How Mobile Is Changing Desktop Search-Shop-Buy

- Published:

- June 2015

- Analyst:

- Douglas Quinby

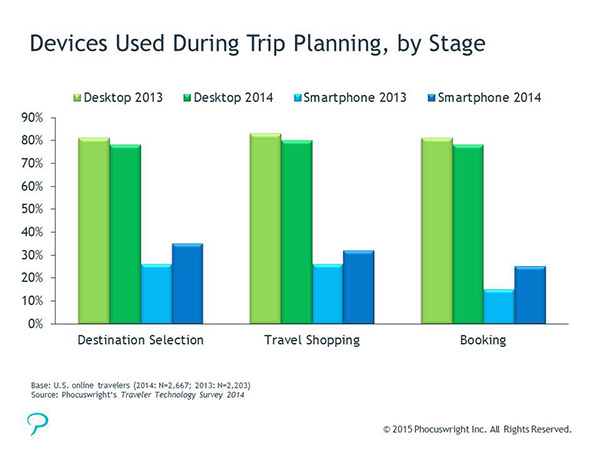

Most of the travel industry is fixated on mobile – with good reason – but the biggest single booking method is still desktop. Mobile – smartphones and tablets, apps and the mobile web – barely broke into double digits as a share of total online travel gross bookings in the U.S. in 2014. Just one in four online travelers booked any travel on their smartphone in 2014 (see Figure 1). By comparison, four in five travelers booked via desktop.

Figure 1 (click graphic to view full-size image)

Mobile bookings are growing rapidly – they will nearly double by 2016 as travelers become increasingly comfortable booking by touch, and travel companies deliver a better mobile experience. But when it comes to travel planning, mobile plays a much bigger role – more than a third of travelers use their smartphone for destination selection and shopping, and when these mobile travel planners do migrate to desktop for the final purchase (and most do), how they book is changing significantly.

So Phocuswright partnered with Millward Brown Digital (MBD – known formerly as Compete), to assess the state of online travel traffic amid an increasingly mobile landscape. We examined and organized traffic patterns and conversion across hundreds of online travel's biggest sites in the U.S. on a monthly basis for 2013 and 2014. Two big trends jumped out:

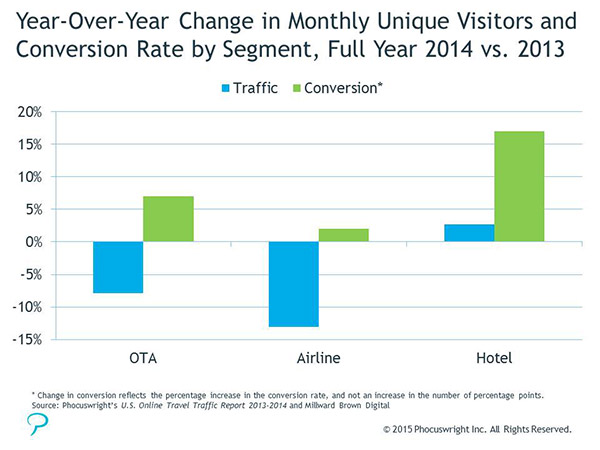

- For travel's biggest online categories, desktop traffic is flat or declining. For the full year 2014, monthly traffic (measured in monthly unique visitors, or MUVs) declined by an average of 8% for online travel agencies (OTAs) and 13% for airline websites. Traffic

was up only slightly for hotel sites (see Figure 2).

- Desktop conversion is up – way up. Average monthly conversion rates – the percentage of monthly unique visitors who book during that same month – rose 7% for OTAs, 2% for airlines, and surged 17% for hotels. (Just to be clear, a 10% increase in the rate of conversion in a month means that the conversion rate increases, for example, to 6.6% from 6%).

So what's going on? Three things:

- Mobile: As more travelers use mobile devices to plan trips, less shopping is taking place on desktops. When travelers do move to their desktops or laptops, they have likely already done research on their phones and are further down the purchasing funnel – they know where to go and what to book.

- OTA

Consolidation: Just a

handful of OTA brands dominate the U.S. market. While traffic to the overall OTA category declined significantly in 2014, visitor volume to top-tier OTA brands was basically steady or down slightly. It's the long tail of smaller OTAs that have suffered the most. Tier-two OTAs are finding it tougher to compete – and

consumers' shift to mobile only makes that harder for the small guys.

- Flight Management Moves to Mobile: Travelers are moving more of their flight management activity (check-in, flight status, loyalty account management, etc.) to mobile apps and away from desktop. Some 40% of mobile travelers checked in for a flight on their smartphone last year, versus 24% in 2013. Use of mobile boarding passes rose to 31% versus 18% over the same period.

As travelers do more via mobile, their travel planning and booking behavior is changing across all devices and channels. Phocuswright's U.S. Online Travel Traffic Report 2013 - 2014 provides a comprehensive analysis of online travel traffic trends in the U.S. This report sizes the U.S. online travel market by traffic (unique visitors) and examines key trends in conversion, clickstream (referral traffic) and site rankings.

Join us for a FREE webinar on Thursday, July 9, when I will present key findings from this study along with Ryan Williams, vice president, travel, at Millward Brown Digital. CLICK HERE to learn more about the webinar.