Two key developments in Japan's travel market

- Published:

- June 2021

- Analyst:

- Phocuswright Research

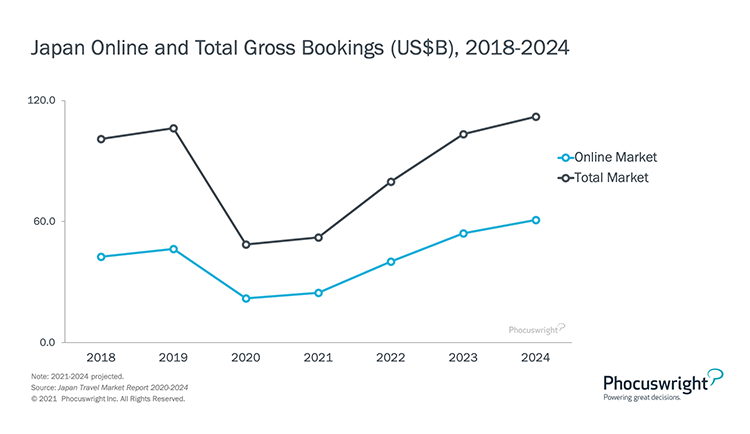

Consumer confidence, international border reopening and vaccination timelines will determine the progress of travel market recovery in Japan. In the best-case scenario, effective vaccines would be widely distributed by the end of 2Q21, leading to a rapid decline in cases and a boost in domestic trips. Still, international leisure travel will not return in the near term, as evidenced by Japan's ban on overseas spectators for the delayed Olympic and Paralympic Games that will be held in Tokyo in the summer. Under the most optimistic scenario, the travel market could cross pre-pandemic levels in 2023, with total travel gross bookings amounting to $119.5 billion in 2024.

(Click image to view a larger version.)

Two key developments

- Airlines move back to basics (domestic)

The significance of domestic operations for Japan's airlines has increased exponentially over the past year. Though Japan's major airlines are conducting trials with various health credential apps to support quick recovery of cross-border travel, scaling up international operations to pre-pandemic levels will require much more effort, political will and better control over the pandemic globally. Meanwhile, airlines anticipate that domestic operations will remain their core revenue driver in the short to medium-term. Japan's vaccination program will reduce the risk of further outbreaks and consequent travel restrictions. Strong domestic recovery will provide a cushion as airlines find their way out of the crisis. - Dynamic packages take center stage

Dynamic packaging (DP) is not a new concept in Japan. The pandemic has accelerated offline travel agencies' move to online and the creation of dynamic packaging products. JTB, Japan's biggest travel agency, launched its domestic dynamic packaging product "MySTYLE" in May 2020. The agency plans to increase the current DP share of total sales to approximately 80% in 2021. H.I.S., JTB's closest competitor, continues to expand the range of its domestic dynamic packaging products by offering "rail + accommodation" packages. In a drastic shift of corporate strategy, KNT-CT shifted its individual leisure travel business entirely on its online platform and began selling domestic DPs in October 2020, with a similar product for overseas travel to follow. As travel bookings shift from masses to individuals and online bookings grow, dynamic packages will experience immense growth and have the potential to become central to most travel sellers' distribution strategies.

Japan Travel Market Report 2020-2024 provides an overview of the Japan travel market, including key developments, market characteristics, distribution trends and major players in each segment. For more detailed data and analysis, see the following related publication:

Japan Travel Market 2020-2024: By the Numbers

To download all of the reports in the Phocuswright research library, subscribe to Open Access. Your entire company gets access to research that powers great decisions.