Unique online dynamics in China's travel market

- Published:

- April 2021

- Analyst:

- Phocuswright Research

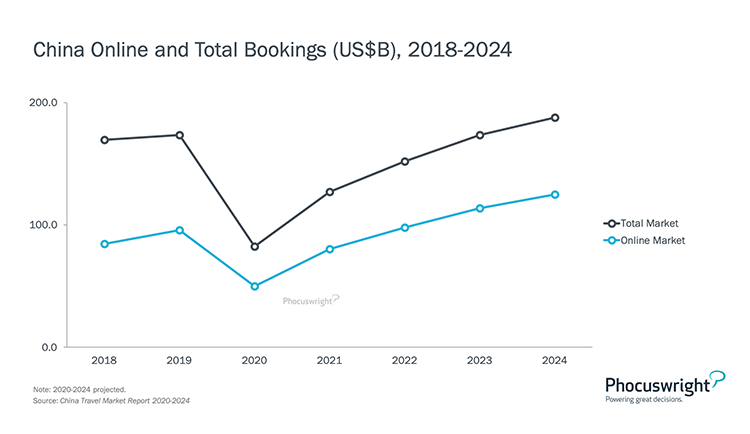

China's online distribution has matured faster than any travel market in the world. In 2015, just 30% of travel was sold online. In 2020, that figure reached 61%. Online bookings stood at $95.7 billion in 2019, and the online channel took a smaller hit from the pandemic compared to travel overall. According to Phocuswright's latest travel research report China Travel Market Report 2020-2024, suppliers and intermediaries place a heavy emphasis on mobile channels, and a robust and fast-moving landscape for social media and mobile commerce keep all players engaged with new marketing platforms and looking out for rising competition.

Mobile bookings - especially but not exclusively in the rail sector - have played such a big role that China's story is truly one of an offline-to-mobile leap. Online penetration is expected to continue to grow, but at a much slower rate than it did when China was still playing catch-up with mature online markets.

(Click image to view a larger version.)

China is unique among the world's travel markets in that Google plays almost no role in travel discovery and shopping. The search engine is blocked, and its local clone, Baidu, does not serve as an equivalent. Instead, social or commercial apps and, increasingly, apps that combine social and commercial with entertainment, are the gateways to the internet, including travel inspiration and booking. Ctrip aims to be the superapp of travel, offering a much wider variety of travel-related products than OTAs like Expedia and Booking.com. In addition to the air, hotel, car rental, and rail categories which Phocuswright includes in its travel market sizing, Ctrip sells products including airport pickup and attraction tickets. Its app also offers location-sensitive restaurant and shopping recommendations, and hosts video streaming for travel inspiration, deal promotion and in-destination content. Its biggest full-fledged OTA competitor - Alibaba-owned Fliggy - offers a similar interface but with less travel-specific content.

Considering OTAs' considerable advantages in customer acquisition, Chinese suppliers' 44% share of 2020 online travel bookings is impressive. Most of this comes from two segments: air and rail. OTAs dominate the hotel space. And intermediary share is expected to increase during the recovery, as suppliers use them to amplify their promotions.

China Travel Market Report 2020-2024 provides an overview of the China travel market, including key developments, market characteristics, distribution trends and major players in each segment. Download it here.

Also in this series: China Travel Market Report 2020-2024: By the Numbers

Related:

5 numbers to remember about the China travel market in 1 minute

5 charts in 3 minutes: APAC region

Looking for more insights? Subscribe to Open Access and unlock the entire Phocuswright research library for you and your company. See the benefits and more information here.