COVID-19 Hotel Forecast: Boston

- Published:

- May 2020

- Analyst:

- Robert Cole

The global hospitality industry has been ravaged by COVID-19, a classic example of a black swan event. While many are looking backwards to compare the current market environment with the post-9/11 or 2008 Great Recession periods, Phocuswright prefers

to look forward - trying to address the tough questions weighing on our collective minds.

The global hospitality industry has been ravaged by COVID-19, a classic example of a black swan event. While many are looking backwards to compare the current market environment with the post-9/11 or 2008 Great Recession periods, Phocuswright prefers

to look forward - trying to address the tough questions weighing on our collective minds.

Over the coming months, by teaming up with the data science team at LodgIQ, Phocuswright will evaluate a broad swath of hotel-related and other data across a variety of key metropolitan areas. Our key objectives are to model the:

- Level of disruption

- Duration of disruption

- Shape of the recovery curve

The goal is to understand the similarities and differences in hotel market dynamics between destinations. This is especially relevant, as some markets may have yet to peak in terms of the level of infections, while others are seeing active coronavirus case counts decline.

Travel's multimodal nature and interdependency of origin and destination markets within different sectors adds necessary, but not always welcome complexity to the model. Therefore, this forecast is probabilistic, with a high degree of uncertainty. The spread of the virus is path-dependent, non-linear and impacted by measures such as local social distancing and broader geographic quarantines.

The forecasting model will be continually evaluated and refined as more data is collected, stronger signals identified, and new outcomes revealed. Understanding the impact of the virus and the path to recovery across major global markets will help the industry regain solid footing through more informed decision making. The simplest way to understand the impact of the virus is to observe the change to the forecast as the spread progresses.

In our exploration of various global gateway markets, we thought it would be interesting to look at a market that is relatively close to one we previously analyzed.

Given the storied rivalry between the New York and Boston sports and social communities, comparing the impact of COVID-19 on the prospects for their respective hotel business sectors seems appropriate.

The impact of the coronavirus pandemic on New York has been widely covered, but Boston actually recorded its first case much earlier, and experienced an early high-profile super-spreader event.

While COVID-19 has been largely associated with its devastating spread through senior living facilities, the Boston market provided a cautionary example of how group meetings can facilitate the spread of the virus. On February 26, global biotech pioneer Biogen held its annual, two-day leadership conference at the Marriott Long Wharf, with 175 people in attendance.

Ironically, for a company whose mission is to eradicate disease, Biogen meeting attendees introduced early COVID-19 cases in Indiana, Tennessee, North Carolina, New Jersey and Washington, D.C. Attendees returning to Germany, Norway, Switzerland and China tested positive, with others suspected in Austria and Argentina. A photographer attending the event transmitted the virus to 15 of the 50 people attending a friend's birthday dinner.

On March 12, the Marriott Long Wharf closed. By March 17, more than half (100) of the 179 confirmed cases identified in Massachusetts were linked to this single conference.

On March 12, the Marriott Long Wharf closed. By March 17, more than half (100) of the 179 confirmed cases identified in Massachusetts were linked to this single conference.

Until an effective antiviral treatment or vaccine become available for broad distribution, hotels - and the meetings and events industry as a whole - cannot reasonably expect to return to what was previously considered normal. The new normal will require explicit, overt measures to demonstrate that the health and welfare of hotel staff and attendees are being protected.

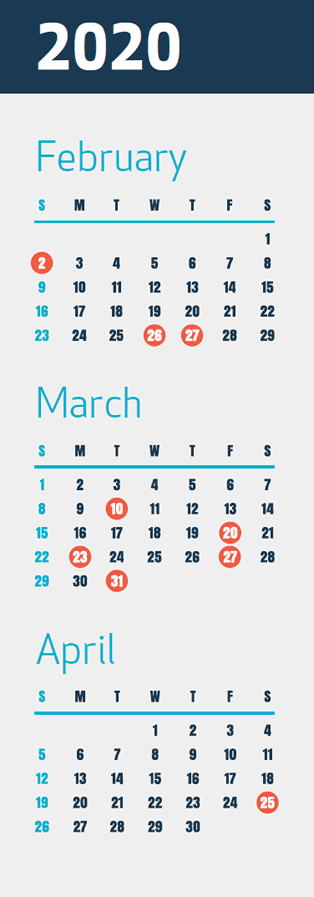

Boston's coronavirus timeline reflects a typical pattern - an early state of emergency declaration, with stricter measures following the first death:

- February 2 - Suffolk County (Boston area) reports first coronavirus case, an asymptomatic University of Massachusetts student who had returned from Wuhan, China

- February 26-27 - Biogen Leadership Meeting turns into viral super-spreader event

- March 10 - Massachusetts Governor Charlie Baker declares state of emergency

- March 20 - First death recorded in Massachusetts (Suffolk County)

- March 23 - Governor Baker announces stay-at-home advisory in effect from March 24 until April 7, later extended to April 16, and again, to May 4

- March 27 - Governor Baker asks out-of-state travelers to avoid Massachusetts or to self-quarantine for 14 days following arrival

- March 31 - Massachusetts Department of Public Health issues order to ban vacation and leisure travel for hotels and home-shares

- April 25 - Governor Baker indicates restrictions will be not lifted on May 4

In March, Boston ended the month seeing a room occupancy decline of 50%, average daily rate (ADR) drop of 22% and revenue per available room (RevPAR) falloff of 57% compared to the previous year. These compared slightly favorably to March month-end stats for New York, which saw declines of 55%, 23% and 62% for the comparable metrics.

Looking a bit deeper into the weekly splits, the story was a bit different. Boston started March in better shape than New York across the board, but the downward slope accelerated much more aggressively, with the YoY RevPAR drop for both destinations falling 88% for the final week of the month.

Interestingly, as New York's healthcare system bordered on overload in early April, New York hotel occupancy increased due to the housing of essential workers and some properties serving as quarantine quarters. Boston not only successfully flattened the curve, but the leisure travel ban there contributed to YoY occupancy falling off 11 points further than New York in the second week of April.

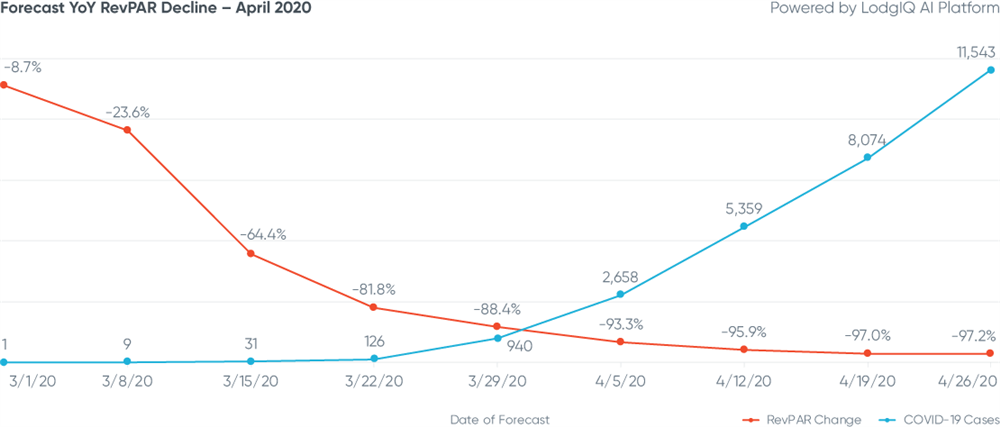

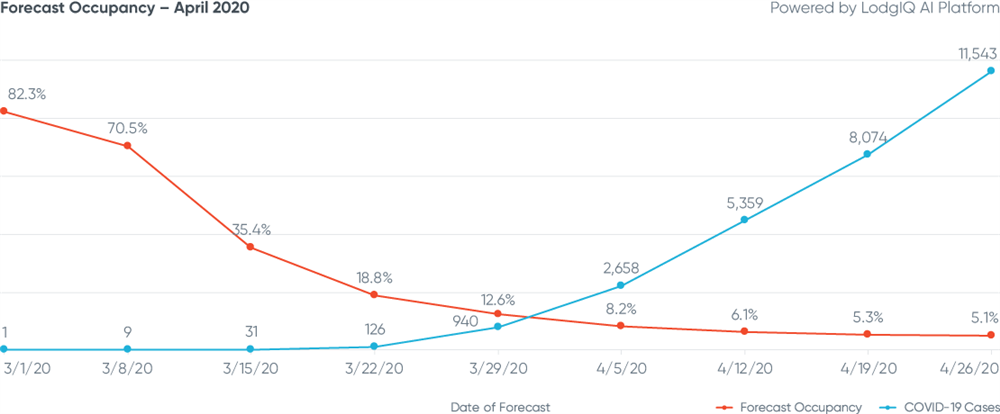

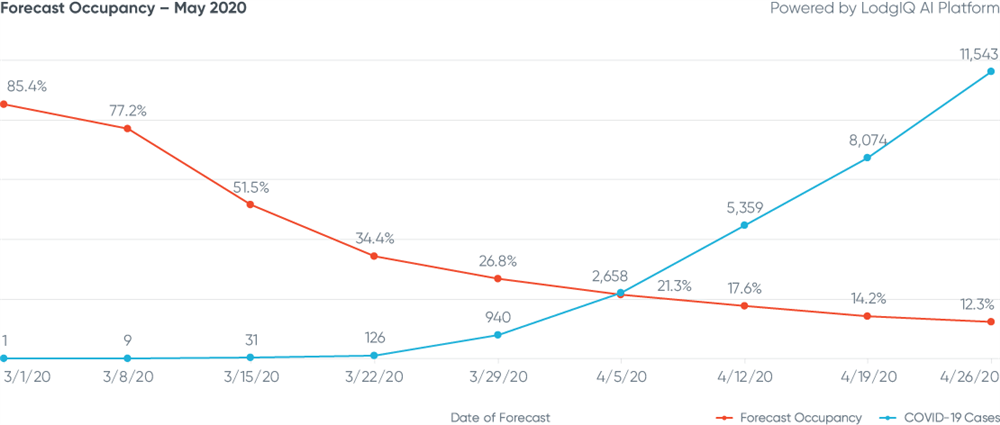

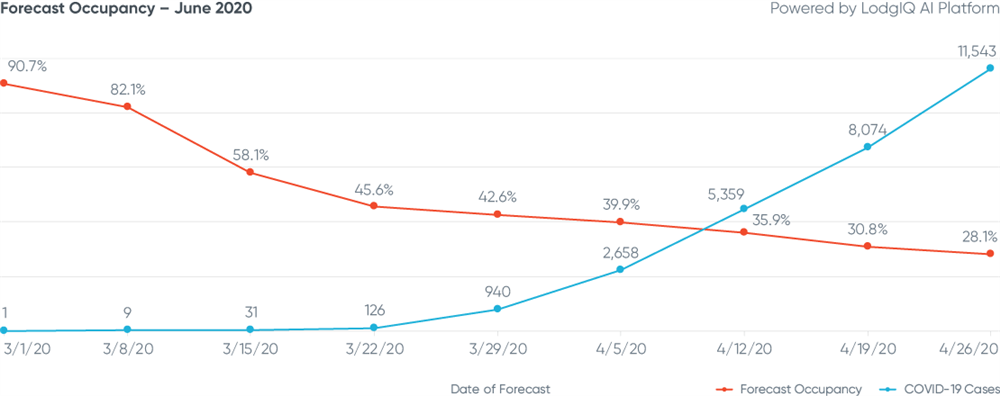

From a macro perspective, Boston exhibits the typical inverse correlation "X" pattern reflecting confirmed virus cases and weakening hotel demand, as evident in other cities.

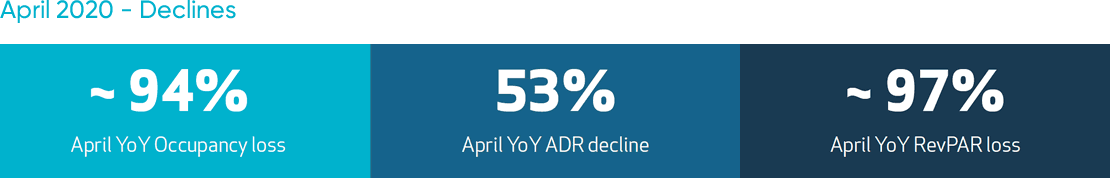

The acceleration of Boston's demand drought through April produces a bottom resulting in a 97% YoY cratering of RevPAR. With hotel closures mitigating some of the negative impact of occupancy declines (which are reported only for operating properties), ADRs continued to fall in April, resulting in an average 53% decline for the month. A good example of this trend was STR reporting a 56% YoY drop the week of April 11 - down 12 points compared with the previous week.

How cash-strapped hoteliers choose to deal with pricing under a no-demand environment will dictate the depth of RevPAR declines and the length of the runway required for recovery. The Global Business Travel Association (GBTA) this week recommended that hotels and corporations extend 2020 corporate rate agreements into 2021.

The dynamics between opportunistic corporations seeking travel cost reductions, and equally opportunistic hoteliers seeking to shift share as limited demand returns, remains a significant uncertainty that could vary widely between markets.

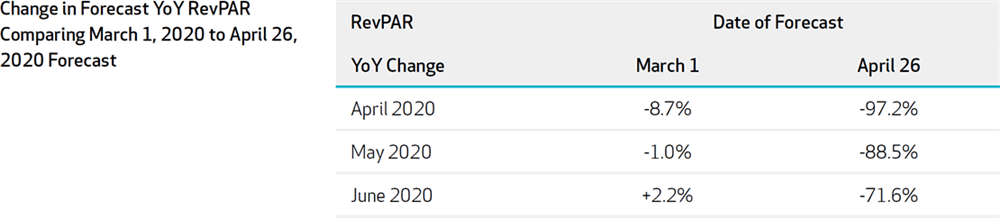

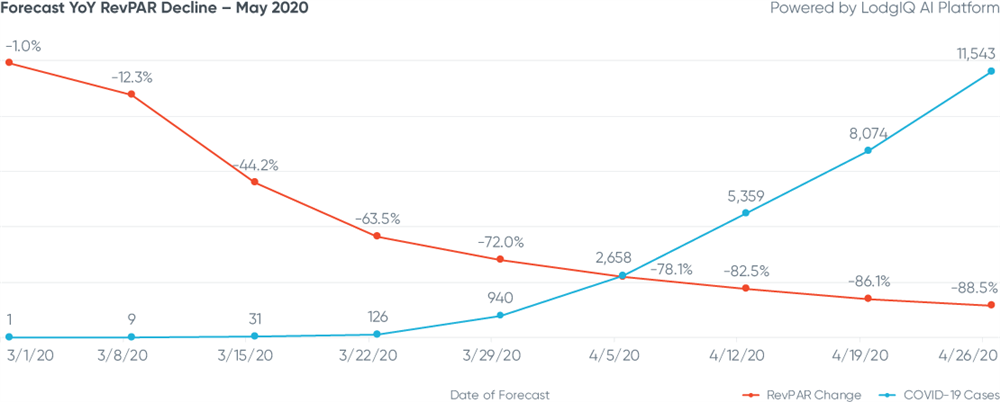

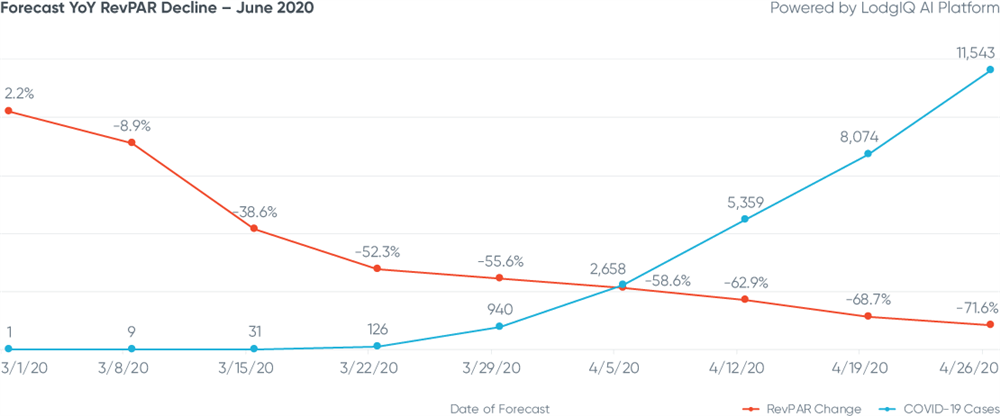

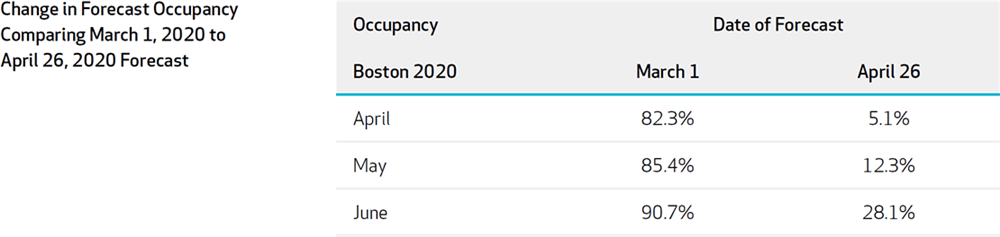

Differences in YoY RevPAR variance forecasts between the pre-COVID-19 forecast (week of March 1) and the most recent April 26 forecast show a now typical 90-point fall-off for April and May. Some potential good news for Boston is that modeling for 2Q20 shows continual improvement in May and June from the April bottom.

COVID-19 has now conditioned observers to discern differences between horrific, terrible and awful - which are accurate descriptions of Boston's forecast hotel performance over the months of April, May and June.

The aggregated 86% YoY RevPAR decline forecast for 2Q20 is empirically bad, but the trend produced by the model indicates that a potential for recovery exists.

Again, as exhibited in other markets, the outcome of government authorities making appropriate decisions to preserve life and public health have a detrimental impact on the performance of the hotel industry. As roughly half of U.S. states (excluding Massachusetts) begin to reopen their economies in early May, the delicate balancing act between the forces desiring economic recovery and those urging greater caution will begin to play out.

The model reflects Boston's opportunity to begin recovering as May ends and June begins, if a reopening process can be successfully structured. A key consideration (and current unknown) is the timing of repeal of the leisure travel ban and/or discouragement of out-of-state travel.

A few additional statistical snapshots of the Boston market highlight the incredible impact of the pandemic on the hotel industry. While RevPAR is considered the common metric to compare performance across all types of hotels, total revenue per available room (TRevPAR) incorporates revenue from additional sources such as food and beverage outlets, banquets, meeting facilities and recreation/spa departments for full-service hotels. Even more importantly, gross operating profit per available room (GOPPAR) is a key metric used by hotel owners to measure profitability.

While these metrics fall beyond the scope of our demand disruption forecasts, they deserve consideration. For the month of March 2020, STR reported TRevPAR for Boston falling 73.1% YoY. This figure is approximately 15 points worse than the comparable RevPAR figure for the month. Even more dramatic was the precipitous fall in YoY GOPPAR, which declined 147% in Boston.

This profitability dimension exacerbates the uncertainty for hotel owners as the duration of lockdowns continue. Like most international gateways, central Boston features both high-inventory density and a greater relative share of upper-upscale and luxury hotel product, which will tend to slow its recovery. The meetings business, now predicted by the American Hotel & Lodging Association (AH&LA) not to recover until sometime in 2021, puts further downward pressure on occupancy forecasts.

Mid single-digit occupancy, low double-digit occupancy and under one third of rooms occupied are hardly conditions that any hotelier would ever want to experience, or in fact has ever experienced. The model's relative increase in the occupancy forecast for June, a month in Boston that would normally see occupancy around 90% (and ADRs exceeding $300), will bring some welcome relief. However, it will still apply intense pressure on hotel profitability, which has traditionally required somewhere around 50% occupancy to achieve break-even performance.

It should be noted that, when comparing our weekly forecast occupancy snapshots, none have yet resulted in any upward adjustment trend in the forecasting.

To borrow a sports analogy, it appears that we may only be approaching the end of the early innings in the hotel industry's battle with COVID-19. The coming weeks will provide some answers as U.S. states experiment with reopening. At this point, those outcomes lie well beyond the data sets used to develop these forecasts, so we look forward to learning more as new information becomes available.

As expressed by Hilton CEO Chris Nassetta at a White House meeting on April 30:

"… our customers are saying they're looking for the government, both state and federal government, to focus on testing so that they understand, you know, what real mortality rates are," adding that guests "want to know that people are being responsible. Right? They want to know that we are doing the testing, the social distancing."

If the U.S. population continues to exhibit personal responsibility for social distancing and governmental authorities are able to support the necessary testing and contact tracing, guest uncertainty will subside.

We are hopeful that the Boston hospitality industry will be able to achieve the forecast gains predicted by the model to begin its recovery. Again, in comparison to New York City, our earlier modeling predicted occupancies to be 10 points higher than Boston for the month of June, so they have considerable ground to cover.

Hopefully, both Boston and New York will soon be able to tout - with equal fervor - their performance in recovering from the coronavirus pandemic, and return to their favored pastime of making the other city painfully aware of their own civic pride.

We continue to identify leading indicators that signal likely pricing strategies as markets decline and recover. ADRs can be misleading in a market experiencing severe supply contraction, as the mix of available rooms may shift to offer higher ratios of economy or luxury properties. Logically, during significant periods of disruption, travelers may become more price-sensitive, but anxious hoteliers engaging in rate wars may suppress pricing not only for their competitive set, but for the destination overall.

It is also important to remember that as the time horizon expands, greater variation may be expected. As more global markets recover from peak virus caseloads, their outcomes will be captured, with the model continually refined to enhance its precision.

This crisis will pass, but until then, the most urgent questions focus on the depth of the decline, the length of its duration and how the recovery will manifest itself. As the analysis continues, the following factors will be closely monitored to identify early signs of recovery:

- Active cases and mortality rates

- Test counts per million

- Government travel policies

- Stock market and volatility indexes

- Unemployment rates

LodgIQ uses state of the art BigData Analytics and AI / Machine Learning algorithms to forecast demand and price hotel rooms. LodgIQ is led by a team of experienced hospitality technologists, data scientists and engineers. Seed funded by Highgate Ventures, LodgIQ is re-imagining revenue management with predictive and prescriptive analytics methods. Our flagship product - LodgIQ RM is used by hotels across the globe, day-in and day-out to understand demand and optimize revenue.