Key developments in China’s online travel market

- Published:

- July 2022

- Analyst:

- Phocuswright Research

China is Asia's largest and the world's second-largest travel market.

Its high-spending tourists make it a coveted market for destinations worldwide, while the domestic market continues to expand and diversify across this continental-sized nation.

Since the emergence of COVID-19 in Wuhan in January 2020, China's "dynamic COVID-Zero" policy has shut down inbound and outbound travel.

The travel industry focus shifted to a vibrant domestic sector, but frequent city lockdowns diluted travel activity in 2020 and 2021. These control measures intensified in the first half of 2022, including a two-month shutdown of Shanghai and tight restrictions in Beijing.

According to Phocuswright’s latest travel research report China Travel Market Report 2021-2025, a reduction of the mandatory on-arrival quarantine period from 14 days to seven (plus three days of self-isolation at home) announced in late June 2022 sparked a surge of online travel searches. More international flights are expected to take off and land in the second half of 2022, with destinations worldwide eager to greet the return of Chinese visitors.

But COVID abruptly halted more than a decade of sustained expansion of the China travel market. The sale of outbound tours by travel agents was prohibited by the government in January 2020 and the block is still in place.

Independent overseas travel is officially discouraged with few, infrequent and costly international flights remaining open and a mandated state quarantine on return to China. In May 2022, the government advised against all overseas travel. And entering China as a foreign visitor remains difficult without a residence or work visa.

With international travel off limits, travelers and travel suppliers turned inwards. Domestic trips to discover China became the only available option.

Chinese travelers took 2.8 billion domestic trips in 2020, down 52% from 2019. A partial rebound in 2021 resulted in approximately 3.3 billon trips, but this was still a 46% shortfall from 2019.

Consequently, total gross bookings slumped from $173.5 billion in 2019 to $117.1 billion in 2020. Marginal growth of gross bookings in 2022, to reach $136.5 billion, will rely on a strong surge of domestic travel activity in the second half of the year.

Additional notable developments uncovered by the research include:

- China's "dynamic Zero COVID" policy clouds the timeline for rebuilding international travel. Should outbound travel pick up in 2023, gross bookings of $182 billion in 2024 would surpass the 2019 level.

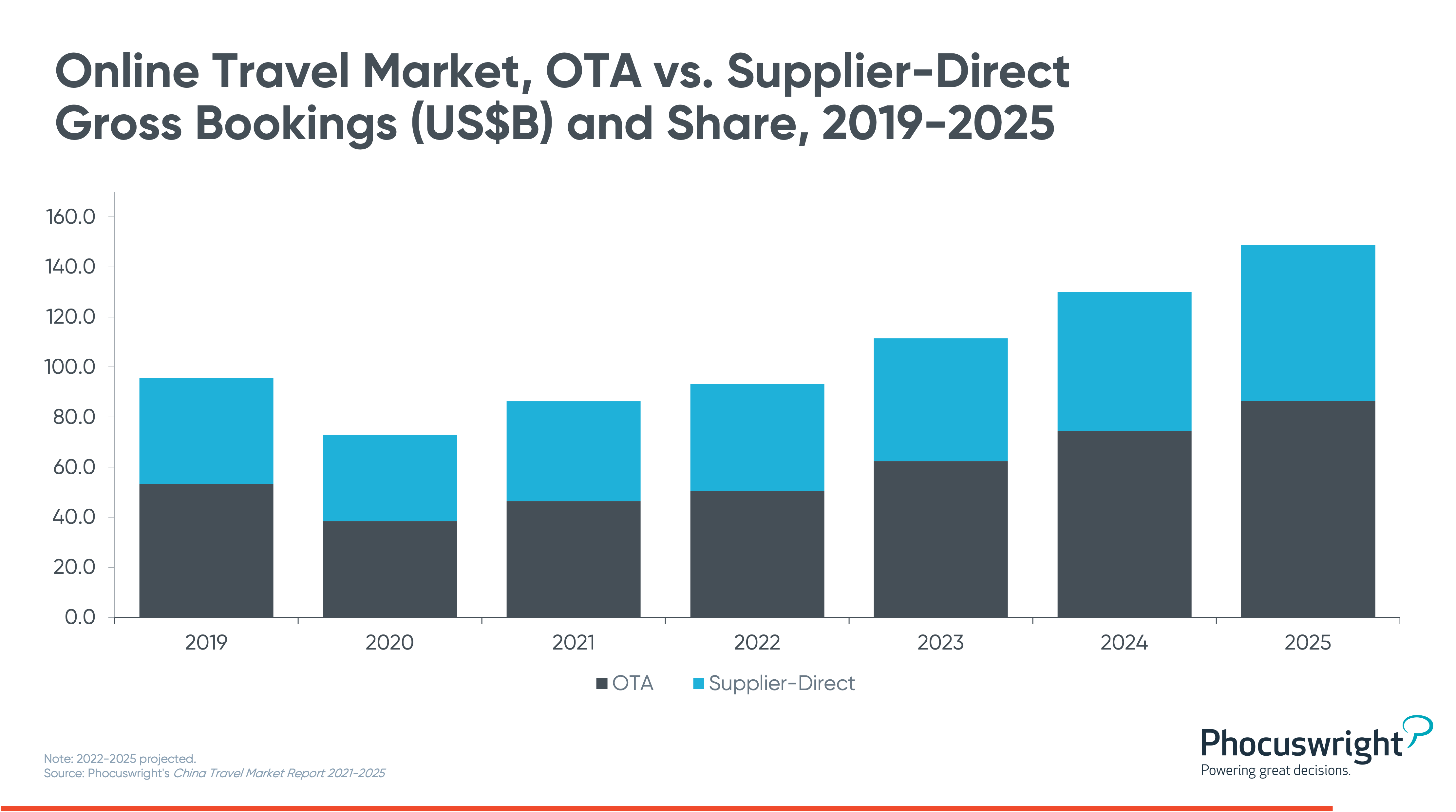

- China is a mobile-first nation and digital commerce is habitual across demographics. Online bookings will drive the travel recovery, rising from 66% of total revenue in 2021 to 73% in 2025.

- The mobile share of online gross bookings is forecast to climb to 88% in 2025, up from 80% in 2019.

- As 5G accessibility broadens and new cutting-edge smartphone technologies are launched, online travel agency mobile bookings will accelerate to reach a forecast $76 billion in 2025.

This full report provides a comprehensive view of the China travel market, including detailed market sizing and projections, distribution trends, analysis of major travel segments, key developments and more.

For further intelligence for you and your entire company, subscribe to Phocuswright Open Access. This subscription puts the entire Phocuswright research library and powerful data visualization tools at your fingertips. There’s a reason executives around the world trust and reference Phocuswright research and data on a daily basis. Explore for yourself why.