Looking ahead in the Northeast Asia travel market

- Published:

- January 2024

- Analyst:

- Phocuswright Research

Northeast Asia is a region of highly differentiated yet closely linked markets. Throughout 2023, airlines increased capacity and flight frequencies between Northeast Asian and Southeast Asian markets, which had decoupled during the pandemic. According to Phocuswright’s research report Northeast Asia Travel Market Report 2023-2026, all carriers prioritized restoring services to/from Chinese first- and second-tier cities and connectivity with Japan. Longer-haul capacity, particularly with the U.S. and European markets, has also stepped up.

Optimism is returning, although the region is characterized by uneven recovery rates and, in the cases of South Korea and Taiwan, more residents traveling overseas than inbound arrivals. Consequently, the outlook for 2024 is mixed.

Looking ahead, here are three key trends to note for the Northeast Asia travel market:

Competitive scramble for Chinese travelers

Chinese tourists and business travelers dominate Northeast Asia's travel landscape. Since Chinese visitor volumes in 2023 fell below expectations, regional airlines are seeking access to Chinese tier-2 airports to broaden the base for tourism board marketing and expand the scope for outbound business and leisure travel. 2024 will witness a scramble across Asia Pacific to entice more visitors from the world's largest outbound market.

Potential for geopolitical flashpoints

With maritime confrontations in the South China Sea between China and the Philippines, Taiwan’s 2024 elections and threats from North Korea, unpredictable security flashpoints entangle nations across Northeast and Southeast Asia and the broader Indo-Pacific region.

Staying awake for night tourism

Night Tourism, also known as the Night Economy, is a hot topic in China and Northeast Asia. Destinations are seeking to correct a shortfall of leisure spending at night compared to the daytime. In Taiwan, Klook launched a digital pass for visitors to earn discounts while exploring Taipei's night street food markets and sampling local dishes.

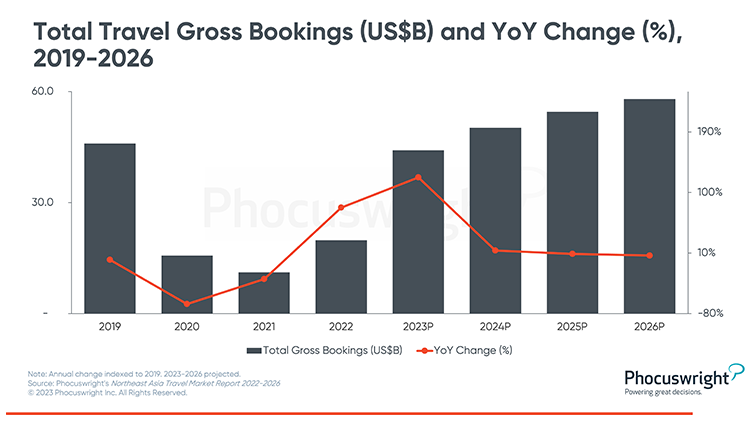

The reopening of Northeast Asia’s major travel markets led to 78% year-over-year growth in 2022, and projected 122% growth in 2023. Notable as the first full year of travel post-COVID, 2023 saw the return of international visitors that have largely driven the recovery. While 2023 bookings are projected to fall slightly short of pre-pandemic numbers, 2024 revenue is expected to easily eclipse that mark.

Phocuswright’s Northeast Asia Travel Market Report 2022-2026 provides a comprehensive view of the Northeast Asia (South Korea, Hong Kong, Taiwan, Macau) travel market, including detailed market sizing and projections, distribution trends, analysis of major travel segments, key developments and more.

This report is part of the Asia Pacific Travel Market Report 2022-2026 series, which includes all of the following publications (available now or publishing soon):

- Asia Pacific Travel Market Report 2022-2026

- Australia-New Zealand Travel Market Report 2022-2026

- China Travel Market Report 2022-2026

- India Travel Market Report 2022-2026

- Japan Travel Market Report 2022-2026

- Southeast Asia Travel Market Report 2022-2026

- Northeast Asia Travel Market Report 2022-2026

- Asia Pacific Travel Market Data Sheet 2022-2026

For further intelligence for you and your entire company, subscribe to Phocuswright Open Access. This subscription puts the entire Phocuswright research library and powerful data visualization tools at your fingertips. There’s a reason executives around the world trust and reference Phocuswright research and data on a daily basis. Explore for yourself why.

Plus, we just redesigned Phocal Point, the powerful data visualization tool that now makes it easier to access and interpret Phocuswright data.

It's all about the data. With an updated navigation interface, new dynamic filtering, additional segment and channel breakouts in select markets and rich detailed views of 35+ markets, Phocal Point allows you to create custom interactive charts and view travel data by segment, channel, device, region and country. Our proprietary travel industry market sizing data allows you to look to the future with projections through 2026, and review historical data as far back as 2009.

.png)

.jpg)