5 APAC market developments to know

- Published:

- September 2021

- Analyst:

- Phocuswright Research

The COVID-19 pandemic ravaged economies and the travel industry in APAC, especially in countries with a higher dependency on tourism. As governments tried to protect their populations, they imposed severe restrictions on national and international mobility dealing a massive blow to the travel and hospitality industry. According to Phocuswright's latest travel research report Asia Pacific Travel Market Report 2020-2024, in 2020, total travel gross bookings were projected to slide 58% to US$184 billion, from $444 billion a year earlier. The percentage drop was the smallest among all regional travel markets, mainly because China - the biggest travel market in APAC - controlled the virus earlier and better than most other countries globally. The road to recovery is long and varies by market, especially as the more contagious Delta variant of the virus wreaks havoc across the region in 2021, hampering travel recovery. The market is still expected to reach its 2019 size by 2024.

These are 5 key developments from the research that travel companies should keep their eye on:

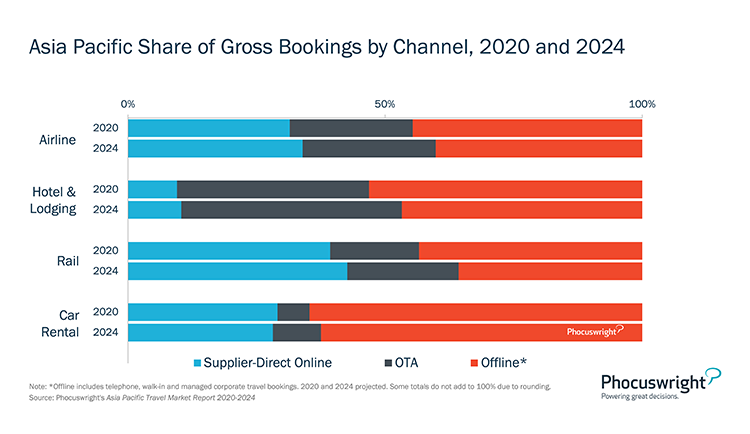

- OTAs emerge stronger: In 2020, OTAs increased their share of online bookings to be at par with suppliers. Strong brands, superior customer experience, increased suppliers' reliance on intermediaries, customers' inclination to use OTAs, and traditional agency business transition to online channels acted as a tailwind for OTAs growth.

- China pulls mobile penetration up: Regionally, almost six dollars will be spent on mobile for every 10 travel dollars spent online in that year.

- Domestic shines, international remains gloomy: Travel suppliers across countries have redesigned their product offerings to focus on local and domestic travel. Countries with an enormous domestic market like China, India and Australia have a natural advantage over others that have a higher dependency on inbound tourism like Singapore and Thailand.

- China sets an example: China's distinct experience may hold lessons for other travel markets globally.

- Vaccines are a cause for optimism: Phocuswright projects that the APAC travel market will nearly reach its 2019 size by 2024. Vaccines will play a vital role in this journey. Though the pace of vaccine rollouts varies by market, many countries in the region aim to vaccinate most of their population by the end of this year.

(Click image to view a larger version.)

For this report, 13 countries comprise the Asia Pacific travel market: Australia, China, India, Japan, New Zealand, Northeast Asia (including Hong Kong, Macau, South Korea and Taiwan) and Southeast Asia (including Indonesia, Malaysia, Singapore and Thailand). This report provides comprehensive market sizing and projections for the Asia Pacific travel industry from 2018-2024, including analysis of key segments, country-level share and trends, distribution dynamics and more. Download it here.

Also available in the Asia Pacific Travel Market Report 2020-2024 series:

- Australia-New Zealand Travel Market Report 2020-2024

- China Travel Market Report 2020-2024

- India Travel Market Report 2020-2024

- Japan Travel Market Report 2020-2024

If you become a Phocuswright Open Access subscriber, this report and the entire Phocuswright research library (and interactive data visualization tools) are available to you and your company. Clients have relied on Phocuswright's deep industry knowledge for over 25 years to power great decisions, help justify a pitch, build a strategic plan and elevate any presentation through trusted research and data. When companies and executives reference Phocuswright, they gain the trust of an industry keen on data, trends and analytics. Explore the Open Access benefits best suited to your company.