The outlook for travel experiences

- Published:

- October 2022

- Analyst:

- Phocuswright Research

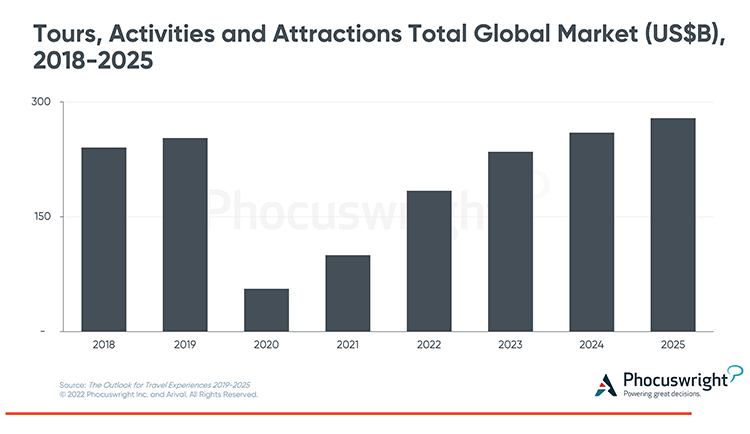

The in-destination industry, which comprises day tours, activities, attractions and related leisure experiences, has long been one of the largest and most important sectors in travel and tourism. According to Phocuswright’s latest joint travel research report with Arival, The Outlook for Travel Experiences 2019-2025, travel experiences represented $253 billion in global gross ticket revenue in 2019, making it the third-largest sector of tourism after transportation and accommodation. The sector grew 6% in 2019, significantly higher than the 3.5% increase in global tourism GDP.

Despite the heavy toll of the pandemic on operators worldwide, the tours, activities and attractions (TAA) sector has remained resilient and has shown strong signs of recovery in 2022. Fears of widespread business collapses have been allayed by governmental support across much of North America and Europe. The sector will reach 93% of 2019's global gross bookings by 2023 and surpass 2019 levels in 2024 when global gross bookings will reach $260 billion, assuming there are no further pandemic-related waves or other outside circumstances that substantially disrupt global travel.

(Click image to view a larger version.)

Tours, activities and attractions will also play a key role in travel's recovery and in creating economic opportunity. The vast majority of those nearly one million operators are small businesses. They are typically led by passionate entrepreneurs who are on the frontlines of tourism, connecting travelers with local communities and experiences. More than eight in 10 operators generate less than $200,000 in annual gross sales. Many are also relatively young companies: 45% started their businesses since 2015.

The recovery may be uneven, with regions seeing different sectors rebounding, but online booking is accelerating with operator websites, especially attractions, benefiting significantly from pandemic-related shifts in booking and shopping behavior.

The Outlook for Travel Experiences 2019-2025 provides updated market sizing and forecasting for the in-destination industry by region, category (i.e., tours, activities, attractions) and distribution channel (online vs. offline points of sale).

Investors, operators and distributors need insights, benchmarks and data to understand this industry and where it is headed. The Outlook for Travel Experiences 2019–2025 is part of a joint research project with Phocuswright's and Arival that provides updated market sizing and forecasting for the in-destination industry by region, category (i.e., tours, activities, attractions) and distribution channel (online vs. offline points of sale).

For more deep insights into the travel markets covered by Phocuswright, subscribe your entire company to Open Access. This subscription puts the entire Phocuswright research library and powerful data visualization tools at your fingertips. There’s a reason executives around the world trust and reference Phocuswright research and data on a daily basis. Explore for yourself why.