocuswright’s latest travel research U.S. Car Rental Market Report 2021-2025, some key steps were taken toward incorporating greener options. In 3Q21, Hertz announced that it ordered 100,000 Teslas, aiming to make the electric vehicles (EVs) a sizeable portion of the global fleet, though it is estimated that around half of the vehicles will be supplied to Uber drivers. The partnership has major implications for the future of mobility as a whole, as detailed by Auto Rental News.

Avis and Enterprise have both expressed intention to grow within their EV strategies, though they remain in more preliminary phases of their plans. Enterprise has rolled out a selection of EVs in test markets and is still collecting data on how they are being driven and charged by consumers. Limitations on charging stations and driving ranges remain greater issues with EVs, and infrastructural improvements will also be needed to stimulate more widespread adoption.

Conditions in 2021 proved optimal for Turo; following the strong performance in the calendar year, they filed for an IPO in January of 2022. While flagship rental companies struggled with replenishing and growing their fleets, Turo had a unique advantage in sourcing inventory from the consumer marketplace as a peer-to-peer rental platform. Sales soared during the calendar year, with the company reporting a 207% increase in revenue in Q1-Q3 2021 compared with 2020. (Note that losses also increased as operations scaled up.)

While untraditional, there is cause for optimism around the model. Turo has minimal equipment and overhead expenses compared with the legacy companies that own and manage their fleets. Increasing their fleet availability requires recruiting car owners in place of making direct vehicle purchases. They remain small compared with other major players, but the low overhead could provide a foundation for more financially healthy operations than their legacy competitors. That said, fleet management is a complicated endeavor; in the not-too-distant future, the legacy rental companies will be well positioned to manage the coming fleets of autonomous and electric vehicles as charging infrastructure expands and these vehicles become more common as rentals. They may also be primed to manage even larger fleets down the line, expanding outside car rental and ride hailing as the line between vehicle ownership and renting/sharing blurs (as speculated in 2018).

The car rental market will see changes in bookings as international travel continues its comeback. There may be an influx of international visitors to U.S. destinations, thereby increasing business. Or U.S. travelers could opt to travel internationally in times of higher confidence, potentially decreasing business. Regardless, the market is expected to experience net positive momentum in the coming years.

With online bookings are recuperating at a faster pace than offline, it’s important for travel companies to know what’s motivating this segment. Consumers are eager to travel, and car rentals remain a more private and COVID-safe form of transit, both between and within destinations, compared to mass transportation. This informs the larger industry of consumer trends and behaviors that all travel companies should want to understand. And it all starts with this report.

How does inventory shortages threaten to hinder growth as demand resurges? Due to manufacturing backups, major car rental companies struggled to expand fleets proportionally to demand in 2021, but what’s the outlook for 2022 and beyond? This new research report provides a comprehensive view of the U.S. car rental segment, including detailed market sizing and projections, distribution trends, key developments and more.

To expand your knowledge of this market, enterprise access for your entire company is available through Phocuswright’s Open Access research subscription. Our dedicated customer concierge can answer any questions you may have about the subscription and show you how the data visualization and report insights can benefit your entire company.