Online bookings dropping 66% to €4.5 billion in Spain

- Published:

- February 2021

- Analyst:

- Phocuswright Research

The Spanish travel industry in 2019 served 84 million international tourists, with at least as many visitors anticipated in 2020 according to Phocuswright's latest travel research Spain Travel Market Report. Instead, during the period of mobility restrictions, the industry suffered an unprecedented stoppage. The only scheduled flights were for repatriation and cargo. The only open hotels were those used to house healthcare professionals from other regions and those serving as makeshift hospitals in cities including Madrid, Barcelona and Valencia.

To artificially maintain the economy, the Spanish central government offered companies low-interest loans with long payback periods and enacted the Record of Temporary Employment Regulation (ERTE) furlough plan. Under the ERTE, travel companies were able to temporarily lay off workers, who would continue to receive up to 70% of their salary paid by the government. Eight in 10 tourism companies, concentrated in beach holiday and urban destinations, benefited from ERTEs, saving many from bankruptcy. As the pandemic has evolved, the government has extended aid measures and target dates for broadly reopening the tourism sector.

At the beginning of the summer, high season for the Iberian Peninsula, a jump in travel bookings suggested a speedy, V-shaped recovery. However, ongoing outbreaks and restrictions in parts of Europe and some regions of Spain prompted German and English tour operators to cancel operations for the season. With a two-week quarantine required for inbound travelers and entry bans in place for some countries, summer tourism was almost entirely domestic. Virus-wary travelers largely avoided popular destinations, air travel and large hotels, opting instead for smaller destinations within driving distance, private accommodation and alternative lodging options such as campgrounds.

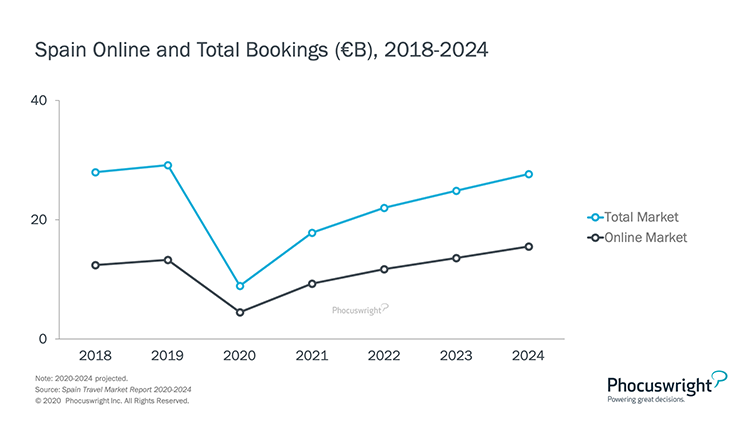

Spanish GDP fell a projected 12.4% in 2020 versus the previous year, with unemployment at nearly 17%. In 2021, GDP is expected to expand 5.4%, even as unemployment worsens slightly to 18%. The 2020 drop in GDP was the largest in the eurozone, due largely to Spain's heavy dependence on tourism. Total Spanish travel gross bookings in 2020 were projected to decline 70% to just €8.9 billion, with online bookings dropping 66% to €4.5 billion.

(Click image to view a larger version.)

For this edition of the Spain Travel Market Report, Phocuswright has defined three potential scenarios for travel market recovery.

Download the report to see the three potential scenarios, and an in-depth look into:

- The Travel Distribution Landscape

- Online Dynamics

- Segment Snapshot

- Online Travel Agencies and Other Intermediaries

- Key Developments

This report is available for purchase now. To get access to these reports and the Phocuswright research library for you and your entire company, consider subscribing to Phocuswright Open Access. Our Open Access research subscription puts the world’s most comprehensive library of travel research and data visualization at your fingertips.