Research Insights

Kayak Finally Gets Street Cred

Kayak Finally Gets Street Cred

- Published:

- July 2012

- Analyst:

- Carroll Rheem

With the ring of a bell, Kayak's co-founders silenced the relentless murmur of naysayers and cynics who said its IPO would never happen. The iconic sound opened NASDAQ trading on July 20, 2012, marking the debut of ticker symbol KYAK – a hard-won finale to a story that started nearly two years before. Investors have welcomed KYAK rather warmly thus far – after an initial pop, the first week of trading is up roughly 20% from the initial price of US$26. Whichever side of the fence you stood on for its IPO odds, there is much to admire about what Kayak's team has accomplished – it independently built a household name brand from scratch, hooked millions of users on a new website genre, and elbowed into a fiercely-competitive, mature industry that wasn't eager to make room for it.

From its beginnings, Kayak has had controversy as a constant companion. Suppliers and online travel agencies (OTAs) have always been somewhat begrudging customers of metasearch referrals. Commoditization is a universally dreaded word – one that many associate with being listed among several booking links in a metasearch display. While the online travel ecosystem ultimately lives off of transactions, the balance of power tilts toward those with the ability to influence travelers' decisions, and no one wants to lose their grip. Nevertheless, suppliers prefer a metasearch referral to an OTA booking because it costs less (and they get the traveler info), and OTAs want to be where the travelers are.

Therefore, despite the ambivalence from metasearch's primary sources of revenue, the model managed to sprout and establish roots. In any case, it wasn't created because the industry was wishing for a new way to get referrals – it aims to address the constant consumer compulsion to shop around. Though it has taken longer (and required more advertising) than some imagined, the model and its leader Kayak have earned mainstream status by giving travelers what they are searching for. In 2011, one out of three (33%) online travel shoppers1 typically turned to metasearch in the process of deciding what to book for their vacations.

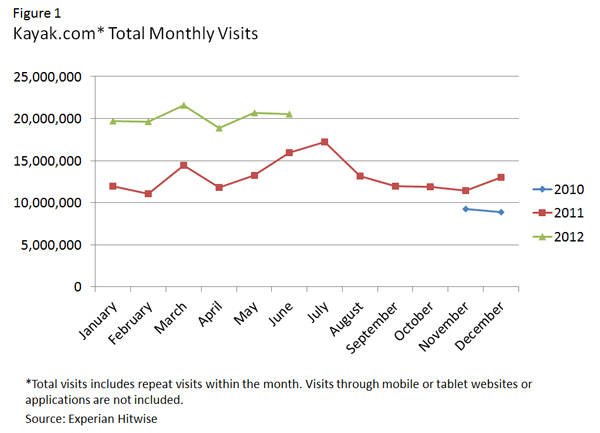

Kayak's journey to mainstream popularity was interesting enough, but its long road to an IPO had a few special twists and turns – namely, the unfortunate occurrence of having the world's largest search engine step into its sandbox. There was also the added insult of Google entering the space by acquiring ITA Software, the air shopping technology company Kayak relies on. Short of bad performance, it's hard to imagine anything else that could have soured investors' appetites more. Not surprisingly, Kayak's IPO momentum fizzled out soon after it started in 2010. But Kayak has since managed to turn its lemons into lemonade by driving solid revenue growth and powering through the launch of Google Flights (September 2011) without losing a bit of steam (see Figure 1). Advertising expenses have increased as well, but have stayed within a relatively consistent range as a portion of total revenue. So far, investors are drinking it up.

As daunting as the journey to an IPO was, the most challenging days for the Kayak team lie ahead. The idea of aggregating all major agencies and suppliers into a one stop shop is fantastic – meaning this conceptual vision of metasearch remains pure fantasy. There is perhaps no better snapshot of the travel industry's messy relationships and power plays than a search on Kayak. Major airlines have strong-armed OTA links out of metasearch flight displays while hotel branded sites (that lack the same clout) are easily lost in a clutter of OTAs. The experience across products is very inconsistent.

Inconsistency also surrounds Kayak's business models – it accepts bookings for hotels in a private label agreement with Travelocity, passes bookings through an API to Air Canada, and facilitates mobile bookings by collecting information and passing it to other sites to book. This mixing begs the question, can metasearch ultimately stand on its own or are players bound to end up in a hybrid meta/OTA scenario? Given the fundamental mission that all websites must champion – make it easy to use – the answer is no. Whether it is by collecting consumer information and passing it to booking sites or by acting as transactional OTAs, metasearch brands must facilitate booking or face eternity as a side dish. This has been the natural evolution for Kayak in the U.S. and will be even more important in other markets as unreliable connections and inconsistency push metasearch players to deliver a dependable, more seamless user experience.

Ultimately, though, the ability to scale for global operations will be what makes or breaks Kayak in the years to come. Geographic expansion is a must for fueling long-term growth, but the challenge of localizing for different consumer markets will be enormous, especially for a team that lacks multi-national experience. The fragmented industry landscape in other markets will be even messier than in the U.S. and will require good old-fashioned manpower to tackle, which is not in Kayak's techie DNA. Though the company already owns some international assets, none are heavyweights. Additionally, metasearch has already grown to a substantial size in many markets without Kayak – it won't be so easy to saunter in. Acquisitions will therefore be key to expansion – Kayak will need the infusion of local talent and organic growth will not move fast enough.

Many questions around the long-term prospects for Kayak and the metasearch model remain, but Kayak wouldn't be itself without at least a little controversy. Google metasearch hasn't gone away, and its true impact may take some time to surface. If Google doesn't manage to accomplish much, other players like TripAdvisor might decide to revisit current offerings and have a more serious go at it. Of course, many industry observers are curious to see how CEO Steve Hafner will adjust to sitting at the grown-ups' table. Whatever the next chapter holds, we're pleased to see him take his seat.

Hear from Kayak's co-founder and CEO, Steve Hafner, at The Phocuswright Conference (November 13 – 15, 2012 • Scottsdale/Phoenix, Arizona USA).

1Phocuswright's U.S. Consumer Travel Report Fourth Edition (May 2012)

.png)

.jpg)