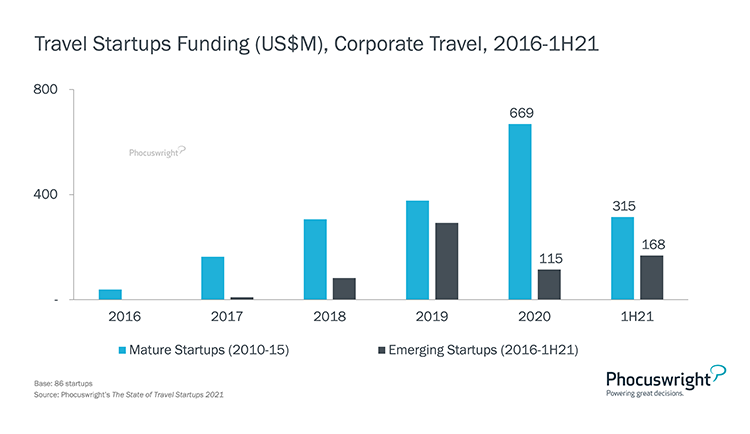

Business travel decimated, yet funding to startups explodes

- Published:

- January 2022

- Analyst:

- Phocuswright Research

The longer-term impact of the pandemic on the future of work has the potential to permanently rewrite the rules for corporate travel – and for the way startups in this space raise capital and operate.

The overview:

- Business travel hit record lows during 2020 and its return will be slow. Total U.S. managed corporate travel bookings plummeted 71% from $133 billion in 2019 to $39 billion in 2020.

- Gross bookings will rise to $121 billion by 2024 (91% of the market's 2019 value).

- Companies worldwide are enacting remote working policies, altering the business travel landscape and evolving their approach to tracking and monitoring business travel needs and spend.

- Business travel startups will have to reposition themselves to cater to reduced corporate interest in travel and spend, while broadening duty of care to consider COVID-19 precautions, quarantine norms, testing and vaccination policies.

- U.S.-based TripActions is the most-funded corporate travel startup founded in the last decade and second most-funded overall, behind OYO. Even at the peak of the pandemic, and despite the slow market recovery, it has raised hundreds of millions of dollars to pursue product enhancements, fin-tech advancements and acquisitions, taking its total funding to $1.3 billion.

- Note: TripActions raised a $275 million Series F round in October 2021, bringing it’s true total funding to over $1.5 billion.

- Expense management solution Divvy and corporate travel management firm TravelPerk are other prominently funded startups in the category.

- Upside ceased operations in August 2021 due to the unprecedented impact of COVID-19 on business travel.

- Analysis by year, type, region and category

- Funding activity by stage

- Market trends driving investment

- Focus on key verticals

(Click image to view a larger version.)

Notable highlights and top-funded startups in corporate travel:

Phocuswright has tracked the digital travel startup landscape for well over a decade, and innovation in the travel industry has flourished during this period. Though the COVID-19 pandemic has had a severe impact on travel startup activity and funding, a rebound is underway, with some companies and categories demonstrating considerable resilience. Leveraging Phocuswright’s proprietary interactive database and in-depth interviews, this updated report provides a comprehensive assessment and outlook for travel startups in today’s challenging environment.

Specific topics include:

To explore the data behind this analysis, please check out The State of Travel Startups Interactive Database – available for Open Access subscribers.

Subscribe to Phocuswright Open Access and download this report and the entire Phocuswright research library for you and your company. The subscription also gives you access to Phocuswright’s data visualization tool, which lets you cut and slice global travel market and segment data as you choose. Subscribe here.

Interested in more insights about the current state of the corporate travel market? Join the Phocuswright Think Tank on the (R)Evolution of Corporate Travel

Thursday, February 10, 2022

Covid-19 decimated business travel, but the longer-term impact of the pandemic on the future of work has the potential to permanently rewrite the rules for corporate travel. Join us to discuss what the future of business travel looks like and hear from the leading tech players on how they are planning to win in this transformed market.

Learn more & register »