What’s next for the U.S. airline market?

- Published:

- March 2022

- Analyst:

- Phocuswright Research

The U.S. airline segment made a stunning recovery in 2021, despite dire concerns for its survival after a dreadful 2020 that saw traffic down by as much as 90%.

Airlines are on their way to a better 2022 and, according to projections in Phocuswright’s latest travel research report U.S. Airline Market Report 2021-2025, should surpass 2019 levels by 2023.

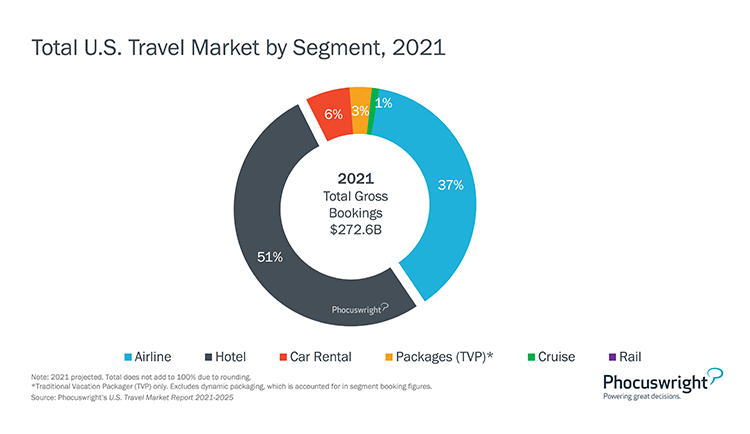

The segment gained back share after a pandemic slump in 2020, and now represents 37% of the U.S. travel market gross bookings, compared to 51% for hotels (see figure below).

(Click image to view a larger version.)

What’s next?

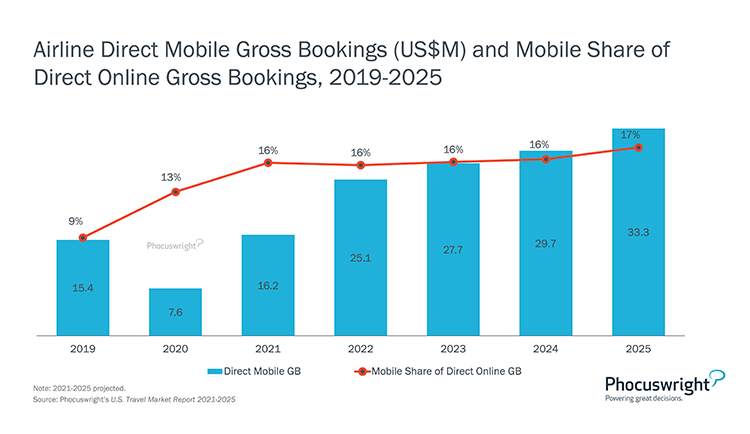

Airlines need to invest heavily in technology to appeal to the post-pandemic traveler. Aside from luring travelers with improved merchandising, they need to enhance self-service features on the mobile app to avoid stressing the call center as changes and cancellations mount. They must also learn to catch up to demand more quickly, including staffing crew on flights, and adding routes and capacity as needed if they are to remain profitable.

(Click image to view a larger version.)

Reaching sustainability goals and reducing CO2 emissions is also high on airlines' agendas. In March 2021, major U.S. airlines agreed to commit to net-zero carbon emissions from their operations by 2050. In November, United claimed to be the first airline to operate a flight powered by 100% drop-in sustainable aviation fuel (SAF).

Airlines have ambitious goals for 2022 and beyond, but they can't do it alone. Partnerships, such as the one formed by American, Alaska and JetBlue in 2020, can offer travelers more connected routes. Consolidation is also likely: In February 2022, Frontier and Spirit announced plans to merge to create the fifth largest U.S. airline. The battered airline industry should eventually pull itself together, but it will take a concerted effort from all airlines and industry players to make that happen.

There are key developments in revenue management, lingering confusion marring an international comeback and modern retailing that travel companies will need to understand to predict how the air market impacts their business.

In addition to the size of the market and distribution landscape, how airlines are performing, positioning themselves and innovating will arm your business future-proofing tools. Get the full report here to see how Phocuswright research powers great decisions.

Think you’d benefit from an Open Access subscription? See how the benefits of the entire Phocuswright research library can fill in the knowledge-gaps that your team requires.