COVID-19 Hotel Forecast: Phuket

- Published:

- August 2020

- Analyst:

- Robert Cole

The global hospitality industry has been ravaged

by COVID-19, a classic example of a black swan event. While many are looking backwards to compare the current market environment with the post-9/11 or 2008 Great Recession periods, Phocuswright prefers to look forward - trying to address the tough

questions weighing on our collective minds.

The global hospitality industry has been ravaged

by COVID-19, a classic example of a black swan event. While many are looking backwards to compare the current market environment with the post-9/11 or 2008 Great Recession periods, Phocuswright prefers to look forward - trying to address the tough

questions weighing on our collective minds.

Over the coming months, by teaming up with the data science team at LodgIQ, Phocuswright will evaluate a broad swath of hotel-related and other data across a variety of key metropolitan areas. Our key objectives are to model the:

- Level of disruption

- Duration of disruption

- Shape of the recovery curve

The goal is to understand the similarities and differences in hotel market dynamics between destinations. This is especially relevant, as some markets may have yet to peak in terms of the level of infections, while others are seeing active coronavirus case counts decline.

Travel's multimodal nature and interdependency of origin and destination markets within different sectors adds necessary, but not always welcome complexity to the model. Therefore, this forecast is probabilistic, with a high degree of uncertainty. The spread of the virus is path-dependent, non-linear and impacted by measures such as local social distancing and broader geographic quarantines.

The forecasting model will be continually evaluated and refined as more data is collected, stronger signals identified, and new outcomes revealed. Understanding the impact of the virus and the path to recovery across major global markets will help the

industry regain solid footing through more informed decision making. The simplest way to understand the impact of the virus is to observe the change to the forecast as the spread progresses.

The forecasting model will be continually evaluated and refined as more data is collected, stronger signals identified, and new outcomes revealed. Understanding the impact of the virus and the path to recovery across major global markets will help the

industry regain solid footing through more informed decision making. The simplest way to understand the impact of the virus is to observe the change to the forecast as the spread progresses.

The kudos for Thailand's response to the global coronavirus pandemic is well deserved.

As a country with a population of 70 million, having reported only 3,376 cases and 58 deaths as of mid-August is remarkable. Most critically, Thailand has not had a single COVID-19-related death in over two months. Community transmission has been largely eradicated.

To give these figures some context, the per capita rate of new infections on a single day in the United States is currently running 3.8x higher than Thailand's cumulative per capita infection rate since late February. The mortality rate figure is even worse at 4.8x, when comparing the same daily and cumulative periods. That scale of variation is unfathomable, especially considering Thailand's status as a newly industrialized, developing country.

It is even more remarkable considering that nearly 10% of the Thai population lives in poverty and only 85% of Thailand's 15-year-olds are expected to live past the age of 60.

Consider further that Thailand's economy relies heavily on tourism - reflecting a sizeable 12% direct contribution to GDP (20%, including indirect.) Foreign arrivals account for 64% of total tourism spend. COVID-19 has ravaged Thailand's tourist industry, with 2020 annual revenue shortfalls forecast to exceed US$50 billion.

Phuket is a major destination for international tourists, ranking in the top 15 global destinations (Bangkok ranks #1 globally). Before the pandemic, Phuket greeted 9.9 million international visitors annually - surpassing other renowned tourist destinations like Barcelona and Hong Kong.

In terms of overnight tourist spend, Phuket ranks even higher, coming in 10th globally, at $12 billion. This makes the ratio of international overnight tourist spend to GDP for Phuket a staggering 179% - the highest in the world.

Understanding the stakes, the Thai government has dealt with the pandemic proactively and aggressively. Despite Thailand and Phuket having every economic incentive to restart tourism as quickly as possible, the government has set public health as the top priority and has acted prudently regarding reopening decisions.

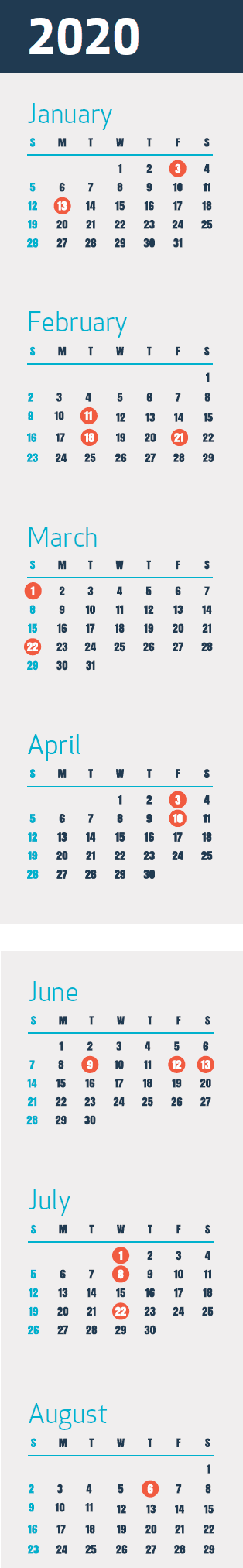

The following are the major milestones in the fight against coronavirus by Thai authorities:

- January 3 - Thailand begins screening passengers from China at most international airports.

- January 13 - A 61-year-old woman from Wuhan, China who arrived in Bangkok on January 8 is first confirmed COVID-19 case.

- February 11 - Thailand refuses permission for cruise ship MS-Westerdam to dock.

- February 18 - COVID-19 screening extended to all arrivals from Japan and Singapore.

- February 21 - Screening extended for visitors from Hong Kong, Macau, South Korea and Taiwan.

- March 1 - First death attributed to COVID-19 is a 35-year-old who died from multiple organ failure due to severe lung damage.

- March 22 - Single largest daily case count, 188 cases, reported.

- April 3 - International passenger flights banned by Civil Aviation Authority of Thailand (CAAT).

- April 10 - Phuket International Airport is closed to all passenger flight traffic.

- June 9 - Phuket reopens beaches after experiencing no new infections over a 15-day period.

- June 12 - "Tourist bubble" plan approved to allow reintroducing international tourism from select partner countries that have successfully controlled the virus.

- June 13 - Phuket International Airport reopens to domestic passenger flights.

- July 1 - Flights resume as Thailand reopens borders for certain categories of travelers. Non-citizens allowed to enter are required to complete a Certificate of Entry document.

- July 8 - Civil Aviation Authority of Thailand postpones "travel bubble" plan due to rising cases outside Thailand.

- July 22 - Government approves trade fair participants, film production crews, foreign patients seeking treatment, and Thailand Elite Card holders to enter the country subject to a 14-day quarantine.

- August 6 - Thailand announces that it is suspending its tourist bubble plan due to rising case counts in planned partner countries.

In early June, Thailand Prime Minister Prayut Chan-o-cha approved a proposal to create "travel bubbles" where foreigners could again be safely allowed to enter the country without having to endure quarantine. Visitors would be subject to a strict set of rules, including possessing letters of invitation, taking virus tests three days before departure and upon arrival in Thailand, buying $100,000 in insurance, and registration in the government's contact tracing system.

Prospective source countries included Australia, Cambodia, China (including Hong Kong and Macau), Japan, Laos, Myanmar, New Zealand, South Korea, Taiwan, Vietnam, and some Middle Eastern countries. The hotels and businesses serving the travelers would also be required to abide by strict hygiene standards. There was some room for optimism, but in early July, the country's aviation authority put the plan on hold, citing rising cases in planned tourism exchange partners.

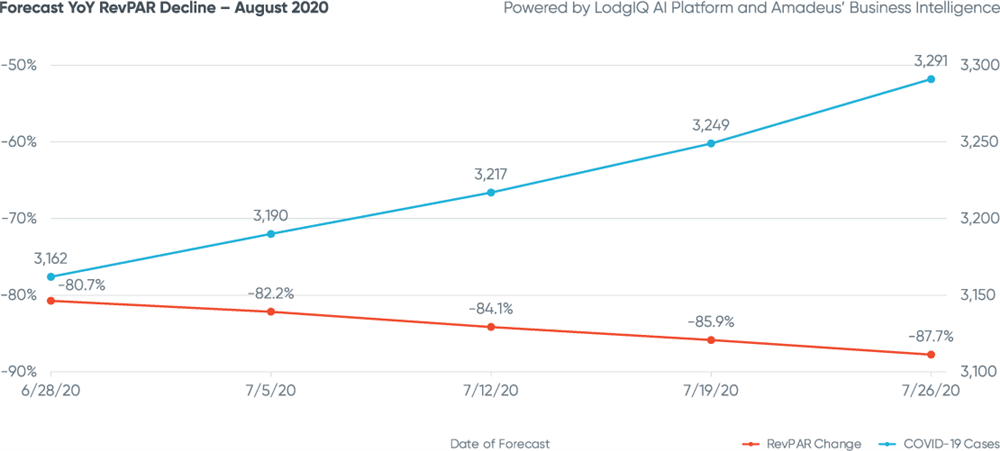

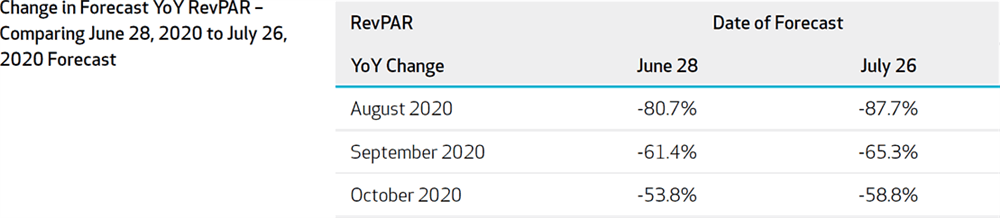

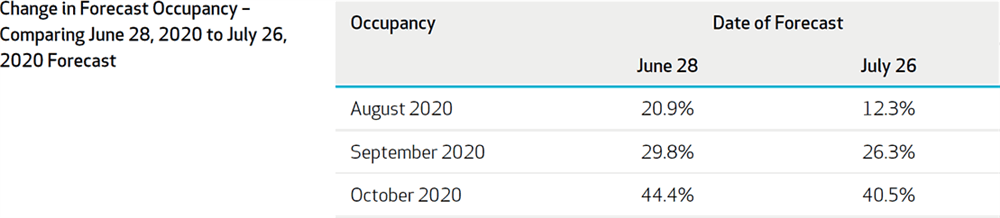

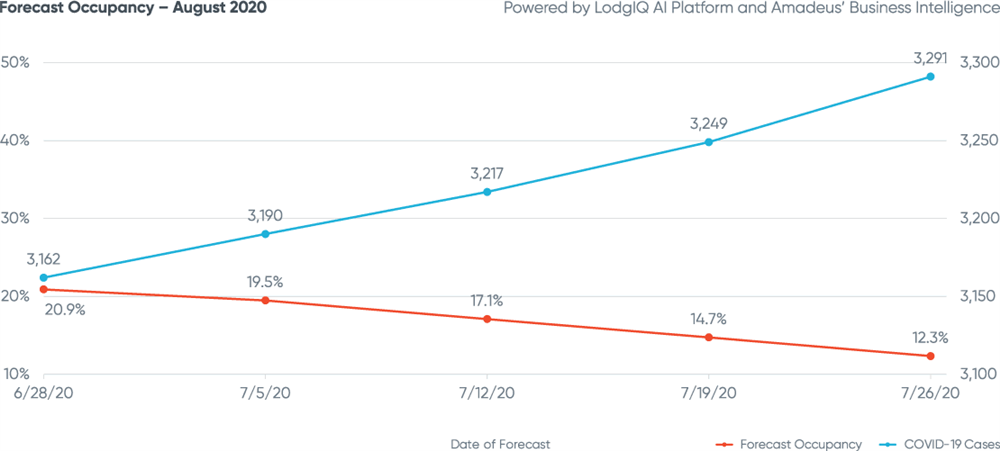

Consistent with all the cities profiled to date, the predicted forecast generated by the model degrades as time progresses. In the case of Phuket, the year-over-year gap in August Revenue per Available Room (RevPAR) fell an additional seven points between the June 28 and July 26 model runs.

Each week since the June 28 forecast, the RevPAR forecast has progressively eroded. For the reasons addressed above, the model projects Phuket's RevPAR for August 2020 to fall 87.7% compared with August 2019.

The rate of growth for COVID-19 cases is quite low in Thailand - by far the lowest in any of the destinations evaluated thus far. Unlike other markets where the local conditions caused the disruption, Thailand's hotel demand is being disrupted by international source markets handling the pandemic much less effectively.

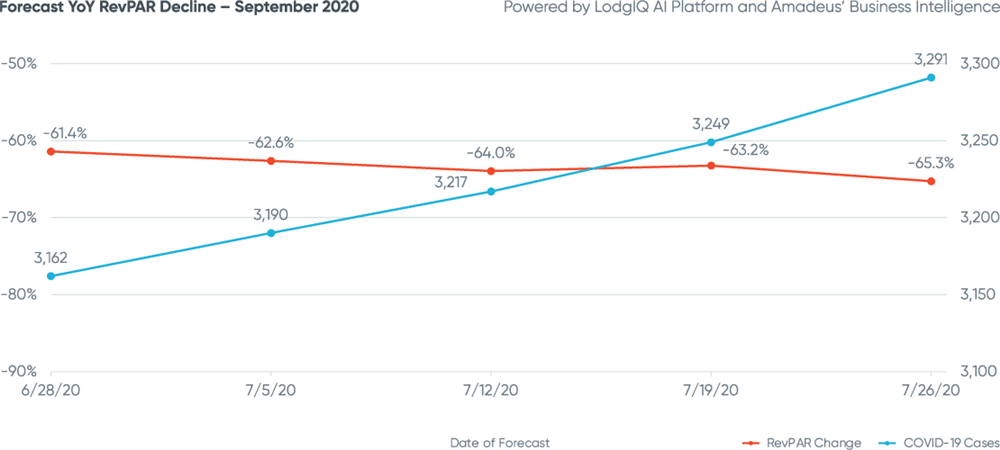

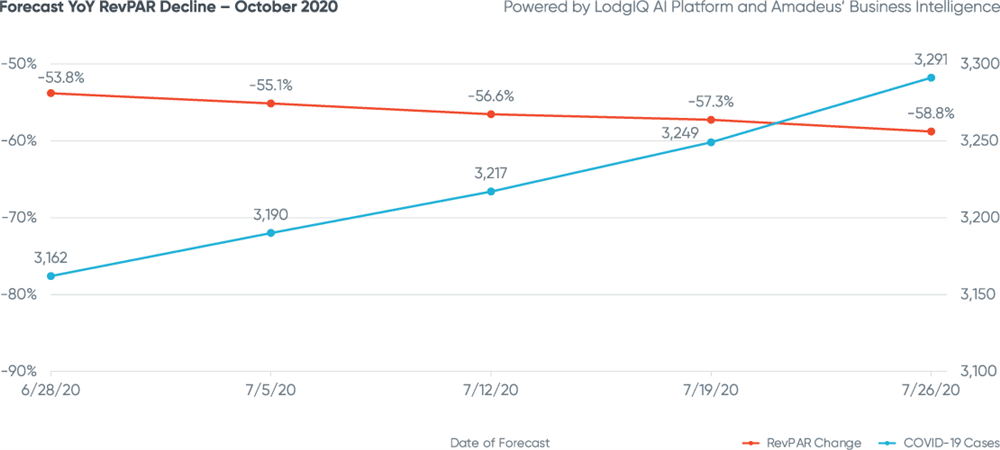

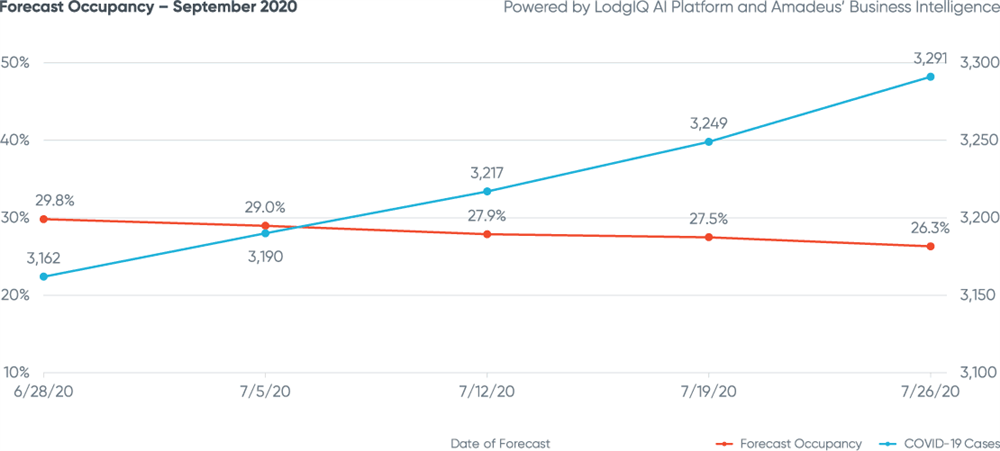

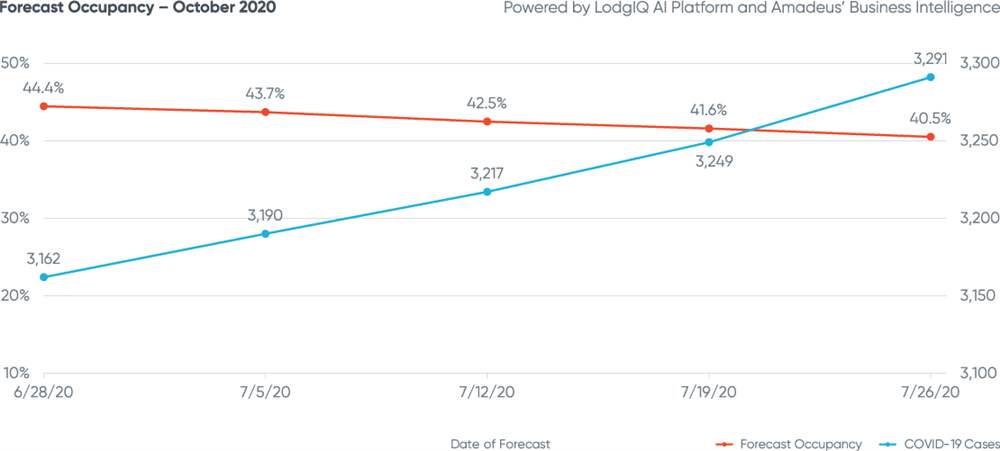

Over the next 90 days, the prospects for a hospitality industry recovery, reflected in Phuket's forecast YoY RevPAR decline, shows some improvement, from -77.7% in August to -58.8% in October. It is believed that the properties that have reopened represent the vast majority of properties that will reopen, so significant future inventory growth is not anticipated.

Phuket's August hotel occupancy is projected to be 12.3%, increasing to 40.5% in October.

On August 6th, the government once again put plans for the travel bubble on hold. As the forecast model did not incorporate this new decision (only a reduced calculated probability that such a postponement was a variable), one can look at the forecast figures as best-case scenarios for the coming 90-day window.

The decisions made by the Thai government regarding the travel bubble illustrate the fluidity of the situation. Most importantly, it demonstrates that many factors are at play and that many are outside the control of any local, state or national jurisdiction.

The next proposal on the table - a modification of the country-wide travel bubble - is to allow tour operators to fly international direct flights into Phuket, under strict testing and tracing guidelines, but no quarantine. It is unclear if, or when, such a proposal might be accepted or put into effect. Until then, Phuket hoteliers will have to rely on domestic travelers to sustain them through the lengthening international tourist drought.

We continue to identify leading indicators that signal likely pricing strategies as markets decline and recover. ADRs can be misleading in a market experiencing severe supply contraction, as the mix of available rooms may shift to offer higher ratios of economy or luxury properties. Logically, during significant periods of disruption, travelers may become more price-sensitive, but anxious hoteliers engaging in rate wars may suppress pricing not only for their competitive set, but for the destination overall.

It is also important to remember that as the time horizon expands, greater variation may be expected. As more global markets recover from peak virus caseloads, their outcomes will be captured, with the model continually refined to enhance its precision.

This crisis will pass, but until then, the most urgent questions focus on the depth of the decline, the length of its duration and how the recovery will manifest itself. As the analysis continues, the following factors will be closely monitored to identify early signs of recovery:

- Active cases and mortality rates

- Test counts per million

- Government travel policies

- Stock market and volatility indexes

- Unemployment rates

LodgIQ uses state of the art BigData Analytics and AI / Machine Learning algorithms to forecast demand and price hotel rooms. LodgIQ is led by a team of experienced hospitality technologists, data scientists and engineers. Seed funded by Highgate Ventures, LodgIQ is re-imagining revenue management with predictive and prescriptive analytics methods. Our flagship product - LodgIQ RM is used by hotels across the globe, day-in and day-out to understand demand and optimize revenue.