What the world's biggest OTAs have been up to

- Published:

- May 2019

- Analyst:

- Phocuswright Research

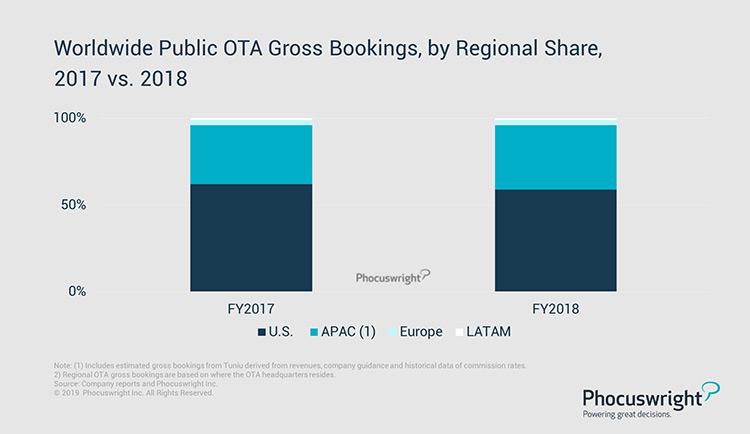

According to Phocuswright's latest Public Online Travel Roundup, Full Year 2018 travel research publication, growth rates in the world of public online travel once again slowed in 2018, but remained in double-digit territory, rising more than twice as fast as the total global travel market. Below are insights into regional focuses for the world's biggest OTAs.

U.S. OTAs: Expedia Group vs. Booking Holdings

The accommodation business for both Expedia and Booking remains a priority, yet each OTA's room nights grew at a more modest rate than either has been accustomed to in prior years. Both companies remain committed to an augmented lodging booking experience with the seamless interweaving of instantly bookable rental listings.

Asia Pacific OTAs

APAC-based OTAs represent more than one third of global gross bookings, fueled by the rise in China's biggest, Ctrip.

(Click image to view a larger version.)

Europe OTAs

European publicly traded OTAs' annual gross bookings increased in 2018. With the European OTA market increasingly feeling the pressure from Booking and Expedia, eDreams and lmgroup (renamed from Lastminute.com Group last year) together remained stagnant with a single-digit share of global gross bookings.

Latin America OTAs

For Buenos Aires-based Despgar, mobile distribution has been and will continue to be a top focus, accounting for a third of 2018 gross bookings. But offline channels remain an important distribution channel, as call center gross bookings are still increasing.

Metasearch and Media

Trivago spent the year recalibrating its ad spend to reduce net losses, significantly increasing marketing targets while cutting branding spend. A decrease in ad spend for the year meant declines in referral revenue and traffic, especially in the Americas where brand recognition is weaker than in Europe.

TripAdvisor has and will continue to prioritize product, supply and marketing investments in its experiences and restaurants businesses especially. On the experiences side, TripAdvisor has been enthusiastically building its bottom-of-funnel play.

Booking integrated the OpenTable team into KAYAK, but the two brands remain individual units of Booking Holdings. In search of synergies between the two brands, OpenTable points can now be used for hotel discounts on KAYAK. The company continued the integration of Momondo and completed its HotelsCombined acquisition in December. Both report into KAYAK.

This report is available for subscribers of Open Access only. To unlock access for your entire company, subscribe here.

.png)

.jpg)