By 2023, hotel supplier-direct will again surpass OTAs

- Published:

- March 2022

- Analyst:

- Phocuswright Research

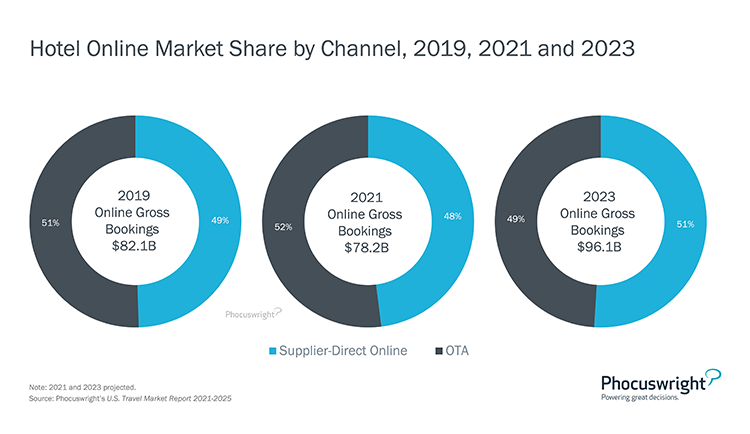

OTAs experienced a rebirth in the leisure market in 2021. According to Phocuswright’s latest travel research report U.S. Hotel & Lodging Market Report 2021-2025, OTA hotel gross bookings rose 97% from 2020 to nearly $41 billion, almost reaching 2019 levels. The scales tipped in their favor, and OTAs represented more than half (52%) of hotel online leisure sales in 2021 (see figure below).

Meanwhile, the supplier-direct online channel capitalized on hotels' "book direct" campaigns, loyalty members' increasing app use for convenience and deals, as well as traveler preference for direct contact with hotels. The channel remained strong, rising 80% in 2021, and is expected to see more strong gains in 2022. By 2023, the online direct channel will once again surpass OTAs, representing a little more than half of total online leisure sales.

(Click image to view a larger version.)

Note: U.S. hotel & lodging figures include 100% of Booking.com's domestic gross bookings, including hotels/motels as well as home/apartment rentals sold through Booking.com. However, the U.S. hotel & lodging figures do not include Expedia's Vrbo, Airbnb or other pure-play short-term rental providers, unless otherwise noted.

Other significant channel shifts have taken place since the onset of the pandemic. This Phocuswright report helps companies understand why OTA total hotel share rose from 2019 to 2021 as other channels faltered. The research also helps decision makers in lodging communicate strategically with guests through marketing and loyalty campaigns, which channels to improve and how pent-up travel demand is impacting the rebound of business travel.

For more insights that will help drive your companies strategy, download the full report or subscribe to Phocuswright Open Acess. The benefits of having first-to-market research and intelligence show up in pitches, keynotes, sales meetings, deals, investments and more. Discover the benefits here.