COVID-19 Hotel Forecast: San Francisco

- Published:

- April 2020

- Analyst:

- Robert Cole

The global hospitality industry

has been ravaged by COVID-19, a classic example of a black swan event. While many are looking backwards to compare the current market environment with the post-9/11 or 2008 Great Recession periods, Phocuswright prefers to look forward - trying to

address the tough questions weighing on our collective minds.

The global hospitality industry

has been ravaged by COVID-19, a classic example of a black swan event. While many are looking backwards to compare the current market environment with the post-9/11 or 2008 Great Recession periods, Phocuswright prefers to look forward - trying to

address the tough questions weighing on our collective minds.

Over the coming months, by teaming up with the data science team at LodgIQ, Phocuswright will evaluate a broad swath of hotel-related and other data across a variety of key metropolitan areas. Our key objectives are to model the:

- Level of disruption

- Duration of disruption

- Shape of the recovery curve

The goal is to understand the similarities and differences in hotel market dynamics between destinations. This is especially relevant, as some markets may have yet to peak in terms of the level of infections, while others are seeing active coronavirus case counts decline.

Travel's multimodal nature and interdependency of origin and destination markets within different sectors adds necessary, but not always welcome complexity to the model. Therefore, this forecast is probabilistic, with a high degree of uncertainty. The spread of the virus is path-dependent, non-linear and impacted by measures such as local social distancing and broader geographic quarantines.

The forecasting model will be continually evaluated and refined as more data is collected, stronger signals identified, and new outcomes revealed. Understanding the impact of the virus and the path to recovery across major global markets will help the industry regain solid footing through more informed decision making. The simplest way to understand the impact of the virus is to observe the change to the forecast as the spread progresses.

San Francisco Mayor London Breed took an early, aggressive stance on social distancing, declaring an emergency on February 25, nine days before the city recorded its first confirmed COVID-19 cases. Despite being criticized at the time for overreacting, Breed's strategy appears to have successfully flattened the curve for San Francisco - a densely populated city with a sizable homeless population.

Flattening the curve is essential to avoid unnecessary stress on healthcare resources and to protect the welfare of the local community. However, for the lodging industry, strong social distancing measures and stay-at-home regulations have a catastrophic effect on operations and profitability.

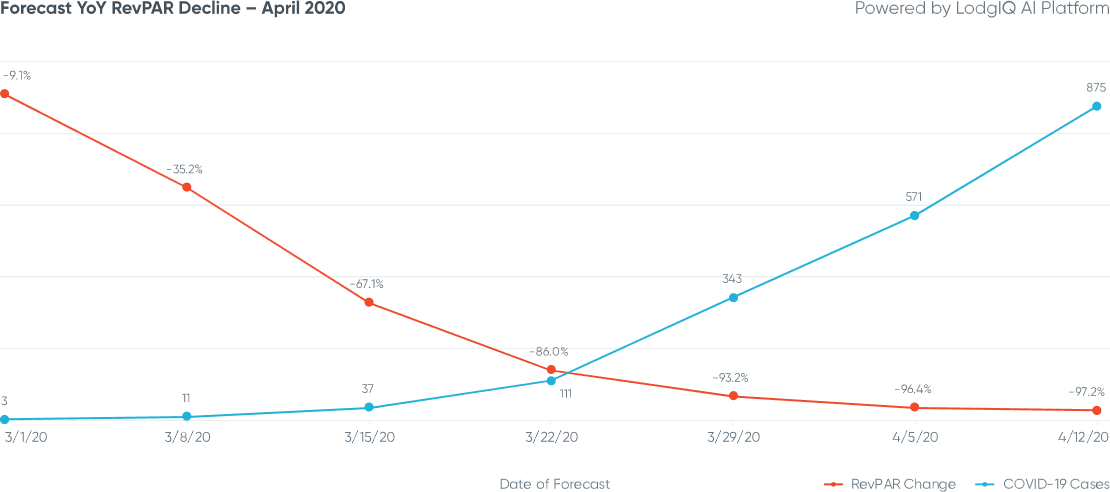

In early March, prior to its first COVID-19 cases, the forecasting model predicted a 9% decline in the city's year-over-year (YoY) Revenue per Available Room (RevPAR) variance for the month of April. Six weeks later, the April 12 model has reforecast the YoY RevPAR collapse to -97% for the month.

Those downplaying the impact of this pandemic on the hospitality industry - sometimes comparing it with the 9/11 terror attacks or the 2008 global financial crisis - are either ill-informed, lying or delusional.

The timeline clearly illustrates the proactive leadership of local authorities:

The timeline clearly illustrates the proactive leadership of local authorities:

- February 3: Two coronavirus patients from San Benito County transported to San Francisco for treatment

- February 25: San Francisco Mayor London Breed declares state of emergency

- March 4: California Governor Gavin Newsom declares state of emergency

- March 5: San Francisco records first two confirmed coronavirus cases

- March 6: Strong social distancing recommendations issued by San Francisco Department of Public Health are resisted by the NBA's Golden State Warriors

- March 16: Shelter-in-place order announced for six Bay Area counties

- March 24: San Francisco records first coronavirus death

- March 31: Shelter-in-place order extended to May 3

As of April 20, San Francisco County (population 880,000) has recorded 1,157 confirmed cases (0.01% of the population) and 20 deaths (1.7% of confirmed cases). San Francisco's testing rates are also the highest among all major California counties.

While delivering commendable public health outcomes is of the utmost importance, it is of little consolation when viewed solely through the prism of near-term business prospects for hoteliers. The lockdowns save lives and suppress hotel occupancy.

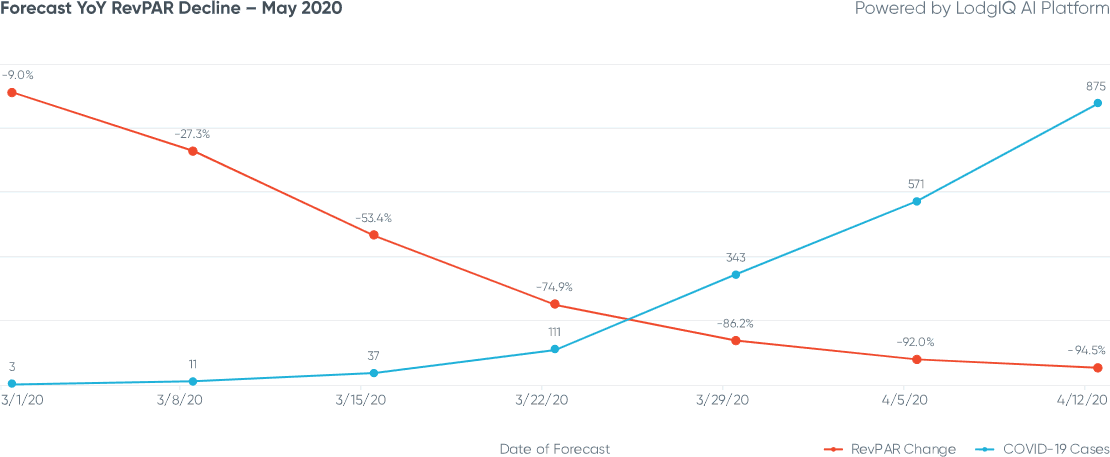

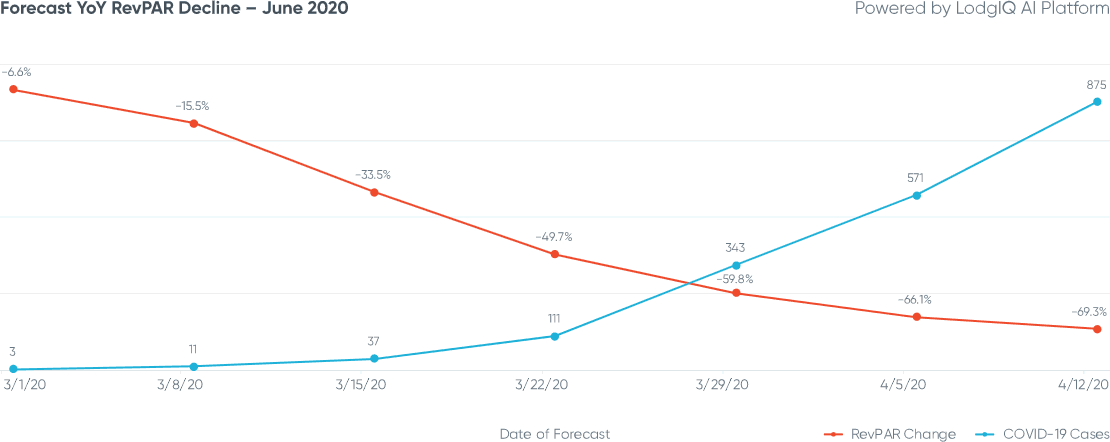

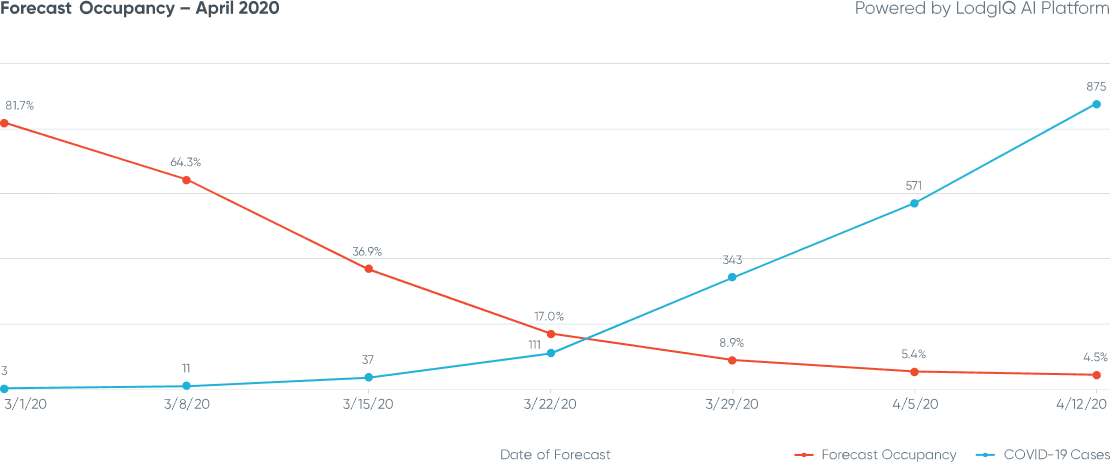

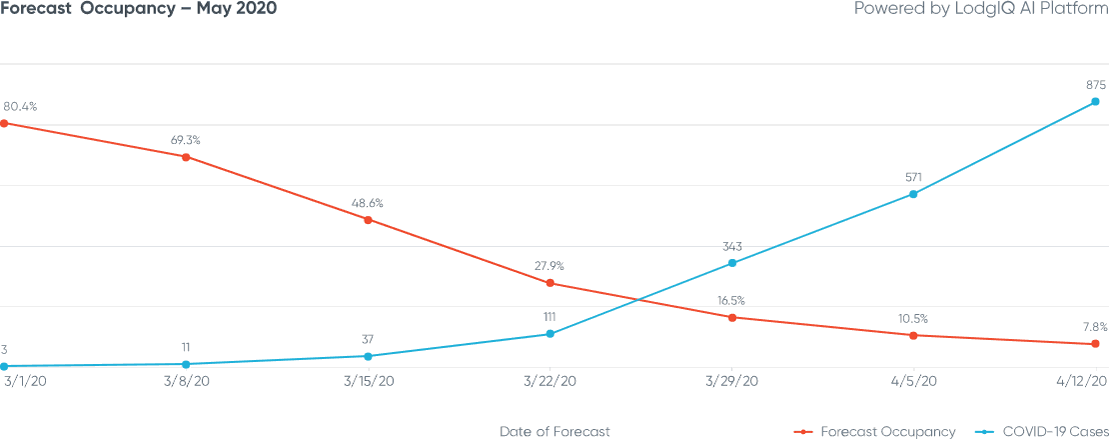

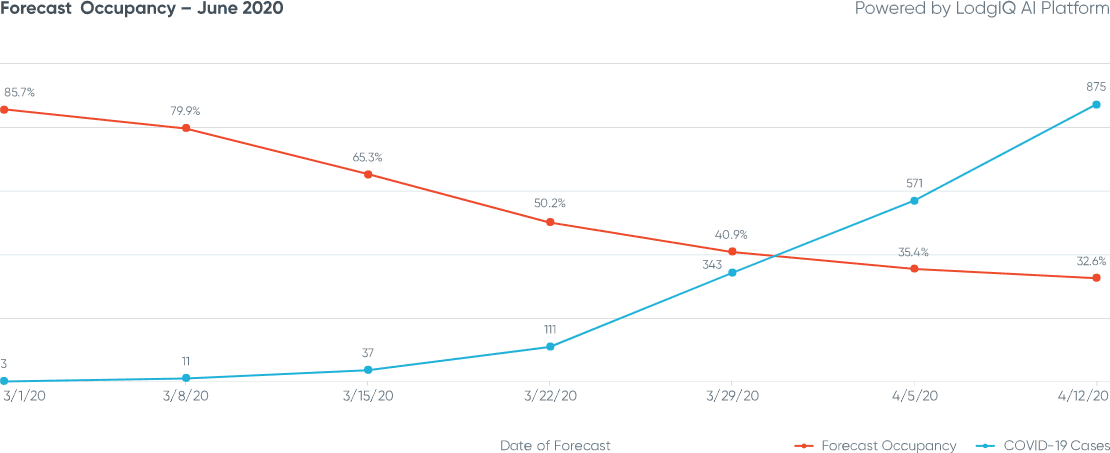

Our previous forecasts in Singapore and New York City clearly illustrated the inverse correlation between confirmed virus cases and weakening of hotel demand. The San Francisco market exhibits the same "X" pattern, even though the case counts have been much more muted in real numbers.

The term devastated does not sufficiently characterize the state of San Francisco hotel demand in April. Driven by a 95% evaporation of hotel occupancy, the RevPAR decline exceeded even New York City's YoY drop. San Francisco's successful curve flattening largely eliminated the need for quarantine quarters or the housing of essential healthcare workers that drove some hotel demand for New York.

The Average Daily Rate (ADR) decline is attributed more to a share shift from luxury to midscale and economy product, as well as a reduction in corporate, group and transient occupancy - leaving mostly contract rate or other structural base business. There is fortunately little evidence of irrational discount pricing from desperate hoteliers who may have learned that such moves do not influence demand under these conditions.

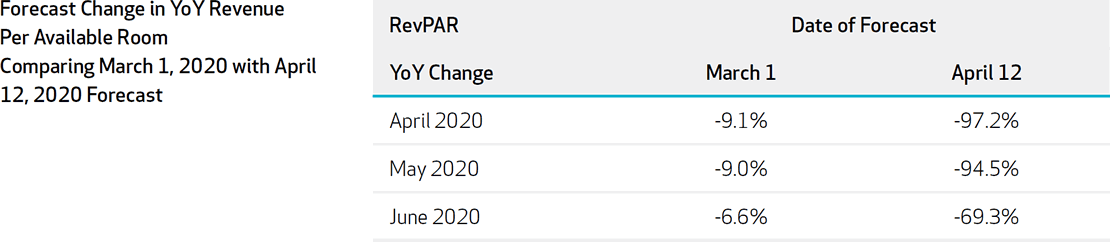

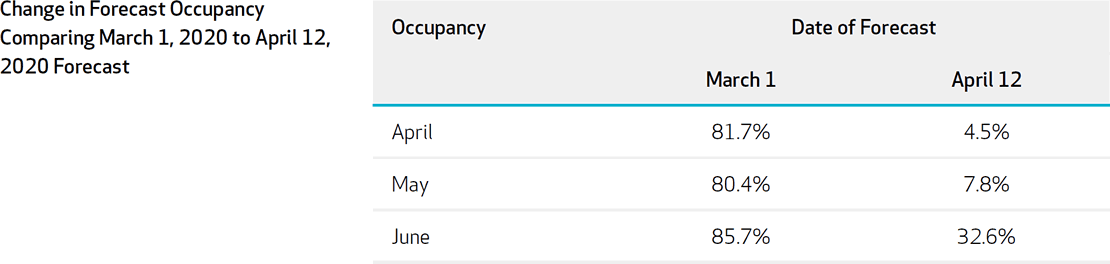

Below is an example of how predicted YoY RevPAR variances changed between the March 1 forecast and the April 12 forecast for each month of the second quarter:

In early March, predicting a 9% decline in RevPAR would have shocked most San Francisco hoteliers facing a tight labor market and 700 additional rooms under construction. Six weeks later, looking at the second quarter of 2020 with an aggregated 87% YoY RevPAR decline, the only glimmer of hope is that the model currently projects a recovery beginning in June.

As always, these figures are based on what we know now. San Francisco hotel demand will not only be dictated by smart local practices, but by how the political and business leadership throughout its feeder markets perform over the coming weeks. For now, we remain optimistic.

As an iconic international gateway destination, San Francisco typically benefits from high demand in the corporate, group, leisure and tour markets - sourcing business both domestically and internationally. It is unlikely that all those markets will rebound at similar rates and over similar timeframes.

Any significant group business recovery is likely to wait until 2021. The corporate market, having largely shut down and furloughed vast resources, and now compounded with the familiarity of virtual meetings, may attempt to preserve scarce cash by deferring all but essential travel.

The resiliency of the leisure and tour sectors will be highly dependent on the duration of lockdowns to mitigate the virus' spread and, perhaps more importantly, unemployment and borrowing rates which will dictate the availability of discretionary income for leisure travel. San Francisco, like many other markets, may need to look for local business to bridge the gap. Staycations and potentially sourcing travelers from California and Pacific Coast states which are now coordinating economic recovery plans, may provide some welcome relief, while other parts of the U.S. may continue to struggle. Prospects for significant international travel are uncertain until a vaccine is broadly distributed.

The model currently projects room occupancy to drop below 5% in April and remain below 8% in May. Showing the pre-COVID-19 projections of second quarter occupancies ranging between 80-86% may simply be cruel at this point, yet it plainly reveals the radical departure from the norm.

Some good news is that the model projects that San Francisco will hit bottom this month, see a slight improvement in May and considerable (relative) rebound in June, if selling less than one in three rooms can be considered a recovery. A remaining question will be the financial solvency of hotel owners. A closed hotel presents disproportionate negative pressure on asset valuations. Operating hotels at low double-digit occupancies can turn net income margins into the deep -50% to -100%+ realms. Hoteliers will be faced with many challenging decisions based on myriad uncertain variables.

We continue to identify leading indicators that signal likely pricing strategies as markets decline and recover. ADRs can be misleading in a market experiencing severe supply contraction, as the mix of available rooms may shift to offer higher ratios of economy or luxury properties. Logically, during significant periods of disruption, travelers may become more price-sensitive, but anxious hoteliers engaging in rate wars may suppress pricing not only for their competitive set, but for the destination overall.

It is also important to remember that as the time horizon expands, greater variation may be expected. As more global markets recover from peak virus caseloads, their outcomes will be captured, with the model continually refined to enhance its precision.

This crisis will pass, but until then, the most urgent questions focus on the depth of the decline, the length of its duration and how the recovery will manifest itself. As the analysis continues, the following factors will be closely monitored to identify early signs of recovery:

- Active cases and mortality rates

- Test counts per million

- Government travel policies

- Stock market and volatility indexes

- Unemployment rates

LodgIQ uses state of the art BigData Analytics and AI / Machine Learning algorithms to forecast demand and price hotel rooms. LodgIQ is led by a team of experienced hospitality technologists, data scientists and engineers. Seed funded by Highgate Ventures, LodgIQ is re-imagining revenue management with predictive and prescriptive analytics methods. Our flagship product - LodgIQ RM is used by hotels across the globe, day-in and day-out to understand demand and optimize revenue.