Airlines may lose $2.8B to fraud by 2020

- Published:

- March 2018

- Analyst:

- Michael Coletta

Fraud continues to be a major source of revenue loss for the global airline industry. In an environment where airlines are pushing for more direct bookings, and the use of mobile as a booking platform is accelerating, the incidence of fraud is rising. Yet many airlines are not tracking the required metrics or devoting the necessary resources to measure and control fraud, and the impact of fraud is projected to grow.

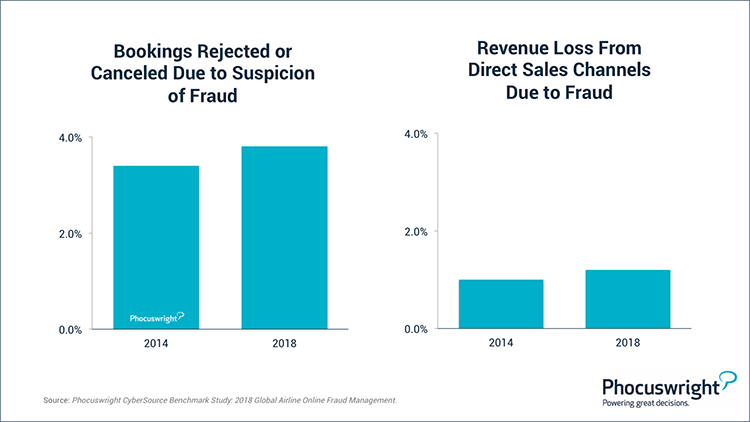

Phocuswright projects that global online direct bookings for airlines will rise from around US$180 billion in 2017 to $230 billion by 2020. Websites represent the largest sales channel globally for airlines, at 31% of all sales. Mobile websites and apps account for 7% but are growing rapidly. The effects of heightened responsibility for fraud management in direct sales channels is placing billions of dollars at stake. Airlines are currently rejecting or canceling almost 4% of bookings due to suspicion of fraud, and they are losing over a full percentage point of revenue in direct channels to fraud. With $280 billion flowing through airline direct sales channels by 2020, the revenue loss rate of 1.2% will translate into a direct impact of $2.8 billion in lost revenue if this trend is not reversed.

(Click image to view a larger version.)

The good news is that while the rates of revenue loss and rejected bookings are rising, the increase is only marginal; airlines are keeping them nearly in check. However, there is still much work to be done to bring these rates down.

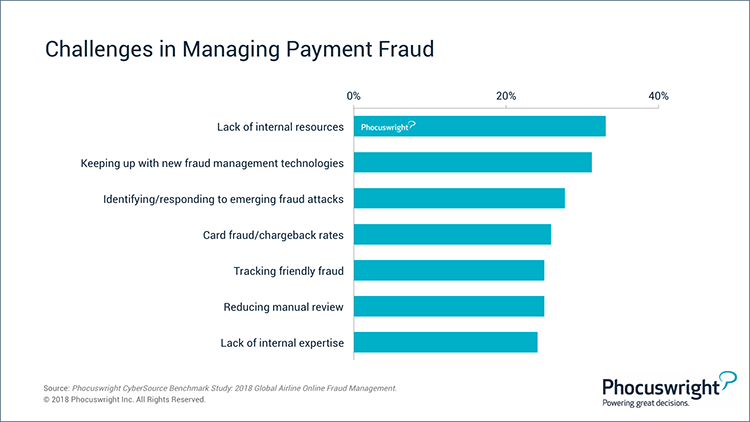

Airlines cite their top challenges as "lack of internal resources" and "keeping up with new fraud management technologies." Related challenges are "reducing manual review" and "lack of internal expertise." For most airlines, the total cost of managing fraud is just under half a percentage point of their total revenue. So while they are keeping fraud management costs constrained, they may not be spending enough on staffing and technology to attack these challenges and mitigate fraud.

(Click image to view a larger version.)

To reverse the trend and reduce the impact of payment fraud, airlines need to properly allocate internal resources and leverage new fraud management technologies and techniques, such as device pattern analysis, identity morphing models, biometric indicators, and other tools and approaches.

For more insights and to understand key trends and metrics in airline payment fraud, download the new (free) white paper, Benchmark Study: 2018 Global Airline Online Fraud Management.

TO LEARN MORE

- For the full analysis of the state of global airline fraud, read the Phocuswright + CyberSource white paper, Benchmark Study: 2018 Global Airline Online Fraud Management.

- Register for the free March 28 webinar – sponsored by CyberSource – Airlines, E-Commerce and the State of Fraud Management – LEARN MORE HERE.

- Gain company-wide access to Phocuswright's research library HERE.

- Need something else? Our team is here to help you! sales@phocuswright.com OR +1 860 350-4084 x501