COVID-19 Hotel Forecast: London

- Published:

- April 2020

- Analyst:

- Robert Cole

The global hospitality industry has been ravaged by COVID-19, a classic example of a black swan event. While many are looking backwards to compare the current market environment with the post-9/11 or 2008 Great Recession periods, Phocuswright prefers

to look forward - trying to address the tough questions weighing on our collective minds.

The global hospitality industry has been ravaged by COVID-19, a classic example of a black swan event. While many are looking backwards to compare the current market environment with the post-9/11 or 2008 Great Recession periods, Phocuswright prefers

to look forward - trying to address the tough questions weighing on our collective minds.

Over the coming months, by teaming up with the data science team at LodgIQ, Phocuswright will evaluate a broad swath of hotel-related and other data across a variety of key metropolitan areas. Our key objectives are to model the:

- Level of disruption

- Duration of disruption

- Shape of the recovery curve

The goal is to understand the similarities and differences in hotel market dynamics between destinations. This is especially relevant, as some markets may have yet to peak in terms of the level of infections, while others are seeing active coronavirus case counts decline.

Travel's multimodal nature and interdependency of origin and destination markets within different sectors adds necessary, but not always welcome complexity to the model. Therefore, this forecast is probabilistic, with a high degree of uncertainty. The spread of the virus is path-dependent, non-linear and impacted by measures such as local social distancing and broader geographic quarantines.

The forecasting model will be continually evaluated and refined as more data is collected, stronger signals identified, and new outcomes revealed. Understanding the impact of the virus and the path to recovery across major global markets will help the industry regain solid footing through more informed decision making. The simplest way to understand the impact of the virus is to observe the change to the forecast as the spread progresses.

On March 3, United Kingdom

Prime Minister Boris Johnson released a 28-page policy paper outlining the country's strategy to combat the coronavirus.

On March 3, United Kingdom

Prime Minister Boris Johnson released a 28-page policy paper outlining the country's strategy to combat the coronavirus.

Then, in a radical departure from the curve-flattening approach employed by major European countries, the U.K. embraced an early "herd immunity" strategy that involved the widespread infection of healthy individuals while protecting the more vulnerable within the population.

By mid-March, messaging from U.K. political leadership became even more contradictory. On March 12, Johnson announced that the country had failed in its initial "containment" phase of battling the pandemic, and was moving to its next "delay" phase. However, restaurants, theaters and schools would still remain open and strict social distancing guidelines were not prescribed.

England's chief medical officer, Professor Chris Whitty, expressed that worst-case scenario planning models for herd immunity predicted that 80% of the population would contract the virus, with a corresponding 1% mortality rate. The resulting math would produce half a million deaths.

On March 13, the U.K. government's chief science officer, Sir Patrick Vallance, projected the true total would be between 5,000 and 10,000 deaths, while reinforcing the need to keep British society open.

By March 23, following intense pressure from the general public, scientific and healthcare communities, the U.K. government invoked emergency powers to lock down large sectors of the country. Johnson himself became an ironic symbol for the severity of the virus, testing positive on March 27 and being hospitalized, and then requiring intensive care on April 6. He was released from the hospital and after recovering, returned to work on April 27.

At this writing, the U.K. has more than 150,000 cases and more than 20,000 deaths attributed to coronavirus - recently averaging approximately 5,000 new cases and 700 deaths per day.

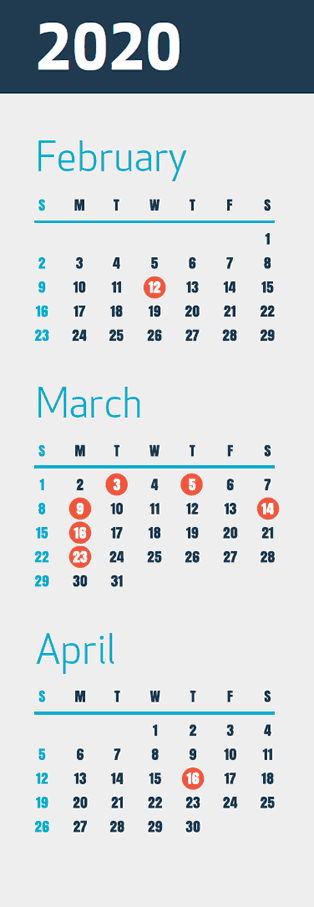

The timeline demonstrates an initial lack of seriousness, followed by reactionary measures:

- February 12 - First confirmed coronavirus case in London

- March 3 - U.K. Prime Minister Boris Johnson releases 28-page coronavirus action plan

- March 5 - London Mayor Sadiq Khan announces "There is no risk in using the Tube or buses or other forms of public transport or going to a concert."

- March 9 - First confirmed death in London attributed to coronavirus

- March 14 - U.K. government partially reverses "herd immunity" strategy by banning large gatherings

- March 16 - U.K. Prime Minister advises against "non-essential" travel

- March 23 - Strict limits on daily life are introduced

- April 16 - U.K. lockdown restrictions extended for "at least" three additional weeks

As identified in earlier destination analyses, it is the lockdown (not solely disease case growth) that negatively impacts hotel demand. Over the very short term, at the beginning of the spread, actions that were detrimental to the National Health Service

(NHS) and downplayed general public welfare actually benefited the financial prospects of the hoteliers through higher demand.

STR's preliminary summary of London's hotel performance for March 2020 indicated the city was not quite as severely impacted as New York or San Francisco - landing at 34.5% occupancy, a 57.8% drop year over year (YoY). Average daily rate (ADR) fell to £124.15 (only -10.4% YoY), with revenue per revenue per available room (RevPAR) falling 62.1% to £42.88.

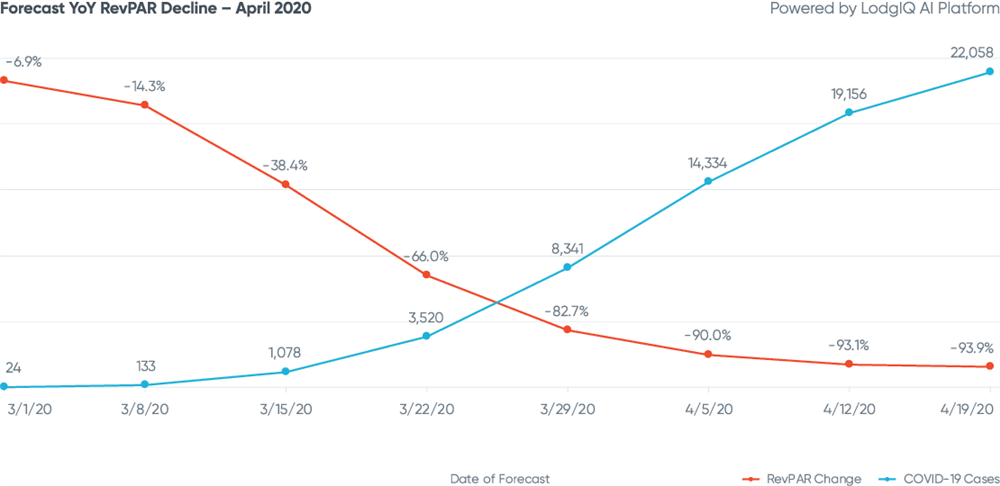

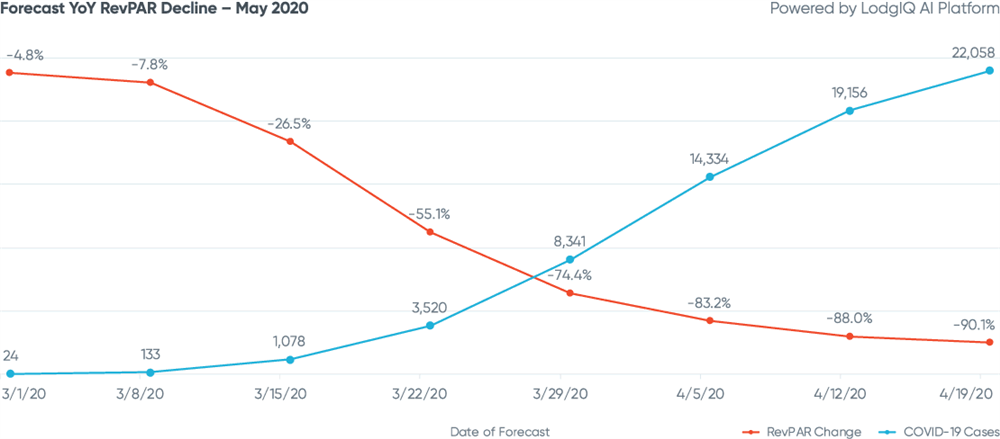

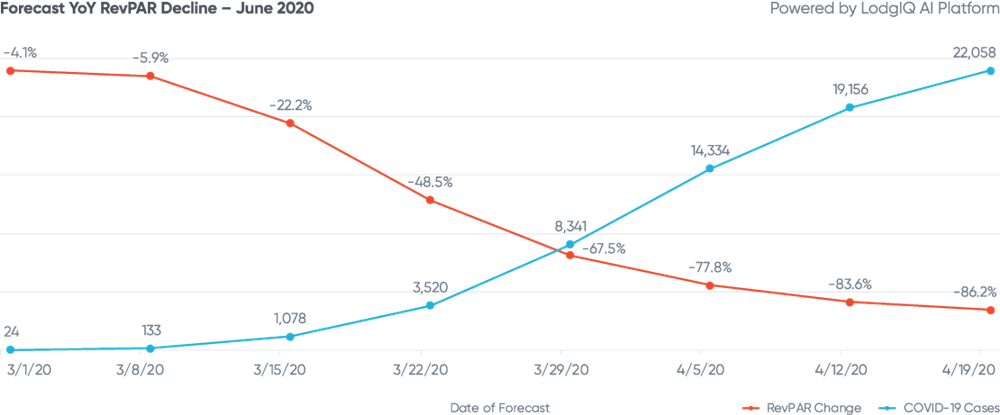

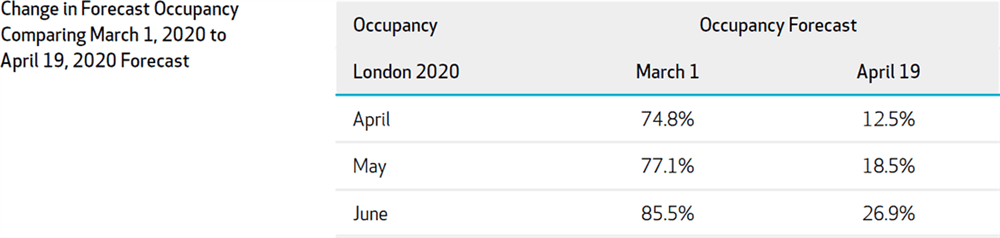

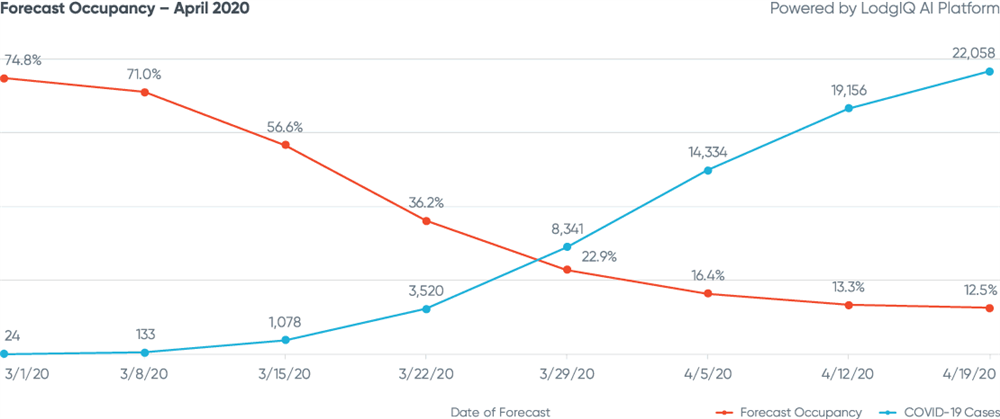

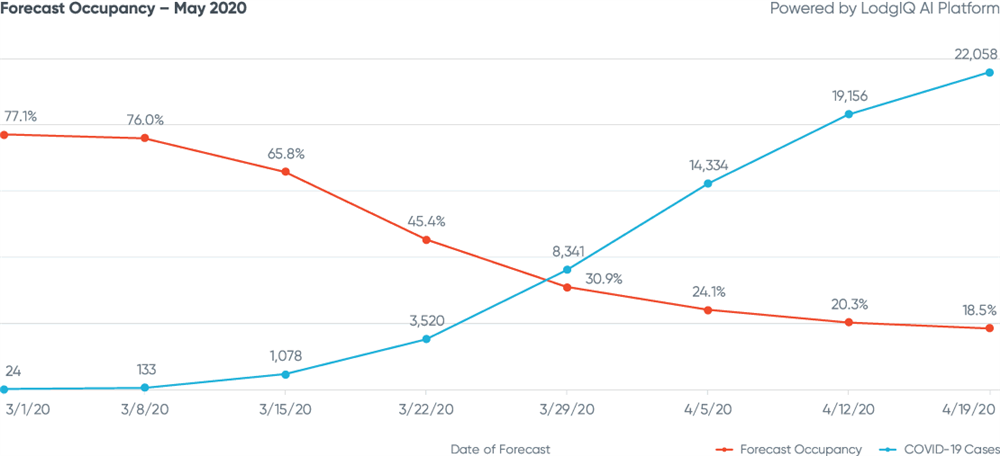

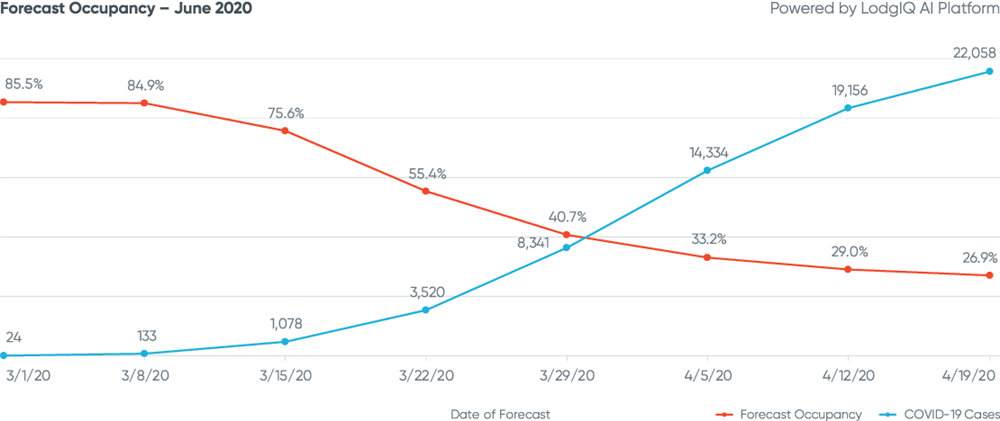

The now familiar "X" pattern reflecting the inverse correlation between confirmed virus cases and the weakening of hotel demand for London is consistent with our modeling for San Francisco, Singapore and New York City.

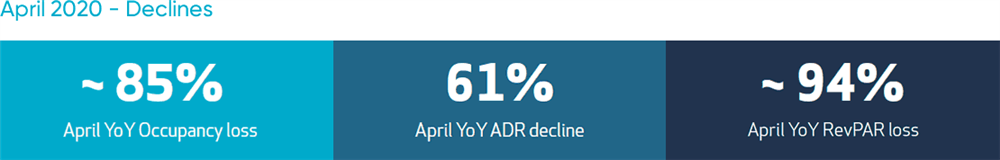

While London's outcomes in March were better than some, its April and May RevPAR declines fall into a similar order of magnitude - with occupancy shortfalls similar to New York and ADR declines similar to San Francisco, resulting in a comparable April 2020 RevPAR decline of 94%. One concerning factor is that London's steep ADR decline may indicate more discounting than merely attributable to share shifts from luxury to midscale and economy chain scale properties.

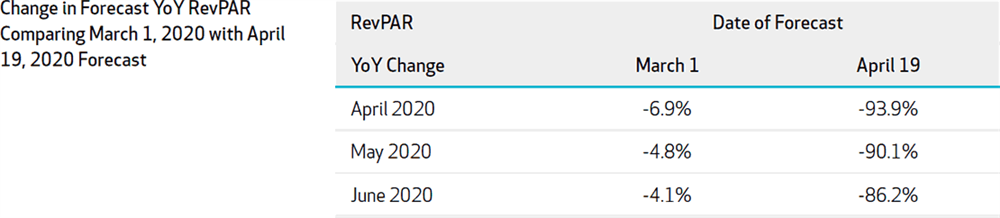

Following is an example of the differences in projected YoY RevPAR variances over the eight weeks between the March 1 (pre-COVID-19) forecast and the April 19 forecast for each month of the second quarter. Given the context of the 24 confirmed COVID-19 cases on March 1 and the thousand-fold increase to 22,058 cases tallied through April 19, the corresponding drops in the RevPAR forecasts are understandable.

While easily forgotten given the tumult of recent weeks, the U.K.'s official "Brexit" on January 31 was the top-of-mind concern creating uncertainty for London hoteliers. By March 1, declining RevPAR growth in the mid-single digits may have been deemed disappointing, but acceptable for hoteliers, given the fears surrounding Brexit and a problem in Wuhan that still seemed quite distant prior to the Northern Italian quarantine.

The aggregated RevPAR forecast for 2Q20 shows a 90% YoY RevPAR decline, with a significantly lower likelihood of a June recovery that was considered a glimmer of hope in other markets.

Now that the U.K. political leadership is taking social distancing seriously, the timing of London's recovery remains highly uncertain. As a global business center that is highly dependent on international trade and travelers, the U.K.'s ability to reopen for business will also be influenced by the actions of its trading partners and nearby EU countries. At this point, the model does not offer much of a foundation for optimism.

Demand from traditional domestic and international corporate, group, leisure and tour markets is virtually absent. Contract, healthcare-related, longer term, micro-local essential worker-sourced businesses are the only sectors that are currently producing any revenue. That largely remains the model's forecast for the coming 75 days.

The duration of London's lockdown will largely dictate the return of domestic leisure travel. As with other destinations, the prospects are weaker for both higher density destinations and locales that are more oriented toward upscale and luxury hotel inventory. London, unfortunately, perfectly matches that profile. Following a failed initial attempt to substantially contain the virus, there may be some reluctance on the part of the general public to begin venturing out when new case and mortality rates begin to decline.

The one slightly brighter spot for London is that forecast occupancy rates are predicted to bottom out in the low teens in April and move into the higher teens in May. While a June forecast of occupancy in the higher twenties does not really justify excitement, it remains a favorable alternative to recovering from the low single-digit April/May occupancies projected in other international gateway destinations.

As always, the question of hotel owner financial solvency and asset valuations will depend highly on the state of the U.K./global economies and the duration of the disruption. While London's luxury lodging sector is expected to be battered over the near and mid-term, it is likely that opportunistic value seekers within the global real estate community are already on the prowl for potential deals on some of the world's most iconic properties.

The best advice for London hoteliers may again be to "Keep Calm and Carry On." Over the centuries, London has survived horrific plagues, wars and fires. Londoners will do what they have always done: pick up the pieces, rebuild and welcome the world to rediscover one of the world's great cities for hospitality.

We continue to identify leading indicators that signal likely pricing strategies as markets decline and recover. ADRs can be misleading in a market experiencing severe supply contraction, as the mix of available rooms may shift to offer higher ratios of economy or luxury properties. Logically, during significant periods of disruption, travelers may become more price-sensitive, but anxious hoteliers engaging in rate wars may suppress pricing not only for their competitive set, but for the destination overall.

It is also important to remember that as the time horizon expands, greater variation may be expected. As more global markets recover from peak virus caseloads, their outcomes will be captured, with the model continually refined to enhance its precision.

This crisis will pass, but until then, the most urgent questions focus on the depth of the decline, the length of its duration and how the recovery will manifest itself. As the analysis continues, the following factors will be closely monitored to identify early signs of recovery:

- Active cases and mortality rates

- Test counts per million

- Government travel policies

- Stock market and volatility indexes

- Unemployment rates

LodgIQ uses state of the art BigData Analytics and AI / Machine Learning algorithms to forecast demand and price hotel rooms. LodgIQ is led by a team of experienced hospitality technologists, data scientists and engineers. Seed funded by Highgate Ventures, LodgIQ is re-imagining revenue management with predictive and prescriptive analytics methods. Our flagship product - LodgIQ RM is used by hotels across the globe, day-in and day-out to understand demand and optimize revenue.