COVID-19 Hotel Forecast: Dallas

- Published:

- May 2020

- Analyst:

- Robert Cole

The global hospitality industry has been ravaged by COVID-19, a classic example of a black swan event. While

many are looking backwards to compare the current market environment with the post-9/11 or 2008 Great Recession periods, Phocuswright prefers to look forward - trying to address the tough questions weighing on our collective minds.

The global hospitality industry has been ravaged by COVID-19, a classic example of a black swan event. While

many are looking backwards to compare the current market environment with the post-9/11 or 2008 Great Recession periods, Phocuswright prefers to look forward - trying to address the tough questions weighing on our collective minds.

Over the coming months, by teaming up with the data science team at LodgIQ, Phocuswright will evaluate a broad swath of hotel-related and other data across a variety of key metropolitan areas. Our key objectives are to model the:

- Level of disruption

- Duration of disruption

- Shape of the recovery curve

The goal is to understand the similarities and differences in hotel market dynamics between destinations. This is especially relevant, as some markets may have yet to peak in terms of the level of infections, while others are seeing active coronavirus case counts decline.

Travel's multimodal nature and interdependency of origin and destination markets within different sectors adds necessary, but not always welcome complexity to the model. Therefore, this forecast is probabilistic, with a high degree of uncertainty. The spread of the virus is path-dependent, non-linear and impacted by measures such as local social distancing and broader geographic quarantines.

The forecasting model will be continually evaluated and refined as more data is collected, stronger signals identified, and new outcomes revealed. Understanding the impact of the virus and the path to recovery across major global markets will help the industry regain solid footing through more informed decision making. The simplest way to understand the impact of the virus is to observe the change to the forecast as the spread progresses.

Texas has always been a place where worlds collide. A young entrepreneur leaves his glass skyscraper office at lunch to drive his Maserati to a dilapidated shack and stand in line behind a highway worker and an undocumented carpenter before the day's ration of barbeque runs out. Very different people share the same objective.

When it comes to coronavirus, Texas is also a study in political worlds colliding. Unfortunately, in our seventh week of studying gateway travel markets, we have discovered political decisions and the resulting social response may have a greater impact on hotel performance than raw case count or unemployment statistics. This makes our job of forecasting even more challenging. It's been said everything is bigger in Texas, and that certainly applies to the state's politics. To be clear, both Democrats and Republicans want to limit the impact of the virus, keep their constituents safe, and have the economy return to normal as quickly as possible. In Texas (and elsewhere in the U.S.), however, they are simply taking two very different approaches, and are often unwilling to compromise to find mutually acceptable common ground.

Texas has a small government philosophy. For example, it only allows its state legislature to meet in odd-numbered years for up to 140 days. As a result, there is currently no active legislative branch functioning in the state. This leaves the state's top elected official, Republican Governor Greg Abbott, and individual county judges (the top elected executive in each of the state's 263 counties), in charge. In Dallas County, that is Democratic Judge Clay Jenkins.

Judge Jenkins has been aggressive and proactive - somewhat similar to the approach taken by San Francisco Mayor London Breed, who locked down the city early to limit the impact on public health - devastating local hotel performance in the process. Governor Abbott initially adopted a highly decentralized approach, delegating decision making to the county judges. Judge Jenkins was extremely critical of that approach, because Dallas' neighboring counties had very different standards. For example, nearby suburban Collin County decided that every business was essential and would remain open.

Governor Abbott's approach changed radically however in mid-April, following U.S. President Donald Trump's plan to reopen the U.S. economy. Trump's plan proposed a phased restart of individual state economies following a continuous 14-day downturn in COVID-19 cases and widespread virus screening, testing and contact tracing. The next day, Abbott announced his three-phase plan to open the Texas economy, following White House guidance. Following this decision, Abbott then signed executive orders that explicitly superseded all local decision making.

Further, Abbott then moved to aggressively reopen Texas, deciding to move forward with Phase I on May 1, despite not meeting the criteria of case levels dropping for 14 consecutive days. Both Dallas and Collin Counties had just reported their single highest case and death counts to date.

Similarly, Governor Abbott announced the move to Phase II on May 18, despite Texas seeing its highest new case count on May 15 and plateauing, but not yet experiencing a downward trend in new cases.

This inconsistency and conflict has not played out well for Dallas from a public health perspective. Dallas County now stands at 320 confirmed cases and 8 deaths per 100,000 of population - substantially higher than Houston's Harris County at 223/5, Austin's Travis County at 225/7 and San Antonio's Bexar County at only 123/3.

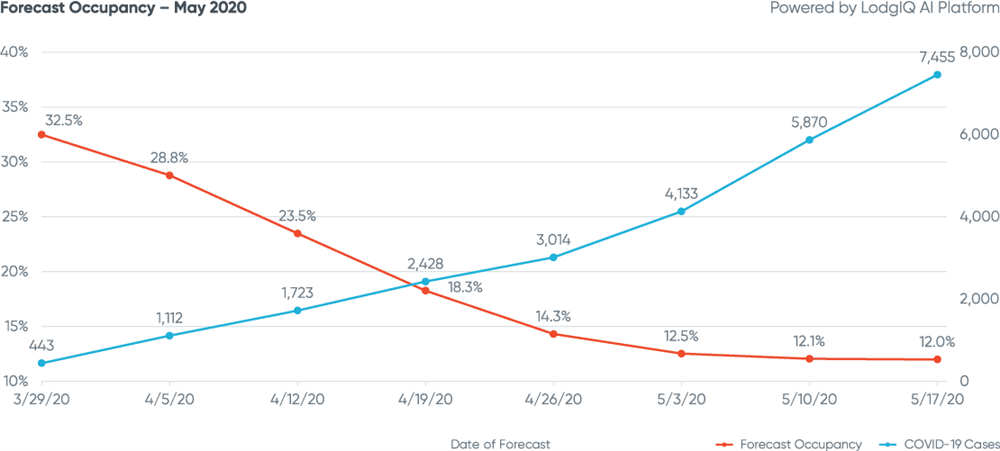

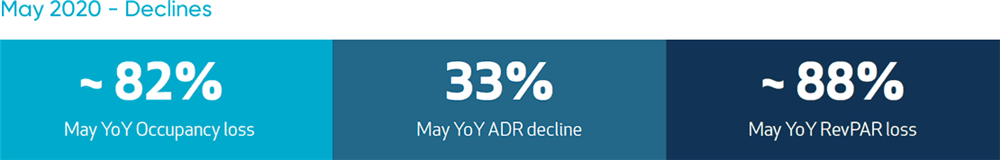

Despite the political infighting and inconsistencies, Dallas' forecast hotel occupancy rate for May is 12%, with a year-over-year (YoY) RevPAR decline of nearly 88%. Each of these figures is in the same realm as Los Angeles, which also leads its state

in case counts and deaths per capita. It will be interesting to see how Dallas and Los Angeles compare in the future, as Los Angeles and California have been tightly aligned in their approaches to combating the virus, whereas alignment has been a

struggle for Dallas and Texas.

Despite the political infighting and inconsistencies, Dallas' forecast hotel occupancy rate for May is 12%, with a year-over-year (YoY) RevPAR decline of nearly 88%. Each of these figures is in the same realm as Los Angeles, which also leads its state

in case counts and deaths per capita. It will be interesting to see how Dallas and Los Angeles compare in the future, as Los Angeles and California have been tightly aligned in their approaches to combating the virus, whereas alignment has been a

struggle for Dallas and Texas.

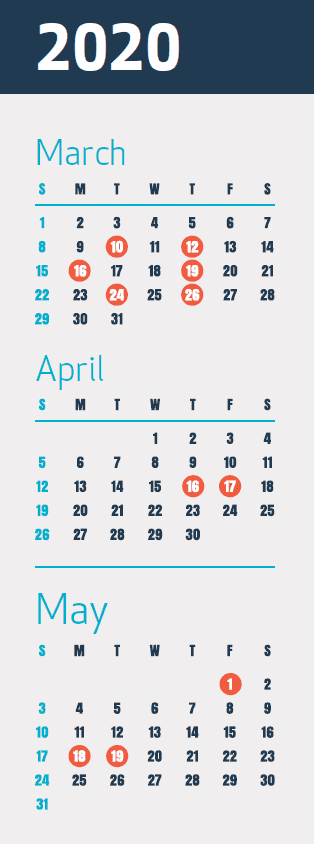

The disparity between local Dallas decisions and statewide decisions regarding health and economic initiatives is highlighted by this timeline:

- March 10 - A 77-year-old man is Dallas County's first presumptive coronavirus case.

- March 12 - Dallas County Judge Clay Jenkins declares a local disaster for public health emergency and bans gatherings exceeding 500 people.

- March 16 - Judge Jenkins prohibits all public and private community gatherings exceeding 50 people, requires social distancing, and closes all schools, bars, dine-in restaurants and gyms (later amended to limit recreational gatherings to 10 people).

- March 19 - Dallas County records first coronavirus-related death.

- March 24 - Judge Jenkins issues strict "safer at home" order, prohibiting people from leaving home for anything other than essential activities, and banning groups of people who are not from the same household or living unit from gathering.

- March 26 - Governor Abbott issues executive order requiring visitors flying into Texas from New York, New Jersey, Connecticut and New Orleans to self-quarantine for 14 days.

- April 16 - U.S. President Donald Trump announces "Opening Up America Again" plan to restart the economy.

- April 17 - Texas Governor Greg Abbott announces Phase I to reopen the Texas economy in stages, superseding local county/city decisions - beginning May 1. Restaurants, retail shops, malls, movie theaters, libraries and museums will be able to open at 25% occupancy.

- May 1 - Dallas County, following the governor's directives, takes its first steps to reopening.

- May 18 - Governor Abbott announces Phase II reopening with nonessential manufacturing, office buildings and bars reopening at 25% capacity; restaurant capacity expanded to 50%.

- May 19 - Dallas County Commissioners vote to extend emergency declaration into June, but also prohibit Judge Jenkins from issuing executive orders without a vote of county commissioners.

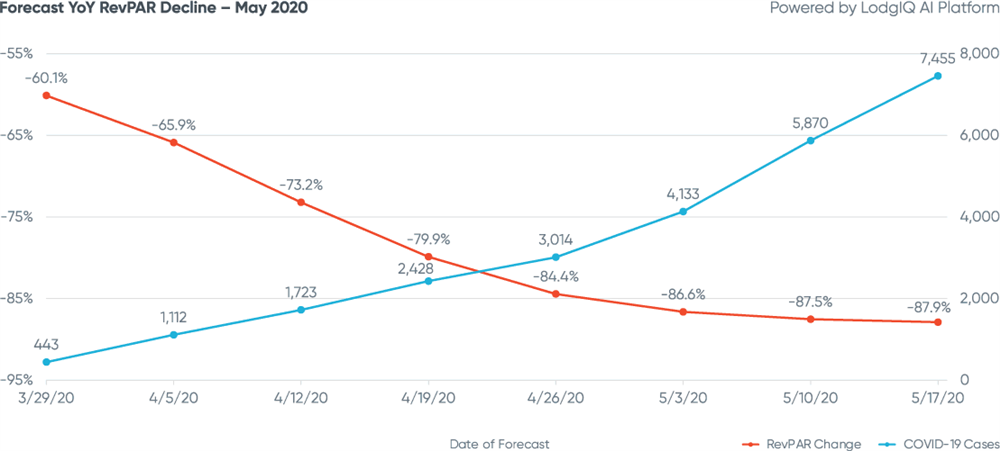

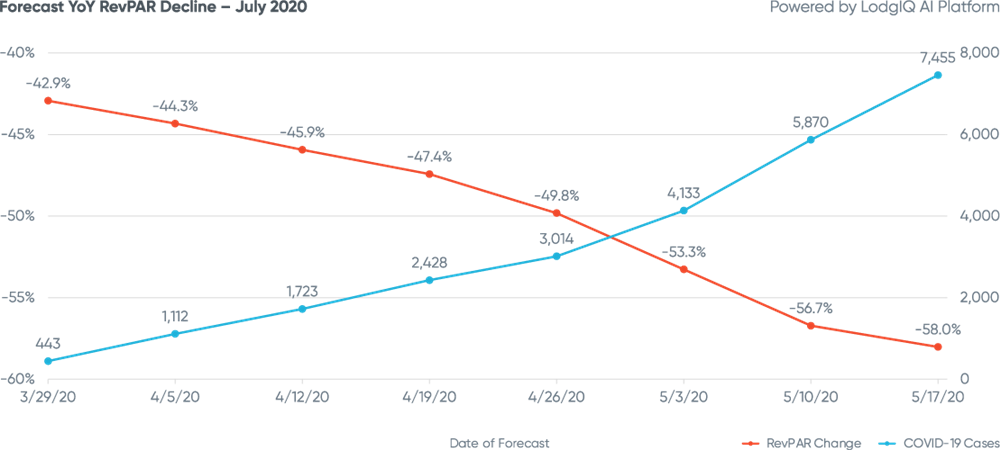

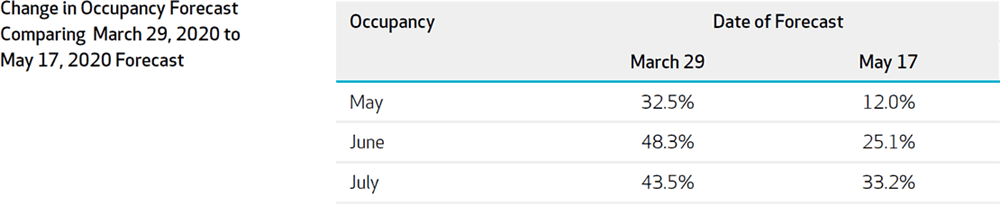

For Dallas, again we observe the continued downward revision trend in the model's year-over-year (YoY) disruption of Revenue per Available Room (RevPAR) across weekly forecasts. Dallas' rate of RevPAR decline across the weekly forecasts covering the seven weeks between March 29 and May 18 has neither been as steep as Boston, nor as bumpy as Los Angeles.

Still, the projection is for a May RevPAR decline of 88% YoY. The March 29 forecast model predicted a May YoY RevPAR drop of 60%; that nearly 30-point degradation does not yet signal much optimism, which is understandable given the highly uncertain nature of how Dallas will fare moving forward with its economy being reopened.

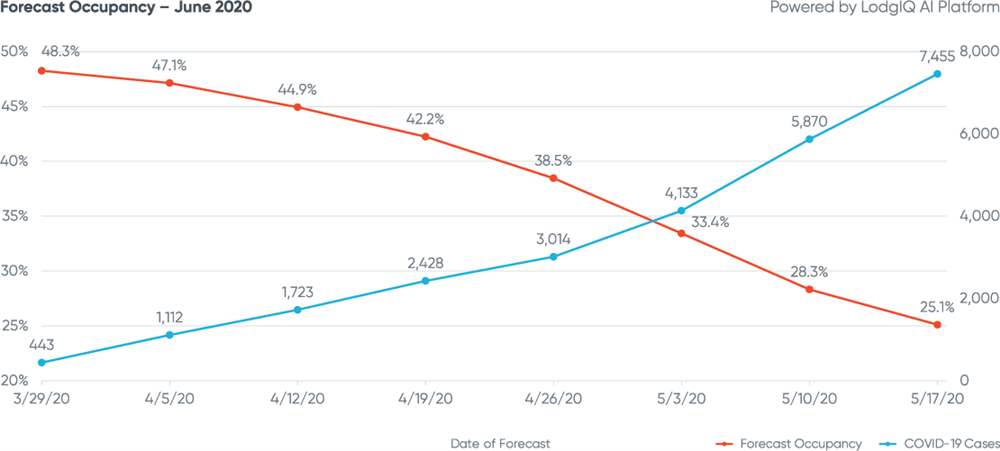

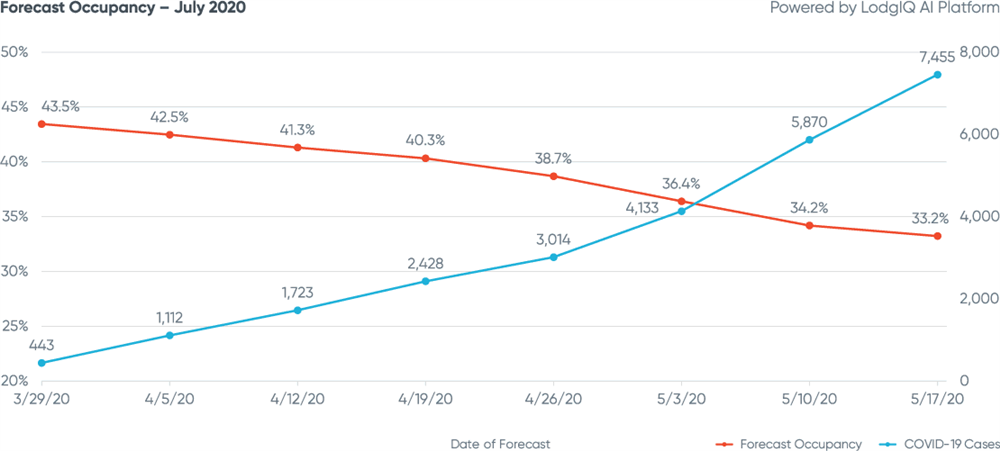

As with all other global gateway cities, Dallas is seeing an "X" pattern depicting increases in confirmed virus cases coinciding with weakening hotel demand as an inverse correlation.

The good news for Dallas is that the projected YoY occupancy rate decline of 82% and 33% YoY drop in average daily rate (ADR) and the dismal 88% RevPAR shortfall compared to the prior year, likely represent a bottom. We have seen in other destinations that the easing of lockdowns is what drives hotel performance. The number of virus cases, while illustrating that strong inverse correlation, does not necessarily reflect causation.

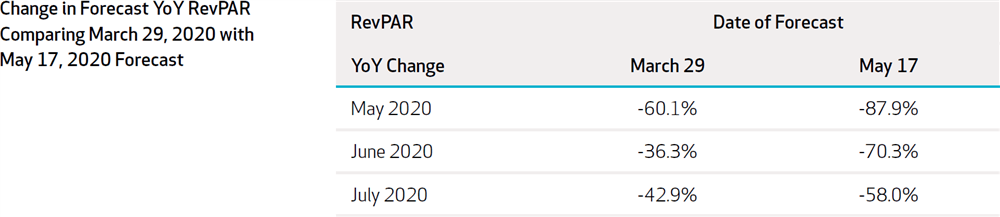

Comparing the most recent May 17 forecast with the model's March 29 forecast, June's YoY RevPAR decline expanded by 34 points - a negative for Dallas, as we normally see the declines reduce as the future time horizon is extended. As Dallas moves into the hotter summer months, it is normally more reliant on group business to fill valley periods. With that market being non-existent, Dallas hoteliers will be pressed to find new sources of demand. One backhanded benefit for Dallas is that its lack of global/national leisure tourism demand, compared with other major travel gateway cities, will not represent a major loss of business. The resulting reliance on local/regional markets may benefit Dallas, especially if neighboring states ease their restrictions as well.

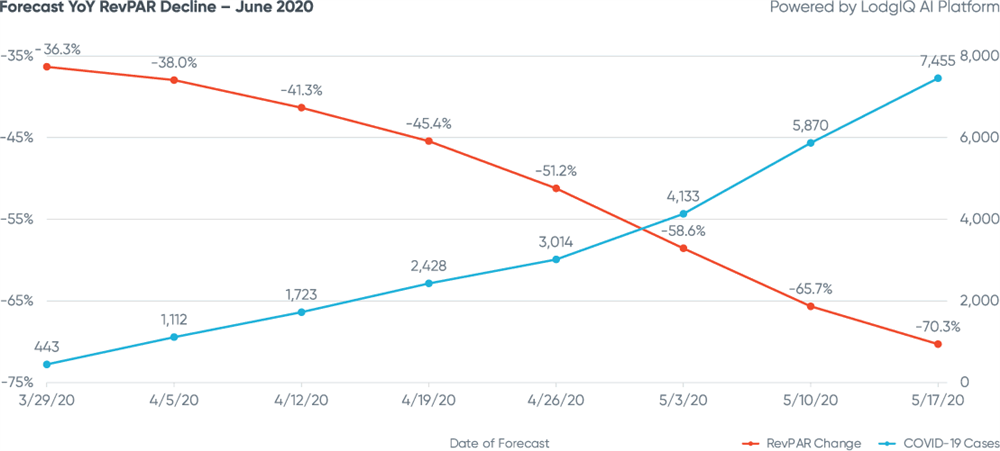

Things are potentially looking a bit better for July, where the RevPAR model dropped only 15 points over the seven weeks between the forecasts.

One important consideration, however, is what will happen if the economic reopening backfires and case counts begin to rise significantly. Regional outbreaks will have a highly detrimental impact on hotel performance, and are nearly impossible to predict. For now, we can only hope for the best.

Over the next 90 days, Dallas's YoY RevPAR disruption forecast comes in at -72%, the best we have observed outside of Singapore. This is mostly attributable to July, normally the worst month of the year for business in Dallas, not representing a very challenging basis for comparison.

Earlier, the forecasts for June were looking decent, but now the reopening has created some risk of higher case and death counts, which could result in new lockdowns, so the model is moderating its earlier optimism somewhat.

That said, there are a couple of factors that may help keep case counts lower in the summer months. First, more people tend to spend time outdoors, limiting the transmission opportunities provided by crowded interior spaces. Additionally, the extreme summer heat of Texas should help reduce the lifespan of the virus on many surfaces - especially those surfaces that are exposed to direct sunlight.

Perhaps most important will be how the Dallas County and Texas leadership cooperate in fighting the pandemic. Unified messaging from political leadership would be helpful in not only reducing public fears, but also in alleviating some of the political friction that is resulting in what can be best described as tribal behavior - especially when it comes to wearing masks in public. Hopefully, both sides of the political aisle can agree that they want the same outcome - a safe public and growing economy.

Dallas, and more broadly Texas, have not experienced any dramatic outbreaks that would tax the healthcare system, so there has not been measurable artificial demand generation that drives a need for contract rooms.

The closure of many properties is boosting hotel occupancy. At the luxury end of the scale, The Fairmont, Four Seasons and Ritz-Carlton are all closed until June. Matching the trends within the greater U.S. hotel industry, economy properties are seeing higher occupancies as travelers avoid higher density central city properties.

The occupancy growth trend for Dallas is positive, especially with a normally low-performing July.

Each market we have covered has exhibited unique traits, and Dallas is no different. The one fascinatingly differentiated aspect of the Dallas market is that it is now unlikely that it will be able to determine its own path through the remainder of the coronavirus crisis.

The performance of Dallas' hotel industry will largely be in the hands of the state's governor, who appears to be highly aligned with the U.S. president. Dallas County leadership also tends to be somewhat at odds, at times, with state leadership, so that could also potentially introduce undesirable consequences.

This differs dramatically from California and New York, where the major city and state governments are run by the same political party. Even the Republican governor of Massachusetts and the Democratic mayor of Boston, despite political differences, appear to be working closely together.

That said, Dallas hotels may benefit from the focused intention of political leadership to open up the economy. While this may carry some public health-related risks, based on every market studied to date, the lesser the social constraints, the better the hotel performance.

Which brings us to a sobering closing thought. McKinsey & Company recently released its second cut of consumer sentiment regarding intended purchase behavior over the next two weeks.

There was very bad news for the hotel industry. Hotel/Resort stays had a lower net purchase intent score than any of the other 34 categories evaluated at -68, a figure that had dropped -4 points since their first survey in mid-March.

Only 5% of those surveyed expressed an intention to spend more on hotel stays than they normally would over the next two weeks. That was also the lowest measure of intended spending growth across all categories.

The next category with the lowest purchase intent was Domestic Flights, which scored -66. For some context, International Flights scored -59, Adventures & Tours -55, and Travel by Car -47.

Even worse news for the lodging segment was that the net intent score for Short-Term Home Rentals came in at -41 (although they reflected an 8-point drop since the March survey). Miraculously, Cruises achieved a score of -46. Falling 22 points lower in immediate purchase intent than the cruise industry, which has incurred considerable damage to its reputation because of the virus, is not desirable positioning, by any measure.

On a positive note, since the time horizon was only two weeks, there may be time for the hotel industry to play catch-up.

With Dallas moving into its summer valley season and its fortunes being largely controlled by other parties, the Dallas hotel community may find itself in more of a reactive than proactive position relative to other major international gateways.

In a state known for bustin' broncs, Dallas may be getting led around the pony ring. The forecast model currently indicates that while they may not be in control, Dallas hoteliers may be able to ride this out in a bit better shape than some others.

All'a y'all (Texas grammar note: the term "y'all" is singular; "all'a y'all" is the plural form) reading this should never bet against residents of a state that's home to 15 species of venomous snakes, black widow and brown recluse spiders, fire ants and oppressive 100+ degree summer heat.

We continue to identify leading indicators that signal likely pricing strategies as markets decline and recover. ADRs can be misleading in a market experiencing severe supply contraction, as the mix of available rooms may shift to offer higher ratios of economy or luxury properties. Logically, during significant periods of disruption, travelers may become more price-sensitive, but anxious hoteliers engaging in rate wars may suppress pricing not only for their competitive set, but for the destination overall.

It is also important to remember that as the time horizon expands, greater variation may be expected. As more global markets recover from peak virus caseloads, their outcomes will be captured, with the model continually refined to enhance its precision.

This crisis will pass, but until then, the most urgent questions focus on the depth of the decline, the length of its duration and how the recovery will manifest itself. As the analysis continues, the following factors will be closely monitored to identify early signs of recovery:

- Active cases and mortality rates

- Test counts per million

- Government travel policies

- Stock market and volatility indexes

- Unemployment rates

LodgIQ uses state of the art BigData Analytics and AI / Machine Learning algorithms to forecast demand and price hotel rooms. LodgIQ is led by a team of experienced hospitality technologists, data scientists and engineers. Seed funded by Highgate Ventures, LodgIQ is re-imagining revenue management with predictive and prescriptive analytics methods. Our flagship product - LodgIQ RM is used by hotels across the globe, day-in and day-out to understand demand and optimize revenue.