How corporate travel will develop in the years to come

- Published:

- April 2021

- Analyst:

- Phocuswright Research

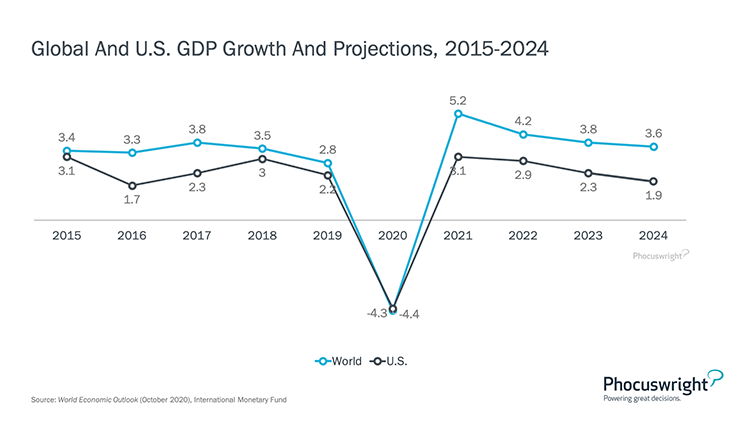

Economic activity plummeted in 2Q20, leading global and U.S. GDP for the full year to contract more than 4%. Now more than a year into the pandemic, with vaccinations underway, the world is looking ahead to recovery. In 2021, Global GDP is expected to expand 5.2%, as the U.S. economy grows 3.1%. Continued economic expansion is expected through 2024 as the recovery continues, with U.S. growth trailing the global average.

(Click image to view a larger version.)

The travel industry overall has experienced some recovery, driven largely by domestic leisure trips. The corporate travel market, however, saw deeper losses, and recovery is expected to be slower. According to Phocuswright’s latest travel research report U.S. Corporate Travel Report 2020-2024, managed corporate travel bookings declined $39 billion in 2020. The corporate recovery will begin slowly, with gross bookings growing just 10% in 2021. Growth will accelerate the following year, and the corporate market is expected to grow to $121 billion by 2024.

(Click image to view a larger version.)

Ongoing limits on large gatherings, duty of care concerns and employee discomfort with travel are among the many factors likely to delay a return to business as usual. Companies have been forced to find alternatives to in-person meetings and events, and many of these practices will continue in the near term. However, while some have asserted that the newly established habits of online meetings and virtual events will permanently shrink the corporate travel market, this threat is overstated. Travel is a cornerstone of global business, and will remain so.

As the recovery continues, a range of factors will impact managed travel, including the pace of vaccination, overall economic growth (GDP), business confidence, geopolitics and global trade dynamics. While the resumption of travel is top of mind, longstanding strategic priorities remain, and technology and platform trends continue to evolve. In fact, with cost control remaining a top priority for travel managers, adoption of supporting technologies is likely to accelerate.

Phocuswright's U.S. Corporate Travel 2020-2024 assesses the current state of the U.S. corporate travel market and anticipates how managed corporate travel will develop in the years to come. Based on a combination of executive interviews, a survey of travel managers and a comprehensive market sizing exercise, this Phocuswright travel research report explores the state of the U.S. corporate travel market, including sizing and projections through 2024.

To give access of this report to your entire company, subscribe to Open Access. Plus, everyone in your organization will have access to the entire Phocuswright research library and data visualization tools.